With a market cap of almost $700 billion, Bitcoin was trading within the $36k price bracket at press time. This, after a volatile few weeks which saw the world’s largest cryptocurrency trade as high as $58k in the second week of May, before depreciating dramatically on the charts. In fact, BTC had fallen as far as $31k too, albeit briefly.

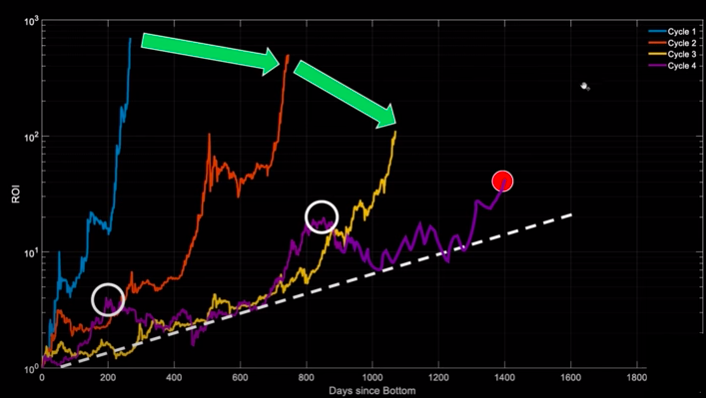

After noting an intermediate peak recently, popular analyst Benjamin Cowen had asserted that Bitcoin’s market cycle top was still well away. Nevertheless, as circled and highlighted in the attached chart, Bitcoin has been ahead of both cycle two and cycle three during different stages. That being said, it has failed to persist and keep pace with either of them.

Here, it is essential to note that the above Bitcoin market cycle ROI chart is measured from the market cycle bottom. Drawing parallels with the previous cycle, Cowen now poudarjeno,

"Da bomo še naprej sledili zadnjemu tržnemu ciklu, se bo Bitcoin do konca leta moral zvišati za 300,000 USD."

Over the past 6 months, Bitcoin has registered a 100.15% surge. If the same 100% is applied to the current $36k market price, Bitcoin would just cross the $72k range. What’s more, according to the analyst, the journey from $30k to the $300k band definitely looks too “far-fetched” for now. Highlighting other obstacles in Bitcoin's path, Cowen added,

»V bistvu je višja tržna kapitalizacija, težje je premikati ceno. Za Bitcoin bo trajalo veliko več volumna in z vsakim ciklom ga bo vedno težje potisniti navzgor. «

The analyst also suggested that it would become essential for institutions to step up to take Bitcoin’s price to the aforementioned level. However, an zgodnejša analiza had pointed out that the same could act as a hindrance and surprise people later. Further elaborating on the same, Cowen said,

"To je cikel institucij in vedno sem bil dvomljiv, da bo vsaka institucija, ki je v lasti človeka, leta 2021 prešla na FOMO v Bitcoin ... Mislim, da bo še veliko institucij vlivalo in ta cikel bo nekoliko drugačen kot kateri koli drug cikel, ki smo ga videli. "

Stalni cikel je precej podoben ciklu iz leta 2013, vendar se je znatno podaljšal. Analitik je menil, da se je čas med različnimi potezami v tem ciklusu podaljšal v primerjavi s tistim iz leta 2013. Nadalje opozarja na nov trend.

"Da bi lahko upamo, da bomo sledili tempu, mora bitcoin hitro okrevati in v naslednjih nekaj mesecih začeti streljati, sicer ni možnosti, da bi sledil tretjemu ciklu ... I resnično mislim, da ne more iti v korak s tem.

Na tej stopnji je možen nadaljnji padec cen na 20 tisoč dolarjev, je zaključil, toda trg bi si kmalu opomogel in znova ustvaril ATH. Vzporednice s ciklom 2019, je zatrdil Cowen,

"Nekaj časa se bomo spustili ali postrani, imeli bomo to konsolidacijsko fazo, nato pa bomo nadaljevali naslednji del našega potovanja in to bo za nas le odskočna deska . Končno se to dogaja. "

- 000

- 100

- 2019

- 7

- 9

- Analitik

- Billion

- Bitcoin

- BTC

- Charts

- konsolidacijo

- naprej

- cryptocurrency

- Trenutna

- krivulja

- Drop

- sledi

- FOMO

- visoka

- Poudarjeno

- HTTPS

- ustanova

- Institucije

- IT

- vzdrževanje

- Stopnja

- moški

- Tržna

- Market Cap

- mesecev

- premikanje

- Novice

- Da

- Ostalo

- ljudje

- Popular

- pritisnite

- Cena

- območje

- Obnovi

- okrevanje

- Stage

- Začetek

- prenapetost

- presenečenje

- čas

- vrh

- trgovini

- Trgovanje

- us

- Obseg

- teden

- v

- leto

- youtube