On Tuesday (September 28), the yield on the U.S. 10 Year Treasury Note hit 1.559%, which is the highest it has been in over three months, as the result of which both tech stocks and cryptoassets have suffered losses.

Som CNBC rapporterade earlier today, the yields on U.S. government bonds appear to be rising as investors expect the Federal Reserve (i.e. the U.S. central bank) to taper its bond purchase program – in the near future — due to elevated inflation numbers. The latest update from Fed Chair Jerome Powell was delivered at 10:00 ET on Tuesday, when he started his testimony before the U.S. Senate Banking Committee.

In his prepared speech, Powell said:

"Inflation is elevated and will likely remain so in coming months before moderating."

The CNBC report went on to say that “the steps toward monetary tightening from the Fed and other central banks come as investors are still worried about inflation pressures, with rising energy prices in Europe being one of the latest concerns.”

Apparently, rising energy prices in Europe are one of the reasons that investors remain worried about higher inflation. Jim Reid, Research Strategist at Deutsche Bank, recently said in a note to the bank’s clients:

"It’s quite clear that a global hiking cycle had already started before the recent mini energy crisis. Will this renewed spike in energy costs mean central banks accelerate this … or will it hit demand enough that it actually slows them down? This is an incredibly delicate and difficult period for central banks."

At the time of writing (19:10 UTC on September 28), all three major U.S. stock indexes are in the red, with the Dow, the S&P 500, and the Nasdaq Composite down 1.04%, 1.44%, and 2.16% respectively.

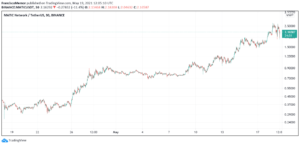

As for the crypto market, in the past 24-hour period, Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Solana (SOL) are trading around $41,697.72 (-3.08%), $2,853.82 (-4.66%), $2.09 (-4.60%), and $131.55 (-8.16%).

Villkor

De åsikter och åsikter som uttrycks av författaren eller personer som nämns i den här artikeln är endast i informationssyfte och de utgör inte finansiella, investeringsrådiga eller andra råd. Att investera i eller handla kryptoassets innebär en risk för ekonomisk förlust.

Image Credit

Bild av "petre_barlea"Via Pixabay

- ADA

- annonser

- rådgivning

- Alla

- runt

- Artikeln

- Bank

- Banking

- Banker

- Bitcoin

- Obligationer

- BTC

- Cardano

- Cardano (ADA)

- Centralbanken

- Centralbankssystemet

- CNBC

- kommande

- Kostar

- kris

- crypto

- Crypto Market

- Efterfrågan

- Deutsche Bank

- dow

- energi

- ETH

- ethereum

- Ethereum (ETH)

- Europa

- Fed

- Federal

- Federal Reserve

- finansiella

- framtida

- Välgörenhet

- Regeringen

- HTTPS

- inflation

- investera

- investering

- För Investerare

- IT

- senaste

- Nivå

- större

- marknad

- månader

- Nasdaq

- Nära

- nummer

- Åsikter

- Övriga

- Personer

- Program

- inköp

- skäl

- rapport

- forskning

- Risk

- S & P 500

- screen

- Senaten

- So

- Solana

- igång

- lager

- Aktier

- tech

- tid

- Handel

- oss

- USAs regering

- Uppdatering

- us

- skrivning

- år

- Avkastning