As the United Kingdom prepares for a ban on finance-related cold calls, His Majesty’s Treasury has issued a consultation paper, and it is calling for evidence to gauge the full impact on businesses and the costs associated with introducing and implementing the ban.

On May 3, the U.K. government announced an ambitious fraud strategy, which would involve adding 400 new jobs to update its approach to intelligence-led policing. As Cointelegraph previously reported, the National Crime Agency estimates that fraud costs the country approximately 7 billion pounds ($8.7 billion) annually.

“The government will not tolerate this behavior,” sade Andrew Griffith, the economic secretary to the Treasury, while criticizing the rising cold calls for financial services and products that often target the most vulnerable members of society.

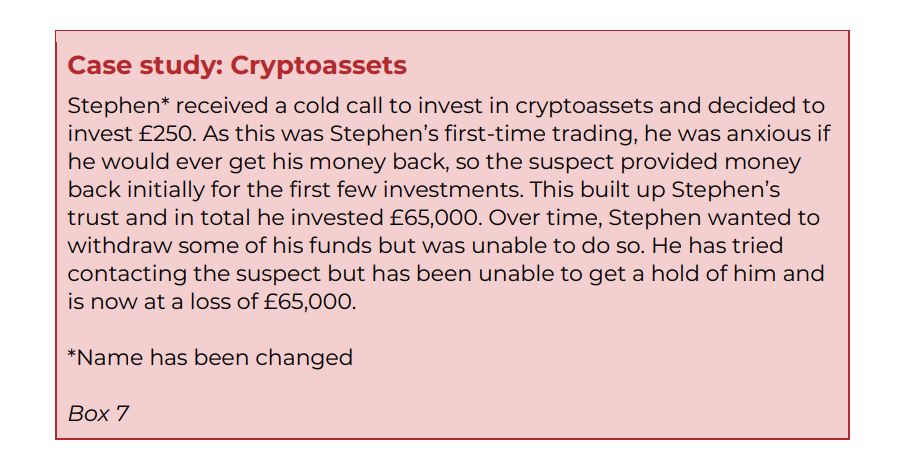

The Treasury highlighted numerous instances where cold calls were responsible for investors’ losses, out of which one involved cryptocurrencies, as shown above. While the U.K. government previously implemented various prohibitions and restrictions on cold calling, scammers often find loopholes in the system to bypass the law.

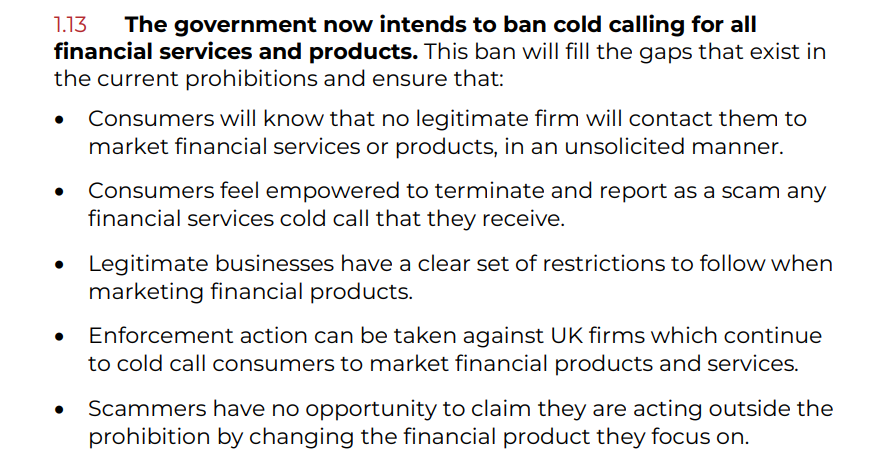

Intending to impose a blanket ban on financial cold calls, the Treasury put forth 19 questions to stakeholders to ensure maximum impact on scammers and minimum effect on businesses that often rely on cold calling prospects. The consultation closes on Sept. 27, 2023.

Relaterat: UK Treasury planerar att utesluta derivat och "icke-backed" tokens från regulatorisk sandlåda

The U.K. government recently rejected the appeal to consider and regulate cryptocurrencies as gambling.

"HM Treasury och FCA [Financial Conduct Authority] kommer att samarbeta med branschen för att säkerställa att kryptoföretag görs fullt medvetna om de standarder som krävs för godkännande vid FSMA-gatewayen. Ytterligare kommunikation kommer att tillhandahållas i sinom tid för att säkerställa att standarder för godkännande är tydligt tillgängliga för kryptoföretag som är verksamma i Storbritannien."

The government response noted that such an approach has the potential to completely counter the globally agreed recommendations from international organizations and standard-setting bodies.

Magazine: Rekursiva inskriptioner: Bitcoin "superdator" och BTC DeFi kommer snart

- SEO-drivet innehåll och PR-distribution. Bli förstärkt idag.

- PlatoData.Network Vertical Generative Ai. Styrka dig själv. Tillgång här.

- PlatoAiStream. Web3 Intelligence. Kunskap förstärkt. Tillgång här.

- Platoesg. Fordon / elbilar, Kol, CleanTech, Energi, Miljö, Sol, Avfallshantering. Tillgång här.

- PlatoHealth. Biotech och kliniska prövningar Intelligence. Tillgång här.

- ChartPrime. Höj ditt handelsspel med ChartPrime. Tillgång här.

- BlockOffsets. Modernisera miljökompensation ägande. Tillgång här.

- Källa: https://cointelegraph.com/news/uk-ban-crypto-investment-cold-calls

- : har

- :är

- :inte

- :var

- 19

- 2023

- 27

- 7

- a

- ovan

- tillsats

- byrå

- överens

- ambitiösa

- an

- och

- Andrew

- meddelade

- Årligen

- överklaga

- tillvägagångssätt

- godkännande

- cirka

- ÄR

- AS

- associerad

- At

- myndighet

- tillgänglig

- medveten

- Förbjuda

- BE

- beteende

- Miljarder

- Bitcoin

- organ

- BTC

- företag

- Ring

- anropande

- Samtal

- Vid

- fallstudie

- klart

- stänger

- Cointelegraph

- förkylning

- kommande

- Trygghet i vårdförloppet

- fullständigt

- Genomför

- Tänk

- anser

- Kostar

- Motverka

- land

- Kurs

- Brott

- crypto

- kryptoföretag

- Crypto-investering

- cryptocurrencies

- Defi

- Derivat

- grund

- Ekonomisk

- effekt

- säkerställa

- uppskattningar

- bevis

- FCA

- finansiering

- finansiella

- Ekonomiskt uppförande

- Finansiellt Conduct Authority

- finansiella tjänster

- hitta

- företag

- För

- vidare

- bedrägeri

- från

- fsma

- full

- fullständigt

- ytterligare

- Betting

- nätbryggan

- mätare

- Globalt

- Regeringen

- Markerad

- hans

- HTTPS

- Inverkan

- genomföras

- genomföra

- ålagts

- in

- industrin

- avser

- Internationell

- införa

- investering

- engagera

- involverade

- Utfärdad

- IT

- DESS

- Lediga jobb

- Kingdom

- Lag

- luckor

- förluster

- gjord

- maximal

- Maj..

- Medlemmar

- minsta

- mest

- nationell

- Nya

- noterade

- talrik

- of

- Ofta

- on

- ONE

- drift

- organisationer

- ut

- Papper

- planer

- plato

- Platon Data Intelligence

- PlatonData

- polisarbete

- potentiell

- förbereder

- tidigare

- Produkter

- utsikter

- förutsatt

- publicering

- sätta

- frågor

- nyligen

- rekommendationer

- Reglera

- regulatorer

- förlita

- Rapporterad

- Obligatorisk

- respons

- ansvarig

- begränsningar

- stigande

- Lurendrejeri

- Bedragare

- sekreterare

- service

- Tjänster

- visas

- Samhället

- Källa

- intressenter

- standarder

- Strategi

- Läsa på

- sådana

- system

- Målet

- den där

- Smakämnen

- lagen

- Storbritannien

- Storbritannien

- detta

- till

- tokens

- kassan

- Storbritannien

- Storbritanniens regering

- Uk

- United

- Storbritannien

- Uppdatering

- olika

- Sårbara

- były

- som

- medan

- kommer

- med

- Arbete

- skulle

- zephyrnet