Біткойн (БТД) saw classic BTC price volatility into the Nov. 7 daily close as a “short squeeze” took the market near $36,000.

Bitcoin hits “key” short squeeze price

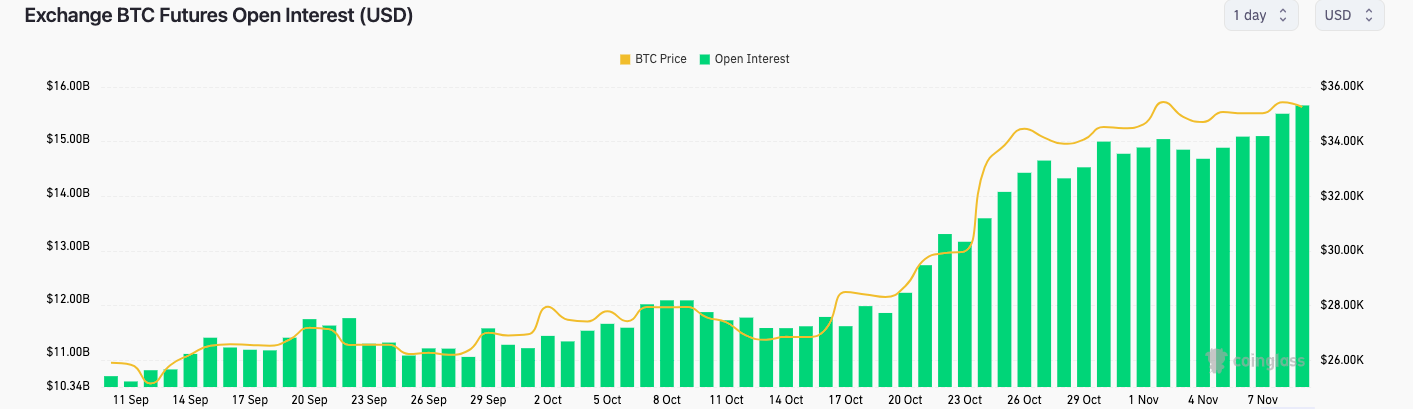

Дані від Cointelegraph Markets Pro та TradingView followed BTC/USD as it reacted amid highly elevated open interest (OI) on exchanges.

Раніше про це повідомляв Cointelegraph more than $15 billion in OI being apt to spark a fresh round of volatility. Some feared that BTC price downside would result, with the ultimate direction unknown.

In the end, shorts felt the heat as Bitcoin made swift gains to top out at just below $35,900.

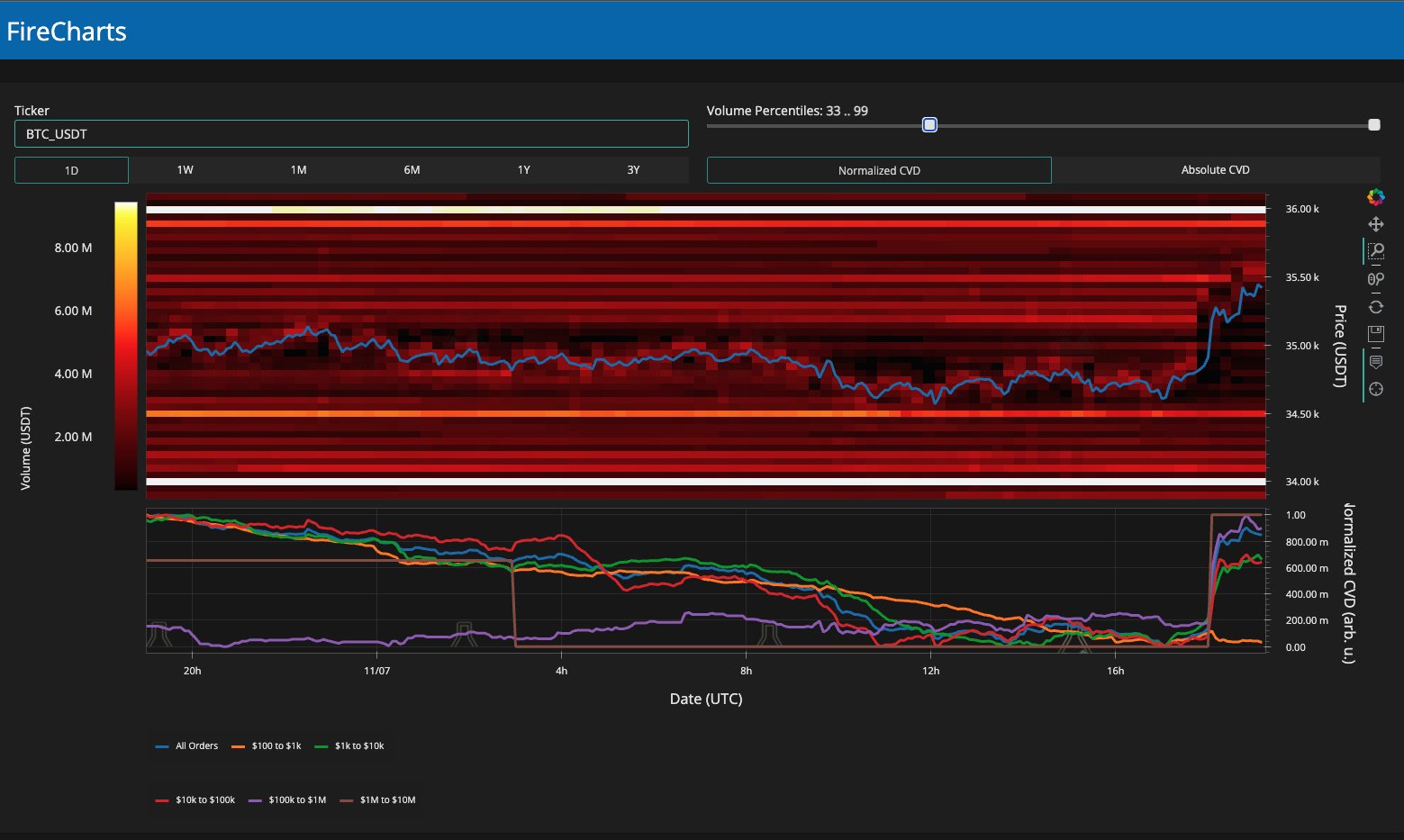

Analyzing the situation before the move, popular trader Skew and others predicted the event in advance. Skew argued that momentum would increase quickly should $34,800 return — a sequence of events which then came true.

“Open interest still building up & looking more like shorts have a higher float in the OI build up here. $34,800 ~ key price for a squeeze,” he сказав X підписників.

Yup there was a significant rise in OI overnight- it seems to be more of the same- shorts aping into passive bids here at the local lows.

We have a big rise in OI, perp takers net selling, funding decreasing, and limit bids being filled. A recipe for a nice squeeze up. https://t.co/IgwSR5dIo9 pic.twitter.com/F82fmNnw7F

- CrediBULL Crypto (@CredibleCrypto) Листопад 7, 2023

On-chain monitoring resource Material Indiators repeated a previous assertion that $36,000 would stay out of reach this week.

“You can never say, ‘Never’ in this game, but based on the latest Trend Precognition signals, I’d be very surprised to see BTC move above $36k before the Weekly candle close,” part of a post-move X post зчитування, referring to one of its proprietary trading indicators.

Fellow trader Daan Crypto Trades meanwhile eyed what he described as “an interesting shift” in derivatives composition.

Traders on largest exchange Binance were positioning themselves bearish compared to exchange Bybit, he зазначив,, but a “long squeeze” was far from certain.

“Bybit perpetuals have consistently traded higher than Binance. There’s been a clear long interest on Bybit while Binance has been more short orientated during this range,” he summarized.

An accompanying chart compared the two exchanges’ BTC/USDT perpetual swap pairs, showing Binance trading lower after the short squeeze.

“Will be very interesting to see how this resolves,” he concluded.

“One thing is clear and that’s that Bybit traders are more bullish than Binance traders.”

Major BTC futures OI flush still to appear

Financial commentator Tedtalksmacro showed the impact of the squeeze on Binance, where short open interest disappeared.

За темою: Надзвичайно високий — Bitcoin Ordinals посилає комісії за транзакції BTC до нового 5-місячного піку

BTC shorts obliterated.

All of the OI built up earlier today ~$350MM USD, wiped in minutes. https://t.co/E8Ev1lsBWe pic.twitter.com/tHU25fTUt0

— tedtalksmacro (@tedtalksmacro) Листопад 7, 2023

BTC/USD traded at $35,300 at the time of writing on Nov. 8, with OI still beyond $15 billion, per data from on-chain monitoring resource CoinGlass.

Ця стаття не містить інвестиційних порад та рекомендацій. Кожен інвестиційний та торговий крок передбачає ризик, і читачі повинні проводити власні дослідження, приймаючи рішення.

- Розповсюдження контенту та PR на основі SEO. Отримайте посилення сьогодні.

- PlatoData.Network Vertical Generative Ai. Додайте собі сили. Доступ тут.

- PlatoAiStream. Web3 Intelligence. Розширення знань. Доступ тут.

- ПлатонЕСГ. вуглець, CleanTech, Енергія, Навколишнє середовище, Сонячна, Поводження з відходами. Доступ тут.

- PlatoHealth. Розвідка про біотехнології та клінічні випробування. Доступ тут.

- джерело: https://cointelegraph.com/news/bitcoin-short-squeeze-btc-price-35-9-k-oi

- : має

- :є

- : ні

- :де

- $UP

- 000

- 7

- 8

- 9

- a

- вище

- просування

- рада

- після

- Серед

- та

- APT

- ЕСТЬ

- сперечався

- стаття

- AS

- At

- заснований

- BE

- ведмежий

- було

- перед тим

- буття

- нижче

- За

- Великий

- Мільярд

- бінанду

- Біткойн

- книга

- БТД

- ціна btc

- BTC / USD

- будувати

- Створюємо

- побудований

- Бичачий

- але

- bybit

- прийшов

- CAN

- певний

- Графік

- classic

- ясно

- близько

- Монеттелеграф

- коментатор

- порівняний

- склад

- уклали

- Проводити

- послідовно

- містити

- крипто

- щодня

- дані

- рішення

- Похідні

- описаний

- напрям

- робить

- зворотний бік

- під час

- Раніше

- піднесений

- кінець

- Event

- Події

- Кожен

- обмін

- Біржі

- далеко

- Інформація про оплату

- помилка

- заповнений

- Поплавок

- потім

- для

- свіжий

- від

- фінансування

- Ф'ючерси

- прибуток

- гра

- Мати

- he

- тут

- Високий

- вище

- дуже

- число переглядів

- Як

- HTTPS

- i

- Impact

- in

- Augmenter

- індикатори

- інтерес

- цікавий

- в

- інвестиції

- IT

- ЙОГО

- просто

- ключ

- найбільших

- останній

- як

- МЕЖА

- місцевий

- Довго

- шукати

- знизити

- Найнижчі

- made

- Робить

- ринок

- ринки

- матеріал

- Між тим

- хвилин

- Імпульс

- моніторинг

- більше

- рухатися

- Близько

- мережу

- ніколи

- Нові

- приємно

- листопад

- of

- on

- На ланцюжку

- ONE

- відкрити

- відкритий інтерес

- or

- порядок

- інші

- з

- власний

- пар

- частина

- пасивний

- для

- Вічний

- Вічні

- plato

- Інформація про дані Платона

- PlatoData

- популярний

- позиціонування

- пошта

- передвіщений

- попередній

- price

- власником

- швидко

- діапазон

- досягати

- читачі

- рецепт

- рекомендації

- повторний

- Повідомляється

- дослідження

- ресурс

- результат

- повертати

- Зростання

- Risk

- круглий

- s

- бачив

- say

- побачити

- Здається,

- Продаж

- послати

- посилає

- Послідовність

- Короткий

- короткий стиснути

- шорти

- Повинен

- показав

- сигнали

- значний

- ситуація

- косий

- деякі

- Source

- Іскритися

- Вичавлювати

- залишатися

- Як і раніше

- абоненти

- здивований

- обмін

- Свопи

- SWIFT

- приймачі

- ніж

- Що

- Команда

- Щотижневик

- їх

- самі

- потім

- Там.

- річ

- це

- На цьому тижні

- час

- до

- сьогодні

- прийняли

- топ

- торгував

- trader

- Traders

- торги

- торгові площі

- TradingView

- угода

- Операційні збори

- Trend

- правда

- два

- кінцевий

- невідомий

- USD

- дуже

- Volatility

- vs

- було

- week

- тижні

- були

- Що

- коли

- який

- в той час як

- з

- б

- лист

- X

- зефірнет