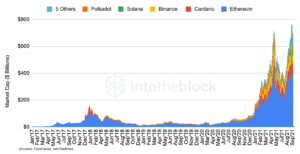

Crypto market capitalization has surpassed $1T for the first time since June 12.

Crypto markets’ recent rally reclaimed an old milestone on Wednesday, as overall market capitalization حد تک $1T for the first time since June 12.

کے بعد peaking above $3B in November 2021, crypto’s market cap has hovered around $900B during the past month. It dropped as low as $800B on June 18, according to data from TradingView.

Cryptocurrencies began trending upward last week. The top seven cryptocurrencies by market capitalization are all up at least 13% since July 12, according to data from The Defiant’s newly released charting feature.

The rally can be attributed to several things, according to جیف ڈور مین, chief investment officer at crypto fund Arca: broader macroeconomic trends, positive developments within crypto and investors betting on the success of The Merge.

Macro Pressures

“First and foremost, macro level, you’ve seen a little bit of an easing on the pressures,” Dorman told The Defiant.

“You’ve seen the dollar stop going higher, you’ve seen front end yields start to come in a little bit. The [U.S. Federal Reserve] and other central banks have started to pivot a little bit towards, if not less aggressive inflation fighting [then] certainly at least more acknowledgement they might have caused too much damage to the economy and therefore would have to lower [interest] rates at some point.”

Correlation To Equities

The crypto-to-equities correlation is indeed alive and well: the ایس اینڈ پی 500 is up 3% since June 12, when Ethereum began to surge. The tech-heavy نیس ڈیک is up 5.6% in that same period.

But there are several things that pushed crypto’s gains beyond those of the U.S. stock market, according to Dorman.

“I think we all can agree that DeFi did its job whereas CeFi didn’t,” he said, echoing other market observers and crypto enthusiasts who saw DeFi vindicated in the fallout from the bankruptcies of firms like Celsius and Voyager. “As a result, it wasn’t surprising that the rally was led by DeFi tokens.” DeFi index DPI is up 31% پچھلے مہینے میں

انضمام پر تمام نظریں

Other tokens were buoyed by positive developments, Dorman added. But the “big one” came late last week, when Ethereum developers gave a clear, if tentative, timeline for the long-awaited update known as The Merge. If all goes as planned, The Merge will occur on ستمبر 19 and slash the network’s energy use and, in turn, carbon emissions by an estimated 99%.

Indeed, while the world’s largest cryptocurrencies have appreciated in value over the past week, Ether has raced ahead and rallied 40% since June 12, according to data from The Defiant’s newly released charting feature. Solana came in second, having risen 25% in that same span.

جبری لیکویڈیشنز

“When you put all those things together, you start to realize that most of the sell-off from Bitcoin $28,000 and Ethereum $1,800 was not because people were trying to sell,” he said. Rather, it was caused by the forced selling of the two assets by distressed firms like crypto hedge fund Three Arrows Capital.

And the worst may be behind us.

“I think, you know, Three Arrows was the biggest culprit from a leverage standpoint, and basically all their collateral has been liquidated,” he said.