Bitcoin and Ether dropped on Monday afternoon in Asia on the first trading day of May, after concerns about the U.S. banking system resurfaced following news of U.S. regulators approving the sale of First Republic Bank’s assets to JPMorgan. Most other top 10 non-stablecoin cryptocurrencies also fell, except Binance’s BNB, with Solana and Litecoin the biggest losers of the day. Most Asian equity markets were closed on Monday for the May 1 holiday.

متعلقہ مضمون ملاحظہ کریں: ہفتہ وار مارکیٹ لپیٹ: بٹ کوائن 30,000 امریکی ڈالر کے ساتھ چھیڑ چھاڑ، ایتھر نے US$1,900 کو دوبارہ حاصل کیا

کرپٹو

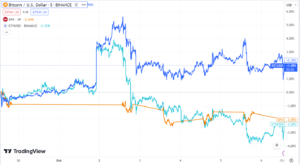

ہانگ کانگ میں 2.2 گھنٹے سے شام 28,640 بجے تک بٹ کوائن 24 فیصد گر کر 4 امریکی ڈالر پر آگیا CoinMarketCap data. The world’s largest cryptocurrency by market capitalization gained 4.37% in the last seven days, and rose as high as US$31,005 in the last month.

Ether lost 2.83% to US$1,850, but traded 0.34% higher on the week. The world’s second-biggest cryptocurrency rose as much as US$2,137 in the last one month.

Solana’s SOL was the day’s biggest loser, dropping 4.72% in 24 hours to US$22.33. Litecoin lost 3.42% to US$87.59 – the second-biggest loser in 24 hours – although it gained 0.5% on the week.

BNB, the native token of world’s largest crypto exchange Binance, was the only gainer, rising 3.71% to US$333, and strengthened 1.39% on the week. Binance on Monday متعارف Sui blockchain’s SUI token to its Launchpool, which allows Binance users to stake their BNB and TrueUSD (TUSD) to farm the recently launched SUI.

The total crypto market capitalization dropped 1.95% to US$1.18 trillion, while the total crypto market volume gained 66.78% to US$39.78 billion.

Nft

Forkast 500 NFT index slid 0.04% to 3,741.30 points on the day and fell 0.66% on the week. The index is a proxy measure of the performance of the global NFT market and includes 500 eligible smart contracts on a given day. It is managed by کریپٹوسلام, Forkast.News کی ایک بہن کمپنی Forkast Labs چھتری کے تحت۔

Bored Ape Yacht Club (BAYC), one of the biggest NFT collections by market capitalization, saw a surge in sales volume in the past 24 hours, jumping 6.24% to US$832,882 million, after dropping 59.41% in the last seven days, according to کریپٹوسلام اعداد و شمار.

ایکوئٹیز

U.S. stock futures traded mixed on Monday at 5:45 p.m. in Hong Kong. The S&P 500 Futures inched up 0.01%, the Dow Jones Industrial Average gained 0.03% and the tech-heavy Nasdaq Composite Index dropped 0.02%.

Many Asian equity markets were closed on Monday. Japan’s نیکی 225 gained 0.92% and ended Monday on a 8.5-month high, driven by strong Japanese corporate earnings reports and a weak yen. The country’s صارفین کے اعتماد کا اشاریہ increased to 35.4 in April from 33.9 in March, the highest since January 2022, according to Tradingeconomics.

Global banking industry concerns resurfaced with خبر of JPMorgan Chase acquiring most assets of First Republic Bank in a deal arranged by the U.S. Federal Deposit Insurance Corporation, a government agency for deposit insurance supply to depositors in American commercial and savings banks. The share price of U.S.-based First Republic Bank plunged 43.20% on Friday after the lender رپورٹ کے مطابق a 40.8% drop in deposits, or around US$100 billion, since the start of the year.

The banking sector has now witnessed three major failures including سلیکن ویلی بینک اور دستخط بینک that were also taken over by the FDIC.

The U.S. Federal Reserve’s next move on interest rates is on May 3. Over the past year, the central bank has consistently raised rates to bring inflation down to its target range of 2%. U.S. interest rates are currently between 4.75% to 5%, the highest since June 2006.

“It is highly anticipated that the Fed may hike the interest rates by 25 basis points,” said Dhruvil Shah, vice-president of technology at Liminal, a wallet infrastructure and custody solutions platform. This will increase interest rates to around 5% to 5.25%, a level not seen since 2007.

یورپی مرکزی بینک مبینہ طور پر ہے expected to increase interest rates on Thursday but analysts are divided on the quantum of the hike.

متعلقہ مضمون ملاحظہ کریں: Coinbase کا کہنا ہے کہ SEC کے قانونی خطرات شفافیت کو سزا دیتے ہیں، عوامی فہرست سازی کے عمل کو کمزور کرتے ہیں۔

- SEO سے چلنے والا مواد اور PR کی تقسیم۔ آج ہی بڑھا دیں۔

- پلیٹوآئ اسٹریم۔ ویب 3 ڈیٹا انٹیلی جنس۔ علم میں اضافہ۔ یہاں تک رسائی حاصل کریں۔

- ایڈریین ایشلے کے ساتھ مستقبل کا نقشہ بنانا۔ یہاں تک رسائی حاصل کریں۔

- ماخذ: https://forkast.news/bitcoin-ether-fall-amid-banking-sector-concern/

- : ہے

- : ہے

- : نہیں

- ][p

- $UP

- 000

- 1

- 10

- 2%

- 2022

- 24

- 30

- 500

- 66

- 7

- 8

- 9

- 95٪

- a

- ہمارے بارے میں

- کے مطابق

- حاصل کرنا

- کے بعد

- ایجنسی

- کی اجازت دیتا ہے

- بھی

- اگرچہ

- امریکی

- کے ساتھ

- تجزیہ کار کہتے ہیں

- اور

- متوقع

- EPA

- اپریل

- کیا

- ارد گرد

- اہتمام

- مضمون

- AS

- ایشیا

- ایشیائی

- ایشیائی ایکویٹی مارکیٹس

- اثاثے

- At

- اوسط

- بینک

- بینکنگ

- بینکنگ کی صنعت

- بینکنگ سیکٹر

- بینکاری نظام

- بینکوں

- بنیاد

- bayc

- کے درمیان

- سب سے بڑا

- ارب

- بائنس

- بٹ کوائن

- bnb

- لانے

- لیکن

- by

- سرمایہ کاری

- مرکزی

- مرکزی بینک

- پیچھا

- بند

- کلب

- سی این این

- CO

- سکے

- مجموعے

- تجارتی

- کمپنی کے

- اندراج

- آپکا اعتماد

- معاہدے

- کارپوریٹ

- کارپوریشن

- ملک کی

- کرپٹو

- کرپٹو سکے

- کرپٹو ایکسچینج

- کرپٹو ایکسچینج بائننس۔

- کرپٹو مارکیٹ

- کرپٹو مارکیٹ کا حجم

- کرپٹو کرنسیوں کی تجارت کرنا اب بھی ممکن ہے

- cryptocurrency

- cryptos

- کریپٹوسلام

- اس وقت

- تحمل

- اعداد و شمار

- دن

- دن

- نمٹنے کے

- ۱۰۰۰۰ ڈالر ڈیپازٹ

- ڈپازٹ انشورنس

- جمع کرنے والے

- ذخائر

- ڈیجیٹل

- تقسیم

- ڈاؤ

- ڈاؤ جونز

- ڈاؤ جونز انڈسٹریل ایوریج

- نیچے

- کارفرما

- چھوڑ

- گرا دیا

- چھوڑنا

- آمدنی

- اہل

- ایکوئٹی

- ایکوئٹی مارکیٹ

- آسمان

- یورپی

- یورپی مرکزی بینک

- اس کے علاوہ

- ایکسچینج

- توقع

- گر

- کھیت

- fdic

- فیڈ

- وفاقی

- وفاقی ڈپازٹ انشورنس کارپوریشن

- فیڈرل ریزرو

- پہلا

- کے بعد

- کے لئے

- فورکسٹ

- جمعہ

- سے

- فیوچرز

- دی

- گلوبل

- حکومت

- گراف

- ہائی

- اعلی

- سب سے زیادہ

- انتہائی

- اضافہ

- چھٹیوں

- ہانگ

- ہانگ کانگ

- HOURS

- HTTPS

- in

- شامل ہیں

- سمیت

- اضافہ

- اضافہ

- انڈکس

- انڈیکس

- صنعتی

- صنعت

- افراط زر کی شرح

- انفراسٹرکچر

- انشورنس

- دلچسپی

- سود کی شرح

- IT

- میں

- جنوری

- جاپان کا

- جاپانی

- فوٹو

- JPMorgan

- jpmorgan پیچھا

- جون

- کانگ

- لیبز

- سب سے بڑا

- سب سے بڑا کرپٹو

- آخری

- شروع

- قانونی

- قرض دینے والا

- سطح

- لسٹنگ

- لائٹ کوائن

- نقصان اٹھانے والے

- کھو

- اہم

- میں کامیاب

- مارچ

- مارکیٹ

- مارکیٹ کیپٹلائزیشن

- مارکیٹ لپیٹ

- Markets

- زیادہ سے زیادہ چوڑائی

- مئی..

- پیمائش

- اقدامات

- دس لاکھ

- مخلوط

- پیر

- مہینہ

- سب سے زیادہ

- منتقل

- بہت

- نیس ڈیک

- مقامی

- آبائی ٹوکن

- خبر

- اگلے

- Nft

- این ایف ٹی کلیکشن

- nft مارکیٹ

- غیر مستحکم کوائن

- اب

- of

- on

- ایک

- صرف

- or

- دیگر

- پر

- گزشتہ

- کارکردگی

- پلیٹ فارم

- پلاٹا

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- پھینک دیا

- پوائنٹس

- قیمت

- پراکسی

- عوامی

- عوامی لسٹنگ

- کوانٹم

- اٹھایا

- رینج

- قیمتیں

- حال ہی میں

- ریگولیٹرز

- متعلقہ

- تجدید

- رپورٹیں

- جمہوریہ

- بڑھتی ہوئی

- گلاب

- s

- ایس اینڈ پی

- ایس اینڈ پی 500

- کہا

- فروخت

- فروخت

- فروخت کا حجم

- بچت

- کا کہنا ہے کہ

- شعبے

- دیکھا

- سات

- سیکنڈ اور

- بعد

- بہن

- ہوشیار

- سمارٹ معاہدہ

- سورج

- سولانا

- حل

- داؤ

- شروع کریں

- اسٹاک

- مضبوط

- سوئی

- فراہمی

- اضافے

- کے نظام

- گولی

- ہدف

- ٹیکنالوجی

- کہ

- ۔

- کھلایا

- ان

- وہ

- اس

- خطرات

- تین

- کرنے کے لئے

- ٹوکن

- سب سے اوپر

- اوپر 10

- کل

- تجارت کی جاتی ہے

- ٹریڈنگ

- شفافیت

- ٹریلین

- trueusd

- ٹسڈ

- ہمیں

- چھتری

- کے تحت

- کمزور

- صارفین

- وادی

- کی طرف سے

- حجم

- بٹوے

- تھا

- ہفتے

- تھے

- جس

- جبکہ

- گے

- ساتھ

- گواہ

- دنیا کی

- لپیٹو

- یاٹ

- یاٹ کلب

- سال

- ین

- زیفیرنیٹ