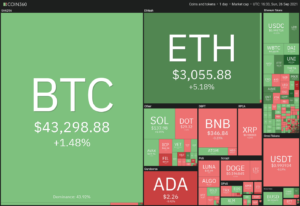

Just this week, Ether (ETH) breached the $4,000 mark while Bitcoin (BTC), the world’s most popular cryptocurrency, recently ایک اور ہر وقت کی اونچائی کو مارا at over $63,000. Meanwhile, Dogecoin (ڈوگے) continues its roller-coaster ride after “Dogefather” Elon Musk’s appearance on Saturday Night Live and news about digital artwork fetching eye-watering prices in the form of nonfungible tokens is all over the airwaves.

Crypto is hot, whether you like it or not.

Still, not everyone is convinced. Janet Yellen, the newly-minted United States secretary of the treasury, previously questioned the legitimacy and stability of cryptocurrency as a store of value. After all, it was only three years ago when we saw the last Bitcoin bubble burst. After a meteoric rise in 2017, which saw BTC crest the $20,000 mark, a 2018 sell-off cratered the asset and attracted “Tulipmania” comparisons.

متعلقہ: کیا بٹ کوائن نے 2020 میں خود کو قابل اعتماد اسٹور ثابت کیا؟ ماہرین جواب دیتے ہیں

Bitcoiners have been called “کلٹس” due to their zealous backing of this new, volatile and arcane technology. But don’t be confused: it’s not just technophiles and eccentric billionaires like Elon Musk diving into cryptocurrency. From JPMorgan to PayPal, bona fide Wall Street bluebloods and Silicon Valley stalwarts have been خرید Bitcoin in a big way.

متعلقہ: کیا پے پال کا کرپٹو انضمام عوام میں کرپٹو لائے گا؟ ماہرین جواب دیتے ہیں

The amount of BTC in circulation is now worth over a trillion dollars. Most of the major financial institutions — including investment giants and payment firms — are now backing the cryptocurrency, and there is growing interest from retail investors. Bitcoin is becoming an increasingly important part of the global financial system.

At the same time, Bitcoin still exists in a regulatory gray area as different governing bodies have knit together a patchwork of cryptocurrency rules over the past 10 years. In many cases, this patchwork isn’t enough to give mainstream investors confidence in the market, as some of the most basic principles about cryptocurrency governance are still up for debate. For example, are cryptocurrencies considered assets or securities? Well, that all depends on who you ask…

What do investors need to know about crypto regulations?

One of the big misconceptions about Bitcoin — and cryptocurrencies in general — is that the market is some sort of “Wild West”: outside the scope of regulators and rife with scammers, outlaws and crooks. That’s simply not true.

Any business that touches consumers in the U.S. and other jurisdictions is subject to some form of regulatory standards and rules, which also apply to digital assets. There may not be a framework created with cryptocurrencies in mind, given that we are at the frontier of a new, disruptive technology. But various rules regarding consumer protection, prevention of money laundering, anti-fraud and other fields apply to the different activities that take place. Crypto companies can work with law firms to interpret the rules in relation to their business and comply with them to the best of their ability.

The current crypto rulebook has been cobbled together over the past 10 years as regulation has played catch-up to innovation. But that might soon change: The confirmation of گیری Gensler — a former head of the Commodity Futures Trading Commission, or CFTC, who has taught classes on blockchain technology and cryptocurrencies at the Massachusetts Institute of Technology — as the new chairman of the Securities and Exchange Commission, or SEC, indicates that the current administration is going to treat digital assets seriously and attempt to provide comprehensive oversight and regulatory guidance for this nascent market.

Gensler کے پاس ہے۔ مطلع that he’s awaiting the completion of Yellen’s review of crypto before enacting a regulatory agenda on digital currencies. Meanwhile, Congress is also taking a hard look. Last month, lawmakers متعارف a bill to create a working group composed of industry experts and representatives from the SEC and CFTC to evaluate the current legal and regulatory framework around digital assets.

متعلقہ: بائیڈن انتظامیہ میں عہدوں کے ل Cry کرپٹو دوستانہ چہرے تیار ہیں

It is hard to predict what we will see in terms of regulations for cryptocurrency and the various business models in the industry in the near future. Still, we have observed regulators becoming increasingly sophisticated and constructive, as they recognize that they have a duty to actively protect consumers, promote innovation and create a positive economic environment.

How can institutional investors trust crypto companies?

With a plethora of crypto firms cropping up against this confusing regulatory backdrop in recent years, it’s important for institutional investors to understand what pitfalls to avoid when choosing a partner to entrust with their digital assets. It is crucial to know how the firm is regulated, information that should be publicly available on their website and verified on the regulator’s website.

In addition, it is worth understanding every business model, as not all firms are the same. The basic concept of paying yield may look the same, but the risk profile may be quite different. If a firm is not transparent in how it operates and creates yield, it should be a cause for concern, and if their rates are materially different from competitors, I think it’s important to understand why. Always read the fine print!

Some companies may opt to work in jurisdictions known for light regulation, but skirting oversight comes at the expense of building trust and long-term business. Any company worth working with will have a proactive and collaborative stance with regulators. It is a complex landscape to navigate, and it can be expensive for startup companies, but it is part of the cost of building long-term value.

Cryptocurrency lenders who want to be at the forefront of the digital revolution need to embrace the regulatory overhaul that is bound to come and welcome the dialogue with regulators. Investors should seek partnerships with firms that value transparency, compliance, expertise and fairness.

اس مضمون میں سرمایہ کاری کے مشورے یا سفارشات نہیں ہیں۔ ہر سرمایہ کاری اور تجارتی اقدام میں خطرہ ہوتا ہے ، اور فیصلہ لیتے وقت قارئین کو اپنی تحقیق کرنی چاہئے۔

یہاں جن خیالات ، خیالات اور آراء کا اظہار کیا گیا وہ مصنف کے تنہا ہیں اور یہ ضروری نہیں ہے کہ سکےٹیلیگراف کے نظریات اور آراء کی عکاسی کی جائے۔

کیملا چرچر is the global head of business development at Celsius Network. Camilla has vast experience in traditional financial services, Wall Street firms and fintech startups. After receiving her Master’s at the University of Edinburgh, Camilla launched her finance career, starting as an analyst for Morgan Stanley and later for Citigroup. Most notably, Camilla served as the director of prime derivatives services at Credit Suisse before becoming Bank of America’s director of prime brokerage sales. Before joining Celsius, her most recent position was as the head of sales at LGO, an institutional digital asset exchange.

- 000

- 2020

- سرگرمیوں

- مشورہ

- تمام

- امریکہ

- تجزیہ کار

- رقبہ

- ارد گرد

- مضمون

- اثاثے

- اثاثے

- بینک

- بینک آف امریکہ

- BEST

- بولنا

- بل

- ارباب

- بٹ کوائن

- blockchain

- blockchain ٹیکنالوجی

- بروکرج

- BTC

- عمارت

- کاروبار

- بزنس ماڈل

- کیریئر کے

- مقدمات

- کیونکہ

- سیلسیس

- CFTC

- چیئرمین

- تبدیل

- سٹی گروپ

- Cointelegraph

- آنے والے

- کمیشن

- شے

- کمپنیاں

- کمپنی کے

- تعمیل

- آپکا اعتماد

- کانگریس

- صارفین

- صارفین کا تحفظ

- جاری ہے

- کریڈٹ

- کریڈٹ سوئس

- کرپٹو

- کرپٹو فرمز

- کریپٹو ضوابط

- کرپٹو کرنسیوں کی تجارت کرنا اب بھی ممکن ہے

- cryptocurrency

- موجودہ

- بحث

- مشتق

- ترقی

- ڈیجیٹل

- ڈیجیٹل اثاثہ

- ڈیجیٹل اثاثے۔

- ڈیجیٹل کرنسیوں

- ڈائریکٹر

- Dogecoin

- ڈالر

- اقتصادی

- یلون کستوری

- ماحولیات

- آسمان

- ایکسچینج

- ماہرین

- چہرے

- قطعات

- کی مالی اعانت

- مالی

- مالیاتی ادارے

- مالیاتی خدمات

- آخر

- فن ٹیک

- فرم

- فارم

- فریم ورک

- مستقبل

- فیوچرز

- جنرل

- گلوبل

- گورننس

- بھوری رنگ

- گروپ

- سر

- یہاں

- کس طرح

- HTTPS

- سمیت

- صنعت

- معلومات

- جدت طرازی

- ادارہ

- اداروں

- انضمام

- دلچسپی

- سرمایہ کاری

- سرمایہ

- IT

- JPMorgan

- قانون

- قانون ساز

- قانونی

- روشنی

- مین سٹریم میں

- اہم

- بنانا

- مارکیٹ

- میسا چوسٹس

- ماشسٹس انسٹیٹیوٹ آف ٹیکنالوجی

- ماڈل

- قیمت

- رشوت خوری

- مورگن سٹینلے

- سب سے زیادہ مقبول

- منتقل

- قریب

- نیٹ ورک

- خبر

- رائے

- دیگر

- اضافی

- پارٹنر

- شراکت داری

- ادائیگی

- پے پال

- مقبول

- روک تھام

- پرائم بروکرج

- پروفائل

- حفاظت

- تحفظ

- قیمتیں

- قارئین

- ریگولیشن

- ضابطے

- ریگولیٹرز

- تحقیق

- خوردہ

- کا جائزہ لینے کے

- رسک

- قوانین

- فروخت

- سکیمرز

- SEC

- سیکورٹیز

- سروسز

- سلیکن ویلی

- معیار

- سٹینلی

- شروع

- سترٹو

- امریکہ

- ذخیرہ

- سڑک

- کے نظام

- ٹیکنالوجی

- وقت

- ٹوکن

- ٹریڈنگ

- شفافیت

- علاج

- بھروسہ رکھو

- ہمیں

- متحدہ

- ریاست ہائے متحدہ امریکہ

- یونیورسٹی

- قیمت

- وال سٹریٹ

- ویب سائٹ

- ہفتے

- ڈبلیو

- کام

- قابل

- سال

- پیداوار