This week I want to pull together two of my recent blogs:

I was fully expecting to see a “SACCR effect” on the amount of FX Clearing we see in 2022. Let’s look into the details below.

Widening Spreads

FX and SACCR have made the headlines a few times in early 2022. Most notably, we saw the following from Rủi ro.net:

Why would a shift in capital rules lead to a change in client facing pricing from a large bank? Let’s look through the details and highlight what has changed in 2022 for FX.

SACCR Models

Clarus have a host of SACCR resources on the blog – see SACCR. This year, I have been writing a series about the basics of SACCR:

The following table provides a nice summary of those 3 blogs:

| MPOR | Yếu tố trưởng thành | Bình luận |

| 40 | 0.60 | Các CSA bị tranh chấp |

| 20 | 0.42 | Các giao dịch khó định giá; Hơn 5,000 bộ lưới |

| 10 | 0.30 | CCP, CSA "sạch" |

| STM (Thanh toán ra thị trường) | 0.20 | Định cư tại Thị trường |

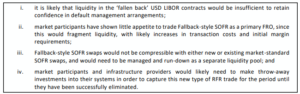

Theo SACCR, the “Maturity Factor” for a portfolio changes depending on what type of margining agreement you have. In some cases, you might not even have a margining agreement. And in others, you may be able to define the Variation Margin as daily settlement (see Định cư tại Thị trường).

Otherwise, the key metric I think about when looking at SACCR is the Exposure at Default. In Phần một, we highlighted how this is largely equivalent to the Potential Future Exposure that we calculated under the old Phương pháp tiếp xúc hiện tại. Under SACCR:

Mức độ tiếp xúc ở mức mặc định cho FX = Danh nghĩa ròng * Hệ số trưởng thành * Hệ số giám sát * Alpha (1.4)

( tag {1} Exposure at Default = Alpha * Supervisory Factor * MF_{i} * Net Notional_{j} )

Let’s look at some values of EADs using the below example as a guide:

| EURUSD danh nghĩa ròng | $ 100m |

| Yếu tố trưởng thành CSA với <5,000 giao dịch, CSA rõ ràng |

0.30 |

| Supervisory Factor (“Risk Weight”) | 4% |

| Alpha | 1.4 |

| Tính toán | 100 * 0.30 * 4% * 1.4 |

| Phơi sáng mặc định (EAD) | $ 1.68m |

Exposure at Default vs PFEs

Rather than present only the SACCR numbers, it is often useful to look at these in context. Therefore, along with the EAD under SACCR, I present the “old” CEM PFE values as well. Largely speaking, both measures dictate the size of the exposure that feeds into capital requirements. For a bank targeting a 7.5% Leverage Ratio (SLR), 7.5% of this exposure value needs to be held as capital (assuming their capital constraint is Leverage).

| Yếu tố rủi ro | Notional ($m) | “Risk Weight” | Maturity Factor/NGR | EAD/PFE ($m) | |||||

| SACCR | EURUSD | 100m | 4.0% | 0.2-0.6 | 1.12-3.36 | ||||

| CEM | EURUSD | 100m | 1.0% -7.5% | Từ 0-100% | 0.40-3.00 |

The table looks pretty good for CEM and woeful for SACCR right?

- The smallest exposure possible is calculated under CEM at just $400k for a $100m position. This represents an out of the money sub-one year FX trade.

- The exact same trade under SACCR generates an exposure of at least $1.12m (2.8 times more!) than under CEM.

Whilst potentially an interesting soundbite to present, this doesn’t really tell the whole story under CEM and SACCR.

From a portfolio perspective, CEM would then go on to Tăng lên positions. Any more gross notional that I add to the portfolio will, by definition, add to the exposure amount and hence add to the capital I must hold against the portfolio.

Under SACCR, the risk factor is calculated based on the mạng danh nghĩa. If I therefore execute a risk offsetting position – e.g. selling $100m EURUSD against the long above – I would neutralise the exposure calculations. If I am risk neutral versus a counterparty, I have zero exposure and hence have to hold zero capital (assuming a suitable netting agreement is in place).

However, this doesn’t necessarily consider the “real world”:

- Netting risk positions in this manner is very helpful for inter-dealer exposures. If my hedging counterparties are truly “risk-neutral” in all of their risk factors, then I can trade in and out with counterparties all day long without adding to my exposures.

- However, is this ever really the case? Without seeing real portfolios it is hard to tell.

- Let’s be generous and state that 50% of the time, an interbank exposure will reduce the existing exposure.

- What does SACCR mean for the 50% of trades that are risk additive? Now, the SACCR capital is more punitive than under CEM.

And what about the rest of the trading world – those counterparties who are not “dealers”?

- All other counterparties will be, by necessity, directional.

- Either hedge funds taking speculative positions.

- Or end users hedging real exposures. These will create directional positions versus the dealer banks. It is the dealer banks who have to hold capital against these directional positions (not the end users, who do not have to follow bank regulations – lucky them!).

- In all of these cases, banks know that customers will only be adding (or replacing/rolling) a directional risk exposure.

- Under SACCR, these exposures will consume more capital than under CEM.

A Typical Comparison

A reasonable comparison of SACCR vs CEM for FX likely lies somewhere between the best and worse cases. Below is my best guess at the real comparison between SACCR and CEM:

| Yếu tố rủi ro | Notional ($m) | “Risk Weight” | Maturity Factor/NGR | EAD/PFE ($m) | |||||

| SACCR | EURUSD | 100m | 4.0% | 0.42 | 2.35 | ||||

| CEM | EURUSD | 100m | 1.0% | 15% | 0.49 |

In short, I think that SACCR is consuming ~4.8 times as much capital in FX compared to the old CEM model.

(Assumptions can always be wrong, but I think it is fair that most interdealer portfolios will have a “hard to value” trade, so will likely attract at 0.42 Maturity Factor under SACCR. Equally, almost all FX positions are less than 1 year, so will have attracted a 1% risk weight under CEM.)

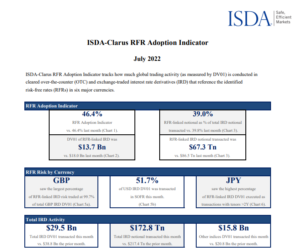

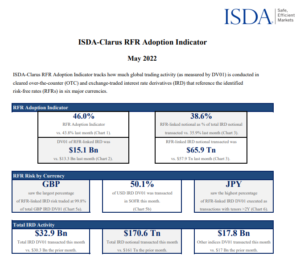

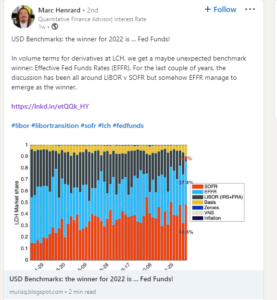

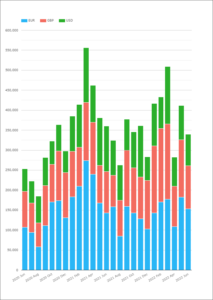

FX Clearing

Going full circle, I therefore fully expected to see a “SACCR effect” in our FX Clearing 2022 blog. Tại sao?

- FX is now “more expensive” under SACCR than CEM.

- SACCR grosses up positions across counterparties.

- Clearing allows for the multilateral netting of positions across counterparties.

- Therefore, if I have a long EURUSD bilateral trade with Deutsche versus a short versus Citi, I can (in theory) novate these into clearing and reduce my SACCR capital consumption. Both Deutsche and Citi would also need to see a commensurate benefit, so this works best on a multilateral basis.

- Even without any netting benefits, you can see a reduction in SACCR-based capital from clearing:

| SACCR | Yếu tố rủi ro | Notional ($m) | Supervis-ory Hệ số |

MF Cleared FX | EAD/PFE ($m) | Quầy tính tiền- bên Risk Weight |

Credit RWA ($ m) |

||

| Tỉ lệ đòn bẩy | EURUSD | 100m | 4.0% | 0.2 | 1.12 | Từ 100-150% | 1.12-1.68 | ||

| Credit RWA | EURUSD | 100m | 4.0% | 0.2 | 2% | 0.022 |

- For a leverage constrained bank, Clearing introduces a 53% saving in EADs under SACCR.

- For a Credit RWA constrained bank, Clearing introduces a 98%+ reduction in EADs under SACCR (!), thanks to the much lower counterparty risk weight for a CCP.

- Of course, some of these savings must be offset against the cost of posting Initial Margin in Clearing.

- Banks must ultimately balance portfolios and optimise.

- This is probably why SACCR has been such a hot topic in 2022.

- And likely why we are seeing the impact on quoted spreads in FX markets for end users.

Tóm tắt

- SACCR significantly impacts the amount of capital that must be held in FX markets.

- It can be reasonably assumed that the amount of capital held against directional positions has increased by nearly five times this year.

- Whilst netting is good, and will reduce capital versus large two-way portfolios, it still means that trades that add to the directionality of a portfolio will need a larger amount of capital held against them than under the previous Current Exposure Methodology.

- Risk-sensitive measures of capital are generally a good thing, so it will be interesting to see how these changes play out in markets.

- Market participants will likely choose to optimise and balance FX portfolios between cleared and uncleared.

- A reduction in capital in clearing must be balanced versus the cost of posting Initial Margin to a CCP.

- kiến tài chính

- blockchain

- hội nghị blockchain fintech

- chuông fintech

- clarus

- coinbase

- thiên tài

- hội nghị tiền điện tử fintech

- fintech

- ứng dụng fintech

- đổi mới fintech

- FX

- OpenSea

- PayPal

- công nghệ thanh toán

- con đường thanh toán

- plato

- Plato ai

- Thông tin dữ liệu Plato

- PlatoDữ liệu

- Platogaming

- tiền dao cạo

- Revolut

- Ripple

- fintech vuông

- sọc

- công nghệ tài chính tencent

- máy photocopy

- zephyrnet