Internal audits play a crucial role in assessing a company’s internal controls, corporate governance, and accounting processes. Automating internal audits can address many challenges of the traditional process.

These audits are essential for ensuring compliance with laws and regulations and maintaining accurate and timely financial reporting and data collection. However, it is often time-consuming, redundant, and prone to reporting inaccuracies and errors.

Let’s take a look at how automating internal audits can streamline the process for your business.

How can you adopt automation for internal audits?

Automation in internal audit could be done through a wide range of digital technologies, from foundational data integration and analytics to advanced cognitive elements mimicking human behavior.

Commonly used tools include audit management software, data analytics tools, Robotic Process Automation (RPA), kunstig intelligens (AI), blockchain technology, and cloud-based solutions.

Here are some specific examples of how these technologies can be used in internal audit:

- Audit management software can be used to:

- Automate the scheduling and tracking of audits

- Manage audit budgets and resources

- Collect and store audit data

- Generate audit reports

- Data analytics tools can be used to:

- Identify patterns and trends in data

- Detect anomalies in data

- Vurder risici

- RPA can be used to:

- Automate data entry and extraction

- Generer rapporter

- Perform compliance checks

- AI can be used to:

- Identificer risici

- Detect fraud

- Assess the effectiveness of controls

- Blockchain technology can be used to:

- Create an immutable revisionsspor

- Securely store audit data

- Cloud-based solutions can be used to:

- Share audit data securely

- Collaborate on audits remotely

The use of automation in internal audits is still evolving. Notably, Deloitte’s survey highlights a growing trend, with 43 % of surveyed auditors already leveraging advanced analytics and automation in their internal audit functions. However, it is clear that these technologies have the potential to significantly improve the efficiency, effectiveness, and risk-based approach of internal audit.

What are the benefits of automation for internal audits?

Automation in internal audit brings myriad benefits, enhancing efficiency and effectiveness in various aspects of the audit life cycle.

Her er et par af fordelene:

- Øget effektivitet: Automation can help to streamline repetitive and time-consuming tasks, such as data entry, report generation, and compliance checks. This can free up auditors’ time so that they can focus on more value-added activities, such as risk assessment and fraud detection.

- Forbedret nøjagtighed: Automation can help improve audit results’ accuracy by reducing the risk of human error. This is because automation can be programmed to follow specific rules and procedures, which can help to ensure that data is entered and processed correctly.

- Enhanced risk identification and assessment: Automation can help to identify and assess risks more effectively by analyzing large amounts of data more quickly and efficiently than manual methods. This can help auditors to focus their attention on areas where there is a higher risk of fraud or error.

- Increased transparency and auditability: Automation can help to improve the transparency and auditability of internal audit processes by generating audit trails that can be used to track the progress of an audit and verify the results. This can help to build trust with stakeholders and improve the overall effectiveness of the internal audit function.

- Reducerede omkostninger: Automation can help reduce the costs of internal audits by automating repetitive tasks and improving the audit process’s efficiency and accuracy.

Overall, automation can be a valuable tool for internal audit, helping to improve the efficiency, effectiveness, and risk-based approach of the function.

Challenges of Automating Internal Audits

While automating internal audits can be a largely beneficial process, there can be a few challenges:

- Datakvalitet: The quality of the data used for automation is critical. If the data is inaccurate or incomplete, the results of the automation will be unreliable. This means it is important to have a good data quality management process before automating any internal audit processes.

- Teknisk ekspertise: Automation requires technical expertise to design, develop, and implement. This can be a challenge for internal audit teams that do not have the necessary skills and resources. It is important to have a team of skilled professionals who can develop and implement automation solutions that meet the organization’s specific needs.

- Forandringsledelse: Automation can disrupt the way that internal audit is conducted. This can be a challenge to overcome, requiring all stakeholders’ buy-in. It is important to communicate the benefits of automation to all stakeholders and work with them to develop a plan for implementing automation to minimize disruption.

- Omkostninger: Automation can be a significant investment, both in terms of the cost of the software and the cost of implementing and maintaining the solution. It is important to carefully consider the costs and benefits of automation before making a decision to implement it.

Getting started with internal audit automation

Gennemførelse automation in your internal audits may seem daunting at first, but there are a few steps you can follow to make it easier:

- Identify automation opportunities. Look for repetitive, rule-based, and time-consuming tasks that can be automated.

- Define the vision and strategy. What do you want to achieve with automation? Improve efficiency, accuracy, risk assessment, or provide more valuable insights?

- Build the necessary infrastructure. This includes technology, tools, resources, skills, and training.

- Choose the right automation tools. RPA, data analytics, NLP, and AI are all options.

- Pilot and test automation. Test in a controlled environment before full implementation.

- Overvåg og optimer. Gather feedback and make adjustments as needed.

- Expand automation gradually. Start with a few processes and tasks, then expand as confidence grows.

With the use of tools like Nanonets, which has AI-powered OCR technology, you can tackle the challenges of automating your internal audit process.

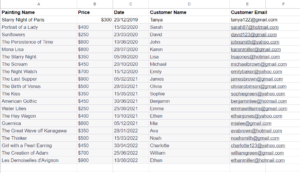

Nanonets uses machine learning algorithms to search for specific entries, such as dates, purchase order numbers, and reference IDs across various financial documents.

Nanonets is a no-code intelligent automation platform. This means that it can be easily customized to meet the specific needs of each organization. Nanonets can also be integrated with most CRM, ERP, or RPA software, ensuring a hassle-free implementation process.

Ofte Stillede Spørgsmål

Kan interne revisioner automatiseres?

Intern revision kan automatiseres i betydeligt omfang. Automatiseringsteknologier såsom robotprocesautomatisering, dataanalyse, kunstig intelligens og naturlig sprogbehandling (NLP) kan strømline gentagne og regelbaserede revisionsopgaver, forbedre dataanalysen og identificere uregelmæssigheder eller potentielle risici. Ved at automatisere disse processer kan interne revisionsteams forbedre effektiviteten, nøjagtigheden og revisionsdækningen, hvilket giver revisorer mulighed for at fokusere på aktiviteter af højere værdi og strategisk beslutningstagning. Selvom fuldstændig automatisering måske ikke er mulig for alle aspekter af intern revision, kan anvendelse af automatiseringsteknologier forbedre effektiviteten og værdien af revisionsfunktionen markant.

Hvordan bruges automatisering i revision?

Robotic Process Automation (RPA) kan automatisere gentagne opgaver som dataindtastning og rapportgenerering, hvilket forbedrer effektiviteten og nøjagtigheden. Dataanalyseværktøjer anvender automatisering til at analysere store datasæt, identificere mønstre og anomalier til risikovurdering og opdagelse af svindel. Natural Language Processing (NLP) gør det muligt for revisorer at behandle ustrukturerede data, såsom tekst, for lettere forespørgsel og analyse. Derudover bruges kunstig intelligens (AI) til forudsigelig modellering og anomalidetektion, hvilket giver værdifuld indsigt. Ved at udnytte automatiseringsteknologier kan revisorer optimere revisionsprocedurer, øge dækningen og fokusere på aktiviteter af højere værdi for at levere mere strategiske og værdifulde resultater.

Hvad er de 3 typer intern revision?

De tre fremherskende typer af interne revisioner er compliance-revision, operationel revision og finansiel revision. En compliance audit indebærer inspektion og sikring af overholdelse af politikker, love og regler, der regulerer et specifikt område, proces eller system, der er under revision. En operationel revision fokuserer primært på at evaluere interne kontroller i nøgleprocesser for at øge produktiviteten og effektiviteten. En finansiel revision er en objektiv vurdering af en organisations regnskaber for at verificere deres nøjagtighed og retfærdighed i at repræsentere de påståede transaktioner. Den stigende udbredelse af digitale værktøjer i erhvervslivet har ført til fremkomsten af informationsteknologirevisioner. Disse revisioner involverer undersøgelse af ledelseskontroller i it-applikationer, operativsystemer, databaser og infrastruktur. De kan udføres uafhængigt for IT eller i forbindelse med compliance, operationelle eller finansielle revisioner. Målet er at sikre integriteten og effektiviteten af it-systemer og -processer, sikre data og optimere it-ressourcer i overensstemmelse med organisatoriske mål.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- PlatoData.Network Vertical Generative Ai. Styrk dig selv. Adgang her.

- PlatoAiStream. Web3 intelligens. Viden forstærket. Adgang her.

- PlatoESG. Automotive/elbiler, Kulstof, CleanTech, Energi, Miljø, Solenergi, Affaldshåndtering. Adgang her.

- PlatoHealth. Bioteknologiske og kliniske forsøgs intelligens. Adgang her.

- ChartPrime. Løft dit handelsspil med ChartPrime. Adgang her.

- BlockOffsets. Modernisering af miljømæssig offset-ejerskab. Adgang her.

- Kilde: https://nanonets.com/blog/internal-audit-automation/

- :har

- :er

- :ikke

- :hvor

- $OP

- 06

- 12

- 13

- 24

- 25

- 7

- 75

- a

- Bogføring og administration

- nøjagtighed

- præcis

- opnå

- tværs

- aktiviteter

- Derudover

- adresse

- justeringer

- vedtage

- Vedtagelsen

- fremskreden

- AI

- AI-drevne

- sigte

- algoritmer

- tilpasning

- Alle

- tillade

- allerede

- også

- beløb

- an

- analyse

- analytics

- analysere

- analysere

- ,

- og infrastruktur

- afsløring af anomalier

- enhver

- applikationer

- tilgang

- ER

- OMRÅDE

- områder

- kunstig

- kunstig intelligens

- Kunstig intelligens (AI)

- AS

- aspekter

- vurdere

- Vurdering

- vurdering

- At

- opmærksomhed

- revision

- auditabilitet

- revision

- revisorer

- revisioner

- automatisere

- Automatiseret

- Automatisering

- Automation

- BE

- fordi

- før

- adfærd

- gavnlig

- fordele

- blockchain

- Blockchain teknologi

- både

- Bringer

- Budgetter

- bygge

- opbyg tillid

- virksomhed

- men

- by

- CAN

- omhyggeligt

- Centers

- udfordre

- udfordringer

- Kontrol

- hævdede

- klar

- Luk

- kognitive

- samling

- KOM

- kommunikere

- selskab

- fuldføre

- Compliance

- gennemført

- tillid

- sammenholdt

- Overvej

- kontrolleret

- kontrol

- Corporate

- Koste

- Omkostninger

- kunne

- dækning

- kritisk

- CRM

- afgørende

- tilpassede

- cyklus

- data

- dataanalyse

- Dataanalyse

- indtastning af data

- databaser

- datasæt

- Datoer

- beslutning

- Beslutningstagning

- levere

- Deloitte

- Design

- Detektion

- udvikle

- digital

- digitale teknologier

- Afbryde

- Forstyrrelse

- do

- dokumenter

- færdig

- hver

- lettere

- nemt

- effektivt

- effektivitet

- effektivitet

- effektivt

- elementer

- fremkomsten

- selvstændige

- muliggør

- forbedre

- styrke

- sikre

- sikring

- indtastet

- indrejse

- Miljø

- ERP

- fejl

- fejl

- væsentlig

- evaluere

- udviklende

- Undersøgelse

- eksempler

- Udvid

- ekspertise

- fairness

- gennemførlig

- tilbagemeldinger

- få

- finansielle

- Fornavn

- Fokus

- følger

- Til

- bedrageri

- bedrageri afsløring

- Gratis

- fra

- fuld

- funktion

- funktioner

- samle

- generere

- generation

- godt

- regeringsførelse

- styrende

- gradvist

- Dyrkning

- Vokser

- Have

- hjælpe

- hjælpe

- højere

- højdepunkter

- Hvordan

- Men

- HTTPS

- menneskelig

- Identifikation

- identificere

- identificere

- id'er

- if

- uforanderlige

- gennemføre

- implementering

- gennemføre

- vigtigt

- Forbedre

- forbedring

- in

- forkert

- omfatter

- omfatter

- Forøg

- stigende

- uafhængigt

- oplysninger

- informationsteknologi

- Infrastruktur

- indsigt

- integreret

- integration

- integritet

- Intelligens

- Intelligent

- interne

- investering

- involvere

- IT

- Nøgle

- Sprog

- stor

- vid udstrækning

- Love

- Love og forskrifter

- læring

- Led

- løftestang

- Livet

- ligesom

- Se

- maskine

- machine learning

- Vedligeholdelse

- lave

- Making

- ledelse

- manuel

- mange

- Kan..

- midler

- Mød

- metoder

- modellering

- mere

- mest

- utal

- Natural

- Natural Language Processing

- nødvendig

- behov

- behov

- NLP

- især

- numre

- målsætninger

- OCR

- of

- tit

- on

- drift

- operativsystemer

- operationelle

- Muligheder

- Optimer

- optimering

- Indstillinger

- or

- ordrer

- organisation

- organisatorisk

- udfald

- samlet

- Overvind

- mønstre

- fly

- perron

- plato

- Platon Data Intelligence

- PlatoData

- Leg

- politikker

- potentiale

- primært

- procedurer

- behandle

- Procesautomatisering

- Behandlet

- Processer

- forarbejdning

- produktivitet

- professionelle partnere

- programmerede

- Progress

- give

- leverer

- køb

- indkøbsordre

- kvalitet

- hurtigt

- rækkevidde

- reducere

- reducere

- fast

- regler

- repetitiv

- indberette

- Rapportering

- repræsenterer

- Kræver

- Ressourcer

- Resultater

- gennemgå

- højre

- Risiko

- risikovurdering

- risici

- Robot procesautomation

- roller

- rpa

- regler

- s

- varetagelse

- planlægning

- Søg

- synes

- signifikant

- betydeligt

- faglært

- færdigheder

- So

- Software

- løsninger

- Løsninger

- nogle

- specifikke

- interessenter

- starte

- påbegyndt

- udsagn

- Steps

- Stadig

- butik

- Strategisk

- Strategi

- strømline

- sådan

- Kortlægge

- adspurgte

- systemet

- Systemer

- tackle

- Tag

- opgaver

- hold

- hold

- Teknisk

- Teknologier

- Teknologier

- vilkår

- prøve

- end

- at

- deres

- Them

- derefter

- Der.

- Disse

- de

- denne

- tre

- Gennem

- tid

- tidskrævende

- til

- værktøj

- værktøjer

- spor

- Sporing

- traditionelle

- Kurser

- Transaktioner

- Gennemsigtighed

- Trend

- Tendenser

- Stol

- typer

- under

- brug

- anvendte

- bruger

- udnytte

- Værdifuld

- værdi

- forskellige

- verificere

- vision

- ønsker

- Vej..

- Hvad

- som

- mens

- WHO

- bred

- Bred rækkevidde

- vilje

- med

- Arbejde

- Du

- Din

- zephyrnet