This op-ed originally appeared as “In defence of stablecoins” on the Financial Times hjemmeside on Monday, August 8, 2022, and in the newspaper’s print edition on Tuesday, August 9, 2022.

Crypto critics are using the collapse of dollar-pegged virtual currency Terra as ammunition to attack stablecoins and the crypto industry as a whole.

Lost in the conversation is, however, the root cause of the turmoil. A better understanding of what went wrong — and why — could help protect consumers while safeguarding innovation.

It’s important first to clarify terms. A stablecoin is cryptocurrency whose price is nominally “pegged” to a stable asset such as the U.S. dollar. People commonly blame the recent blow-up on so-called “algorithmic stablecoins,” which are typically programmed to automatically incentivize the creation and destruction of coins to maintain the price peg.

The attack on them is off the mark. Putting aside that TerraUSD should never have been considered a “stablecoin,” the real issue here has little to do with computer code and everything to do with a concept as old as finance itself: collateralization, or the use of assets to underpin value.

It is a crucial point that policymakers across the world need to consider as they draft legislation to prevent future Terra-like collapses. If legislators believe algorithms are to blame, they risk enacting counter-productive, innovation-stifling regulations. Poorly designed laws could disrupt markets, encourage regulatory arbitrage, and diminish Western democracies’ influence in the rising, decentralized internet economy known as web3.

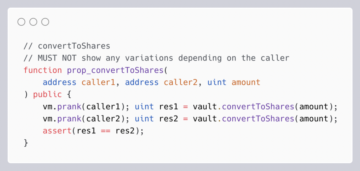

The promise of decentralized finance — Defi — rests largely on the breakthrough ability of blockchains to execute transparent, algorithmic contracts with instant finality.

Amid the recent market volatility, the vast majority of “decentralized” stablecoins backed by blockchain assets such as bitcoin and ether performed superbly, handling extreme price fluctuations and unprecedented redemptions without fail. Generally speaking, algorithms aren’t the issue with modern stablecoins. Instead, essentially all risk now arises from their collateral design.

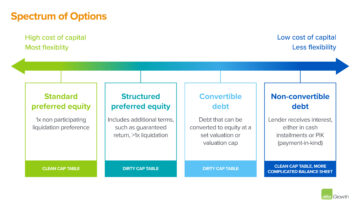

The riskiest stablecoins are readily apparent: they are significantly under-collateralized (less than $1 of collateral is required to mint $1 of stablecoin), and they rely on “endogenous” collateral (collateral created by the issuer such as governance tokens that give holders voting powers on a blockchain’s rules and procedures).

Endogenous collateral enables dangerous, explosive growth: when an issuer’s governance token appreciates, users can mint many more stablecoins. That sounds fine until one considers the flipside: When the price declines — as is practically guaranteed during a bank run — cascading collateral liquidations to meet redemptions trigger a death spiral. See TerraUSD as an example.

Regulation is necessary to prevent similar breakdowns, but overly restrictive rules are not. The truth is enforcement actions under existing securities laws and anti-fraud statutes could have curtailed the proliferation of nearly every failed stablecoin to date.

Even so, additional, targeted regulation could be beneficial. While it is difficult to pinpoint exactly where regulators should establish collateralization requirements, it’s clear that without guardrails, stablecoin issuers may once again take on unreasonable amounts of risk.

Well-tailored rulemaking could support the crypto ecosystem and protect consumers. Wholesale changes — such as prohibiting the use of algorithms and digital assets as collateral altogether — would place an enormous burden on the burgeoning DeFi industry, disrupt digital asset markets, and hinder web3 innovation.

This is because stablecoins can, indeed, be stable if they manage their collateral properly. For “centralized” stablecoins backed by real-world assets, the liquidity and transparency of reserves may be low, so collateral should include less volatile assets like cash, treasuries, and bonds. Regulators can establish parameters regarding these types of collateral and require regular audits.

For “decentralized” stablecoins, the almost exclusive use of blockchain assets such as bitcoin or ether as collateral has trade-offs. Digital assets, while often volatile, are also highly liquid and can be transparently and algorithmically managed. Liquidity can happen nearly instantaneously, enabling much more efficient systems. As a result, decentralized stablecoins could, ultimately, be more resilient than centralized ones.

Algorithmic stablecoins present a unique opportunity to make all sorts of assets productive and drive digital commerce around the globe. Placing guardrails around their collateral could help unlock that potential.

Redaktør: Robert Hackett @rhhackett

***

De synspunkter, der er udtrykt her, er dem fra det enkelte AH Capital Management, LLC ("a16z") personale, der er citeret, og er ikke synspunkter fra a16z eller dets tilknyttede selskaber. Visse oplysninger indeholdt heri er indhentet fra tredjepartskilder, herunder fra porteføljeselskaber af fonde forvaltet af a16z. Selvom det er taget fra kilder, der menes at være pålidelige, har a16z ikke uafhængigt verificeret sådanne oplysninger og fremsætter ingen repræsentationer om den aktuelle eller vedvarende nøjagtighed af oplysningerne eller dens passende for en given situation. Derudover kan dette indhold omfatte tredjepartsreklamer; a16z har ikke gennemgået sådanne annoncer og støtter ikke noget reklameindhold indeholdt deri.

Dette indhold er kun givet til informationsformål og bør ikke påberåbes som juridisk, forretningsmæssig, investerings- eller skatterådgivning. Du bør rådføre dig med dine egne rådgivere om disse spørgsmål. Henvisninger til værdipapirer eller digitale aktiver er kun til illustrationsformål og udgør ikke en investeringsanbefaling eller tilbud om at levere investeringsrådgivningstjenester. Ydermere er dette indhold ikke rettet mod eller beregnet til brug af nogen investorer eller potentielle investorer og kan under ingen omstændigheder stoles på, når der træffes en beslutning om at investere i en fond, der administreres af a16z. (Et tilbud om at investere i en a16z-fond vil kun blive givet af private placement-memorandummet, tegningsaftalen og anden relevant dokumentation for en sådan fond og bør læses i deres helhed.) Eventuelle investeringer eller porteføljeselskaber nævnt, refereret til eller beskrevne er ikke repræsentative for alle investeringer i køretøjer, der administreres af a16z, og der kan ikke gives sikkerhed for, at investeringerne vil være rentable, eller at andre investeringer foretaget i fremtiden vil have lignende karakteristika eller resultater. En liste over investeringer foretaget af fonde forvaltet af Andreessen Horowitz (undtagen investeringer, hvortil udstederen ikke har givet tilladelse til, at a16z offentliggør såvel som uanmeldte investeringer i offentligt handlede digitale aktiver) er tilgængelig på https://a16z.com/investments /.

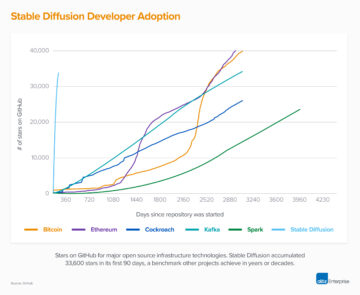

Diagrammer og grafer, der er angivet i, er udelukkende til informationsformål og bør ikke stoles på, når der træffes nogen investeringsbeslutning. Tidligere resultater er ikke vejledende for fremtidige resultater. Indholdet taler kun fra den angivne dato. Alle fremskrivninger, estimater, prognoser, mål, udsigter og/eller meninger udtrykt i disse materialer kan ændres uden varsel og kan afvige fra eller være i modstrid med andres meninger. Se venligst https://a16z.com/disclosures for yderligere vigtige oplysninger.

- a16z krypto

- Andreessen Horowitz

- Bitcoin

- blockchain

- overholdelse af blockchain

- blockchain konference

- coinbase

- coingenius

- Konsensus

- Krypto og web3

- kryptokonference

- krypto minedrift

- cryptocurrency

- decentral

- Defi

- Digitale aktiver

- ethereum

- machine learning

- ikke fungibelt symbol

- plato

- platon ai

- Platon Data Intelligence

- Platonblockchain

- PlatoData

- platogaming

- Politik og regulering

- Polygon

- bevis for indsatsen

- W3

- zephyrnet