Ikke engang 24 timer efter, at Canadian University Dubai (CUD) annoncerede sit partnerskab med Binance Pay for at acceptere kursusgebyrer i kryptovalutaer, udvandede en teknisk vejspærring spændingen bag det kortvarige initiativ.

CUD, a private university in Dubai, was seemingly interested in allowing students — both domestic and international — to pay their tuition and course fees in cryptocurrencies. This initiative would have allowed students from varied backgrounds easy access to the Canadian curriculum in Dubai.

Kære CUD-fællesskab,

Af tekniske årsager vil CUD indtil videre ikke acceptere cryptocurrency som betalingsmetode.

Vi beklager ulejligheden. pic.twitter.com/b9rERYHR7g

— CUDubai (@CUDUAE) Februar 10, 2023

Binance Pay, en betalingsgateway-tjeneste lanceret af kryptobørsen Binance, giver virksomheder mulighed for at integrere understøttelse af kryptovalutabetalinger. Ifølge universitetets første meddelelse tillod Binance-partnerskabet institutionen at "har tilpasset sig det transformerende digitale betalingsrum."

#Binance hjælper med at bringe krypto til @CUDUAE, et førende universitet i Dubai.

Potentielle og nuværende studerende kan nu betale deres gebyrer, inklusive studieafgifter, med krypto.

Drevet af Binance Pay. pic.twitter.com/bqWuezZVKJ

- Binance (@binance) Februar 9, 2023

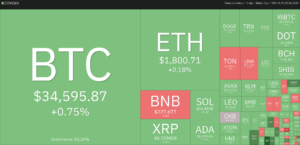

Binance Pay understøtter over 200 kryptovalutaer, inklusive Bitcoin (BTC), Dogecoin (DOGE) og Ethereum (ETH), and charges 0 fees per transaction. On Feb. 7, Binance hosted a cryptocurrency workshop and information session for CUD wherein students were taught about blockchain fundamentals, crypto fundamentals, web3 , metavers.

Som vist ovenfor er CUD hjemsted for over 1800 indenlandske og internationale studerende - indskrevet i et af de 25 bachelor- og seks kandidatuddannelser - som betaler et årligt undervisningsgebyr på $18,000.

Canadian University Dubai har endnu ikke reageret på Cointelegraphs anmodning om kommentar.

Related: Crypto projects respond to privacy coin ban in Dubai

Right when Binance was eyeing a partnership with CUD, Dubai released crypto regulations for virtual asset service providers (VASPs) on Feb. 7. The Virtual Asset Regulatory Authority (VARA) issued its “Full Market Product Regulations,” which include four compulsory rulebooks and activity-specific rulebooks that lay down the rules for operating VASPs.

⚠️Dubai nyheder

Dubais Vurtual Assets and Regulatory Authority udstedte de længe ventede Full Market Regulations for Vurtual Assets Services Providers (VASP'er).

— Irina ₿. Heaver (@IrinaHeaver) Februar 7, 2023

“Regulatory certainty is very good for business. It is good for consumers, investors and for the Emirate of Dubai. The regulations are long-awaited and mostly welcomed,” said Irina Heaver, a crypto and blockchain lawyer based in the United Arab Emirates, speaking to Cointelegraph.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- Platoblokkæde. Web3 Metaverse Intelligence. Viden forstærket. Adgang her.

- Kilde: https://cointelegraph.com/news/canadian-university-dubai-backtracks-on-accepting-crypto-via-binance-pay

- 000

- 10

- 7

- 9

- a

- Om

- over

- Acceptere

- adgang

- Ifølge

- Efter

- tillade

- tillader

- ,

- annoncerede

- Fondsbørsmeddelelse

- Arab

- aktiv

- Asset Regulatory

- Aktiver

- myndighed

- baggrunde

- Forbyde

- baseret

- bag

- binance

- Binance partnerskab

- binance løn

- Bitcoin

- blockchain

- bringe

- virksomhed

- virksomheder

- Canadian

- sikkerhed

- afgifter

- Coin

- Cointelegraph

- KOMMENTAR

- samfund

- Forbrugere

- Kursus

- krypto

- krypto udveksling

- Crypto Exchange Binance

- kryptoprojekter

- Krypto-regler

- cryptocurrencies

- cryptocurrency

- Cryptocurrency-betalinger

- Nuværende

- Curriculum

- digital

- Digital betaling

- dogecoin

- Indenlandsk

- ned

- Dubai

- Emirat

- emirates

- indskrevet

- ethereum

- Endog

- udveksling

- Spænding

- gebyr

- Gebyrer

- For forbrugere

- fra

- fuld

- Fundamentals

- yderligere

- yderligere varsel

- gateway

- godt

- eksamen

- hjælper

- Home

- hostede

- HOURS

- HTTPS

- in

- omfatter

- Herunder

- oplysninger

- initial

- initiativ

- Institution

- integrere

- interesseret

- internationalt

- Investorer

- Udstedt

- IT

- lanceret

- advokat

- førende

- længe ventet

- Marked

- metode

- nummer

- ONE

- drift

- Partnerskab

- Betal

- betaling

- betalinger

- plato

- Platon Data Intelligence

- PlatoData

- Beskyttelse af personlige oplysninger

- private

- Produkt

- Programmer

- projekter

- udbydere

- årsager

- regler

- lovgivningsmæssige

- frigivet

- anmode

- Svar

- regler

- Said

- tjeneste

- service-udøvere

- Tjenester

- Session

- vist

- SIX

- Kilde

- Space

- taler

- Studerende

- support

- Understøtter

- Teknisk

- deres

- til

- I alt

- transaktion

- omdanne

- Forenet

- Forenede Arabiske Emirater

- universitet

- VARA

- vasper

- via

- Virtual

- virtuelt aktiv

- tjenesteudbydere af virtuelle aktiver

- Virtual Asset Service Providers (VASP'er)

- hilste

- som

- WHO

- vilje

- værksted

- ville

- zephyrnet