- According to the court proceedings, the SEC has halted all crypto trading activities of Coinbase Exchange other than bitcoin.

- The SEC’s pursuit of the second-largest crypto exchange dates back to 2019.

- According to the crypto lawsuit, the Coinbase exchange has engaged in several transactional processes involving unregistered securities.

With the recent turmoil brewing within the industry, all eyes have been set on the endeavours of the US SEC against crypto projects. Since the FTX crash, this crypto regulator has featured numerous highlights within the industry. What appeared as a prevention measure soon became a front for persecution. The SEC has targeted several Crypto exchanges shutting down any that go against the vague Crypto rules established.

According to the regulator, crypto lawsuits are a means to cut down the “legal” crypto scammers before they can damage the ecosystem. In recent news, SEC has hogged the spotlight by targeting all three major cryptocurrencies; Binance, Coinbase Exchange and Kraken. Unfortunately, the sheer tenacity of the SEC has forced Coinbase Exchange, the second-largest crypto exchange, to halt all transaction activities apart from Bitcoin services.

The “reasoning” behind the legal pursuit of Coinbase Exchange and its peers

Since 2009, the crypto ecosystem has had its ups and downs. Despite all odds, the industry has significantly gained global recognition through individual interest. The ecosystem offers high-risk and high returns but has gradually grown to become a standardized economic activity.

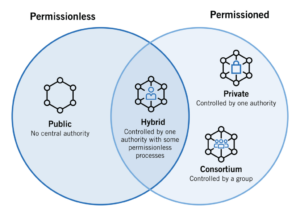

Unfortunately, one of the main agenda of the web3 roadmap is to ensure the integration of digital assets within an economy. To fulfil this highly sought-after vision, developers have merged Web3 concepts into web2 technology. This led to the development of centralized blockchain systems like exchanges, and throughout the years, they have dominated the franchise.

We can view a centralized blockchain system as one of the best ways to integrate digital currency into society. Unfortunately, it also envisions the collaboration of two technologies built on two polar opposite concepts. Thus, as a result, the legal applications of centralized blockchain systems are strenuous at best.

This fact was significantly highlighted after the FTX crashed, causing the entire ecosystem to implode. Fortunately, the crypto ecosystem survived through the interventions of organizations like Binance, Coinbase Exchange and others. However, the damages were severe, and it justified the fears of many crypto regulators. This forced a mass panic causing a significant hindrance in the ecosystem.

Læs også Binance wins a court case against US SEC’s demand to shut down operations.

The SEC’s pursuit of the second-largest crypto exchange går tilbage til 2019. According to the crypto lawsuit, the Coinbase exchange has engaged in several transactional processes involving unregistered securities. The SEC stated that the second-largest crypto exchange provided a marketplace to accumulate the orders for securities of multiple buyers and sellers.

To achieve this, Coinbase established non-discretionary methods prone to high-risk factors. In addition, they claimed Coinbase Exchange engages in several activities affecting securities transactions for its user accounts. Finally, this crypt regulator claimed, “Coinbase Exchange provides facilities for comparison of data respecting the terms of settlement of crypto asset securities transactions, serves as an intermediary in settling transactions in crypto asset securities by Coinbase customers, and acts as a securities’ depository."

At the time, the SEC has filed these crypto lawsuits among the backlog of other cases, paying only the bare minimum attention it required. Unfortunately, this quickly changed after the FTX crashed, highlighting how dangerous established crypt exchanges can become if unchecked. Thus, recently, this crypto regulator has doubled its efforts in, “securing” its crypto ecosystem and focused on bringing down exchanges, operating outside their legal framework.

Coinbase Exchange loses the battle but not the war

After the near end of the trillion-dollar franchise, the SEC has focused the majority of its effort on controlling the crypto franchise. Their efforts have paid off since they have managed to corner the second-largest crypto exchange. They have recommended a complete halt of most of its services on US soil.

According to the court proceedings, the SEC has halted all crypto trading activities of Coinbase Exchange other than bitcoin. Brian Armstrong, CEO of Coinbase, stated that the SEC made the recommendation before launching another crypto lawsuit against the Nasdaq-listed company.

Læs også Binance fights crypto crackdown and threatens to sue SEC.

Armstrong said, “They came back to us, and they said. . . We believe every asset other than Bitcoin is security. And, we said, well, how are you coming to that conclusion because that’s not our interpretation of the law. And they said, we’re not going to explain it to you, you need to delist every asset other than Bitcoin.” Aside from its allegations, the crypto regulator identified 13 traded currencies on Coinbase as securities. Thus, they ascertained that by offering them to customers, they went against the crypto regulator remits.

Brian Armstrong, CEO of Coinbase, has stated that halting all operations aside from Bitcoin will be suicide for the organization and the market.[Photo/Medium]

Unfortunately, if Coinbase Exchange adheres to this recommendation, the industry will rumble upon its feet. Armstrong stated that halting other trades would end the crypto industry in the US, causing a significant effect on other regions. In response, the SEC has said,” We do not ask companies to delist crypto assets. During an investigation, the staff may share its view as to what conduct may raise questions for the Commission under the securities laws."

With the recent activities of the SEC, it’s safe to say that the crypto regulator is trying to dominate the industry’s legal sector by applying pressure when most vulnerable.

Konklusion

At the time of writing, Coinbase Exchange is yet to halt its operations within the US. Unfortunately, given the industry’s current state, dealing with multiple crypto lawsuits is not a favourable environment for progress. Fortunately, nothing unites a community like a common enemy, and the SEC has done just that.

Læs også Flutterwave secures two digital currency licenses from Rwanda.

With its numerous crypto lawsuits, this crypto regulator has presented a single voice within the community. Other titans within web3, like Ethereum, Solana and Binance, have come to a somewhat single motive to prevent the SEC from crushing the industry.

With the odds stacked against it, the second-largest crypto exchange has managed to maintain its operations. From an individual viewpoint, Coinbase Exhcganeg might survive this recent ordeal given the stakes presented.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- PlatoData.Network Vertical Generative Ai. Styrk dig selv. Adgang her.

- PlatoAiStream. Web3 intelligens. Viden forstærket. Adgang her.

- PlatoESG. Automotive/elbiler, Kulstof, CleanTech, Energi, Miljø, Solenergi, Affaldshåndtering. Adgang her.

- BlockOffsets. Modernisering af miljømæssig offset-ejerskab. Adgang her.

- Kilde: https://web3africa.news/2023/08/04/news/coinbase-exchange-versus-us-sec/

- :har

- :er

- :ikke

- 13

- 2019

- a

- Ifølge

- Konti

- Ophobe

- opnå

- aktiviteter

- aktivitet

- handlinger

- Desuden

- påvirker

- Efter

- mod

- dagsorden

- Alle

- beskyldninger

- også

- blandt

- an

- ,

- En anden

- enhver

- fra hinanden

- dukkede

- applikationer

- Anvendelse

- ER

- Armstrong

- AS

- aktiv

- Aktiver

- At

- opmærksomhed

- tilbage

- Battle

- BE

- blev

- fordi

- bliver

- været

- før

- bag

- Tro

- BEDSTE

- binance

- Bitcoin

- Bitcoin-tjenester

- blockchain

- blockchain-system

- Bringe

- bygget

- men

- købere

- by

- kom

- CAN

- tilfælde

- tilfælde

- forårsager

- centraliseret

- Direktør

- hævdede

- coinbase

- Coinbase udveksling

- samarbejde

- Kom

- kommer

- Kommissionen

- Fælles

- samfund

- Virksomheder

- selskab

- sammenligning

- fuldføre

- begreber

- konklusion

- Adfærd

- styring

- Corner

- Ret

- Retssag

- Crackdown

- Crash

- Kørt galt

- krypt

- krypto

- krypto aktiv

- CRYPTO CRACKDOWN

- Krypto-økosystem

- krypto udveksling

- Kryptobørser

- Kryptoindustri

- krypto retssag

- Krypto retssager

- kryptoprojekter

- kryptoregulator

- kryptohandel

- krypto-aktiver

- cryptocurrencies

- valutaer

- Valuta

- Nuværende

- Nuværende tilstand

- Kunder

- Klip

- Dangerous

- data

- Datoer

- beskæftiger

- Efterspørgsel

- Depot

- Trods

- udviklere

- Udvikling

- digital

- Digitale aktiver

- digital valuta

- do

- Dominere

- færdig

- fordoblet

- ned

- nedture

- i løbet af

- Økonomisk

- økonomi

- økosystem

- effekt

- indsats

- indsats

- ende

- bestræbelser

- beskæftiget

- indgreb

- sikre

- Hele

- Miljø

- forestiller sig

- etableret

- ethereum

- Hver

- udveksling

- Udvekslinger

- Forklar

- Øjne

- faciliteter

- Faktisk

- faktorer

- frygt

- featured

- Feet

- slagsmål

- indgivet

- Endelig

- fokuserede

- Til

- Heldigvis

- Framework

- franchisen

- fra

- forsiden

- FTX

- ftx nedbrud

- vundet

- given

- Global

- Go

- gå

- gradvist

- voksen

- havde

- standse

- Have

- Høj

- høj risiko

- Fremhævet

- fremhæve

- højdepunkter

- stærkt

- hindring

- Hvordan

- Men

- HTTPS

- identificeret

- if

- in

- individuel

- industrien

- industriens

- integrere

- integration

- interesse

- mellemmand

- fortolkning

- interventioner

- ind

- undersøgelse

- Investopedia

- involverer

- IT

- ITS

- lige

- Kraken

- lancering

- Lov

- Love

- retssag

- Retssager

- Led

- Politikker

- juridiske rammer

- licenser

- ligesom

- taber

- lavet

- Main

- vedligeholde

- større

- Flertal

- lykkedes

- mange

- Marked

- markedsplads

- Masse

- max-bredde

- Kan..

- midler

- måle

- metoder

- måske

- minimum

- mest

- motiv

- flere

- I nærheden af

- Behov

- nyheder

- intet

- talrige

- Odds

- of

- off

- tilbyde

- Tilbud

- on

- ONE

- kun

- drift

- Produktion

- modsat

- ordrer

- organisation

- organisationer

- Andet

- Andre

- vores

- uden for

- betalt

- Panic

- betale

- plato

- Platon Data Intelligence

- PlatoData

- polære

- forelagt

- tryk

- forhindre

- Forebyggelse

- Proceedings

- Processer

- Progress

- projekter

- forudsat

- giver

- udøvelse

- Spørgsmål

- hurtigt

- rejse

- Læs

- nylige

- for nylig

- anerkendelse

- Anbefaling

- anbefales

- regioner

- regulator

- Regulators

- påkrævet

- respektere

- svar

- resultere

- afkast

- køreplan

- regler

- sikker

- Said

- siger

- Snydere

- SEK

- næststørste

- sektor

- Sikrer

- Værdipapirer

- Værdipapirlove

- sikkerhed

- Sælgere

- tjener

- Tjenester

- sæt

- afregning

- afregning

- flere

- svær

- Del

- Luk ned

- lukker ned

- signifikant

- betydeligt

- siden

- enkelt

- Samfund

- jord

- Solana

- noget

- snart

- Spotlight

- stablet

- Personale

- Tilstand

- erklærede

- sagsøge

- overlever

- overlevede

- systemet

- Systemer

- målrettet

- rettet mod

- Teknologier

- Teknologier

- vilkår

- end

- at

- Møntbasen

- loven

- deres

- Them

- Disse

- de

- denne

- truer

- tre

- Gennem

- hele

- Dermed

- tid

- til

- handles

- handler

- Trading

- transaktion

- transaktionsbeslutning

- Transaktioner

- sand

- to

- under

- desværre

- uregistrerede

- uregistrerede værdipapirer

- på

- UPS

- us

- US Sec

- Bruger

- Specifikation

- vision

- Voice

- Sårbar

- var

- måder

- we

- Web2

- Web3

- GODT

- gik

- var

- Hvad

- hvornår

- vilje

- Vinder

- med

- inden for

- ville

- skrivning

- år

- endnu

- Du

- zephyrnet