Yassine Elmandjra, an analyst at Ark Investment Management, has defended the firm’s prediction that the price of the flagship cryptocurrency Bitcoin ($BTC) will top $1 million in the future.

Interjú közben Bloomberg, Elmandjra defended a price prediction made by the fund manager of Ark’s flagship innovation-themed exchange-traded funds ($ETFs), Cathie Wood, that BTC would top $1 million by 2030.

Míg a BTC és más kockázati eszközök ára zuhant az elmúlt néhány hónapban, az amerikai jegybank és más központi bankok az infláció megfékezése érdekében emelik a kamatokat. Elmandjra szerint még mindig jelentős lehetőség van a BTC-be való befektetésben, mivel számos lehetséges felhasználási esete van.

Az elemző azt mondta:

When we look at Bitcoin’s potential, we segment it across several use cases — everything from it competing as a digital store of value, to a settlement network, to an insurance policy against arbitrary asset seizure. When you stack every use case one on top of another, you come to about a 28 trillion-dollar opportunity, which translates to more than a million dollars per Bitcoin.

Despite the analyst’s comments, Ark Investment Management has recently stopped being the third-largest shareholder of the Nasdaq-listed cryptocurrency exchange Coinbase, as it sold over 1.41 million COIN shares over the summer, worth $75 million at the time, over a U.S. Securities and Exchange Commission (SEC) probe.

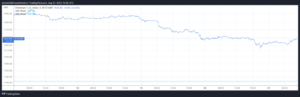

Ark’s $7.1 billion Innovation ETF hasn’t had a favorable year, plunging over 60% so far this year, compared to the S&P 500’s 24% drop. Nevertheless, the analyst remains bullish on the flagship cryptocurrency.

Per Elmandjra, looking at BTC as a “strategic asset, non-sovereign, censorship-resistant money, competing against central banks and fiat currencies,” it’s in an “arms race” to be an asset independent from the traditional financial system.

Bitcoin’s adoption has been on the rise. As CryptoGlobe reported, BNY Mellon has announced that its Digital Asset Custody platform had gone live in the U.S. with “select clients” now able to hold and transfer Bitcoin ($BTC) and Ethereum ($ETH).

BNY Mellon is America’s oldest bank, having been founded in 1784. It has more than $2.4 trillion in assets under management.

Képhitel

Kiemelt kép a Unsplash

- Bitcoin

- blockchain

- blokklánc megfelelőség

- blockchain konferencia

- coinbase

- coingenius

- megegyezés

- kriptokonferencia

- kriptikus bányászat

- cryptocurrency

- CryptoGlobe

- decentralizált

- Defi

- Digitális eszközök

- Ethereum

- gépi tanulás

- nem helyettesíthető token

- Plató

- plato ai

- Platón adatintelligencia

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- a tét igazolása

- W3

- zephyrnet