A hitelező Onyx egysége tokenizált devizák élő kereskedéseit hajtja végre a kísérleti projektben

JPMorgan Chase & Co., the No. 1 U.S. bank and a charter member of Wall Street’s financial establishment, has gone DeFi.

Or at least, one of its blockchain-focused units has.

On Nov. 1, the New York-based lender’s Onyx unit executed trades in a new project launched in Singapore. Along with DBS Bank, and SBI Digital Asset Holdings, Onyx conducted live foreign exchange swaps of tokenized Japán jen (JPY) és a Singapore Dollars (SGD).

Wholesale Funding

In addition, transactions involving tokenized Singapore government securities bonds and Japanese government bonds were simulated, according to a engedje. The pilot program is part of Project Guardian, an initiative backed by the Monetary Authority of Singapore, the Asian city-state’s central bank. The project aims to explore DeFi applications in wholesale funding markets.

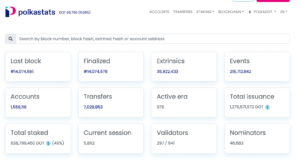

Project Guardian deployed on Polygon, a Proof of Stake scaling solution for Ethereum, to minimize transaction costs. As it rolls out, Project Guardian plans to work with other blockchain networks, according to Ty Lobban, who works on Web3 products at Onyx.

A befektetők 28 millió dollárt szánnak LUSD csirke kötvényekre

A likviditás közel 500,000 XNUMX dollárral növeli a jegyzőkönyv szerinti likviditást

A projekt telepített a modified version of Aave Arc, the leading DeFi money market’s permissioned offering for institutional investors, and proceeded to create a token representing Singapore Dollar deposits in JPMorgan (JPM SGD). The bank has $3.8T in assets.

“The live pilots led by industry participants demonstrate that with the appropriate guardrails in place, digital assets and decentralized finance have the potential to transform capital markets,” said Sopnendu Mohanty, Chief FinTech Officer at MAS.

Nice Win

The involvement of JPMorgan Chase is striking given that Jamie Dimon, the lender’s CEO, has long pilloried crypto as a fraud. Just last month, he hívott crypto tokens “decentralized Ponzis” while acknowledging some potential benefits of blockchain technology.

A Coinbase 1.5%-os APY fele a bankok által kínált megtakarítási ráta

Az ajánlat a MakerDAO-val kötött múlt heti partnerség után érkezik

“As a heavily regulated bank, we cannot enable money laundering and must undertake KYC. Using VCs & allowlists was crucial for enabling us to use DeFi pools with certainty on these points,” Lobban írt, referring to know-your-customer checks.

It’s also a nice win for Aave, which has been cultivating business among institutional investors as part of its Ív vállalkozás.

Adoption Wide Open

Almost 90% of global institutional investors are comfortable with digital representations of cash using blockchain-based technology and want to invest in tokenized assets, according to a jelentést co-authored by the pilot’s participants and the Oliver Wyman Forum.

The report goes on to note that while the road to institutional adoption is wide open, further work needs to be done in areas including legal recourse mechanisms in case of disputes, meeting KYC and AML requirements, and promoting common industry standards to facilitate interoperability.

- Bitcoin

- blockchain

- blokklánc megfelelőség

- blockchain konferencia

- coinbase

- coingenius

- megegyezés

- kriptokonferencia

- kriptikus bányászat

- cryptocurrency

- decentralizált

- Defi

- Digitális eszközök

- Ethereum

- gépi tanulás

- nem helyettesíthető token

- Plató

- plato ai

- Platón adatintelligencia

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- a tét igazolása

- A Defiant

- W3

- zephyrnet