In an era driven by data and technological innovation, the financial sector finds itself at the intersection of analytics and business strategy.

Indonesian financial institutions (FIs) recognise the game-changing capabilities of advanced analytics and are proactively aligning their strategies to leverage these tools for a competitive edge.

To delve deeper into the adoption and challenges of advanced analytics in the Asia Pacific region, FICO commissioned Forrester Consulting to conduct the “Current State of Advanced Analytics Adoption” research.

The study, conducted between September and October 2022, involved 57 respondents from Indonesia, encompassing CXOs, senior leaders, and decision-makers responsible for advanced analytics and digital transformation strategies.

The insights from this survey offer a panoramic view of the priorities, challenges, and future trajectories of Indonesian FIs in advanced analytics.

Shared priorities, distinct focus

The strategic priorities of Indonesian financial institutions are firmly rooted in the broader regional context, yet they possess distinct nuances that highlight their unique landscape.

While Indonesian FIs share common objectives with their regional counterparts, such as harnessing emerging technologies and fostering a culture of innovation, these priorities may be lower on their agendas.

However, the exceptional emphasis on improving customer experience remains a consistent thread.

According to the survey, the most pressing priorities of Indonesian FIs include enhancing the customer experience (74 percent), optimising the usage of data/insights in business decisions (70 percent), transitioning into a digital business (68 percent), boosting revenue growth (67 percent), and expediting responses to market shifts (65 percent).

These priorities underscore their unwavering commitment to crafting seamless customer journeys characterised by speed, simplicity, and personalised interactions.

Harnessing the power of customer insights

Indonesian FIs recognise the transformative power of advanced technologies like digitalisation, artificial intelligence (AI), and advanced analytics in shaping their future. Their interests converge on enhancing the incorporation of data and insights into business decisions, a core aspect of their evolving digital transformation journey.

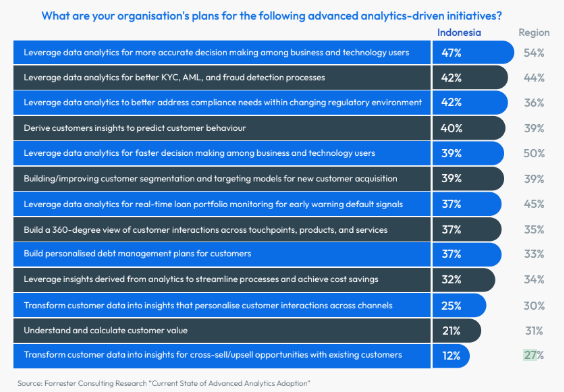

Among the standout endeavours are predicting customer behaviour, developing comprehensive customer insights, and tailoring personalised debt management strategies. These initiatives correlate with broader regional aspirations.

However, Indonesian FIs diverge when it comes to data analytics applications for cross-selling and upselling to existing customers. While the regional average for this endeavour is 27 percent, Indonesian FIs exhibit a lower level of prioritisation at just 12 percent.

This discrepancy suggests untapped revenue potential and the importance of offering the right product to the right customer at the right time.

Indonesia’s advanced analytics evolution

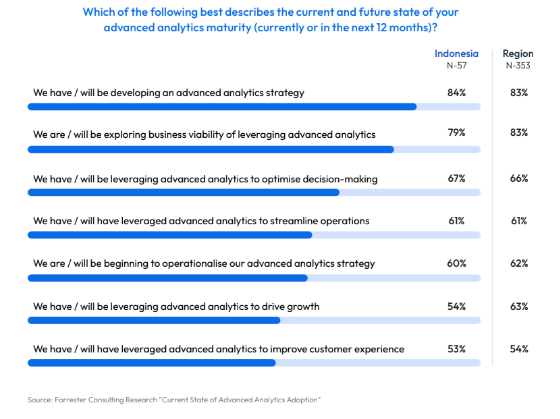

The Indonesian financial landscape aligns itself closely with the broader regional trajectory regarding the maturity of advanced analytics initiatives.

An impressive 84 percent of Indonesian FIs revealed that they are in the process of developing their advanced analytics strategy or have already developed one.

Additionally, 79 percent explore the viability of leveraging advanced analytics for business purposes, while 67 percent express their intent to optimise decision-making through its implementation.

This level of maturity underscores the proactive approach of Indonesian FIs in embracing the transformative capabilities of advanced analytics.

Charting challenges and building confidence

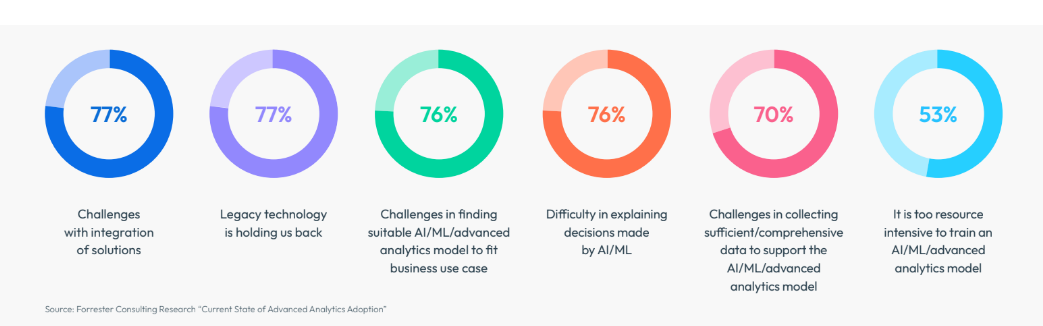

Despite their enthusiasm for advanced analytics adoption, Indonesian FIs acknowledged the technological hurdles that lie ahead. One of the most significant challenges they cited was integrating siloed customer data across various departments and legacy systems.

This challenge is not unique to Indonesian FIs but resonates with organisations globally, prompting the need for adaptable and agile solutions.

Addressing this challenge requires streamlined data integration practices and robust technological solutions that can bridge gaps and offer a holistic view of customers.

While Indonesian FIs expressed confidence in certain aspects of advanced analytics-driven initiatives, such as building insights on products and services for the market (75 percent), they showed lower confidence in expanding data integration practices for improved data quality and quantity (58 percent) and building a comprehensive customer view across channels (58 percent).

Paving the way for sustainable growth

The survey brings to light a critical aspect—the analytics feedback loop, which holds immense significance. As models are put into action and novel products and services emerge, the refinement and creation of fresh models emerge as necessities, ensuring more precise segmentation and heightened personalisation.

In this intricate journey, factors like scalability, agility, relentless focus on feedback loops and outcome monitoring become the bedrock of sustainability for these endeavours.

Guided by the collective objectives of enhancing customer experiences, embracing data-driven decision-making, and embarking on digital transformation, Indonesian FIs are navigating the intricate landscape of advanced analytics adoption.

As the realms of digital transformation unfold, Indonesian financial institutions must confront the challenges posed by data integration and the cultivation of comprehensive customer insights. This endeavour is essential to deliver unparalleled experiences to their clientele.

The future lies in seamless technology integration, swift operationalisation of insights, and an unyielding pursuit of customer-centric excellence.

Indonesian FIs are charting a course toward a future where data is a guiding light for growth and success, transforming the financial landscape’s institutions and fabric.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://fintechnews.sg/77263/indonesia/79-of-indonesian-financial-institutions-believe-in-data-driven-decision-making/

- :is

- :not

- :where

- 12

- 2022

- 27

- 67

- 7

- 70

- 75

- 84

- a

- acknowledged

- across

- Action

- Adoption

- advanced

- agile

- ahead

- AI

- aligning

- Aligns

- already

- an

- analytics

- and

- applications

- approach

- ARE

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- asia

- asia pacific

- aspect

- aspects

- At

- average

- BE

- become

- believe

- between

- boosting

- BRIDGE

- Brings

- broader

- Building

- business

- business strategy

- but

- by

- CAN

- capabilities

- caps

- certain

- challenge

- challenges

- channels

- charting

- cited

- clientele

- closely

- Collective

- comes

- commitment

- Common

- competitive

- comprehensive

- Conduct

- conducted

- confidence

- consistent

- consulting

- context

- converge

- Core

- Course

- creation

- critical

- Culture

- customer

- customer data

- customer experience

- Customers

- data

- Data Analytics

- data-driven

- Debt

- Decision Making

- decision-makers

- decisions

- deeper

- deliver

- delve

- departments

- developed

- developing

- digital

- Digital Transformation

- digitalisation

- discrepancy

- distinct

- Diverge

- driven

- Edge

- embarking

- embracing

- emerge

- emphasis

- encompassing

- endeavours

- enhancing

- ensuring

- enthusiasm

- Era

- essential

- evolving

- Excellence

- exceptional

- exhibit

- existing

- expanding

- experience

- Experiences

- explore

- express

- expressed

- fabric

- factors

- false

- feedback

- FICO

- financial

- Financial institutions

- Financial sector

- finds

- fintech

- firmly

- FIS

- Focus

- For

- Forrester

- fostering

- fresh

- friendly

- from

- future

- gaps

- Globally

- Growth

- Harnessing

- Have

- heightened

- Highlight

- holds

- holistic

- HTTPS

- Hurdles

- immense

- implementation

- importance

- impressive

- improved

- improving

- in

- include

- Indonesia

- Indonesian

- initiatives

- Innovation

- insights

- institutions

- Integrating

- integration

- Intelligence

- intent

- interactions

- interests

- intersection

- into

- involved

- IT

- ITS

- itself

- journey

- Journeys

- just

- landscape

- leaders

- Legacy

- Level

- Leverage

- leveraging

- lie

- lies

- light

- like

- lower

- management

- Market

- maturity

- max-width

- May..

- models

- monitoring

- more

- most

- must

- navigating

- necessities

- Need

- novel

- objectives

- october

- of

- offer

- offering

- on

- ONE

- optimise

- or

- Organisations

- Outcome

- Pacific

- percent

- Personalised

- plato

- Plato Data Intelligence

- PlatoData

- possess

- potential

- power

- practices

- precise

- predicting

- pressing

- Proactive

- process

- Product

- Products

- purposes

- pursuit

- put

- quality

- quantity

- recognise

- regarding

- region

- regional

- relentless

- remains

- requires

- research

- resonates

- respondents

- responses

- responsible

- return

- Revealed

- revenue

- revenue growth

- right

- robust

- Scalability

- seamless

- sector

- segmentation

- senior

- September

- Services

- shaping

- Share

- Shifts

- showed

- significance

- significant

- simplicity

- Singapore

- Solutions

- speed

- State

- Strategic

- strategies

- Strategy

- streamlined

- Study

- success

- such

- Suggests

- Survey

- Sustainability

- sustainable

- SWIFT

- Systems

- technological

- Technology

- that

- The

- their

- These

- they

- this

- Through

- time

- to

- tools

- toward

- trajectory

- Transformation

- transformative

- transforming

- transitioning

- underscores

- unique

- unparalleled

- untapped

- unwavering

- Usage

- various

- viability

- View

- was

- Way..

- when

- which

- while

- window

- with

- yet

- zephyrnet