-

This strategic overhaul, aimed at intensifying listing requirements, underscores Binance’s commitment to prioritizing investor protection on its platform.

-

Its initiative to revamp its token listing process is also a response to the evolving regulatory landscape that governs the cryptocurrency industry.

-

The exchange’s leadership in establishing enhanced listing protocols underscores the importance of transparency.

In a decisive move to bolster investor confidence and uphold market integrity, Binance has announced significant adjustments to its token listing process. This strategic overhaul, aimed at intensifying listing requirements, underscores Binance’s commitment to prioritizing investor protection on its platform.

As the leading name in the cryptocurrency exchange sector, Binance’s initiative marks a pivotal shift toward more rigorous oversight in the rapidly evolving digital asset landscape.

Binance’s revamped strategy focuses on implementing a series of stringent measures to ensure that new tokens meet elevated standards before listing. Projects aspiring to join Binance’s prestigious roster now face a more extended cliff period, increasing from six months to a year.

This modification ensures that coins are held for a longer duration before they can be sold, a move that Binance executives believe will foster deeper project commitment and, consequently, benefit the broader ecosystem.

Furthermore, we have implemented the requirement that projects allocate a higher proportion of tokens to market makers and contribute a security deposit. These adjustments aim to guarantee sufficient liquidity and mitigate the risk of market manipulation, thereby safeguarding the interests of the investing public.

Binance’s approach not only enhances the stability and reliability of its platform but also sets a new benchmark for listing practices across the cryptocurrency exchange industry.

Navigating Regulatory Challenges and Market Dynamics

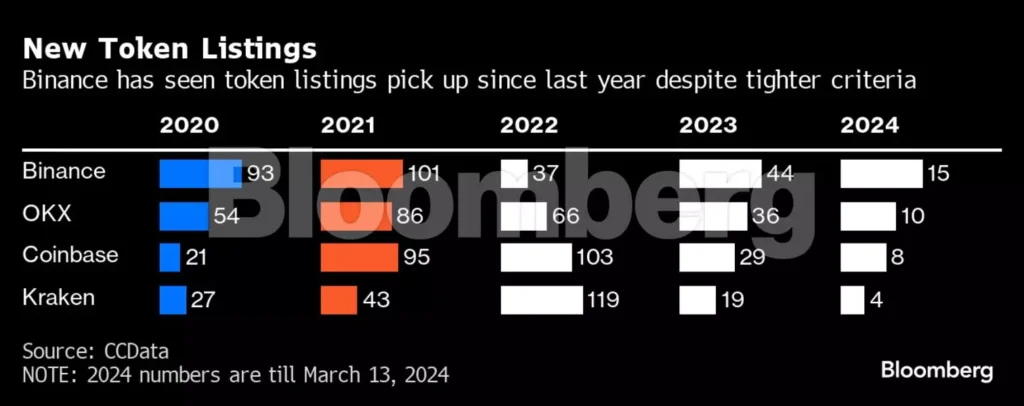

Binance’s recalibrated listing criteria emerge amid a backdrop of regulatory scrutiny and fluctuating market share. The exchange’s proactive stance on investor protections aligns with its efforts to navigate the complex regulatory landscape and address the challenges posed by past regulatory issues.

Despite a temporary dip in Binance’s market dominance, the exchange continues to lead with a significant margin over competitors. However, the changes to listing requirements reflect a strategic shift from aggressive market expansion to ensuring compliance and maintaining the trust of its vast user base.

This shift is particularly relevant in light of Binance’s recent legal settlements and the evolving expectations of regulatory authorities worldwide. By tightening its token listing process, Binance not only aims to mitigate the risk of regulatory repercussions but also to fortify its market position by enhancing the quality and reliability of its listings. Such measures are indicative of a maturing industry that is increasingly prioritizing long-term sustainability over short-term gains.

Also, Read Hedera Hashgraph Association Secures $250 Million Partnership for Web3 Advancements in Saudi Arabia.

Binance’s revised approach to token listings represents a significant step forward in the exchange’s ongoing efforts to align its operations with the highest standards of investor protection and regulatory compliance. By implementing more stringent listing requirements, Binance not only protects its platform and its users but also contributes to the integrity and stability of the wider cryptocurrency market.

As the digital asset industry continues to evolve, Binance’s leadership in establishing enhanced listing protocols underscores the importance of transparency, accountability, and investor safety in sustaining market growth and confidence.

This strategic realignment, while potentially impacting the short-term profitability of token projects and the exchange itself, sets a commendable precedent for responsible market conduct and regulatory adherence in the fast-paced world of cryptocurrency trading.

To ensure the long-term growth and stability of its trading platform, Binance has decided to tighten its token listing criteria. By extending the cliff period for newly listed tokens and imposing stricter collateral requirements, Binance is taking a proactive stance to address concerns around market volatility and the potential for speculative trading practices that can undermine investor confidence.

This approach not only enhances the robustness of the trading environment but also encourages projects to demonstrate their commitment and long-term viability before becoming part of Binance’s ecosystem.

An integral component of Binance’s updated listing policy is the increased emphasis on partnerships with market makers. By requiring a more substantial allocation of tokens to market makers, Binance aims to ensure that there is sufficient liquidity for new listings, which is critical for maintaining orderly market conditions.

This initiative underscores Binance’s commitment to creating a more transparent and reliable trading experience for its users, further solidifying its market dominance in the cryptocurrency exchange sector.

Binance’s initiative to revamp its token listing process is also a response to the evolving regulatory landscape that governs the cryptocurrency industry. By adopting more stringent listing requirements, Binance is demonstrating its dedication to compliance and regulatory alignment, which is essential for navigating the complexities of global financial regulations.

This adaptability is crucial for maintaining Binance’s market share and leadership position, as it seeks to balance aggressive expansion with the need to adhere to regulatory expectations and safeguard investor interests.

In summary, Binance’s comprehensive overhaul of its token listing process is a strategic move that reflects its dedication to enhancing investor protection, ensuring market liquidity, and adhering to regulatory standards.

These measures not only reinforce Binance’s position as a market leader but also contribute to the broader effort to promote transparency, stability, and trust in the cryptocurrency market. As the industry continues to mature, Binance’s forward-thinking approach to token listings will likely serve as a benchmark for other exchanges seeking to navigate the challenges of market dynamics and regulatory compliance.

Also, Read Revolutionizing Web3: The Best White-Label Crypto Exchanges of 2023.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2024/03/26/news/binance-token-listing-process/

- :has

- :is

- :not

- 1

- a

- accountability

- across

- address

- adhere

- adherence

- adhering

- adjustments

- Adopting

- advancements

- aggressive

- aim

- aimed

- aims

- align

- alignment

- Aligns

- allocate

- allocation

- also

- Amid

- and

- announced

- approach

- ARE

- around

- AS

- aspiring

- asset

- Association

- At

- Authorities

- backdrop

- Balance

- base

- BE

- becoming

- before

- believe

- Benchmark

- benefit

- BEST

- binance

- bolster

- broader

- but

- by

- CAN

- challenges

- Changes

- Coins

- Collateral

- commendable

- commitment

- competitors

- complex

- complexities

- compliance

- component

- comprehensive

- Concerns

- conditions

- Conduct

- confidence

- Consequently

- continues

- contribute

- contributes

- Creating

- criteria

- critical

- crucial

- crypto

- Crypto Exchanges

- cryptocurrency

- Cryptocurrency Exchange

- Cryptocurrency Industry

- cryptocurrency market

- cryptocurrency trading

- decided

- decisive

- dedication

- deeper

- demonstrate

- demonstrating

- deposit

- digital

- Digital Asset

- Dip

- Dominance

- duration

- dynamics

- ecosystem

- effort

- efforts

- elevated

- emerge

- emphasis

- encourages

- enhanced

- Enhances

- enhancing

- ensure

- ensures

- ensuring

- Environment

- Era

- essential

- establishing

- evolve

- evolving

- exchange

- Exchanges

- executives

- expansion

- expectations

- experience

- extended

- extending

- Face

- fast-paced

- financial

- focuses

- For

- fortify

- Forward

- forward-thinking

- forward-thinking approach

- Foster

- from

- further

- Gains

- Global

- global financial

- governs

- Growth

- guarantee

- hashgraph

- Have

- Held

- higher

- highest

- However

- HTTPS

- impacting

- implemented

- implementing

- importance

- imposing

- in

- Including

- increased

- increasing

- increasingly

- indicative

- industry

- Initiative

- integral

- integrity

- intensifying

- interests

- investing

- investor

- investor protection

- issues

- IT

- ITS

- itself

- join

- landscape

- larger

- lead

- leader

- Leadership

- leading

- Legal

- light

- likely

- Liquidity

- Listed

- listing

- Listings

- long-term

- longer

- Maintaining

- Makers

- Manipulation

- Margin

- Market

- market conditions

- Market Dominance

- Market Leader

- market makers

- market manipulation

- market share

- market volatility

- mature

- max-width

- measures

- Meet

- million

- Mitigate

- months

- more

- move

- name

- Navigate

- navigating

- Need

- New

- newly

- now

- of

- on

- ongoing

- only

- Operations

- Other

- over

- Overhaul

- Oversight

- part

- particularly

- Partnership

- partnerships

- past

- period

- pivotal

- platform

- plato

- Plato Data Intelligence

- PlatoData

- policy

- posed

- position

- potential

- potentially

- practices

- Precedent

- prestigious

- prioritizing

- Proactive

- process

- profitability

- progressive

- project

- projects

- promote

- proportion

- protection

- protects

- protocols

- public

- quality

- rapidly

- Read

- recent

- reflect

- reflects

- regulations

- regulatory

- Regulatory Compliance

- regulatory landscape

- reinforce

- relevant

- reliability

- reliable

- repercussions

- represents

- requirement

- Requirements

- response

- responsible

- revamped

- rigorous

- Risk

- robustness

- s

- safeguard

- safeguarding

- safer

- Safety

- Saudi

- scrutiny

- sector

- Secures

- security

- seeking

- Seeks

- Series

- serve

- Sets

- Settlements

- Share

- shift

- short-term

- significant

- SIX

- Six months

- sold

- solidifying

- speculative

- Stability

- stance

- standards

- Step

- Strategic

- Strategy

- stricter

- stringent

- substantial

- such

- sufficient

- SUMMARY

- Sustainability

- taking

- temporary

- that

- The

- their

- There.

- thereby

- These

- they

- this

- tighten

- tightening

- to

- token

- Token Projects

- Tokens

- toward

- towards

- Trading

- Trading Platform

- Transparency

- transparent

- Trust

- Undermine

- underscores

- updated

- Uphold

- User

- users

- Vast

- viability

- Volatility

- we

- Web3

- webp

- which

- while

- wider

- will

- with

- world

- year

- zephyrnet