Discover arenas, collect NFTs, and fight your way to the treasure

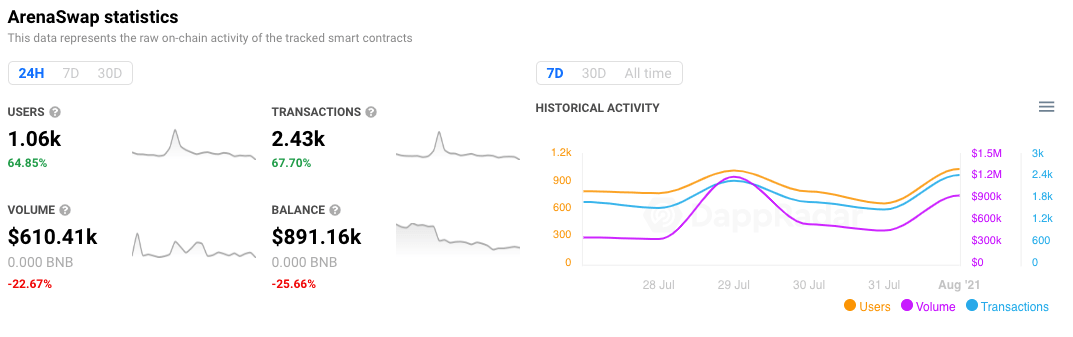

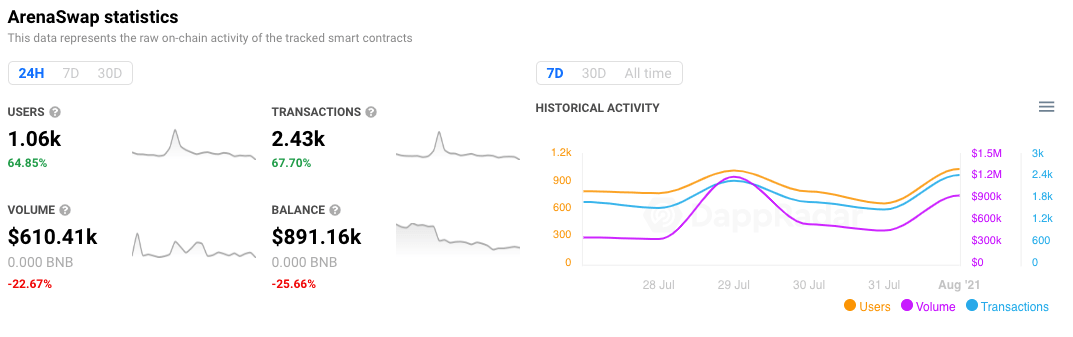

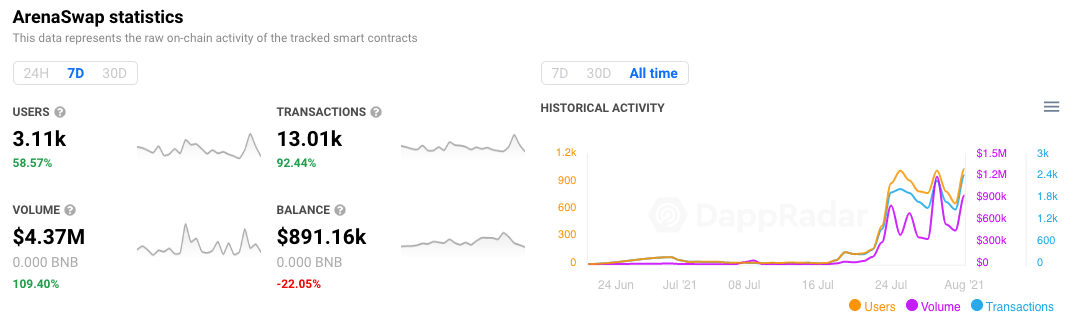

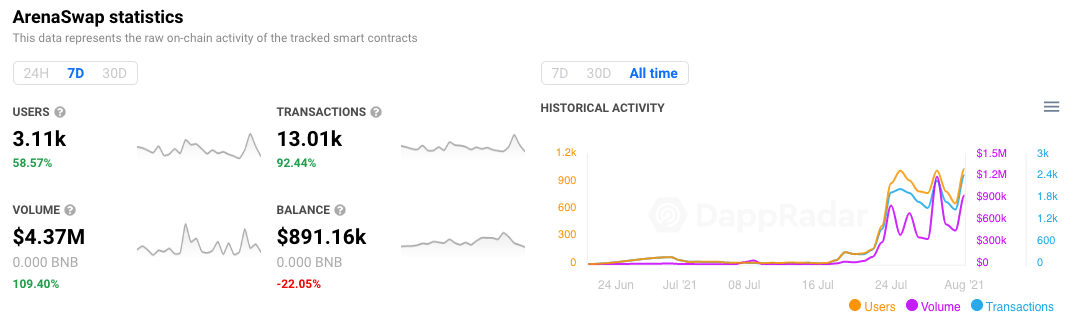

ArenaSwap, a decentralized exchange platform built on Binance Smart Chain that focuses on the gamification of yield farming has seen a big increase in its active users. As interest in the play-to-earn category starts to grow the platform attracted over 3,000 unique active wallets in the last 7 days, with 1,060 of those arriving within the last 24 hours. Reaching a total value locked of just over $1.7 million across all its farms and pools at the time of writing.

Looking at the data over a longer time period reveals more. The platform launched back at the end of June 2021 but did not start to see any meaningful traction until around the 20th of July. Having really picked up pace in the last few weeks. We can see that in the last 7 days the number of active wallets interacting with the dapps smart contracts has risen by almost 59% to 3,110 week-over-week. Meanwhile, transactions have swelled by 92% to over 13,000 which has generated $4.37 million in volume.

What’s happening?

Between the 22nd and the 25th of July user numbers really started to swell. Continuing today. Growing from just 166 to 1000 in that time frame. This sort of surge usually indicates an upgrade, new opportunity, partnership, or feature launch.

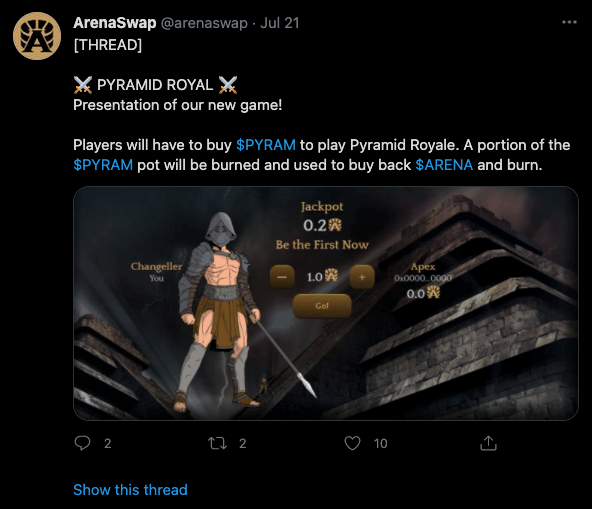

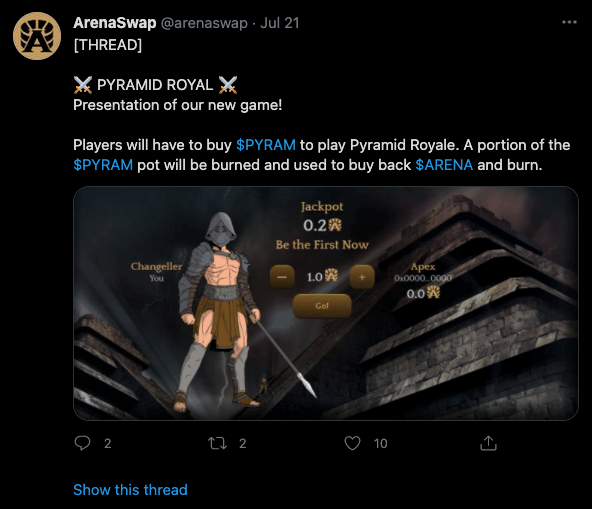

In the case of ArenaSwap, the surge represents the commencing of the token distribution. Two tokens have a function in the ArenaSwap ecosystem. ARENA and PYRAM. Players have to buy PYRAM to play the Pyramid Royale mode within the game. Which became available on the 21st July.

ARENA can be used to purchase the weapons, equipment, and gladiators of all the games in the ecosystem. Importantly, a portion of the PYRAM pot will be burned and used to buy back ARENA and burn. Seemingly, the vision for ArenaSwap is to make DeFi and yield farming mainstream through gamification and storytelling. Creating an ecosystem that supports the value of the token and NFTs.

In a nutshell, the developers of ArenaSwap claim DeFi is not fun and is just mechanical investing. Instead, they want to give users a game world in which they can play, collect, explore, and get paid for their passion. Imagine Pancakeswap with a narrative and gaming element and you start to understand ArenaSwap more.

Farming Opportunities

Farming the Arena token requires the purchase of liquidity provider tokens initially. At the time of writing four options exist offering APRs from 85% to 553%. Placing the ARENA token in a pool to earn ARENA represents the simplest action and can return stakers 107% APR.

Importantly the platform has a harvest lockup mechanism. The Harvest Guardian is an innovation to prevent arbitrage bots from stealing from investors. Through limiting the frequency of harvest, it prevents bots from continuously harvesting and dumping, which leads to diminishing the financial returns from the community. For example, the harvest lockup of the ARENA-BUSD farm is 2 hours. It means that farmers who stake in the ARENA-BUSD farm can only claim their rewards from farming every 2 hours.

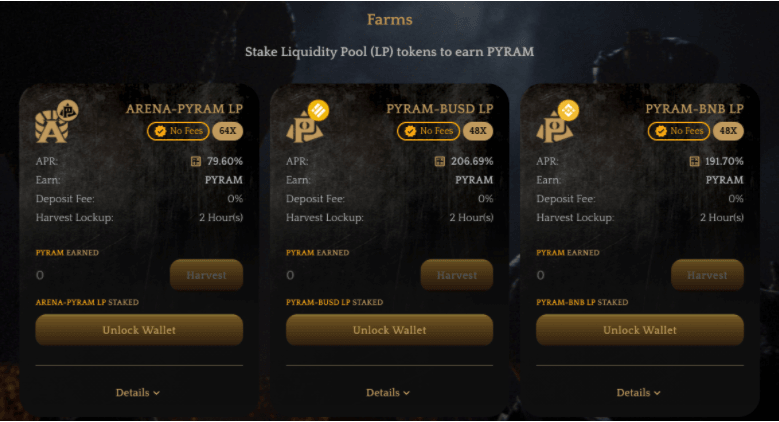

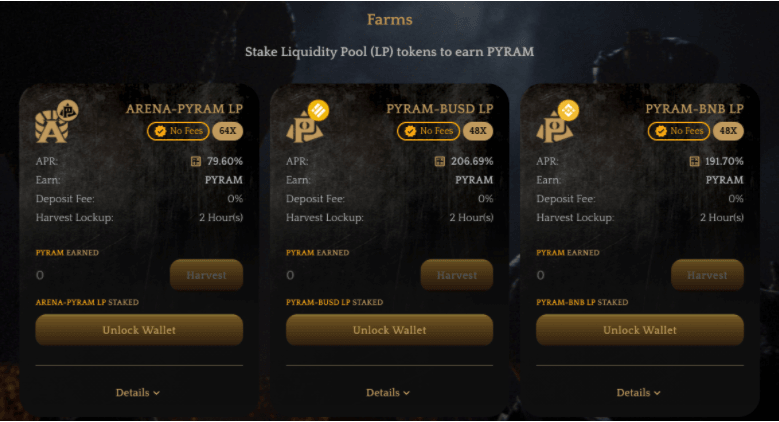

Farming PRYAM involves staking liquidity provider tokens to earn more PRYAM. Once again, there are currently just a few farms to choose from offering APRs ranging from 62% to 206%.

GameFi

Good yield farmers need to optimize their earnings and move their funds around to enjoy the best returns on their investments. That’s why yield farming on its own, is already a bit of gamification of finance. Gamified DeFi or simply GameFi, adds another layer of gamification.

The development of GameFi is clearly shown on blockchains like Polygon and Binance Smart Chain, where projects like Mobox, Cometh, and Aavegotchi combine gaming with yield farming. As a matter of fact, these dapps on BSC aren’t that much different from Alien Worlds, for example. These are projects that combine passive gaming elements with NFTs and yield farming, resulting in a new type of financial entertainment product. Some might argue that the future of financial institutes lies in the implementation of gamified elements. In that case, these GameFi projects are true frontrunners.

During the second quarter of 2021, blockchain-powered games have found a wider audience, driven by the success of gamified finance, the Wax blockchain, and Axie Infinity. The industry now offers more options for developers to launch their products on different blockchain platforms, as the multichain paradigm also slowly moves into the gaming space. Play-to-earn as a business model has gained attention within the industry itself, but also from the mainstream. Above all, consumers have the ability to interact with gaming dapps, without having to worry about transaction costs typically associated with DeFi offers on Ethereum.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research. The writer holds positions in ETH, BTC, ADA, NIOX, AGIX, DECENTRALAND, SAFEMOON, SDAO, CAKE, HEX, LINK, GRT, CRO, SHIBA INU, AND OCEAN.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet