The top echelons of the US government held a closed door meeting attended by Jereme Powell and Janet Yellen to discuss stablecoins.

Publicly, almost nothing was said about this meeting except that they spoke of the rapid growth of stablecoins, potential uses of stablecoins as a means of payment, and potential risks to end-users.

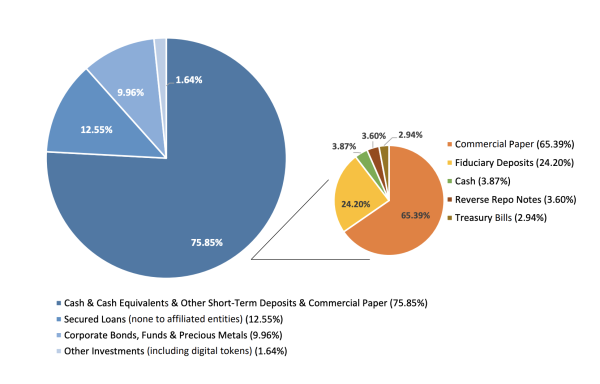

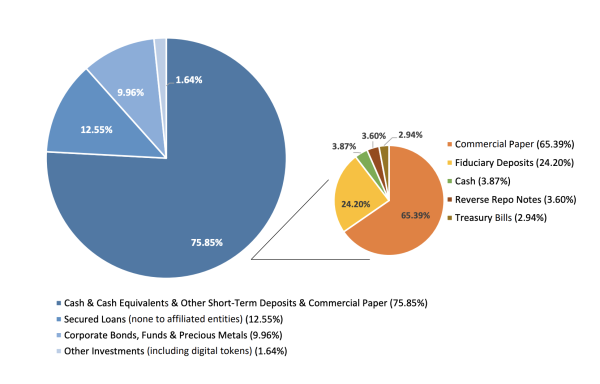

What has been leaked to the media suggests the focus was Tether’s use of commercial paper, a common form of unsecured, short-term debt issued by corporations.

According to a presentation, some $40 billion worth of USDt is backed by commercial paper, making Tether the world’s seventh biggest holder according to a report by JP Morgan strategists.

Yellen told those gathered to “act quickly to ensure there is an appropriate U.S. regulatory framework in place.”

In attendance were Janet L. Yellen herself as Secretary of the Treasury, Jerome Powell as Chair, Board of Governors of the Federal Reserve System, Gary Gensler as Chair, Securities and Exchange Commission, Rostin Behnam as Acting Chairman, Commodity Futures Trading Commission, Jelena McWilliams as Chairman of the Federal Deposit Insurance Corporation, Michael J. Hsu as Acting Comptroller of the Currency, Randal Quarles as Vice Chair for Supervision, Board of Governors of the Federal Reserve System and J. Nellie Liang as Under Secretary for Domestic Finance at the U.S. Department of the Treasury.

They compared the tether situation to an unregulated money-market mutual fund that can potentially be susceptible to a rush for an exit in times of uncertainty.

Tether has experienced many such episodes when the crypto space was concerned whether it is really backed. Those concerns subsided after the New York Attorney General effectively said they were backed, with Tether apparently also holding US government bonds.

Tether is also not the only one doing stablecoins. There’s Circle’s USDc with Circle itself soon to IPO. There are others, including Binance’s bUSD.

Fed-ing the Crypto Netflix

If bitcoin 10x-es from here, which it may well do, it’s not out of foreseeability that stablecoins reach a market cap of $1 trillion or in a decade potentially even ten trillion.

That’s of course something systemically relevant, and if they want to move there can be benefits for the stablecoins industry presuming Yellen and Powell act reasonably and with consent, consent that can be reached if their intentions are judged logical and reasonable.

Powell recently met Coinbase’s Brian Armstrong and we know they discussed stablecoins. What exactly is not clear, but they have to be careful not to be seen picking winners and losers.

That includes between banks and crypto as well as within crypto. For the former, because they risk propping up Blockbuster when Netflix is on the way, and that Netflix may not be American if the elderly are not careful.

For the latter, because they risk picking petshop over Amazon with Tether being the initial innovator of these stablecoins while USDc effectively copy pasted.

This growing space arose out of necessity as previously pretty much all crypto trading pairs were against volatile BTC, which had the effect of kind of pegging them to bitcoin’s price. Now USDt dominates globally with its crypto like qualities making it far more efficient than USD to the point one can easily imagine in a decade or so from now, crypto USD will become a daily part of financial life.

Because Netflix is obviously more convenient than Blockbuster. The tokenized dollar likewise, especially as it provides access to decentralized autonomous finance where the inability to cheat, like with Libor, itself provides huge efficiency gains where the end user is concerned.

Currently the defi space is very much a playground of risk takers, but someone like Senator Elizabeth Warren will use it in a decade because whoever plays her role at that point may be currently taking risks on defi to pave the way for mainstream usage just as supercoders in the 90s paved the way for mainstream internet.

“DeFi refers to a fast-growing and highly opaque corner of the cryptocurrency market which allows users to engage in a variety of financial activities – including lending, borrowing, and trading derivatives to take on leverage – without an intermediary like a bank,” Warren said, further adding:

“Given that participants and project developers may remain anonymous, DeFi could present particularly severe financial stability risks. According to a 2019 Financial Stability Board report, decentralized financial technologies may raise new forms of concentration risks, unclear allocation of liability, and recovery and resolution challenges.”

She is right in some ways. Some of us are still waiting for our MT Gox coins, just as some are waiting for real wage increases since the 70s.

The latter speaks clearly of what would happen if proposed measures do not have consensual buy-in due to being reasonable. Coders will just Nakamoto because the potential efficiency gains for their country and their people are far too great to not utilize.

Jurisdictions like Europe would accommodate in any event, and if they’re pressured to the point coders see them as just a vassal – which is very unlikely because they are democracies answerable to those very coders – there’s always jurisdictions like Russia or complete anonymity like Nakamoto.

Because banks, and that includes Powell as well as the entire US government, can delay innovation in this space, but they can’t stop it as it is impossible to stop the publishing of code which is what stablecoins ultimately are.

Their choice is just one: either buy up the Netflix startup or copy it to compete or bring it in within the oversight parameters as the copyrights industry did with Netflix.

What that would look like exactly is not clear with the decision that of Powell mainly, or more correctly whatever millennials are at the Fed doing research input.

Fed Upgrading?

It’s not an easy matter to strike the right balance, but where US is concerned this is a great problem to have because they actually do have this fast growing stablecoins market that brings their printed out of nothing money into the digital era.

Europe might have an actual problem: how do they compete in this new digital financial realm to get some market share so that the dollar is not the only used fiat coin at scale.

Countries like Russia have an even bigger problem. How do they prevent the Ruble from weakening due to an increased use of USD coins especially if there’s financial turbulences. Something Vladimir Putin, their president, could have addressed if he spent resources to increase competency in this area instead of being distracted by imperial games.

For China, the problem might be even existential because while they can fool their populace with paper scanned e-CNY to call it a coin, they risk unnoticeable and utterly gradual innovation in this area in America and Europe leaving them in the dust in a decade or two due to completely closing the door to innovation in this space which may well turn out to be one of the biggest strategic mistake of this century.

Thus while Warren can say whatever she wants, as can Yellen, it won’t be either who will be here in a decade or two in a competent form, but the supercoders who are generally millennials or younger and those currently going through the political ladder who may well be participants in this space, certainly if they’re smart enough to manage well investments and risk.

50% of family offices are looking to crypto. 25% in US have already bought. That’s who people will listen to, not grandpas or grandmas that look to the past rather than the future, and certainly not banks which are infested with cheating and abuse of power to the point of rigging all prices, including housing prices through their buy to let schemes and much else.

Any decision thus needs to be thought very carefully and in an objective manner with a realistic clear eyed view regarding the harnessing of these new capabilities that encourage innovation and widespread benefits through new efficiencies.

More perhaps the Fed even guaranteeing the peg or even making them part of the Reserve System because in many ways this is a gift to the dollar system and their monopoly of printing it out of nothing.

Fed, in a decade or two, could even participate in this automated defi finance because the dollar is probably not going anywhere any time soon unless they very badly mismanage it.

That could also court some political buy-in especially if these token reserves get Fed interest that is passed on to the end user, so potentially bypassing what can become a very politically charged matter in regards to Fed demanding interest on printed out of nothing lended money while not giving the public any of that interest.

However these are probably for the next generation once we, the digital natives, get to chair things as for current grandpas they might be unable to comprehend the new code based system. But it doesn’t fundamentally threaten anything, neither the Fed nor the government, as things like stablecoins or defi are more a change in form than in substance.

A change in substance is something like bitcoin, but that’s not going to replace the dollar anytime soon and the only way to compete with that is to have a fixed limit on the dollar which is obviously not going to happen.

Bitcoin’s digital gold quality moreover can have its own uses for central banks, including as reserves, but the administration appears to be more looking at effectively how something like USDc can extend the dollar’s dominance.

Innovation First For a Digital Dollar

Publicly they say something different, which to our ears reads more like re re re from donkeys, but you’d think privately they have a far more sophisticated analysis and consideration of the matter because in many ways stablecoins are their savior, their Netflix while Blockbuster was still at its prime.

It can be their way of upgrading themselves, and so keep bitcoin to just digital gold instead of passing the tipping point for payments usage.

As such, the only real concern at this stage without any indication to the contrary is potentially monopolistic restrictions that limit competition in the stablecoins space, and thus potentially limit innovation at too far an early stage.

Things like interest payments for example are not even being experimented. Stuff like defi have not even gone through a proper painful bear yet when coders start shouting at each other as some of the sun lit fields get a more realistic look.

It’s too early in our view for any real involvement by the grandpas, especially in the defi space which currently is untouchable in any event as the coders’ spirit is too high and therefore any action would be a very big and potentially risky mistake because you can just fork these projects.

But it is too early for stablecoins as well. The $1 trillion line maybe would be more appropriate to move towards making them part of the system with the stablecoins market currently needing a bit of competition or to sort out the on-going competition of sorts which is barely one year old.

However it depends what exactly they want to do, which is why there should be a public consultation and not just closed doors meetings because these are huge matters.

If they do want to be involved, then in our view that should be on the basis of innovation first and not risks because currently it is only risk takers taking risk, and therefore there is no harm, with everyone very aware of the dangers in this space, especially code bugs or high volatility.

Those things have to be ironed out by the market, and this space needs to be given some room to grow and mature with any current action needing to consider it would be the same as taking action on internet developments in 1995 before the likes of Powell learned how to send an e-mail, with today’s equivalent being before ‘normy’ Powell, rather than Fed chair, learned how to install MetaMask.

On the other hand, it is probably around 1995 when Fed put up its first website, so it is very much the time to see how these new capabilities can be utilized, but that’s while bearing in mind that in ten years time they may also sign up to crypto’s equivalent of Twitter, after perhaps skipping MySpace and maybe even Facebook.

Because finance is changing and eventually Fed will probably be a user of this new finance too as it does bring new capabilities which eventually will probably be utilized by all to some extent with it not quite foreseeable currently just what new innovation will arise out of it, and thus those in charge need to tread very carefully and always with general buy-in from those that are making all of this possible.

Source: https://www.trustnodes.com/2021/07/28/biden-administration-ponders-crypto-approach

- "

- 2019

- access

- Action

- activities

- All

- allocation

- Amazon

- america

- American

- analysis

- Anonymity

- AREA

- around

- Automated

- autonomous

- Bank

- Banks

- biden

- Biggest

- Billion

- Bit

- Bitcoin

- board

- Bonds

- Borrowing

- BTC

- bugs

- BUSD

- buy

- call

- Central Banks

- chairman

- change

- charge

- charged

- China

- closed

- code

- Coin

- Coins

- commercial

- commission

- commodity

- Common

- competition

- concentration

- consent

- Corporations

- Court

- crypto

- crypto trading

- cryptocurrency

- cryptocurrency market

- Currency

- Current

- Debt

- decentralized

- DeFi

- delay

- Derivatives

- developers

- DID

- digital

- digital gold

- Dollar

- Early

- early stage

- efficiency

- Elderly

- Europe

- Event

- exchange

- Exit

- family

- FAST

- Fed

- Federal

- federal reserve

- Fiat

- Fields

- finance

- financial

- First

- Focus

- fork

- form

- Framework

- fund

- future

- Futures

- Games

- General

- Giving

- Gold

- Government

- great

- Grow

- Growing

- Growth

- here

- High

- housing

- How

- How To

- HTTPS

- huge

- Including

- Increase

- industry

- Innovation

- insurance

- interest

- Internet

- Investments

- involved

- IT

- jp morgan

- learned

- lending

- Leverage

- liability

- Line

- Mainstream

- Making

- Market

- Market Cap

- Matters

- Media

- meetings

- MetaMask

- Millennials

- money

- move

- MT

- Netflix

- New York

- Other

- Paper

- payment

- payments

- People

- power

- present

- president

- price

- project

- projects

- public

- Publishing

- quality

- raise

- RE

- recovery

- report

- research

- Resources

- Risk

- rush

- Russia

- Scale

- Securities

- Securities and Exchange Commission

- Senate

- Senator

- Share

- smart

- So

- Space

- Stability

- Stablecoins

- Stage

- start

- startup

- Strategic

- substance

- system

- Technologies

- Tether

- time

- token

- top

- Trading

- u.s.

- us

- us government

- USD

- USDC

- USDT

- users

- View

- Vladimir Putin

- Volatility

- warren

- Website

- WHO

- within

- worth

- year

- years