The rise of digital currencies and the increasing interest in blockchain technology have sparked significant developments in central bank digital currencies (CBDCs) and crypto assets.

Central banks worldwide are actively exploring the potential benefits and implications of CBDCs while monitoring the rapid growth of crypto assets and stablecoins.

In late 2022, the Bank for International Settlements (BIS) conducted a comprehensive survey of 86 central banks to assess the progress of CBDC work, motivations for issuance, involvement of stakeholders, and the impact of crypto assets on CBDC initiatives.

CBDC experiments and pilots

The survey findings demonstrate a remarkable advancement in CBDC work, with 93 percent of central banks engaged in some form of CBDC development.

Retail CBDCs, digital versions of a country’s fiat currency accessible to the general public, are leading the way, with almost a quarter of central banks piloting retail CBDCs.

Wholesale CBDC projects, which target financial institutions and aim to enhance cross-border payments, are also gaining momentum, albeit slower.

The progress in retail CBDCs is particularly notable, with four central banks already issuing live CBDCs in The Bahamas, the Eastern Caribbean, Jamaica, and Nigeria.

The survey reveals that emerging markets and developing economies (EMDEs) are at the forefront of retail CBDC implementation, as all current live CBDCs are issued in these jurisdictions.

Additionally, EMDEs are more advanced in their CBDC work than developed economies (AEs), with a higher proportion of EMDE central banks piloting retail and wholesale CBDCs.

Motivations for Retail CBDCs

The motivations for issuing retail CBDCs have increasingly aligned between AEs and EMDEs. Both groups recognise the importance of improving domestic payment efficiency, ensuring payment safety, and enhancing cross-border payment efficiency. Financial stability is another crucial driver for both AEs and EMDEs.

However, EMDEs emphasise financial inclusion-related motivations, aiming to provide broader access to financial services.

Furthermore, EMDEs consider the role of retail CBDCs in monetary policy implementation more significant than AEs, although the difference has decreased since the previous year.

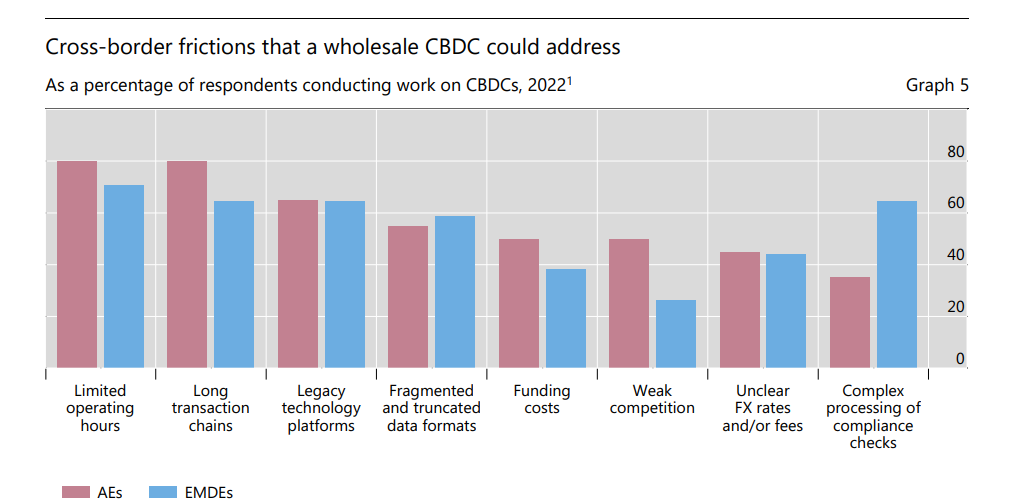

Enhancing Cross-Border payments with Wholesale CBDCs

While retail CBDCs focus on domestic payment systems, wholesale CBDCs aim to enhance cross-border payments. Central banks recognise the potential of wholesale CBDCs in facilitating cheaper, faster, and safer cross-border transactions.

Collaborative projects, such as Project Dunbar, involving multiple central banks, explore the possibilities of a common platform for multi-CBDCs to streamline cross-border payments.

Financial inclusion plays a lesser role in the motivation for wholesale CBDCs than retail CBDCs, as their primary objective is improving efficiency in international transactions.

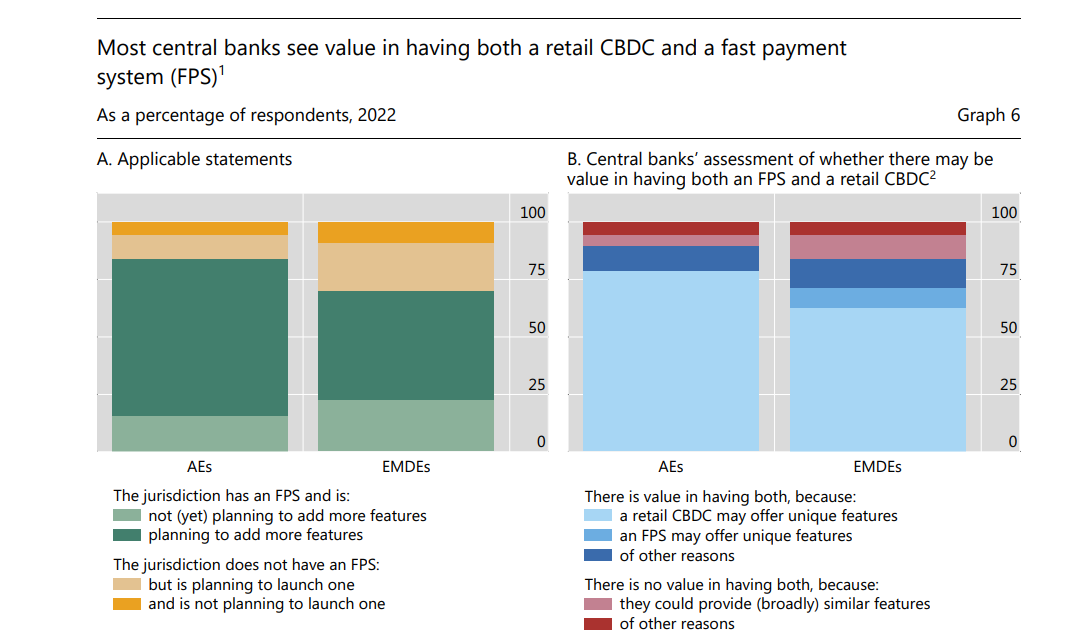

Complementing Fast Payment Systems (FPS)

Fast payment systems (FPS) have gained widespread adoption worldwide, offering real-time and 24/7 availability of small-value account-based transactions.

The BIS survey highlights that over 70 percent of jurisdictions already have an FPS, with plans to upgrade these systems with additional functionalities. While FPS and CBDCs share common objectives, such as financial inclusion and faster payments, they differ in their underlying nature.

CBDCs represent central bank money, whereas FPS involves commercial bank money. Central banks recognise the value of having both FPS and CBDCs, with over 80 percent believing in the benefits of their coexistence.

Future outlook: More live CBDCs expected

The survey reveals a growing likelihood of retail CBDC issuance within the next three years. The number of central banks considering the issuance of retail CBDCs has increased, indicating that there could be 15 retail CBDCs publicly circulating by the end of the decade.

The likelihood of wholesale CBDC issuance has also doubled compared to the previous year, with a significant proportion of central banks indicating their plans to issue wholesale CBDCs in the short and medium term. EMDEs exhibit a greater inclination towards issuing both retail and wholesale CBDCs soon.

However, legal considerations remain crucial, as a quarter of central banks still lack the required legal foundation for CBDC issuance.

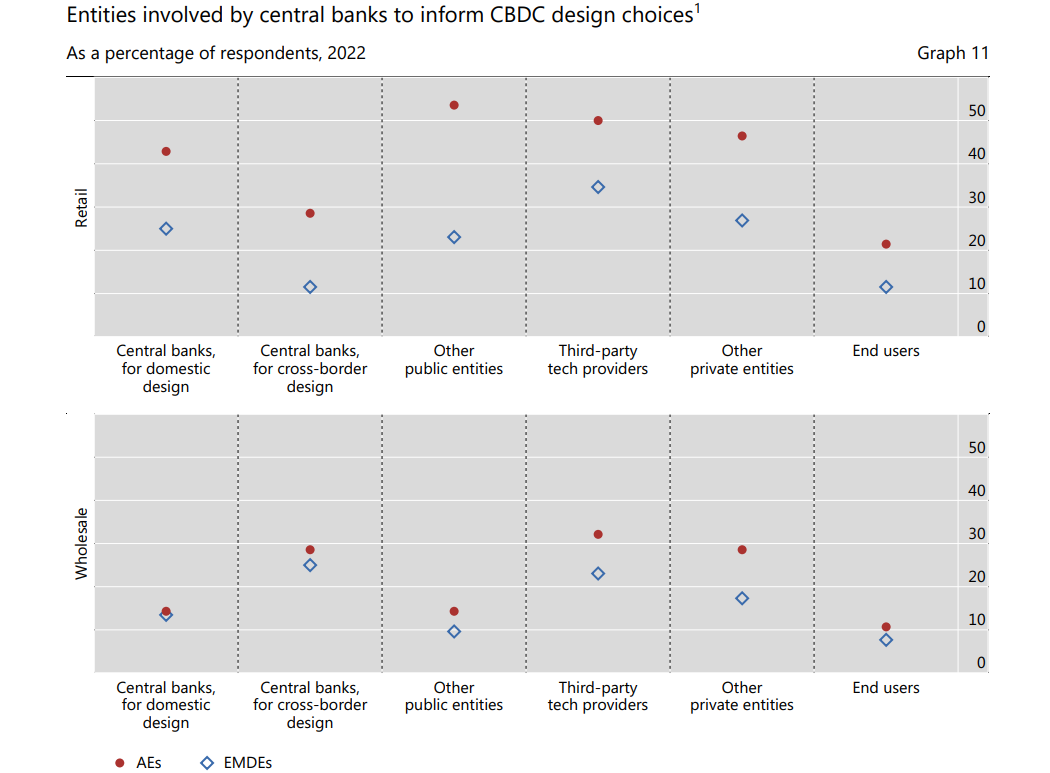

Involvement of stakeholders in CBDC design

Central banks recognise the importance of collaboration and engagement with various stakeholders in designing and implementing CBDCs.

The survey findings indicate that nearly 93 percent of central banks involved other entities, such as governments, public authorities, external technology providers, and commercial banks, in their CBDC projects.

The level of engagement varies between AEs and EMDEs, as well as between retail and wholesale CBDC initiatives.

Some central banks also involve end users in the development process through public consultations and focus group studies, ensuring that CBDCs are designed to meet the users’ needs.

Crypto developments and regulatory efforts

Cryptocurrency assets’ emergence and rapid growth have significantly impacted central banks’ CBDC work.

The BIS survey reveals that nearly 60 percent of central banks reported accelerating their CBDC efforts due to the rise of crypto assets and stablecoins.

To address the risks associated with crypto assets, regulators and international standard-setting bodies have intensified their efforts in monitoring and regulating these markets.

Updated guidance and standards have been published to strengthen regulatory approaches and contain the potential risks to financial stability.

Limited use of stablecoins for payments

While stablecoins and other crypto assets have gained attention recently, their use for payments outside the crypto ecosystem remains limited.

The survey findings indicate that stablecoins are mainly used for remittances and niche groups, with minimal adoption in consumer payments or wholesale transactions.

Notable differences exist between AEs and EMDEs, with developed economies exhibiting a higher usage of stablecoins in remittances, while EMDEs show a more elevated use for cross-border wholesale payments.

Effective regulation and monitoring are crucial to managing the risks associated with stablecoins and other crypto assets.

Roadmap for central banks

The results of the 2022 BIS survey provide valuable insights into the progress and motivations behind CBDC initiatives and the impact of crypto assets on central banks’ work.

The increasing interest in CBDCs, advancements in retail and wholesale CBDC projects, involvement of stakeholders, and regulatory efforts highlight the evolving landscape of digital currencies.

As central banks continue to explore the potential benefits and risks, collaboration, interoperability, and effective regulation will play crucial roles in shaping the future of CBDCs and their integration into the global financial system.

The BIS survey results serve as a roadmap for central banks to navigate the complexities of digital currencies and make informed decisions in their CBDC endeavours.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://fintechnews.sg/76268/crypto/bis-survey-reveals-93-of-central-banks-engaged-in-cbdc-work/

- :has

- :is

- 15%

- 2022

- 500

- 60

- 7

- 70

- 80

- a

- accelerating

- access

- accessible

- actively

- Additional

- address

- Adoption

- advanced

- advancement

- advancements

- AES

- aim

- Aiming

- aligned

- All

- already

- also

- Although

- an

- and

- Another

- approaches

- ARE

- AS

- assess

- Assets

- associated

- At

- attention

- Authorities

- availability

- Bahamas

- Bank

- Banks

- BE

- been

- behind

- believing

- benefits

- between

- bis

- blockchain

- blockchain technology

- bodies

- both

- broader

- by

- caps

- Caribbean

- CBDC

- CBDC PROJECTS

- CBDCs

- central

- Central Bank

- central bank digital currencies

- CENTRAL BANK DIGITAL CURRENCIES (CBDCS)

- Central Banks

- cheaper

- circulating

- collaboration

- commercial

- Common

- compared

- complexities

- comprehensive

- Consider

- considerations

- considering

- consultations

- consumer

- contain

- continue

- could

- country’s

- cross-border

- cross-border payments

- crucial

- crypto

- Crypto ecosystem

- crypto-assets

- currencies

- Currency

- Current

- decade

- decisions

- demonstrate

- designed

- designing

- developed

- developing

- Development

- developments

- differ

- difference

- differences

- digital

- digital currencies

- Domestic

- doubled

- driver

- due

- eastern

- economies

- ecosystem

- Effective

- efficiency

- efforts

- elevated

- emergence

- emerging

- emerging markets

- end

- endeavours

- engaged

- engagement

- enhance

- enhancing

- ensuring

- entities

- evolving

- exhibit

- Exhibiting

- exist

- experiments

- explore

- external

- facilitating

- false

- FAST

- faster

- Fiat

- Fiat currency

- financial

- financial inclusion

- Financial institutions

- financial services

- financial stability

- financial system

- findings

- fintech

- Focus

- For

- forefront

- form

- Foundation

- four

- fps

- friendly

- functionalities

- future

- gained

- gaining

- General

- general public

- Global

- global financial

- global financial system

- Governments

- greater

- Group

- Group’s

- Growing

- Growth

- guidance

- Have

- having

- higher

- Highlight

- highlights

- HTTPS

- Impact

- impacted

- implementation

- implementing

- implications

- importance

- improving

- in

- inclusion

- increased

- increasing

- increasingly

- indicate

- informed

- initiatives

- insights

- institutions

- integration

- interest

- International

- international settlements

- Interoperability

- into

- involve

- involved

- involvement

- involving

- issuance

- issue

- Issued

- issuing

- Jamaica

- jpg

- jurisdictions

- Lack

- landscape

- Late

- leading

- Legal

- lesser

- Level

- likelihood

- Limited

- live

- mainly

- make

- managing

- Markets

- max-width

- medium

- Meet

- minimal

- Momentum

- Monetary

- Monetary Policy

- money

- monitoring

- more

- Motivation

- motivations

- multiple

- Nature

- Navigate

- nearly

- needs

- next

- Nigeria

- notable

- number

- objective

- objectives

- of

- offering

- on

- or

- Other

- Outlook

- outside

- over

- particularly

- payment

- Payment Systems

- payments

- percent

- plans

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Play

- plays

- policy

- possibilities

- potential

- previous

- primary

- process

- Progress

- project

- projects

- proportion

- provide

- providers

- public

- publicly

- published

- Quarter

- rapid

- real-time

- recently

- recognise

- regulating

- Regulation

- Regulators

- regulatory

- remain

- remains

- remarkable

- Remittances

- Reported

- represent

- required

- Results

- retail

- retail CBDC

- return

- Reveals

- Rise

- risks

- roadmap

- Role

- roles

- safer

- Safety

- serve

- Services

- Settlements

- shaping

- Share

- Short

- show

- significant

- significantly

- since

- Singapore

- some

- soon

- sparked

- Stability

- Stablecoins

- stakeholders

- standards

- Still

- streamline

- Strengthen

- studies

- such

- Survey

- system

- Systems

- Target

- Technology

- term

- than

- that

- The

- The Bahamas

- The Future

- their

- There.

- These

- they

- three

- Through

- to

- towards

- Transactions

- true

- underlying

- upgrade

- Usage

- use

- used

- users

- Valuable

- value

- various

- versions

- Way..

- WELL

- whereas

- which

- while

- wholesale

- wholesale CBDC

- widespread

- will

- window

- with

- within

- Work

- worldwide

- year

- years

- zephyrnet