-

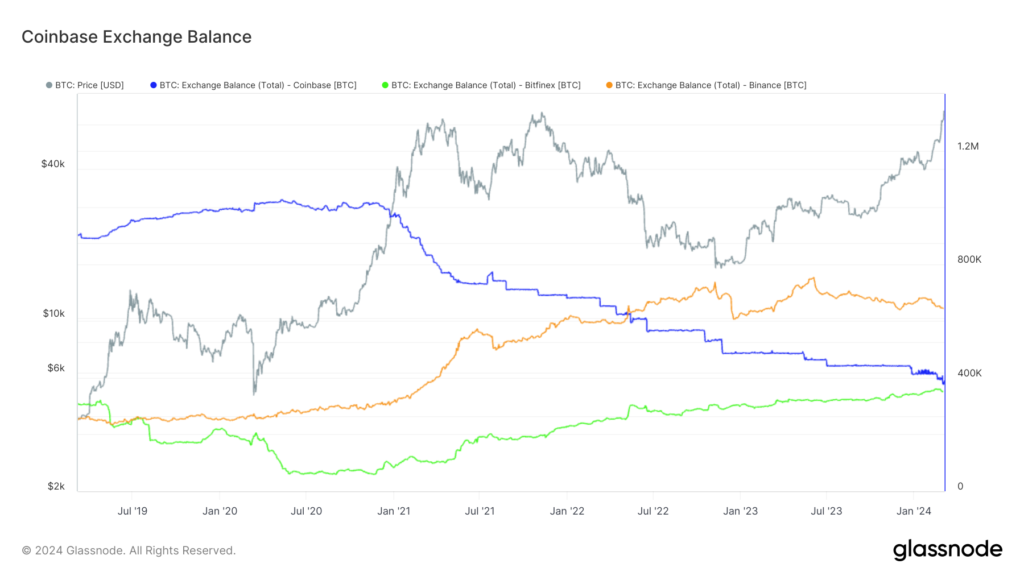

Coinbase Exchange has experienced a significant depletion in Bitcoin reserves, highlighting the movements of crypto whales.

-

Some analysts posit that the whales might be transferring their wealth to cold storage solutions, indicative of a bullish outlook.

-

This move could be part of a broader trend towards decentralization, with investors preferring to store their assets away from centralized exchanges.

Coinbase, one of the world’s premier cryptocurrency exchanges, has experienced a significant depletion in Bitcoin reserves, casting a spotlight on the movements of crypto whales and the strategies of large-scale investors. Recent blockchain analytics have shed light on this pivotal shift in digital asset holdings, signifying a possibly transformative moment in the cryptocurrency landscape.

Coinbase Exchange Witnesses Unprecedented Bitcoin Withdrawal

On February 20, 2024, observers noted a significant transaction where over 18,000 BTC, equivalent to approximately US$1 billion, moved from Coinbase’s wallets. Blockchain analytics company CryptoQuant confirmed this large-scale mobilization of funds, dispersing these assets into a gamut of new addresses. With individual wallet values averaging $55 million and some reaching as high as $171 million, the sheer volume of this transfer could not go unnoticed.

Following these transactions, Coinbase’s total Bitcoin reserves plummeted to levels not seen since the explosive bull run in 2017 when Bitcoin prices surged to their then-all-time highs. At last glance, Coinbase’s order book displayed a substantial count of approximately 394,000 BTC, valuing over $20.5 billion.

The Enigmatic Movers: Crypto Whales and Their Influence

The identities and intentions of the parties involved in such a behemoth exodus of Bitcoin remain elusive, yet the crypto community often refers to such entities as “whales.” These high-worth investors are known for their ability to sway the markets, and this recent event has undoubtedly given rise to a maelstrom of theories and conjectures.

Also, Read Coinbase Cloud Enhances Ethereum Staking: Diversifying Client Usage.

Some analysts posit that the whales might be transferring their wealth to cold storage solutions, indicative of a bullish outlook, trusting in the ascent of Bitcoin’s value over the long term. This strategic diversification is common among seasoned investors looking to mitigate risk amid market turmoil and regulatory uncertainties.

On the other hand, a school of thought also associates this movement with a potential sell-off. Market analysts suggest these whales could diversify their portfolios or liquidate assets to realize gains.

Market response and future implications

Despite this notable withdrawal, the price of Bitcoin has maintained its gradual upward trajectory. A 0.6% incremental increase echoes the resilience of Bitcoin’s valuation, which hovers around the $52,400 mark. Despite potential whale-induced volatility, Bitcoin’s price remains a.

The community remains vigilant as these large-scale transfers present prospective optimism and caution. Historical trends have taught us to interpret exchange withdrawals as bullish, yet the enigmatic and volatile character of the market decreases absolute certainty.

The massive Bitcoin outflow from Coinbase may have several potential implications for the overall cryptocurrency market:

- When someone withdraws a large amount of Bitcoin from an exchange, it typically indicates the transfer of the coins to personal wallets or cold storage. This could lead to reduced market liquidity, which can stabilize the price as fewer Bitcoins are available for trading on exchanges.

- Investors moving Bitcoin into cold storage could signal long-term confidence in the asset. They hold onto their investments, believing that Bitcoin’s value will increase.

- Price Stability or Increase: Historically, large outflows from exchanges have sometimes preceded price increases as the market’s supply diminishes. If investors perceive this action as bullish, confidence may lead to price stability or even an uptick in valuation.

- On the other hand, there’s speculation that large holders (“whales”) might be preparing for a sell-off by moving bitcoins to individual wallets to distribute sales over time or through various platforms to minimize price impact.

- Signal for Portfolio Diversification: The whales might be reallocating their investments for diversification. Portfolio diversification is a common strategy to manage risk, and significant Bitcoin owners are moving funds to invest in other cryptocurrencies or assets, which could lead to a slight dip in Bitcoin prices as the market adjusts.

- This move could be part of a broader trend towards decentralization, with investors preferring to store their assets away from centralized exchanges due to potential security risks or concerns over regulatory actions against cryptocurrency exchanges.

- Large movements of funds could alter how the crypto ecosystem handles large-volume trading, reshaping trading dynamics by increasing activity on OTC (over-the-counter) platforms rather than public exchanges.

- Insiders linking to the withdrawal could signal turbulent market conditions or exchange issues, prompting investors to monitor closely.

These are speculative potential outcomes. Investors should track market data, news, and blockchain analytics to inform their decisions and understand the broader impact of such large-scale transfers within the complex and ever-evolving cryptocurrency market.

Also, Read Coinbase and Yellow Card Driving Digital Asset Adoption.

Gargantuan crypto transfers nearing the billion-dollar echelon remind us of the enduring intrigue and complexity intertwined within the cryptocurrency market. Changing opinions, strategic portfolio diversifications, the trend towards cold storage, and the deep insights provided by blockchain analytics all work together to create a complex web of cryptographic movement and potential that defines the modern financial era.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2024/03/09/news/whales-bitcoin-coinbase-exchange/

- :has

- :is

- :not

- :where

- $1 billion

- 000

- 1

- 20

- 2017

- 2020

- 2024

- 385

- 400

- a

- ability

- Absolute

- Action

- actions

- activity

- addresses

- adjusts

- against

- All

- also

- Amid

- among

- amount

- an

- Analysts

- analytics

- and

- approximately

- ARE

- around

- AS

- ascent

- asset

- Assets

- associates

- At

- available

- averaging

- away

- BE

- behemoth

- believing

- Billion

- binance

- Bitcoin

- Bitcoin prices

- bitcoin reserves

- Bitcoins

- blockchain

- BLOCKCHAIN ANALYTICS

- book

- broader

- BTC

- bull

- Bull Run

- Bullish

- by

- CAN

- card

- casting

- caution

- centralized

- Centralized Exchanges

- certainty

- changing

- character

- client

- closely

- Cloud

- coinbase

- coinbase exchange

- Coinbase’s

- Coins

- cold

- Cold Storage

- Common

- community

- company

- complex

- complexity

- Concerns

- conditions

- confidence

- CONFIRMED

- could

- count

- create

- crypto

- crypto community

- Crypto ecosystem

- Crypto Whales

- cryptocurrencies

- cryptocurrency

- Cryptocurrency Exchanges

- cryptocurrency market

- cryptographic

- cryptoquant

- data

- Decentralization

- decisions

- decreases

- deep

- Defines

- Despite

- digital

- Digital Asset

- Dip

- displayed

- distribute

- diversification

- diversify

- drain

- driving

- due

- dynamics

- echoes

- ecosystem

- enduring

- Enhances

- enigmatic

- entities

- Equivalent

- Era

- ethereum

- ethereum staking

- Even

- Event

- exchange

- Exchanges

- Exodus

- experienced

- February

- fewer

- financial

- For

- from

- funds

- future

- Gains

- gamut

- given

- Glance

- Go

- gradual

- hand

- Handles

- Have

- Held

- High

- highlighting

- Highs

- historical

- historically

- hold

- holders

- Holdings

- How

- HTTPS

- identities

- if

- Impact

- implications

- in

- In other

- Increase

- Increases

- increasing

- incremental

- indicates

- indicative

- individual

- inform

- insights

- intentions

- intertwined

- into

- Invest

- Investments

- Investors

- involved

- issues

- IT

- ITS

- just

- known

- landscape

- large

- large-scale

- Last

- lead

- levels

- light

- linking

- liquidate

- Liquidity

- Long

- long-term

- looking

- maintained

- maintains

- manage

- March

- march 2020

- mark

- Market

- market conditions

- Market Data

- Markets

- massive

- max-width

- May..

- might

- million

- minimize

- Mitigate

- mobilization

- Modern

- moment

- Monitor

- move

- moved

- movement

- movements

- Movers

- moving

- nearing

- New

- news

- notable

- noted

- observers

- of

- often

- on

- ONE

- onto

- Opinions

- Optimism

- or

- order

- OTC

- Other

- outcomes

- outflows

- Outlook

- over

- over-the-counter

- overall

- owners

- part

- parties

- personal

- pivotal

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- portfolio

- portfolios

- possibly

- potential

- premier

- preparing

- present

- previously

- price

- Prices

- prospective

- provided

- public

- rather

- reaching

- realize

- recent

- Reduced

- reduction

- refers

- regulatory

- remain

- remains

- reportedly

- Reserve

- reserves

- reshaping

- resilience

- response

- Rise

- Risk

- risks

- Run

- s

- sales

- School

- seasoned

- security

- security risks

- seen

- sell-off

- several

- shed

- shift

- should

- Signal

- significant

- since

- Solutions

- some

- Someone

- sometimes

- Sparks

- speculation

- speculative

- Spotlight

- Stability

- stabilize

- Staking

- storage

- store

- Strategic

- strategies

- Strategy

- substantial

- such

- suggest

- supply

- Surged

- Sway

- taught

- term

- than

- that

- The

- The Coins

- their

- These

- this

- thought

- Through

- time

- to

- together

- Total

- towards

- track

- Trading

- trajectory

- transaction

- Transactions

- transfer

- Transferring

- transfers

- transformative

- Trend

- Trends

- true

- trusting

- turbulent

- typically

- uncertainties

- understand

- undoubtedly

- unprecedented

- upward

- us

- Valuation

- value

- Values

- valuing

- various

- volatile

- Volatility

- volume

- Wallet

- Wallets

- Wealth

- web

- webp

- whales

- when

- which

- while

- will

- with

- withdrawal

- Withdrawals

- within

- Work

- work together

- world’s

- Yahoo

- Yellow Card

- yet

- zephyrnet