On December 7, 2023, Jurrien Timmer, the Director of Global Macro at Fidelity Investments, shared his perspective on Bitcoin’s current state and future prospects in a thread on social media platform X (formerly, known as Twitter). His analysis draws parallels between Bitcoin and traditional assets while exploring its unique characteristics.

Timmer begins by noting the recent rise in Bitcoin’s price, surpassing $40,000, signaling a recovery from the latest crypto winter. He introduces his personal thesis: Bitcoin is akin to ‘digital gold’ but with an added ‘venture twist,’ referring to it as ‘exponential gold.’ He reflects on the effects of fiscal and monetary stimulus in 2020, which bolstered the case for both Bitcoin and gold as assets holding their value during times of structural inflation. Gold, as Timmer notes, is a proven leader in value preservation, while Bitcoin is seen as its emerging counterpart.

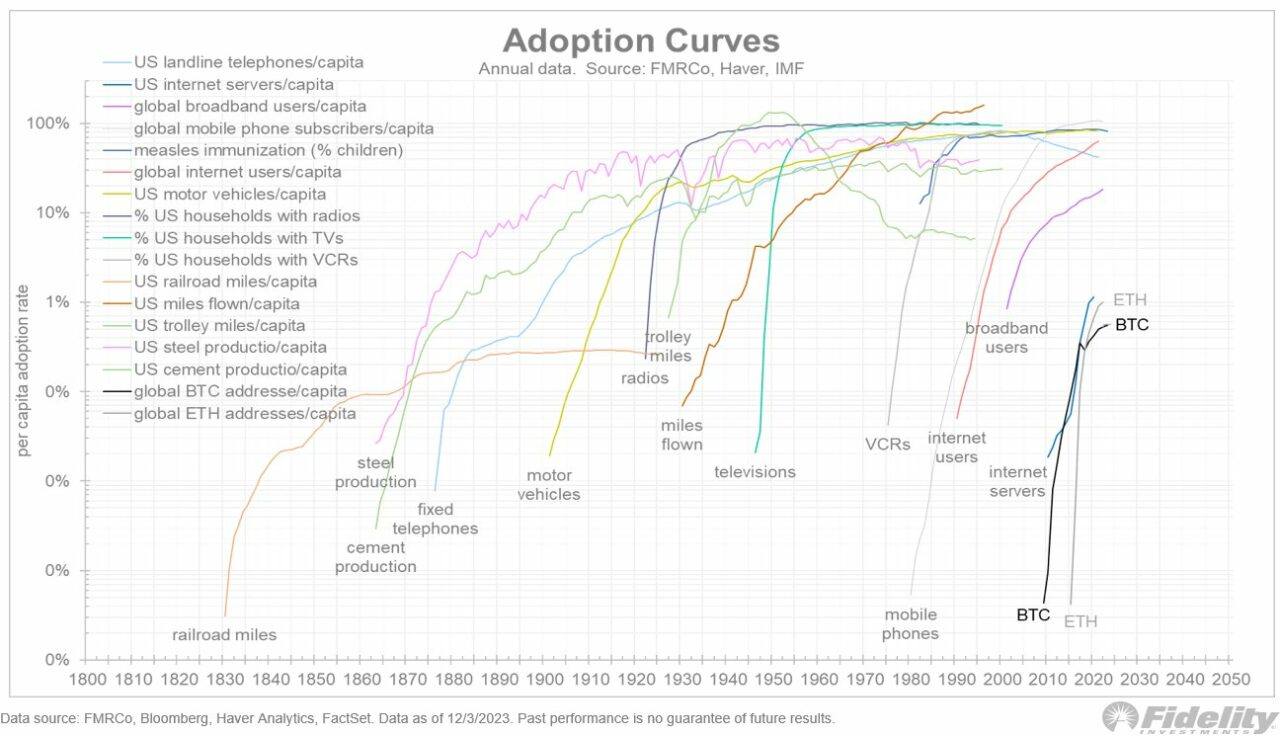

Highlighting Bitcoin’s distinct features, Timmer focuses on its fixed supply cap of 21 million coins, contrasting it with the annually growing supply of gold. This aspect elevates Bitcoin’s ‘stock-to-flow’ ratio significantly above gold’s. Furthermore, he describes Bitcoin as a network asset, having experienced exponential growth in adoption, akin to various technological innovations’ S-curve paths over centuries.

Timmer then delves into the complexities of comparing Bitcoin’s adoption curve with past S-curves, such as those of internet users and cell phone subscribers.

He points out that even minor differences in these growth curves can lead to varied outcomes for Bitcoin’s valuation.

The analysis proceeds with Timmer illustrating the significance of even the slightest slope changes from the exponential to the asymptotic phase in these curves. He highlights how different adoption models, like worldwide internet usage versus that in developed countries, can impact Bitcoin’s valuation.

<!–

–> <!–

–>

Timmer concludes his thread by pondering the maturity of Bitcoin’s network. He suggests that the SEC’s ongoing deliberations around pending product applications could potentially usher in a new wave of investors or advisors, thereby influencing Bitcoin’s position on its S-curve.

Anthony Pompliano, founder of Pomp Investments, appeared on CNBC’s “Squawk Box” on 6 December 2023, to discuss Bitcoin’s notable rally, which has propelled its value to over $43,000. Pompliano characterized Bitcoin as a “free market asset,” highlighting its forward-looking nature in the financial markets. He associated the surge in Bitcoin’s price with investor anticipation of its future value growth, driven by factors such as the prospects of a Bitcoin ETF and the fact that a significant majority, around 70%, of Bitcoin’s circulating supply hasn’t moved in the past year. This trend indicates a strong holding sentiment among investors.

Elaborating on the market dynamics, Pompliano explained that the unchanging status of 70% of Bitcoin’s supply is at an all-time high, fostering a reflexive cycle where limited selling pressure and rising prices lead to even less selling and further price hikes. This trend is fueled by both existing Bitcoin holders and new investors entering the market.

Pompliano also discussed broader economic factors affecting Bitcoin’s value, notably the Federal Reserve’s potential policy shifts. He noted the market’s expectation of interest rate cuts in 2024, a factor increasingly being incorporated into Bitcoin’s pricing. He posited that such economic shifts, alongside the anticipated need for central banks to finance debt through money printing, render assets like Bitcoin more appealing.

Addressing the global distribution of Bitcoin ownership, Pompliano distinguished between Bitcoin and its hash rate, pointing out that approximately 35% of the hash rate is based in the United States. He acknowledged the challenges in accurately determining ownership distribution due to wallet anonymity but indicated that the U.S. and Asia are substantial contributors to capital flows in the Bitcoin market.

Discussing Bitcoin’s valuation potential, Pompliano speculated that Bitcoin matching gold’s market value could lead to a Bitcoin price of $500,000. He also speculated on Bitcoin’s integration into payment systems, which could significantly enhance its market value.

[embedded content]

Featured Image via Pixabay

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cryptoglobe.com/latest/2023/12/fidelity-investments-jurrien-timmer-bitcoin-is-a-form-of-digital-gold-with-a-venture-twist/

- :has

- :is

- :not

- :where

- 000

- 2020

- 2023

- 2024

- 35%

- 360

- 7

- a

- above

- accurately

- acknowledged

- added

- Adoption

- Ads

- advisors

- affecting

- akin

- All

- alongside

- also

- america

- among

- an

- analysis

- analyzes

- and

- Annually

- Anonymity

- Anthony

- Anthony Pompliano

- Anticipated

- anticipation

- appealing

- appeared

- applications

- approximately

- ARE

- around

- AS

- asia

- aspect

- asset

- Assets

- associated

- At

- Banks

- based

- BE

- being

- between

- Big

- Bitcoin

- Bitcoin and cryptocurrency

- Bitcoin ETF

- Bitcoin market

- Bitcoin Price

- both

- broader

- but

- by

- CAN

- cap

- capital

- case

- central

- Central Banks

- centuries

- challenges

- Changes

- characteristics

- characterized

- circulating

- Coins

- comparing

- complexities

- concludes

- content

- contributors

- could

- Counterpart

- countries

- crypto

- Crypto Winter

- cryptocurrency

- CryptoGlobe

- Current

- Current state

- curve

- cuts

- cycle

- Debt

- December

- determining

- developed

- differences

- different

- Director

- discuss

- discussed

- distinct

- Distinguished

- distribution

- draws

- driven

- due

- during

- dynamics

- Economic

- effects

- elevates

- embedded

- emerging

- enhance

- entering

- ETF

- Even

- existing

- expectation

- experienced

- explained

- Exploring

- exponential

- Exponential Growth

- fact

- factor

- factors

- Features

- Federal

- Federal Reserve’s

- fidelity

- Fidelity Investments

- finance

- financial

- Fiscal

- fixed

- Flows

- focuses

- For

- formerly

- forward-looking

- fostering

- founder

- from

- fueled

- further

- Furthermore

- future

- future growth

- Global

- going

- Gold

- Growing

- Growth

- hash

- hash rate

- having

- he

- High

- highlighting

- highlights

- Hikes

- his

- holders

- holding

- How

- HTTPS

- illustrating

- image

- Impact

- in

- Incorporated

- increasingly

- indicated

- indicates

- inflation

- influencing

- integration

- interest

- INTEREST RATE

- Internet

- into

- Introduces

- Investments

- investor

- Investors

- IT

- ITS

- Jurrien Timmer

- known

- latest

- lead

- leader

- less

- like

- Limited

- Macro

- Majority

- Market

- market value

- Markets

- matching

- maturity

- max-width

- Media

- million

- minor

- models

- Monetary

- money

- money printing

- more

- moved

- Nature

- Need

- network

- New

- notable

- notably

- noted

- Notes

- noting

- of

- on

- ongoing

- or

- out

- outcomes

- over

- ownership

- Parallels

- past

- paths

- payment

- Payment Systems

- pending

- personal

- perspective

- phase

- phone

- platform

- plato

- Plato Data Intelligence

- PlatoData

- points

- policy

- Pomp

- pompliano

- position

- potential

- potentially

- predicting

- preservation

- pressure

- price

- Prices

- pricing

- printing

- proceeds

- Product

- propelled

- prospects

- proven

- Race

- rally

- Rate

- ratio

- recent

- recovery

- reflects

- render

- Rise

- rising

- s

- says

- Screen

- screens

- seen

- Selling

- sentiment

- shared

- Shifts

- significance

- significant

- significantly

- sizes

- Slope

- Social

- social media

- State

- States

- Status

- stimulus

- strong

- structural

- subscribers

- substantial

- such

- Suggests

- supply

- surge

- surpassing

- Systems

- technological

- that

- The

- their

- then

- thereby

- These

- thesis

- this

- those

- Through

- times

- to

- traditional

- trajectory

- Trend

- twist

- u.s.

- unique

- United

- United States

- Usage

- use

- users

- usher

- Valuation

- value

- varied

- various

- Versus

- via

- Wallet

- Wave

- which

- while

- winner

- Winter

- with

- worldwide

- X

- year

- youtube

- zephyrnet