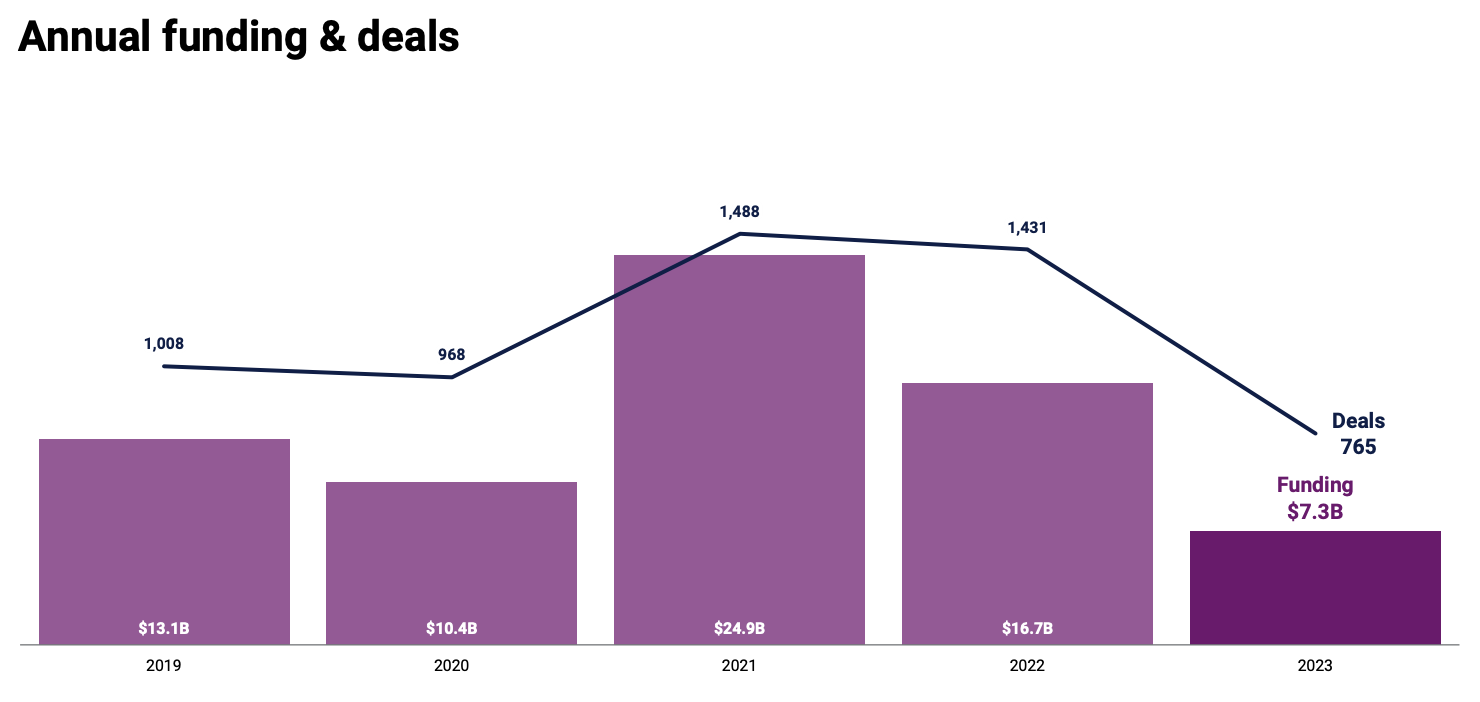

Fintech funding in Asia (including the Middle East) plunged by a significant 56% in 2023, carrying a downtrend that started the year prior, new data released by market intelligence and business analytics platform CB Insights reveal. Total fintech funding in the region reached a total of US$7.3 billion in 2023, down from US$16.7 billion in 2022 and the all-time high of US$24.9 billion secured in 2021, the data show. Deal count plunged by a similar rate, declining by 46.5% year-over-year (YoY) from 1,431 in 2022 to 765 in 2023.

Asia annual fintech funding and deals, Source: State of Fintech 2023, CB Insights, January 2024

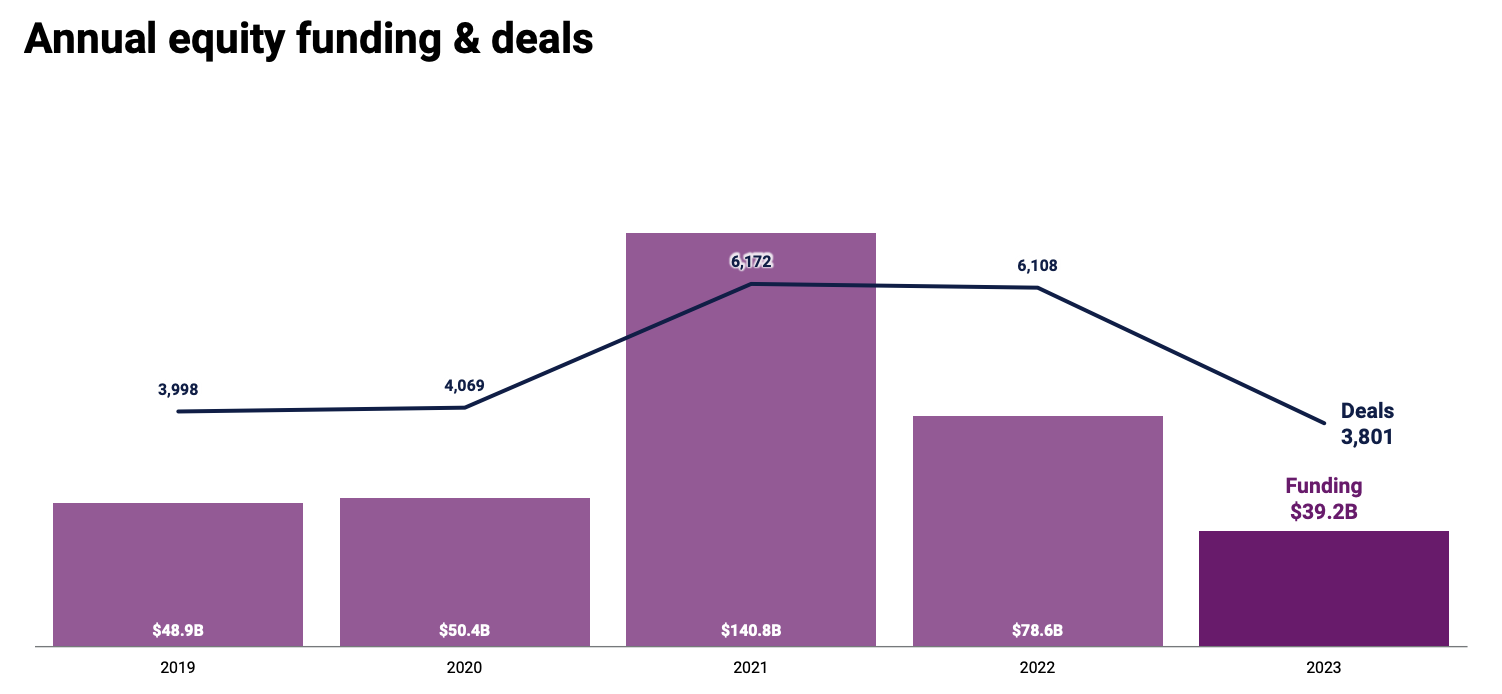

The drop marks a continued downtrend observed in the broader global fintech funding landscape in 2022 and 2023, a trend that’s been driven by economic uncertainties, soaring inflation and a looming global recession. Global fintech funding dropped by 50% in 2023, falling from US$78.6 billion in 2022 to US$39.2 billion in 2023. These figures are a far cry from the record of US$140.8 billion secured in 2021.

Global annual fintech equity funding and deals, Source: State of Fintech 2023, CB Insights, January 2024

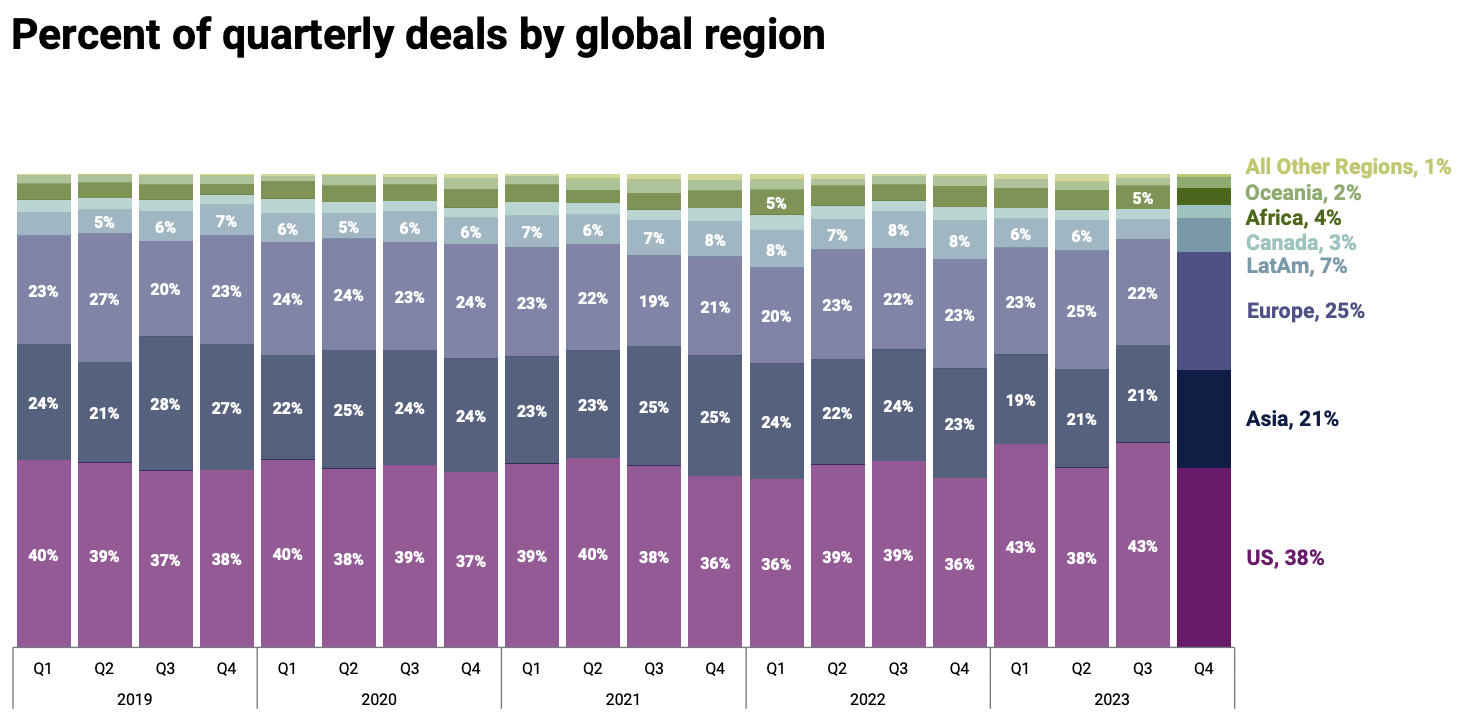

Looking at regional data, the report shows that Asia lost its position as the second largest fintech market in terms of fintech deals. With a share of about 20% of all fintech rounds, the region was surpassed by Europe which secured a 25% share in Q4 2023, and the historical leader, the US, with a 38% share.

Percent of quarterly deals by global region, Source: State of Venture 2023, CB Insights, January 2024

Despite the plunge, 2023 also recorded some positive indicators in Asia’s fintech funding landscape, including large rounds of fundraising and new unicorn minting. Out of the 14 mega-rounds secured in Q4 2023, four deals went to Asian fintech companies, totaling US$1.1 billion, the data show. The figures make Asia the second biggest recipient of mega-round funding during the quarter, behind only the US with US$1.7 billion raised through five mega-rounds.

In addition, Asia contributed half of the new eight fintech unicorns born in Q4 2023, with Tabby (Saudi Arabia), InCred (India), Andalusia Labs (United Arab Emirates (UAE)) and Tamara (Saudi Arabia) all reaching a US$1 billion+ valuation.

The report also showcases the largest fintech deals announced in Q4 2023, revealing that Indonesia, India and Singapore secured some of the largest fintech rounds of the quarter. Notable deals include Investree’s US$231 million Series D in Indonesia; InCred’s US$60 million Series D and InsuranceDekho’s US$60 million Series B, both from India; Shinhan Card’s US$60 million round in South Korea; and YouTrip’s US$50 million Series B in Singapore.

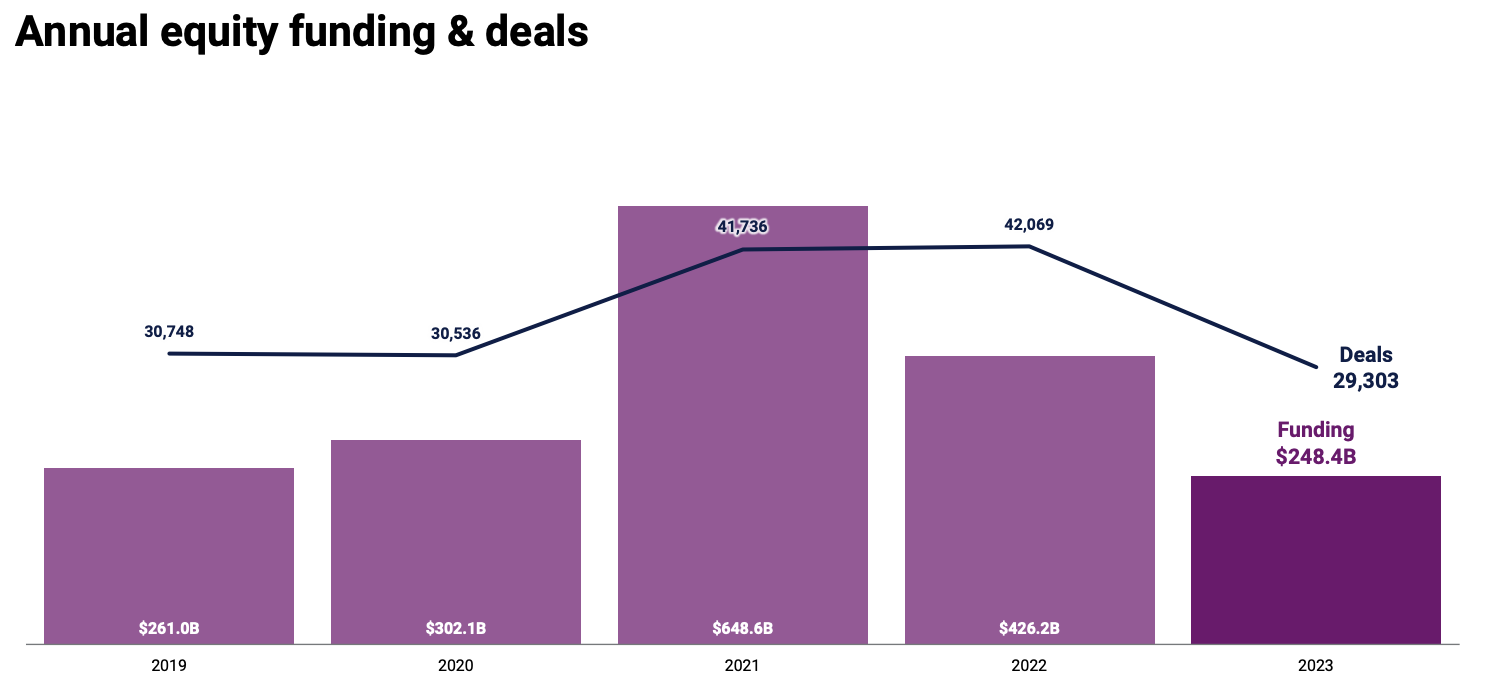

Venture funding continues to plunge

In 2023, venture funding fell to US$248.4 billion, the lowest level since 2017, data from CB Insights’ State of Venture 2023 report show. Global deal volume also tumbled 30% YoY to 29,303 in 2023, a six-year low. The declines were felt across most major global regions and sectors, though fintech and retail tech saw modest quarterly gains in funding in Q4.

Global annual equity funding and deals, Source: State of Venture 2023, CB Insights, January 2024

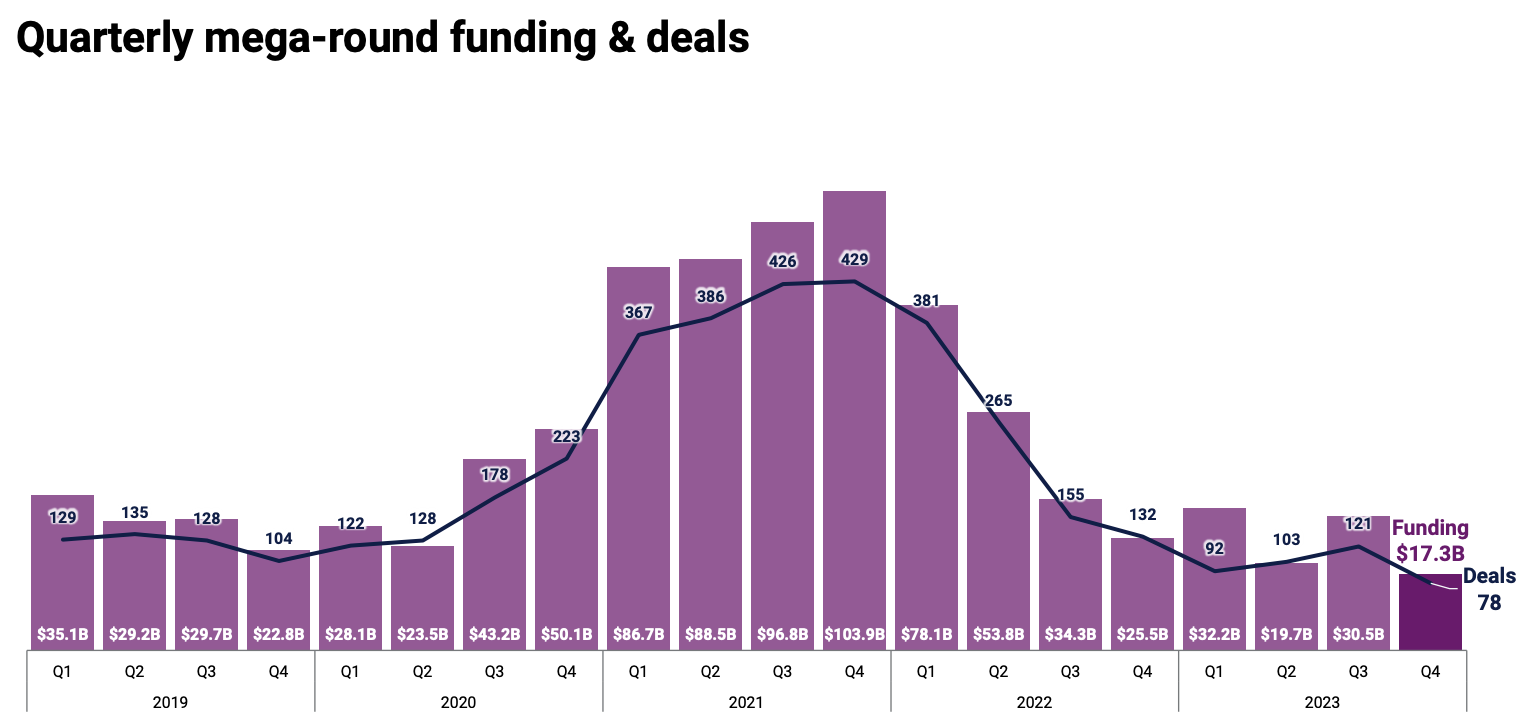

Data also reveal that investors were more selective, shying away from large, late-stage rounds. Late-stage deal size fell more than 50% between 2021 and 2023, plunging from US$50 million to US$21 million. Similarly, the number of mega-rounds in Q4 2023 fell to its lowest level since 2017, falling to just 78 deals compared to a record of 429 in Q4 2021.

Global quarterly mega-round funding and deals, Source: State of Venture 2023, CB Insights, January 2024

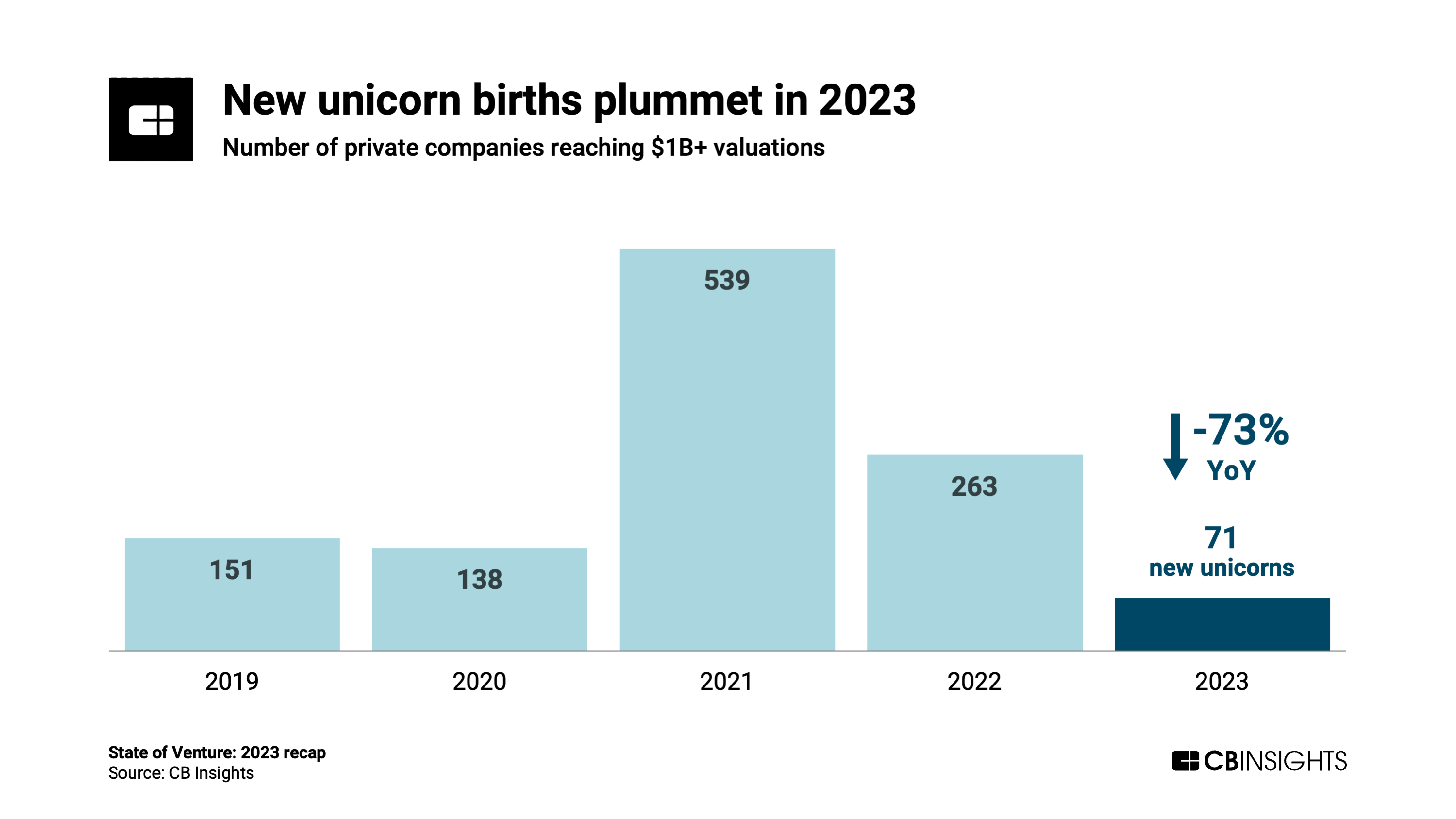

Consequently, only 71 startups reached unicorn status in 2023, a seven-year low and a staggering 73% YoY decline from 263 in 2022. The number of private companies reaching US$1 billion valuations remained in 2023 well below where it was even before the pandemic. In 2019 and 2020, 151 and 138 fintech companies reached unicorn status, respectively.

Number of private companies reaching US$1 billion+ valuations, Source: State of Venture 2023, CB Insights, January 2024

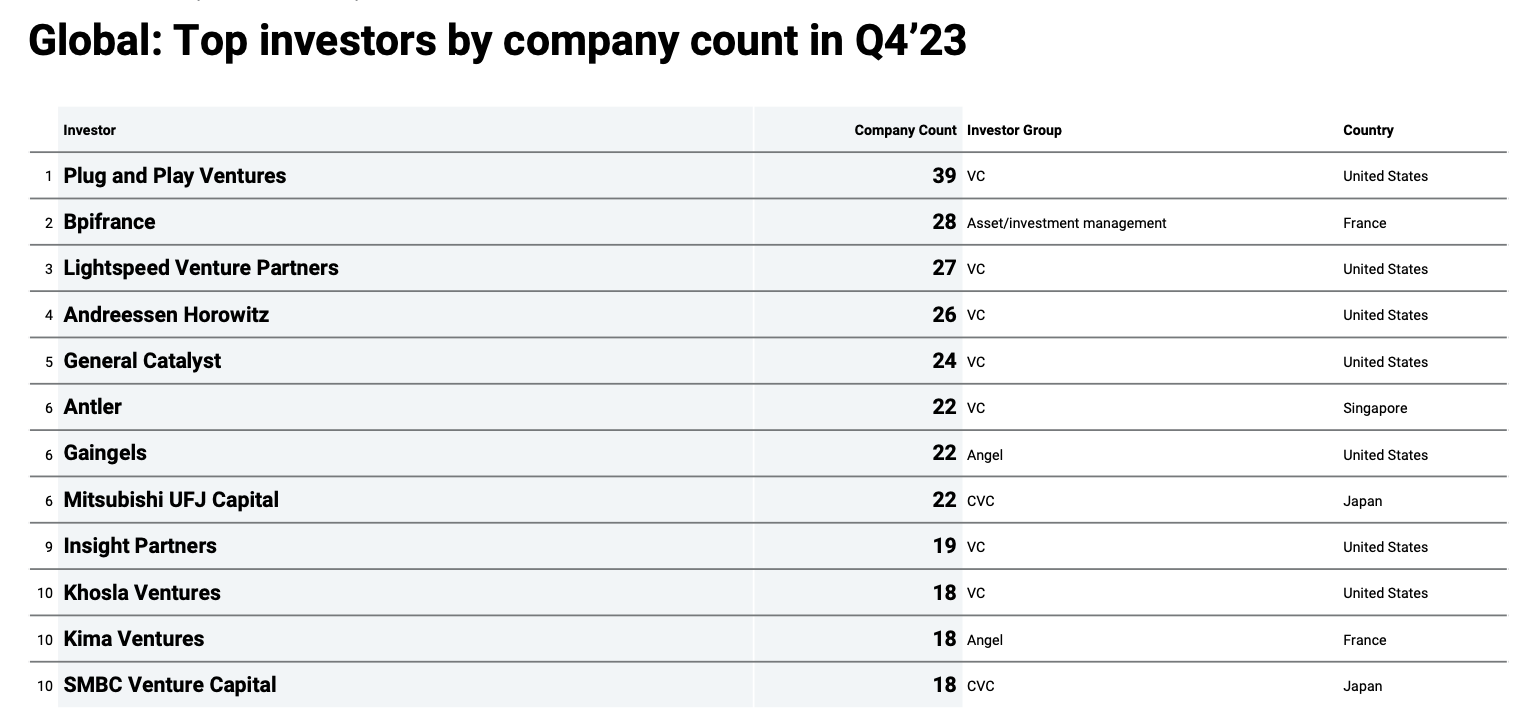

Looking at the most prolific investors in 2023, the data show that Plug and Play’s venture arm, Plug and Play Ventures, topped the list in Q4 2023, backing 39 unique companies. It was followed by France-based asset manager Bpifrance with 28, and American venture capital (VC) firms Lightspeed Venture Partners with 27 and Andreessen Horowitz with 26.

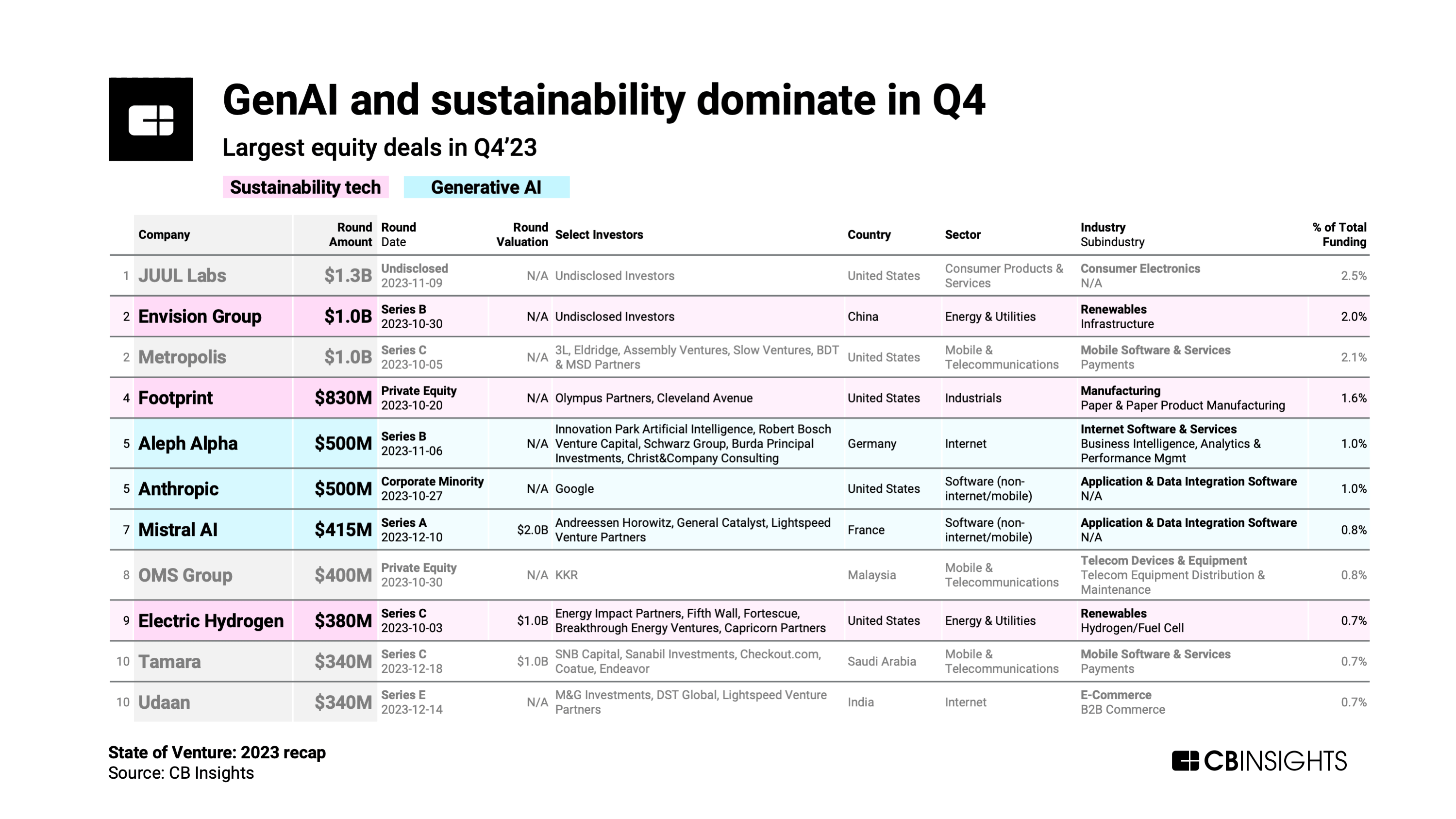

In Q4 2024, generative artificial intelligence (AI) and sustainability-focused tech were two central focus areas for venture investors, securing some of the largest equity deals of the quarter.

In generative AI, all three top deals went to large language model developers, with two of these deals, namely Aleph Alpha’s US$500 million Series B and Mistral AI’s US$415 million Series A, involving European startups building competitors to OpenAI. The third deal was American Anthropic’s US$500 million round.

In sustainability, the focus was on renewable energy with deals such as Envision Group’s US$1 billion Series B; Electric Hydrogen’s US$380 million Series C; as well as sustainable packaging like Footprint’s US$830 million equity round.

Generative AI and sustainability dominate in Q4 2023, Source: State of Venture 2023, CB Insights, January 2024

Main Picture: Source Freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/84269/funding/fintech-funding-in-asia-sees-positive-signs-despite-56-plunge/

- :where

- 1

- 14

- 15%

- 2017

- 2019

- 2020

- 2021

- 2022

- 2023

- 2024

- 250

- 26%

- 27

- 28

- 29

- 300

- 35%

- 36

- 39

- 7

- 8

- 9

- a

- About

- across

- addition

- AI

- All

- also

- American

- analytics

- and

- Andreessen

- Andreessen Horowitz

- announced

- annual

- Arab

- Arab Emirates

- ARE

- areas

- ARM

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- asia

- Asia’s

- asian

- asset

- At

- author

- away

- backing

- been

- before

- begin

- behind

- below

- between

- Biggest

- Billion

- born

- both

- broader

- Building

- business

- by

- capital

- caps

- carrying

- CB

- CB Insights

- central

- Companies

- company

- compared

- competitors

- content

- continued

- continues

- contributed

- count

- data

- deal

- Deals

- Decline

- Declines

- Declining

- Despite

- developers

- Dominate

- down

- downtrend

- driven

- Drop

- dropped

- during

- East

- Economic

- eight

- Electric

- emirates

- end

- energy

- envision

- equity

- Europe

- European

- Even

- Falling

- far

- Far Cry

- felt

- Figures

- fintech

- Fintech Companies

- Fintech Funding

- Fintech News

- firms

- five

- Focus

- followed

- For

- form

- four

- from

- funding

- Fundraising

- Gains

- generative

- Generative AI

- Global

- global recession

- Group’s

- Half

- High

- historical

- Horowitz

- hottest

- HTTPS

- in

- include

- Including

- india

- Indicators

- Indonesia

- inflation

- insights

- Intelligence

- Investors

- involving

- IT

- ITS

- January

- jpg

- just

- korea

- Labs

- landscape

- language

- large

- largest

- leader

- Level

- lightspeed

- like

- List

- looming

- lost

- Low

- lowest

- lowest level

- mailchimp

- major

- make

- manager

- Market

- max-width

- Middle

- Middle East

- million

- minting

- model

- modest

- Month

- more

- most

- namely

- New

- news

- notable

- number

- of

- on

- once

- only

- OpenAI

- out

- packaging

- pandemic

- partners

- percent

- picture

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Play

- plug

- plug and play

- plunge

- plunged

- plunging

- position

- positive

- Posts

- Prior

- private

- Private Companies

- prolific

- Quarter

- quarterly

- raised

- Rate

- reached

- reaching

- recession

- record

- recorded

- region

- regional

- regions

- released

- remained

- Renewable

- renewable energy

- report

- respectively

- retail

- reveal

- revealing

- round

- rounds

- Saudi

- Saudi Arabia

- saw

- Second

- Sectors

- Secured

- securing

- sees

- selective

- Series

- Series A

- Series B

- Series C

- Share

- show

- Shows

- significant

- Signs

- similar

- Similarly

- since

- Singapore

- Size

- soaring

- some

- Source

- South

- South Korea

- staggering

- started

- Startups

- State

- Status

- such

- surpassed

- Sustainability

- sustainable

- tabby

- tamara

- tech

- terms

- than

- that

- The

- These

- Third

- though?

- three

- Through

- to

- top

- topped

- Total

- totaling

- Trend

- two

- UAE

- uncertainties

- unicorn

- unicorn status

- unicorns

- unique

- United

- United Arab

- United Arab Emirates

- us

- Valuation

- Valuations

- VC

- venture

- venture capital

- venture capital (VC)

- venture-funding

- Ventures

- volume

- was

- WELL

- went

- were

- which

- with

- year

- Your

- zephyrnet