Stake it till you make it

Earning an income from the assets you already hold has become a core part of the global economy. Think about Airbnb, they are the largest hotel room supplier on earth and they don’t actually own a single hotel or room. They simply built a platform that allowed people with excess space (an asset) to leverage that for a profit. Of course, they take their percentage. The same is occurring with cars, bikes, and other valuable assets.

Your crypto tokens are an asset. They represent a monetary value. Albeit a changing one, but still, represent value. They are an asset that using the right platforms owners can leverage. Especially if they have no intention of selling and look at them as long-term investments. Importantly, the term ‘long-term’ in crypto can mean as little as 90 days. But overall this article will appeal to those people that want to hold their tokens and are not looking for a quick flip opportunity. Additionally, we will look at stablecoin staking which is arguably the least risk-averse way to participate in decentralized finance and passive income generation.

For the purposes of this article, we will look at the options available through one of the most widely used platforms – Crypto.com. Founded in 2016, Crypto.com today serves over 10 million customers with the world’s fastest-growing crypto app, along with the Crypto.com Visa Card — the world’s largest crypto card program — the Crypto.com Exchange and Crypto.com DeFi Wallet. Whilst the Recently launched, Crypto.com NFT marketplace is a platform for collecting and trading NFTs. We will imagine you already have an account with the platform and that you have not yet explored the crypto staking options available due to fear or misunderstanding of their purpose.

Firstly, we are going to be looking at earning a passive income. This requires that you hold a certain token first, in order to then stake that. For example ETH, BTC, MATIC, etc. By letting the platform use your asset for liquidity purposes over set amounts of time they will reward you. This is how you can earn a passive income.

See your tokens, NFTs and DeFi positions across different blockchains, all in one place. Connect your Web3 wallet and check out your portfolio!

Importantly in all options given the reward is paid in the corresponding token. I.e stake BTC, get BTC, stake TETHER, get TETHER, and so on. These rewarded tokens can then be sold, traded, or transferred as you wish. So the nasty rumor that you can’t then release the rewards as spendable money is frankly incorrect.

If you don’t have a Crypto.com account but would like to make one before proceeding with this information head to the app store on your iOS or Android mobile device and simply download the app. You will need to go through the KYC processes and become accepted which can take a few days. But as long as you are not an international fugitive wanted on charges of war crimes – you should be fine. Bookmark this page and come back later!

Buying Tokens With High Percentage Rewards

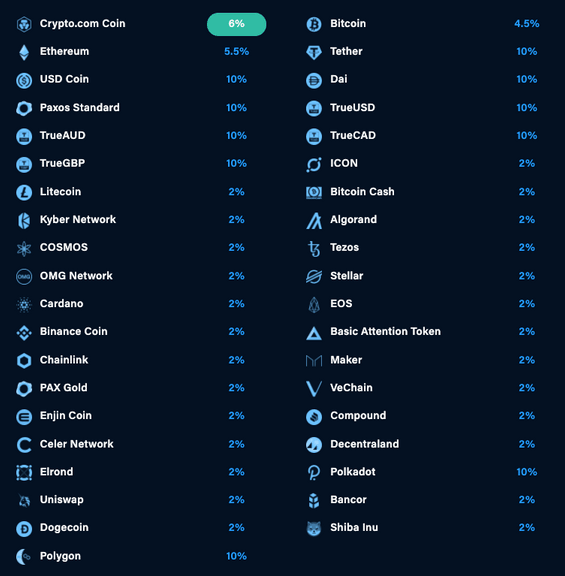

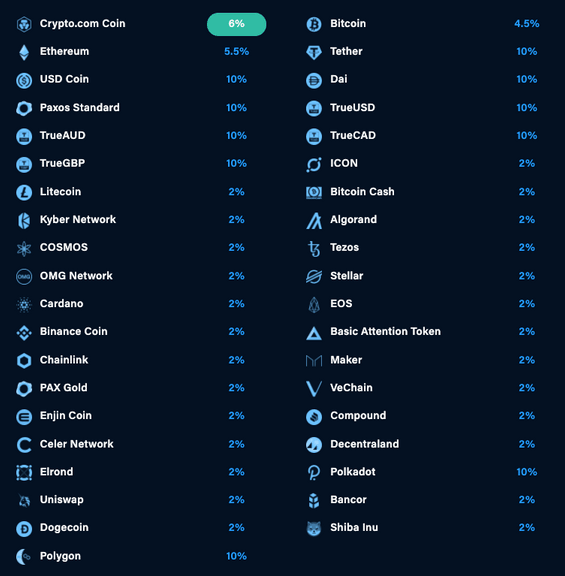

Firstly, as mentioned you need to acquire some tokens within the platform. A smart strategy here would be to go for the tokens that the platform offers the highest returns on. Luckily for us, Crypto.com is efficient and provides all the percentages in an easy-to-view way. Vitally, the percentages given here are achievable only after first staking the platform’s native token CRO up to a value of $400.

But don’t worry, you’re not chucking that $400 into the wind. In return for staking $400 worth of CRO, you will receive a metal Crypto.com debit card that can be topped up with fiat currencies and used to pay for goods and services. With the added bonus of 2% cashback in CRO on all purchases and $14.99 towards either a Spotify or Netflix subscription. This in itself can provide a nice passive income as the price of CRO fluctuates. One day the 2% reward could be worth $1, the next it can be worth $5.

Interestingly you will see the majority of the highest returns on crypto-assets known as stablecoins. Such as USDC, Paxos standard, and Tether. This is great for risk-averse investors. A stable coin is a token that is pegged to an existing monetary asset such as the US Dollar or British Pound. As such the volatility of the token matches that of the underlying currency. Which as we know fluctuates by small degrees rather than huge leaps as can occur with cryptocurrencies. Additionally, you may have also noticed some high returns for tokens such as Polygon and Polkadot.

If you have a medium appetite for risk then one way to go about business would be to choose four high-interest-bearing tokens. Two stable coins and two standard coins. Obviously, you can change the weighting and this is just for explainer purposes. Let’s take Tether and Dai at 10% and then Polygon at 10% and Ethereum at 5.5%. Let’s imagine we are playing with a $20,000 investment pot. First, I will minus the needed CRO stake so we are now down to $19,600.

The division of the assets is entirely your choice but again for explainer purposes, I will decide here what I would do in this scenario. It is also important to understand that two of these four tokens are subject to the normal volatility of crypto, which therefore affects the rewards. Whilst the other two can be expected to perform consistently.

TETHER – $10,000

DAI – $5,000

ETHEREUM – $1,600

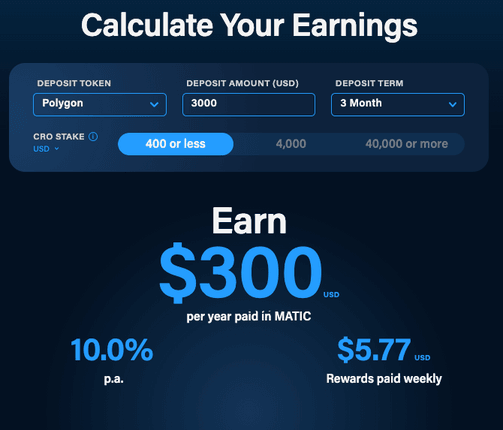

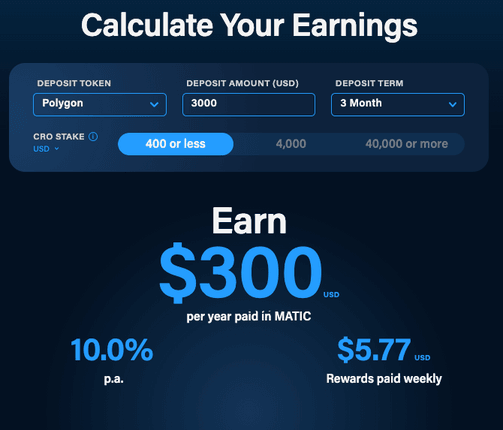

POLYGON – $3,000

I divided the pot according to my appetite for risk. Now it’s time to see what I could be collecting should I choose to put these assets into 90 days of fixed staking, four times in one year. So effectively we are staking for a year to achieve the stated APY. Vitally, fixed staking means you cannot remove your tokens until the stake has ended. Even if the entire crypto industry goes down the toilet – your tokens are trapped. So timing is everything in my humble opinion. Starting a stake at the beginning of a bull run for example would be the perfect scenario.

Ethereum

Based on the token price of Ethereum today a $1,600 investment would yield me a profit of $88 after one year. You might be thinking – chump change. But I beg you to investigate what percentage you would get from your local bank where you probably can’t earn that much interest in one year on $50,000 in savings.

Polygon (Formally MATIC)

Based on the token price of Polygon today a $3,000 investment would yield me a profit of $300 after 1 year.

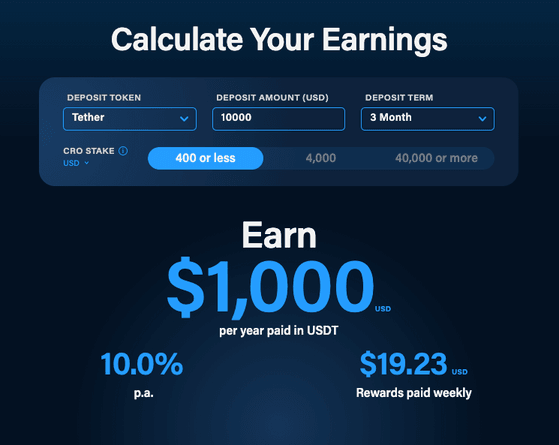

Tether

Based on the token price of Tether which is pegged to the US dollar a $10,000 investment would yield me a profit of $1000 after 1 year.

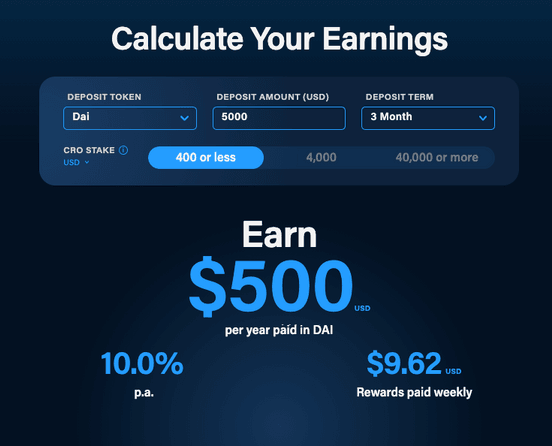

DAI

Based on the token price of DAI which is pegged to the US dollar a $5,000 investment would yield me a profit of $500 after 1 year.

100% Stable

Now let’s look at our theoretical portfolio 12-months down the line. From an original $19,600 invested a further $1,888 is now added. Taking the total after just months to $21,488. Quite impressive for doing very little, I think you will agree.

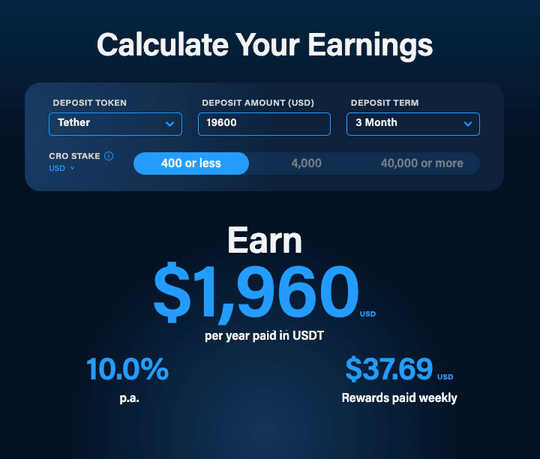

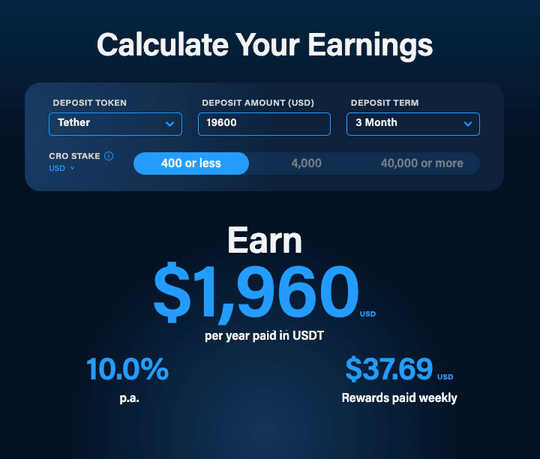

Obviously, this is just theoretical and to explain one more possibility we can look at the idea of staking all $19,600 into just the Tether stablecoin.

This approach would yield a profit of $1,960 after one year. Just marginally higher, but much less risky than the other idea presented using four tokens.

Interested yet?

The easiest way to think about all this for those quite new to the space is just to think of the Tether token, for example, as your money that’s currently in the bank. Potentially you are hoarding money in fiat currency in a bank and receiving very little in the way of rewards for that. Additionally, post-pandemic we are likely to see interest rates cut further globally to ease the damage done by massive government borrowing, which is ultimately to fight inflation.

Taking your saved dollars, yen, pounds, etc, and turning them to Tether for example, then staking at 10% seems a very logical thing to do in the mind of this writer. Of course, the underlying peg could fail, but it’s unlikely in the immediate future and without prior notice.

How to stake

The act of actually placing your tokens into a staking situation couldn’t be easier and involves just a few clicks and a long-term investment mentality. Below is how to navigate through the Crypto.com application to find and activate staking.

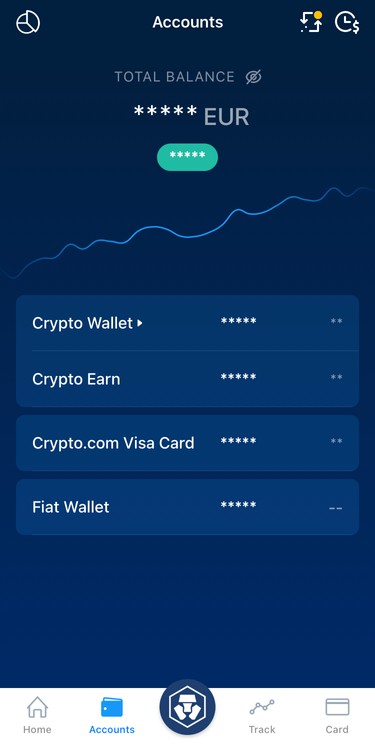

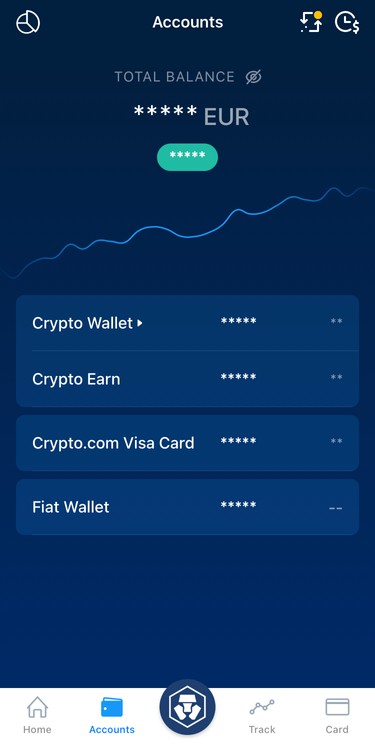

Firstly from your accounts homepage head to the bottom and find the Crypto Earn tab.

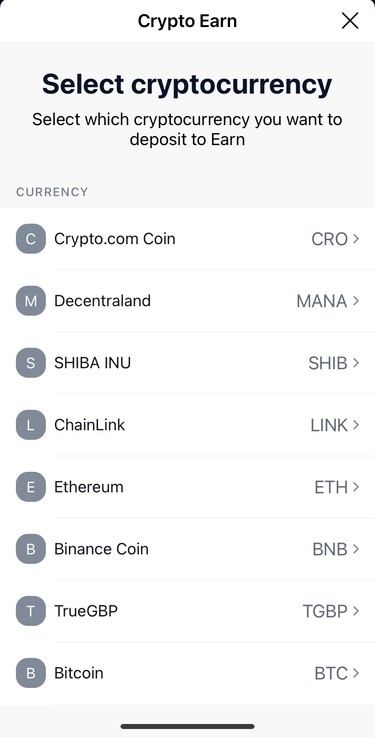

Click on that tab and then on the next page that opens look for the plus logo in the top right corner. You will then be presented with a list of tokens you are able to stake.

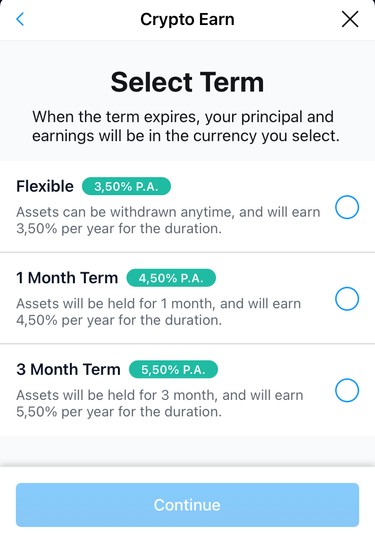

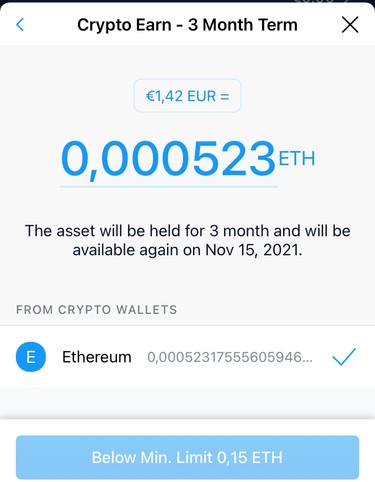

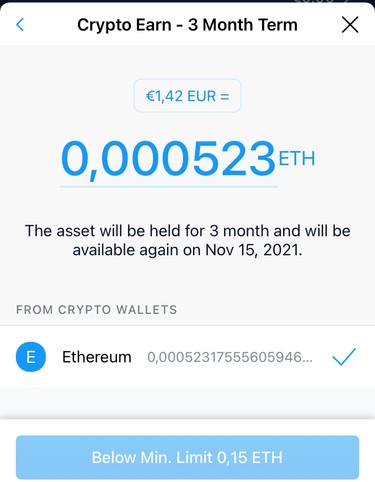

Choose the token you wish to stake and then select the time frame. You will now see the different options and percentages given for different lock-up time frames. To replicate what we did above – choose 3 months. Accept all the terms and conditions and proceed.

Now it’s time to allocate an amount. Note the minimum amounts required are stated at the bottom of the page in the blue box. Importantly you cannot ‘top up’ stakes with the Crypto.com platform yet. So allocate the amount you wish to stake from the start.

That’s it. You are now staking your crypto with Crypto.com and once a week you will receive the token rewards to your account. What you do with those rewards is entirely up to you. One strategy is to use them to purchase more tokens of interest and expand your portfolio without spending any more money.

In summary

Staking has become the new way to save and earn. The real issues with why people perhaps are not rushing to this new service are trust and understanding. Trust that their savings are safe and an understanding of what staking actually is and entails.

Indeed, holding cryptocurrencies in exchanges rather than a blockchain wallet puts them at risk if the platform is hacked. But, in reality, this is quite unlikely to happen with a platform as established and robust as Crypto.com. But, of course, it could happen. In the same way, hackers could break into your normal bank and drain all the funds. Overall, people would do well to remember the industry is now over ten years deep and that hacks and exploits are generally affecting fully decentralized services. Plus, there are countless other platforms on which to stake crypto, all offering different levels of safety, yield, and user experience.

Moreover, there has been a rush of new blood into the space over the last 12 months that has not only put crypto on the radar of average joes but also perhaps the people you would never expect to be involved. More people than ever are holding crypto. Now it’s time to put it to work.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research. The writer holds positions in ETH, BTC, ADA, NIOX, AGIX, MATIC, MANA, SAFEMOON, SDAO, CAKE, HEX, LINK, GRT, CRO, SHIBA INU, AND OCEAN.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet