Despite a global downturn in fintech investments, Singapore’s fintech sector has experienced a significant surge in funding for artificial intelligence (AI) technologies.

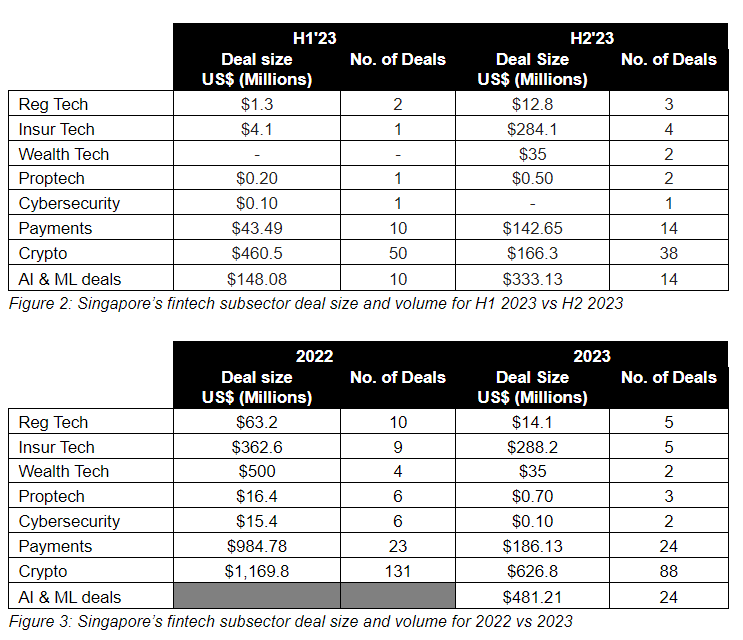

According to the KPMG Pulse of Fintech H2’23 report, AI fintech funding in Singapore soared to US$333.13 million in the second half of 2023.

This represents a 77 percent increase from the US$148.08 million recorded in the first half, culminating in a total investment of US$481.21 million across 24 deals for the year.

The boom in AI funding has enabled companies to rapidly innovate and launch AI-driven products, securing a competitive edge in the market.

Singapore Dominates APAC Fintech Space

Despite the global downturn in fintech investments, Singapore’s fintech sector had showed remarkable resilience, according to KPMG Pulse of Fintech H2’23 report.

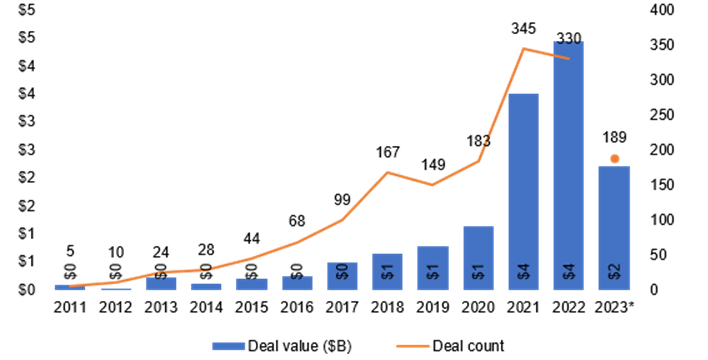

In 2023, Singapore’s fintech sector raised a total of US$2.20 billion through mergers & acquisitions (M&A), private equity (PE), and venture capital (VC) deals.

This marks a 68 percent decrease from the US$4.4 billion raised in 2022. Deal activity significantly declined, with the number of deals halving to 189 from the previous year.

Year-on year (2011 – 2023) fintech VC, PE, and M&A activity in Singapore in US dollars (billion)

The slowdown was especially pronounced in the second half of the year, with funding falling by 64 percent, from US$1,455 million across 102 deals to US$747 million across 87 deals.

This downturn reflects the slowest performance for fintech funding since the Covid-19 year of 2020.

Investor sentiment was affected by geopolitical conflicts, high interest rates, and a lackluster exit environment, leading to increased scrutiny on potential deals with a focus on profitability.

Despite the global challenges, Singapore has solidified its status as a leading fintech hub in the Asia Pacific, capturing 21% of all fintech deals in the region in 2023.

The resilience of Singapore’s fintech sector is further highlighted by significant deals, such as a venture capital investment in digital bank AnextBank, which topped the list by raising US$359 million.

Measured Approach to Fostering the Crypto Space

Despite a broader investment slowdown, Singapore’s commitment to nurturing the crypto/blockchain space remained steadfast in H2’23.

New regulations were introduced to safeguard customer assets and finaliSe the regulatory framework for stablecoins, with Paxos and StraitsX receiving approvals to issue regulated USD and SGD stablecoins.

This careful regulatory approach underscores Singapore’s dedication to balancing innovation with consumer protection in the evolving crypto landscape.

Notable Growth and Strategic Shifts in Insurtech and Payments

The insurtech sector in Singapore experienced a remarkable investment surge in the second half of 2023, with a 194 percent increase to US$284.1 million from just US$4.1 million in the first half.

This growth was led by a significant early-stage VC round for Bolttech, totaling US$246 million. The sector has shifted its focus towards the SME market, addressing specific challenges within the insurance value chain.

Although the payments sector saw a considerable drop in annual investment to US$186.13 million in 2023 from US$984.78 million in 2022, it maintained a stable deal volume, indicating ongoing interest and the critical role of this sector within the fintech ecosystem.

Caution in Fintech Investments Through Early 2024

The report suggests that global fintech investment is expected to remain soft into the first half of 2024, due to ongoing global conflicts and high interest rates.

However, as conditions begin to stabilise, investments in AI and B2B solutions are likely to pick up, with M&A activity potentially rebounding as investors look toward distressed assets.

Anton Ruddenklau

“The fintech market floundered somewhat in 2023, buffeted by many of the same issues challenging the broader investment climate. While there were still good deals to be had, investors were definitely sharpening their pencils—enhancing their focus on profitability.

While it was a depressed year for the fintech market overall, there were a few particularly bright lights. Proptech, ESG fintech, and investors embraced AI-focused fintechs—which helped particularly in the last six months.”

said Anton Ruddenklau, Global Head Fintech and Innovation, Financial Services, KPMG International.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/84690/funding/kpmg-singapore-ai-fintech-funding-up-77-defies-global-slump-in-h2-2023/

- :has

- :is

- $UP

- 08

- 1

- 13

- 150

- 16

- 20

- 2011

- 2020

- 2022

- 2023

- 2024

- 24

- 250

- 300

- 360

- 7

- 77

- 87

- a

- According

- acquisitions

- across

- activity

- addressing

- affected

- AI

- All

- and

- annual

- APAC

- approach

- ARE

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- asia

- asia pacific

- Assets

- author

- B2B

- balancing

- Bank

- BE

- begin

- Billion

- boom

- Bright

- broader

- by

- capital

- caps

- Capturing

- careful

- chain

- challenges

- challenging

- Climate

- commitment

- Companies

- competitive

- conditions

- conflicts

- considerable

- consumer

- Consumer Protection

- content

- COVID-19

- critical

- crypto

- crypto landscape

- culminating

- customer

- deal

- Deals

- decrease

- dedication

- definitely

- digital

- digital bank

- distressed

- dollars

- dominates

- DOWNTURN

- Drop

- due

- Early

- early stage

- ecosystem

- Edge

- embraced

- enabled

- end

- Environment

- equity

- ESG

- especially

- evolving

- Exit

- expected

- experienced

- Falling

- few

- financial

- financial services

- fintech

- Fintech Funding

- FinTech investment

- Fintech News

- First

- Focus

- For

- form

- fostering

- Framework

- from

- funding

- further

- geopolitical

- Global

- good

- Growth

- had

- Half

- Halving

- head

- helped

- High

- Highlighted

- hottest

- HTTPS

- Hub

- in

- Increase

- increased

- innovate

- Innovation

- insurance

- Insurtech

- Intelligence

- interest

- Interest Rates

- International

- into

- introduced

- investment

- Investments

- Investors

- issue

- issues

- IT

- ITS

- jpg

- just

- KPMG

- Lackluster

- landscape

- Last

- launch

- leading

- Led

- likely

- List

- Look

- M&A

- mailchimp

- maintained

- many

- Market

- max-width

- mergers

- Mergers & Acquisitions

- million

- Month

- months

- news

- number

- nurturing

- of

- on

- once

- ongoing

- overall

- P&E

- Pacific

- particularly

- Paxos

- payments

- percent

- performance

- pick

- plato

- Plato Data Intelligence

- PlatoData

- Posts

- potential

- potentially

- previous

- private

- Private Equity

- Products

- profitability

- pronounced

- PropTech

- protection

- pulse

- raised

- raising

- rapidly

- Rates

- receiving

- recorded

- reflects

- region

- regulated

- regulations

- regulatory

- remain

- remained

- remarkable

- report

- represents

- resilience

- Role

- round

- safeguard

- same

- saw

- scrutiny

- Second

- sector

- securing

- sentiment

- Services

- SGD

- shifted

- Shifts

- showed

- significant

- significantly

- since

- Singapore

- Singapore’s

- SIX

- Six months

- Slowdown

- Slump

- SME

- soared

- Soft

- Solutions

- somewhat

- Space

- specific

- stable

- Stablecoins

- Status

- steadfast

- Still

- StraitsX

- Strategic

- such

- Suggests

- surge

- Technologies

- that

- The

- their

- There.

- this

- Through

- to

- topped

- Total

- totaling

- toward

- towards

- underscores

- us

- US Dollars

- USD

- value

- VC

- venture

- venture capital

- venture capital (VC)

- volume

- was

- were

- which

- while

- with

- within

- year

- Your

- zephyrnet