In Asia, the wealth of affluent and mass-affluent customer segments is growing rapidly, bringing about new opportunities and growth prospects for banks and wealth managers alike in the region.

But to tap into this opportunity, services providers will need to embrace technology and digital platforms to not only provide customers the services they expect, but also gain in productivity and efficiency, a new report by global consultancy McKinsey says.

The report, titled Digital and AI-enabled wealth management: the big potential in Asia and released on February 02, looks at the region’s fast growing household wealth and shares how wealth managers can capture this opportunity by embracing data analytics and artificial intelligence (AI) to reduce costs, increase access for their clients and improve customer experience across the entire lifecycle.

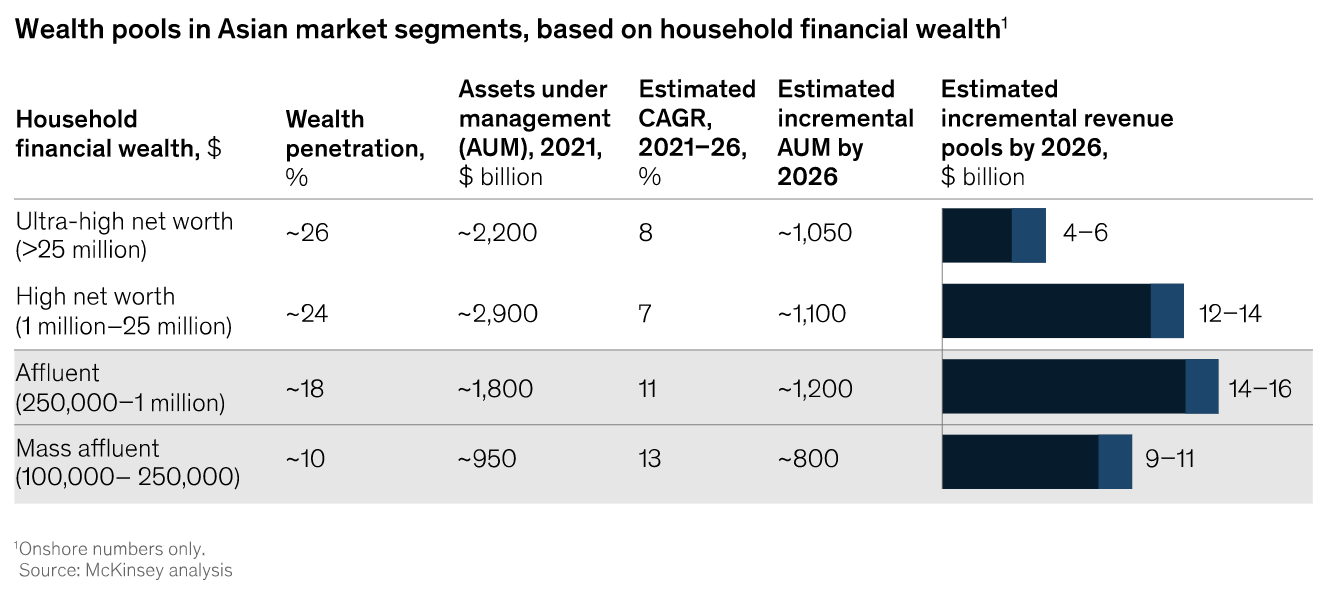

In 2021, the wealth pool of households with investable assets of US$100,000 to US$1 million in Asia totaled US$2.7 trillion. That sum is projected to soar to US$4.7 trillion by 2026 as incomes continue to rise across the region, the report says.

These figures imply a potential incremental revenue of US$20 billion to US$25 billion for banks and wealth managers making this market a significant opportunity in financial services.

Wealth pools in Asian market segments, based on household financial wealth, Source: McKinsey, Feb 2023

To capture this, banks and wealth managers must embrace technology, it says, and adopt what the consultancy refers to as an “AI-led full-stack approach”.

AI-led wealth management

This approach, the report says, focuses on leveraging data analytics and AI to improve efficiency, access critical insights, and offer superior customer experience. It’s articulated around four pillars: analytics-driven customer segmentation, impactful digital engagement, AI-powered decision making and core technology as well as the right operating model and talent.

Analytics-driven customer segmentation refers to the use of data to make customer segmentation more granular. The end goal here is to provide personalized recommendations based on one’s specific needs, attitude toward risk, preference for digital versus face-to-face engagement, desire for advice or planning services, and many other variables, rather than solely focus on traditional metrics such as portfolio size and income level, the report says.

Banks and wealth managers should also seek to strike a balance between personal interactions and digital interactions, it warns and stresses that innovative user-interface solutions can significantly help improve both customer experience and internal productivity.

Technology like AI and data analytics can be used to enhance digital interactions via mobile platforms by enabling for instance 24/7 decision support, financial health checks, budgeting tools and gamification, it says.

Along the same veins, apps can be elevated with features like analytics-driven investment recommendations, risk optimization, personalized portfolio rebalancing and other portfolio management functionalities to improve customer experience.

For banks and wealth managers, AI and digital tools can help them tailor offerings to specific customer needs, whether that’s savings, investment or insurance advisory, expense or debt management, or tax-loss harvesting. They can also improve productivity, enable end-to-end client servicing, and allow the bank or wealth manager to aggregate all client data into a “single source of truth,” the report says.

But for banks and wealth managers to fully tap into the potential of AI-led digital wealth management, these providers will need to adopt the right core technology and data layers, McKinsey warns. This might mean outsourcing some of their services, or moving onto a cloud-based platform that supports real-time analytics across multiple data sets and service providers.

Untapped opportunities

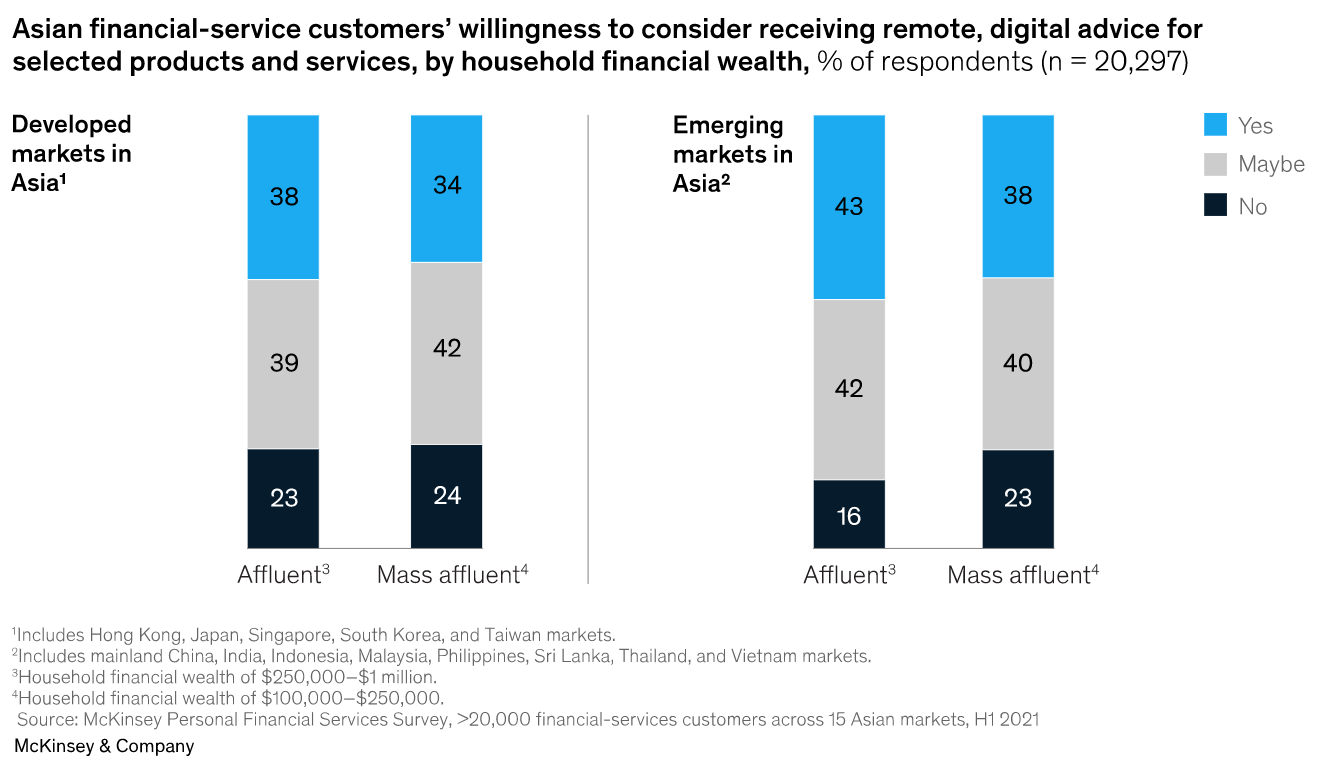

In Asia, the digital wealth management opportunity is further evidenced by a clear interest from consumers in these new tech-enabled products.

In McKinsey’s 2021 Personal Financial Services Survey, approximately 80% of affluent and mass-affluent respondents in Asia said they would or might consider receiving advisory services remotely through digital channels.

Asian financial service customers’ willingness to consider receiving remote, digital advice for selected products and services, by household financial wealth, Source: McKinsey, Feb 2023

But despite an evident willingness to use digital wealth management services, the market remains largely underserved and existing products are failing to impress.

A 2021 report by KPMG, which looked at the state of digital wealth management in Asia Pacific (APAC), found that, overall, digital offerings were not meeting client expectations, owing to limited online services and lack of customization and self-service functionality.

Going even further, a 2022 study conducted by Accenture found that even though most investors were happy with the returns they achieved in 2021, roughly 30% of the investors surveyed planned to leave their current wealth management provider in 2022.

Featured image credit: Freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://fintechnews.sg/69804/wealthtech/mckinsey-asias-booming-affluent-segments-introduce-new-opportunities-in-digital-wealth/

- 000

- 2021

- 2022

- 2023

- 7

- a

- About

- Accenture

- access

- achieved

- across

- adopt

- advice

- advisory

- advisory services

- AI

- AI-powered

- All

- analytics

- and

- APAC

- approach

- approximately

- apps

- around

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- asia

- asia pacific

- Asia Pacific (APAC)

- Asia’s

- asian

- Assets

- attitude

- Balance

- Bank

- Banks

- based

- between

- Big

- Billion

- Bringing

- budgeting

- caps

- capture

- channels

- Checks

- clear

- client

- clients

- Consider

- consultancy

- Consumers

- continue

- Core

- Costs

- credit

- critical

- Current

- customer

- customer experience

- Customers

- customization

- data

- Data Analytics

- data sets

- Debt

- decision

- Decision Making

- Despite

- digital

- digital wealth management

- efficiency

- elevated

- embrace

- embracing

- enable

- enabling

- end-to-end

- engagement

- Entire

- Even

- existing

- expect

- expectations

- experience

- FAST

- Features

- February

- Figures

- financial

- financial service

- financial services

- Focus

- focuses

- found

- friendly

- from

- fully

- functionalities

- functionality

- further

- Gain

- gamification

- Global

- goal

- Growing

- Growth

- happy

- Harvesting

- Health

- help

- here

- household

- households

- How

- HTTPS

- image

- impactful

- improve

- in

- Income

- Increase

- innovative

- insights

- instance

- insurance

- Intelligence

- interactions

- interest

- internal

- introduce

- investment

- Investors

- IT

- KPMG

- Lack

- largely

- layers

- Leave

- Level

- leveraging

- Limited

- looked

- LOOKS

- make

- Making

- management

- manager

- Managers

- many

- Market

- max-width

- McKinsey

- meeting

- Metrics

- might

- million

- Mobile

- model

- more

- most

- moving

- multiple

- Need

- needs

- New

- offer

- Offerings

- online

- operating

- opportunities

- Opportunity

- optimization

- Other

- Outsourcing

- overall

- Pacific

- personal

- Personalized

- planned

- planning

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- pool

- Pools

- portfolio

- portfolio management

- potential

- productivity

- Products

- projected

- prospects

- provide

- provider

- providers

- rapidly

- real-time

- rebalancing

- receiving

- recommendations

- reduce

- refers

- region

- remains

- remote

- report

- return

- returns

- revenue

- Rise

- Risk

- roughly

- Said

- same

- Savings

- says

- Seek

- segmentation

- segments

- selected

- Self-service

- service

- service providers

- Services

- Sets

- Shares

- should

- significant

- significantly

- Size

- Solutions

- some

- Source

- specific

- State

- strike

- Study

- such

- superior

- support

- Supports

- Survey

- surveyed

- Talent

- Tap

- tech-enabled

- Technology

- The

- The State

- their

- Through

- titled

- to

- tools

- toward

- traditional

- Trillion

- underserved

- use

- Versus

- via

- Warns

- Wealth

- wealth management

- What

- whether

- which

- will

- Willingness

- would

- zephyrnet