I spent last evening listening to an event on Twitter featuring Bitcoiners from all over the world speaking with one another in quite a conversational way. It was my plan to sit down and spend the time writing out some thoughts on geopolitics, as the Russian declaration that it was moving away from the US Dollar made its ripples in recently-sideways crypto markets. Like the rest of the longs, I’ve been patiently waiting for this consolidation period to end so that a return to the dopamine rush of endless new all-time highs can occur. Fortunately for us, it’s entirely possible that the Russian declaration will soon be overshadowed by another commonly expected phenomenon: nation-state BTC FOMO.

The original article was going to do a bit of a dive into some unfortunate events around inflation and the possible decline of the US Dollar as the world’s reserve currency that have been going on. Twitter’s Spaces feature has launched and derailed this plan by providing a very simple solution: cryptocurrency.

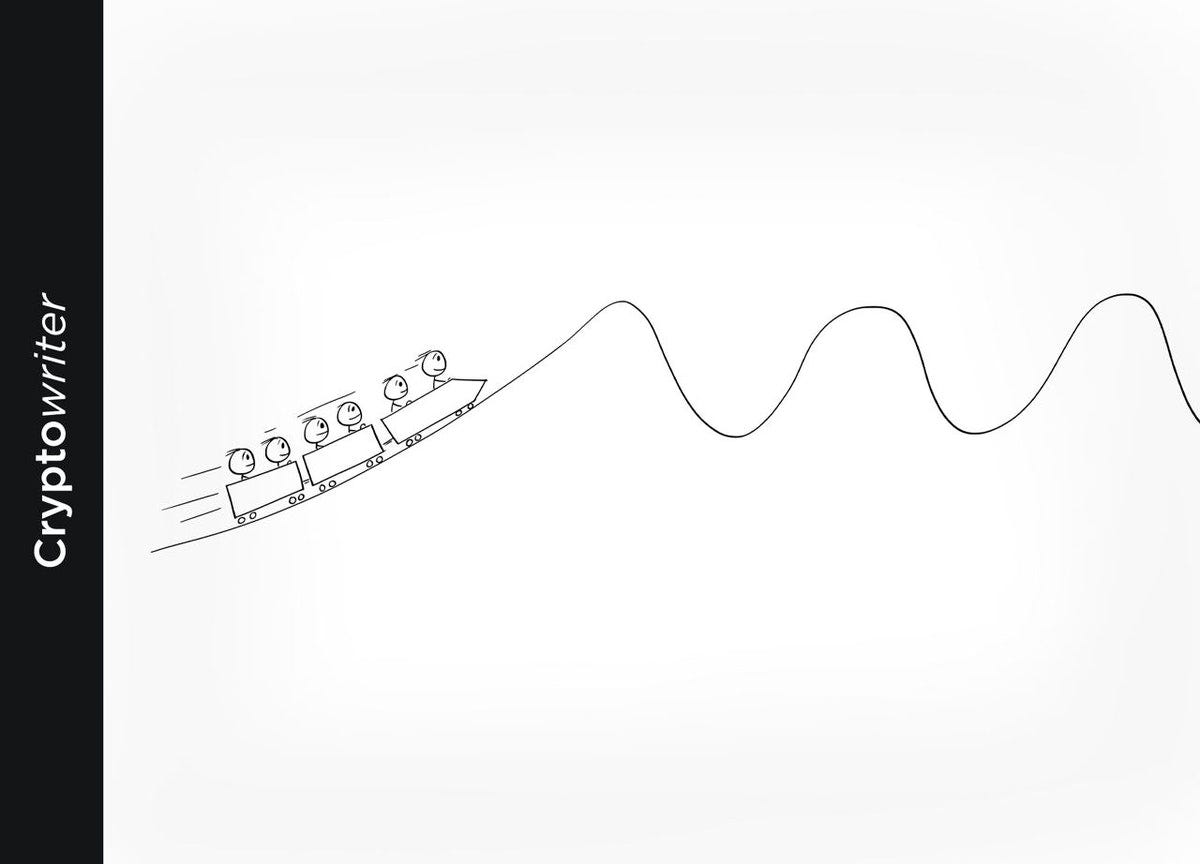

Here are a few of the trains of thought that are ping-ponging their way through my brain right now:

1. Bitcoin and Emerging Market Economies

Bitcoin is a saving grace for countries whose currencies have not historically been stable or done well in competition with the rest of the global currencies in the market. Bitcoin does one thing very well: it prevents excessive manipulation by anyone. This makes it an ideal reserve currency because its decentralized nature prevents central banks from controlling it, while the markets make it too expensive for whales to come in and buy up.

In El Salvador, Bitcoin is seen as a currency of the people. “Geopolitical support for open source code,” one Twitter user said last night, “has been historically embraced tonight,” by the government of a small Central American nation in which substantial support for Bitcoin has been found in the lower echelons of society. Why? Because it’s easier and cheaper than the US Dollar, and perhaps because USD hyperinflation is expected.

2. The Petrodollar: Weakness??

Russia declared that it would seek to divest from the US Dollar this week, a bad sign for one of the brightest economies in the post-covid world. Essentially, we can expect those dollars to begin to flow out of the Russian economy and not be replaced by more petrodollars. It won’t be good for the American economy, as the increase in liquid dollars could contribute to what early indicators point to as inflation.

If Russia is leaving the US Dollar behind, China and smaller nations could follow suit. This could leave Americans in uncharted economic waters, as the supply of USD skyrockets while demand falls.

Cryptocurrencies look like an excellent hedge against inflation because the projected path after this evening’s news has a destination: nation-state BTC FOMO, driving prices higher and higher. The prices are historically measured in USD, but this accounting system could be threatened if measures are not invented on the fly to quickly and accurately contain the inflation. These are what Terry Pratchett would refer to as “interesting times.”

3. I still do not view Bitcoin as an investment

Bitcoin is likely to become the standard by which other currencies are valued if last night simply marks the first night on which a nation passed legislation granting Bitcoin the status of legal tender. This will cause a lack of supply in the cryptocurrency, and it will cause a relative de-valuing of other notable legal tenders, unfortunately for me including the US Dollar which my nation has become quite used to seeing as a global reserve currency.

Bitcoin can be expected to moon, assuming that El Salvador was simply the first of many governments to make a move along these lines. It is possible, however, that Bitcoin will simply become a gateway by which the world is invited to learn and trade altcoins. A more bullish scenario can scarcely be imagined, for the cryptocurrency universe. It appears possible that crypto is within striking distance of displacing traditional currency altogether, and a few more strategic moves such as the Russian USD divestment may seal the once-mighty Dollar’s fate altogether.

The geopolitical consequences of the COVID-19 pandemic have not yet made themselves entirely clear, either. What’s coming is a new way of doing things, powered by various different cryptocurrencies and all of the worldwide economic consequences of this revolution.

I do not advocate panic, but major changes are on the way in the near term and any time that happens, the best attitude to take would seem to be caution. I’m not a financial advisor, but as a writer who has been following crypto for 18 months, semi-professionally, I can’t help but wonder what the alternative to general cryptocurrency maximalism would even look like today. The idea that fiats could somehow make a comeback and win out after all seems rather preposterous. We’ve seen Kenya and now El Salvador make major steps this year, and if things go well we are likely to see many, many more nations follow suit.

Support is even increasing here in the US — perhaps our nation here will find a way to heal itself by forging new economic structures and self-governing via blockchain technologies. In all these thoughts, only one crystal of certainty has formed: cryptocurrency is rapidly becoming a defining political issue of our time.

- Accounting

- advisor

- advocate

- All

- Altcoins

- American

- around

- article

- Banks

- BEST

- Bit

- Bitcoin

- bitcoiners

- blockchain

- blockchain technologies

- BTC

- Bullish

- buy

- Cause

- Central Banks

- China

- code

- coming

- competition

- consolidation

- countries

- COVID-19

- COVID-19 pandemic

- crypto

- Crypto Markets

- cryptocurrencies

- cryptocurrency

- currencies

- Currency

- decentralized

- Demand

- distance

- Dollar

- dollars

- driving

- Early

- Economic

- economy

- emotions

- EU

- EV

- Event

- events

- Feature

- financial

- First

- flow

- follow

- FOMO

- General

- Global

- good

- Government

- Governments

- here

- hr

- HTTPS

- hyperinflation

- ia

- idea

- Including

- Increase

- inflation

- IP

- IT

- kenya

- LEARN

- Legal

- Legislation

- Liquid

- Listening

- major

- Market

- Markets

- medium

- mixed

- months

- Moon

- move

- Near

- news

- open

- open source

- Other

- pandemic

- Panic

- People

- REST

- rush

- Russia

- saving

- Simple

- small

- So

- Society

- spend

- Status

- Strategic

- supply

- support

- system

- Technologies

- time

- trade

- trains

- us

- US Dollar

- USD

- valued

- View

- week

- WHO

- win

- within

- world

- worldwide

- writer

- writing

- year