SNEAK PEEK

- Ripple price analysis shows a decline in price action.

- The support level at $0.4620 has remained stable, indicating that bulls are pushing for a recovery.

- Technical indicators suggest that XRP could recover if bulls regain momentum

The latest Ripple price shows the crypto asset has experienced a pullback, with bulls retreating and bears taking control over the market. The sellers dominate the market and push prices down, which could signal a possible bearish reversal. The XRP/USD pair has dropped by 0.90% since its recent high of $0.4759, trading at around $0.467 at the time of writing.

XRP/USD trades downward following the rejection at the $0.4759 resistance. The support level at $0.4606 has remained stable for more than 24 hours, indicating that bulls are pushing for a recovery. The next major support level for XRP lies at $0.4450, with strong resistance near the $0.4800 mark if bulls manage to regain control of the market.

XRP’s market capitalization currently stands at $24,420,959,2138, with the asset’s 24-hour trading volume at $873,104,826. The market cap has slightly dropped since yesterday, indicating that more sellers are entering the market. The trading volume is rising as it displays a positive trend, having gained 1.56 percent in the past 24 hours.

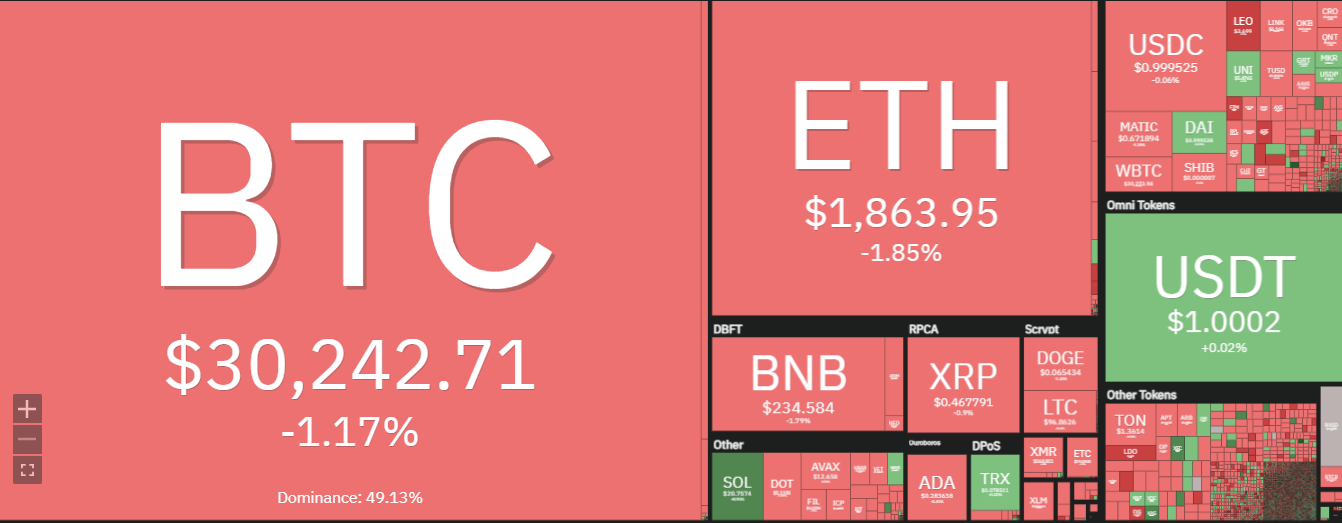

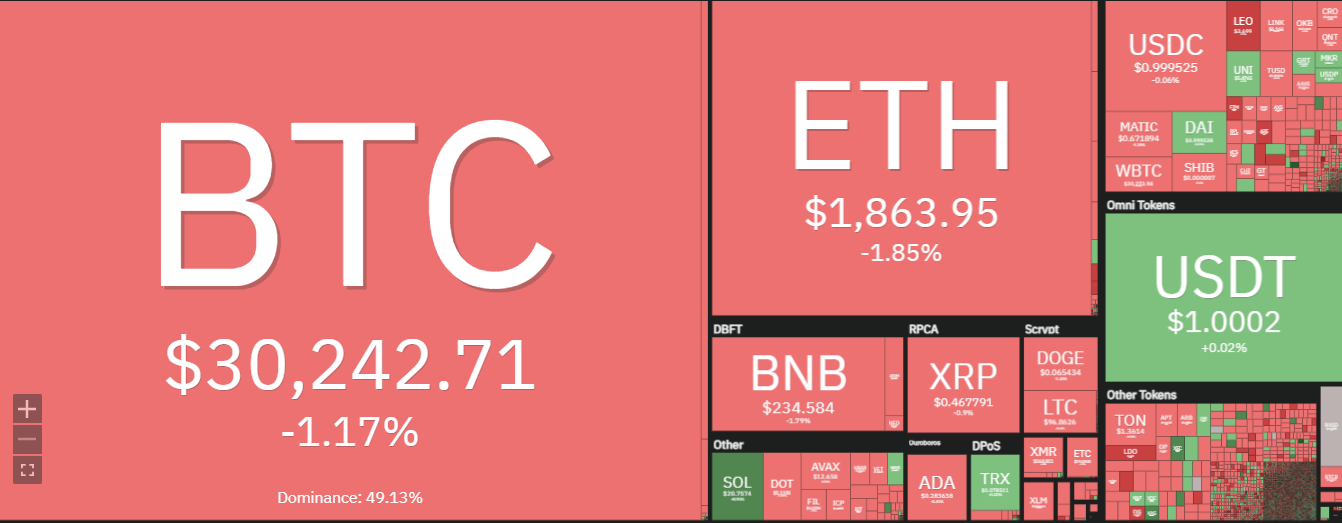

The whole crypto market remains bearish in the short term, and XRP is no exception. Top coins like Bitcoin, Ethereum, and Binance Coin are all in the red zone. Although XRP is still trading above its support level at $0.4606, further decline could lead to a more bearish reversal.

Regarding technical indicators, the MACD shows that XRP is currently in bearish territory. The 9-day RSI for XRP indicates that the asset is trading above the oversold levels and could soon experience some recovery. However, it is important to remember that the current market conditions could remain unfavorable toward bulls.

The relative strength index (RSI) is currently at 41.92, indicating that XRP is in equilibrium. It also indicates that the bulls struggle to increase prices while the bears remain in market control. The Bollinger Bands for XRP/USD pair have narrowed, signaling that the price will likely remain range-bound soon.

However, a green candlestick has been observed forming at the lower band, suggesting a possible bounce soon. The MACD indicates a bearish outlook, with the red line crossing below the blue line. This further confirms that XRP could enter a bearish trend in the short term.

Ripple’s market shows signs of bearish reversal as bulls retreat and bears take control. The current technical indicators suggest that XRP could stay range-bound for some time, with a possible recovery if bulls regain momentum.

Disclaimer: Cryptocurrency price is highly speculative and volatile and should not be considered financial advice. Past and current performance is not indicative of future results. Always research and consult with a financial advisor before making investment decisions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://investorbites.com/ripple-xrp-price-analysis-07-07/

- :has

- :is

- :not

- 1

- 22

- 220

- 24

- 420

- 7

- a

- above

- Action

- advice

- advisor

- All

- also

- Although

- always

- an

- analysis

- and

- ARE

- around

- AS

- asset

- At

- BAND

- BE

- bearish

- Bears

- been

- before

- below

- binance

- Binance Coin

- Bitcoin

- Blue

- Bollinger bands

- Bounce

- Bulls

- by

- cap

- capitalization

- Coin

- Coins

- conditions

- considered

- control

- could

- crypto

- crypto asset

- Crypto Market

- cryptocurrencies

- Current

- Currently

- decisions

- Decline

- discussion

- displays

- Dominate

- down

- downward

- dropped

- Enter

- entering

- Equilibrium

- ethereum

- exception

- experience

- experienced

- extensive

- external

- financial

- financial advice

- following

- For

- further

- future

- gained

- Green

- Have

- having

- High

- highly

- HOURS

- However

- HTTPS

- if

- important

- in

- Increase

- index

- indicates

- Indicators

- internal

- investment

- investor

- IT

- ITS

- lead

- Level

- levels

- lies

- like

- likely

- Line

- lower

- MACD

- major

- Making

- manage

- mark

- Market

- Market Cap

- Market Capitalization

- market conditions

- Market News

- Momentum

- more

- Near

- news

- next

- no

- of

- Outlook

- over

- pair

- past

- percent

- performance

- plato

- Plato Data Intelligence

- PlatoData

- positive

- possible

- price

- PRICE ACTION

- Price Analysis

- Prices

- pullback

- Push

- Pushing

- recent

- Recover

- recovery

- Red

- regain

- relative

- relative strength index

- remain

- remained

- remains

- remember

- research

- Resistance

- Results

- Retreat

- Reversal

- Ripple

- Ripple News

- ripple price

- Ripple Price Analysis

- rising

- rsi

- Sellers

- Short

- should

- Shows

- Signal

- Signs

- since

- some

- soon

- Source

- speculative

- stable

- stands

- stay

- Still

- strength

- strong

- Struggle

- suggest

- support

- support level

- Take

- taking

- Technical

- term

- than

- that

- The

- this

- time

- to

- top

- toward

- trades

- Trading

- trading volume

- Trend

- volatile

- volume

- What

- What is

- What is bitcoin

- which

- while

- whole

- will

- with

- writing

- xrp

- XRP/USD

- yesterday

- zephyrnet