In Singapore, competition in the financial services industry is heating as customers grow frustrated with underwhelming digital experiences and are becoming more and more open to switching providers.

A new global survey conducted by customer relationship management (CRM) provider Salesforce polled nearly 500 financial services customers in the city-state and found that in the past year, over a third (34%) of Singapore respondents switched banks and insurers, while 41% changed wealth managers. Respondents cited the desire for better digital experiences as the number one reason for turning to another provider.

These results show that many Singapore finance customers are disappointed with the digital experiences their financial services providers are offering and that increased competition in the sector is making it ever so easy to change services providers.

This requires financial services institutions to build up customer trust and deepen loyalty, Sujith Abraham, senior vice president and general manager for Salesforce ASEAN said in a statement. By making use of technologies such as artificial intelligence (AI), data and CRM, financial services providers can create superior and personalized customer experiences, and win over customers.

Further proving this point, 63% of Singapore customers that took part in the Salesforce study said that they would share data in exchange for better experiences. This suggests that customers are valuing personalization and highlights the digital transformation imperative.

Findings also show a positive sentiment and interest amongst customers in exploring alternative products and providers, with 80% of Singapore customers stating that they had either looked into or planned to look into cryptocurrency.

Despite a clear desire for better digital experiences and openness to changing providers, the study found that Singapore customers still crave human interaction with 63% of respondents stating that they would switch providers if services felt impersonal.

Findings of the Salesforce study are consistent with other research conducted on today’s banking customers. A 2023 Accenture survey of 49,000 people revealed that consumers across all generations and nearly all geographies still value physical bank branches in their neighborhoods and want to have a personal interaction with their banks.

Of the Singapore respondents surveyed, 69% said that they enjoyed seeing bank branches in their neighborhood, while 71% indicated that they turned to their bank’s branches to solve specific and complicated problems.

Global finance customers largely unsatisfied with current digital experiences

Salesforce’s Connected Financial Services Report, released on July 06, shares findings of a global survey of 6,000+ financial institution customers. The study sought to understand why finance customers switch providers and what customers look for in a great digital experience. It also sought to understand customers’ evolving sentiments on AI, cryptocurrency, and consumer brands entering the financial space.

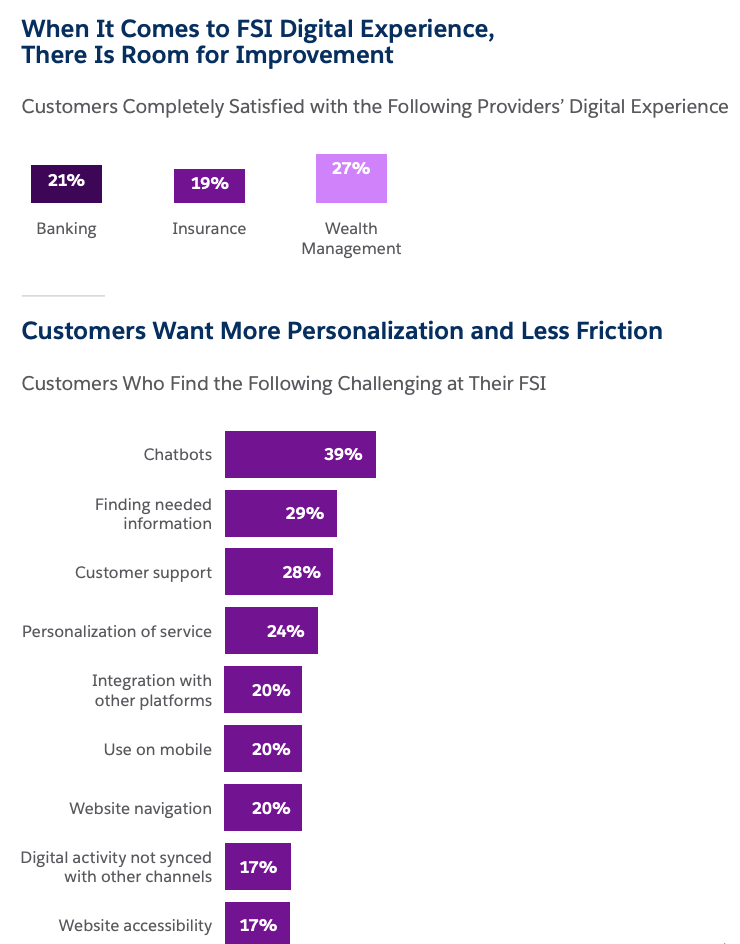

Results of the survey show that, overall, finance customers globally are dissatisfied with their current financial services providers, with only 21%, 19% and 27% of customers stating they were content with their banking, insurance and wealth management providers, respectively.

Additionally, 39%, 24% and 20% of global customers said that chatbots, personalization of services and integration with other platforms, respectively, were challenging at their current financial institutions, falling short of satisfying their needs.

What global financial services customers want and what they are frustrated about at their current financial services providers, Source: Connected Financial Services Report, Salesforce, 2023

Across banking (61%), insurance (66%) and wealth management (73%), the majority of customers indicated wanting more personalization while 73% said that they expected companies to understand their unique needs and expectations.

Global finance customers demand more personalization, Source: Connected Financial Services Report, Salesforce, 2023

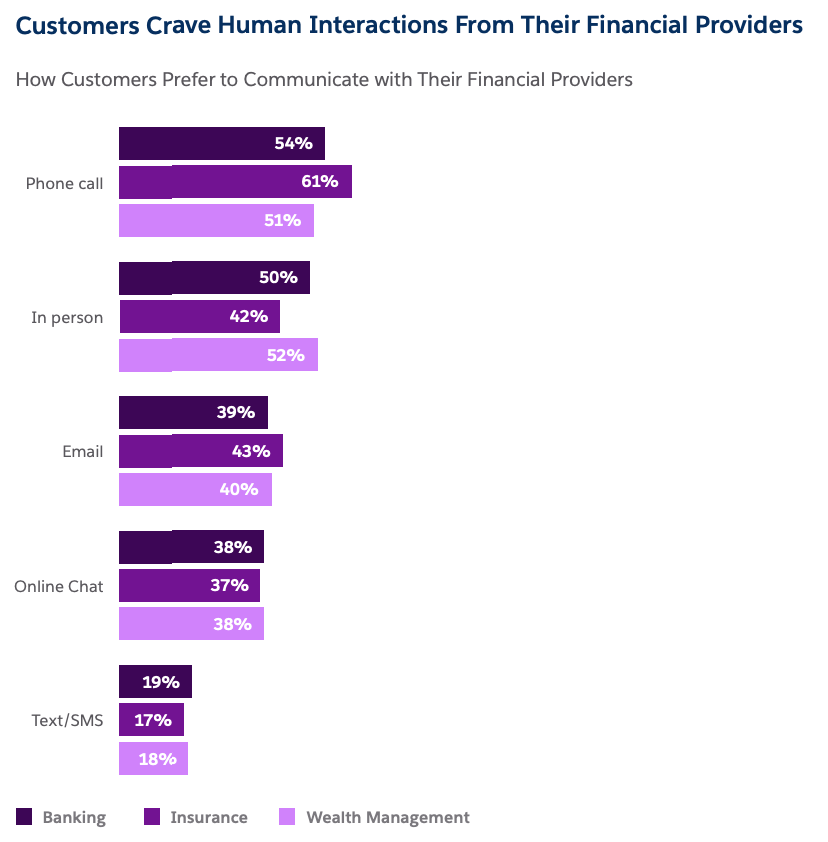

Despite an increasingly digital world and clear demand for improved digital experiences, global customers still crave human and face-to-face interaction. The majority of respondents said they preferred non-digital interactions such as phone calls or in-person meetings over digital ones across banking, insurance and wealth management.

How customers prefer to communicate with their financial providers, Source: Connected Financial Services Report, Salesforce, 2023

And similar to the Singapore results, global customers were found to be more apt to explore or even switch to alternative products and providers with 61% of respondents stating that they had either researched or planned to research cryptocurrency.

Non-traditional finance vendors and products have become more common these past years, owing to new favorable regulations, advancements in technology and changing customer habits. In Singapore, digital banking has accelerated as deregulation encouraged Internet companies like Sea Group and Grab to enter the market.

Superapp operator Grab and partner Singtel launched in August 2022 their digital bank. Called GXS Bank, the outfit currently offers its services to selected Grab and Singtel customers, providing savings accounts and fixed deposits. The partners have a combined local customer base of more than three million, according to a Nikkei Asia report. Sea Group’s MariBank, meanwhile, is only available to employees of the group.

Another online retail bank that launched last year is Trust Bank. A partnership between Standard Chartered and Singapore’s largest supermarket chain FairPrice Group, Trust Bank appears to be making some headway since its launch in September 2022, having attracted more than 450,000 customers and achieved 9% of banking market share in Singapore within five months, CNBC reported in February.

Featured image credit: Edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://fintechnews.sg/76233/virtual-banking/salesforces-findings-show-that-consumers-crave-better-experiences-from-their-bank/

- :has

- :is

- $UP

- 000

- 000 Customers

- 2022

- 2023

- 36

- 49

- 500

- 7

- a

- About

- accelerated

- Accenture

- Accounts

- achieved

- across

- advancements

- AI

- All

- also

- alternative

- amongst

- an

- and

- Another

- appears

- APT

- ARE

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- Asean

- asia

- At

- attracted

- AUGUST

- Bank

- Banking

- Banks

- base

- BE

- become

- becoming

- Better

- between

- branches

- brands

- build

- by

- called

- Calls

- CAN

- caps

- chain

- challenging

- change

- changed

- changing

- Chartered

- chatbots

- cited

- clear

- CNBC

- combined

- Common

- communicate

- Companies

- competition

- complicated

- conducted

- connected

- consistent

- consumer

- Consumers

- content

- crave

- create

- credit

- CRM

- cryptocurrency

- Current

- Currently

- customer

- Customers

- data

- Deepen

- Demand

- deposits

- desire

- digital

- digital bank

- digital banking

- Digital Transformation

- digital world

- easy

- either

- employees

- encouraged

- Enter

- entering

- Even

- EVER

- evolving

- exchange

- expectations

- expected

- experience

- Experiences

- explore

- Exploring

- Falling

- falling short

- false

- favorable

- February

- finance

- financial

- financial institution

- Financial institutions

- financial services

- findings

- fintech

- fixed

- For

- found

- friendly

- from

- frustrated

- General

- generations

- geographies

- Global

- global financial

- Globally

- grab

- great

- Group

- Group’s

- Grow

- GXS Bank

- had

- Have

- having

- highlights

- How

- HTML

- HTTPS

- human

- if

- image

- imperative

- impersonal

- improved

- in

- in-person

- increased

- increasingly

- indicated

- industry

- Institution

- institutions

- insurance

- integration

- Intelligence

- interaction

- interactions

- interest

- Internet

- into

- IT

- ITS

- jpg

- July

- largely

- largest

- Last

- Last Year

- launch

- launched

- like

- local

- Look

- looked

- Loyalty

- Majority

- Making

- management

- manager

- Managers

- many

- MariBank

- Market

- max-width

- Meanwhile

- meetings

- million

- months

- more

- nearly

- needs

- New

- number

- of

- offering

- Offers

- on

- ONE

- ones

- online

- only

- open

- Openness

- operator

- or

- Other

- over

- overall

- part

- partner

- partners

- Partnership

- past

- People

- personal

- personalization

- Personalized

- phone

- phone calls

- physical

- planned

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Point

- positive

- prefer

- preferred

- president

- problems

- Products

- provider

- providers

- providing

- reason

- relationship

- released

- report

- requires

- research

- respectively

- respondents

- Results

- retail

- return

- s

- Said

- salesforce

- Savings

- SEA

- sector

- seeing

- selected

- senior

- sentiment

- September

- Services

- Share

- Shares

- Short

- show

- similar

- since

- Singapore

- Singapore’s

- Singtel

- So

- SOLVE

- some

- sought

- Source

- Space

- specific

- standard

- Standard Chartered

- Statement

- stating

- Still

- Study

- such

- Suggests

- superior

- Survey

- surveyed

- Switch

- switched

- Technologies

- Technology

- than

- that

- The

- their

- These

- they

- Third

- this

- three

- to

- today’s

- took

- Transformation

- Trust

- Trust Bank

- Turned

- Turning

- understand

- unique

- use

- value

- valuing

- vendors

- vice

- Vice President

- want

- wanting

- Wealth

- wealth management

- were

- What

- while

- why

- win

- window

- with

- within

- world

- would

- year

- years

- zephyrnet