Southeast Asia is expected to remain an appealing destination to both private equity (PE) firms and venture capitalists (VCs), with Indonesia and Singapore remaining as the top choice for venture capital in Southeast Asia while Vietnam and Malaysia are gaining momentum.

According to the “Southeast Asia: Private Capital Breakdown” report by PitchBook, Southeast Asia has become a compelling region for private capital investment in recent years, owing to the region’s fast-growing and diverse economies, as well as its vast investment opportunities and its important consumer story.

Southeast Asia is home to a large and young population. The region is nearing 700 million people and the median age of the population stands below 30 years. When comparing with China (39.8), the US (38.5) and Japan (49.5), the potential of Southeast Asia’s consumer base is apparent.

At the same time, the Southeast Asian startup ecosystem is vibrant and now boasts a robust pipeline of high-quality startups that are attracting investment from both local and foreign investors.

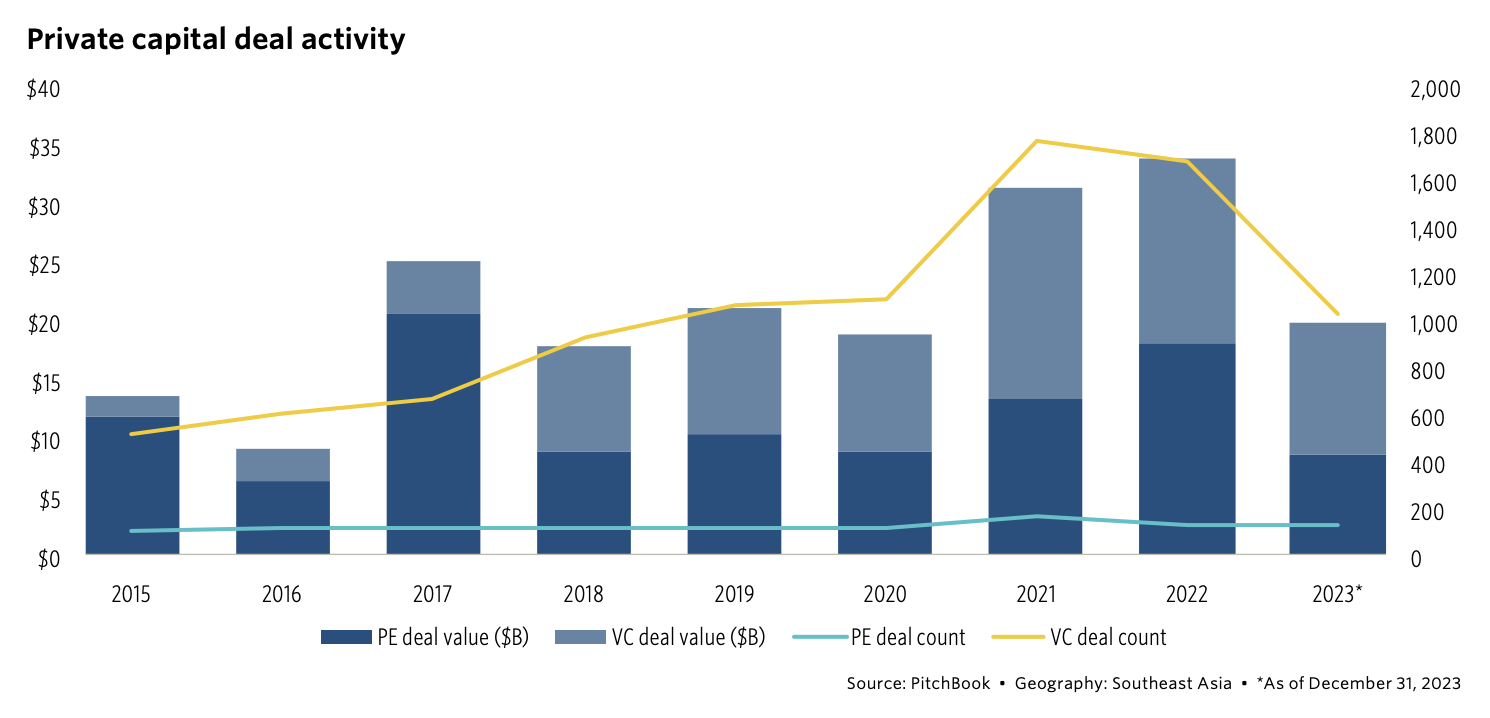

These factors have allowed Southeast Asia to grow into an emerging private capital market with strong momentum. Between 2015 and 2021, deal count within the region more than tripled, the PitchBook report shows, a testament of Southeast Asia’s burgeoning investment landscape. In 2022, the region recorded its highest level ever, attracting US$34.1 billion in private capital deal value or nearly twice that of 2020, the data show.

Private capital deal activity, Source: 2024 Southeast Asia Private Capital Breakdown, PitchBook, Mar 2024

Private capital leans heavily on Venture Capital in Southeast Asia

Looking at private capital market trends, the report notes that investment in Southeast Asia has so far leaned heavily toward VC. This is due to the region’s nascent tech ecosystems and to the fact that much of investment activity has mainly occurred in earlier stages of venture.

But as these startups grow and expand, demand for larger size rounds and growth-stage capital will increase, fueling PE activity in the region.

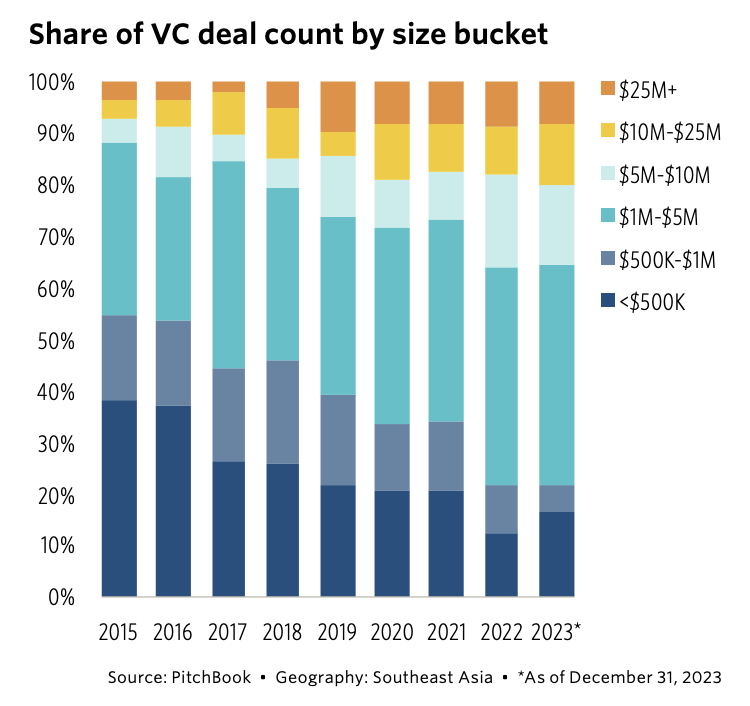

According to PitchBook data, 48 venture-growth deals were closed in 2022, a record high for the regional VC ecosystem but a far cry compared to other regions. On a deal count basis, the proportion of VC rounds with a ticket size north of US$25 million stood below 9% between 2020 and 2023. In 2023, only 34 VC deals from the region with known deal value were above US$10 million.

These data are a testament to the lack of venture funds with the scalability to support startups that need significant capital injection, the report says.

Share of VC deal count by size bucket, Source: 2024 Southeast Asia Private Capital Breakdown, PitchBook, Mar 2024

Vietnam is emerging as a key player in the startup scene, while Malaysia offers substantial potential for growth in venture capital in Southeast Asia, especially as many deals have been done through high-net-worth individuals or wealthy families. Meanwhile, smaller markets such as Myanmar, Cambodia, and Laos are limited by market size and have a low volume of venture-style investments. Nevertheless, these markets present opportunities for investors to delve into new and evolving ecosystems, according to the report.

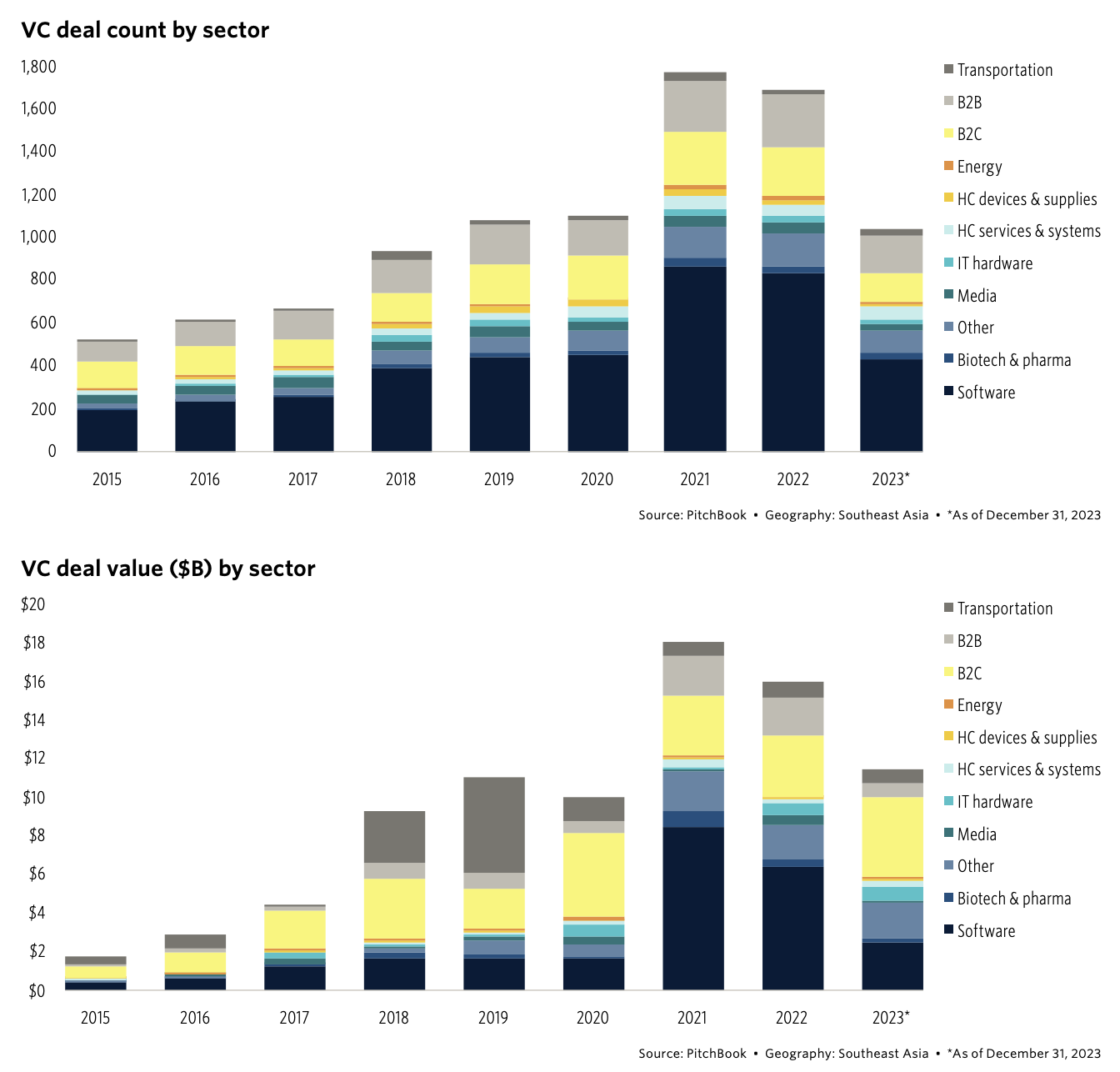

A focus on consumer products and software

Looking at investment activity, the report highlights the dominance of consumer products and software, a trend that’s driven by the region’s growing consumer base, mobile adoption, and increased tech adoption post-COVID-19.

Between 2018 and 2023, the number of software deals as a proportion of annual deal count consistently hovered above 40%, attesting to investors’ belief that technology applications can unlock significant market growth potential and outsized financial returns from the Southeast Asian ecosystem. During the 2021 market frenzy, the amount of venture dollars that were funneled into software deals constituted 46.9% of the region’s total VC deal value.

B2C companies, meanwhile, more than doubled their share of annual deal value during the same period, surging from 16.8% in 2021 to 36.2% in 2023.

VC deal count and value (US$B) by sector, Source: 2024 Southeast Asia Private Capital Breakdown, PitchBook, Mar 2024

Foreign investors to maintain their dominant position

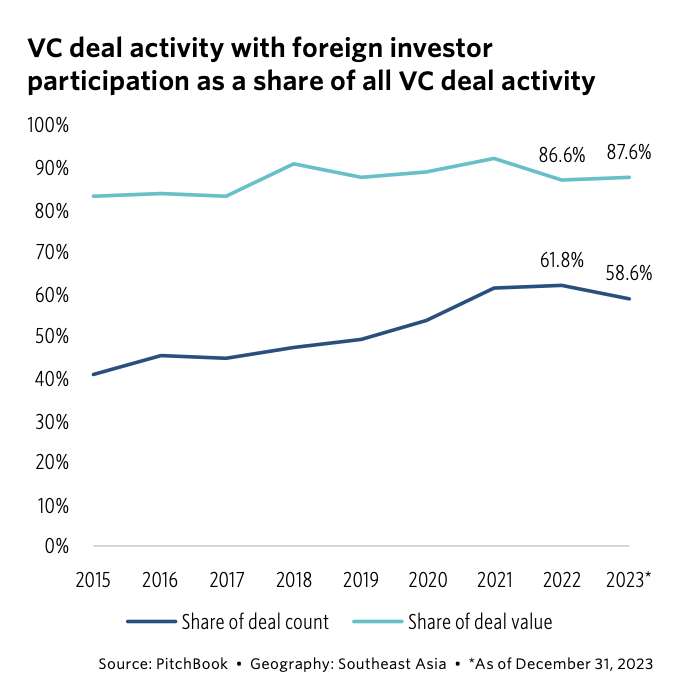

Over the past years, the engagement of venture capital in Southeast Asia has fluctuated in response to changing macroeconomic conditions. Between 2021 and 2022, during a period of heightened capital inflow globally due to the COVID-19 pandemic, foreign investor participation in the region surged, making up more than 60% of PE and VC deals during the period.

VC deal activity with foreign investor participation as a share of all VC deal activity, Source: 2024 Southeast Asia Private Capital Breakdown, PitchBook, Mar 2024

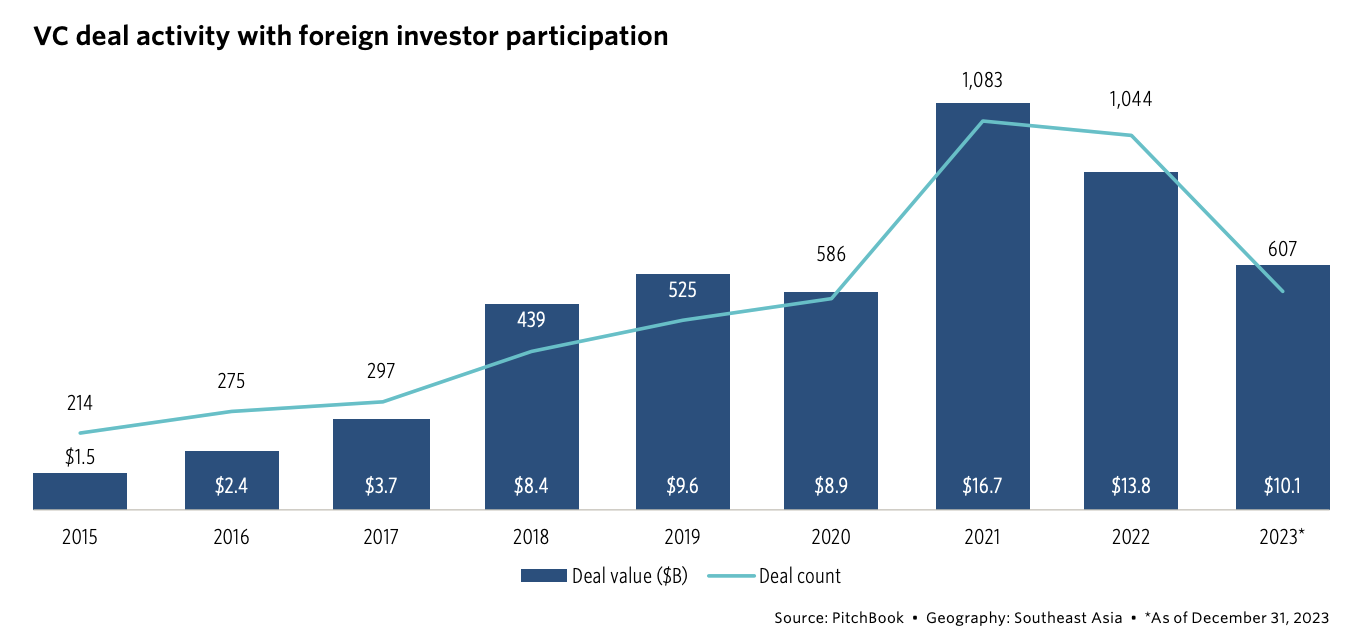

In 2021, a record of US$16.7 billion was deployed to Southeast Asia by foreign investors, representing a staggering 92.1% of the total VC deal value of US$18.1 billion, while participating in 61.2% of completed deals for the year.

VC deal activity with foreign investor participation, Source: 2024 Southeast Asia Private Capital Breakdown, PitchBook, Mar 2024

Looking ahead, PitchBook anticipates that interest of venture capital in Southeast Asia will pick up over the next few years. To start with, the region’s favorable macroeconomic outlook and strong demographics point to a consistently growing startup ecosystem. Also, regional success stories such as Grab and Gojek demonstrate vast market potential. Finally, in light of elevated US-China tensions in 2023, foreign investors, particularly those from the US, are turning their eyes to other parts of Asia-Pacific, including Japan, India, and Southeast Asia.

Featured image credit: edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/93378/funding/singapore-remains-the-top-choice-for-venture-capital-in-southeast-asia/

- :has

- :is

- $UP

- 1

- 16

- 2%

- 2015

- 2018

- 2020

- 2021

- 2022

- 2023

- 2024

- 250

- 26%

- 30

- 300

- 36

- 39

- 49

- 7

- 700

- 750

- 8

- a

- above

- According

- activity

- Adoption

- age

- ahead

- AI

- All

- allowed

- also

- amount

- an

- and

- annual

- anticipates

- apparent

- appealing

- applications

- ARE

- AS

- asia

- Asia’s

- asian

- At

- attracting

- author

- base

- basis

- become

- been

- begin

- belief

- below

- between

- Billion

- boasts

- both

- Breakdown

- burgeoning

- but

- by

- Cambodia

- CAN

- capital

- capitalists

- caps

- changing

- China

- choice

- closed

- Companies

- compared

- comparing

- compelling

- Completed

- conditions

- consistently

- consumer

- Consumer products

- content

- count

- COVID-19

- COVID-19 pandemic

- credit

- data

- deal

- Deals

- delve

- Demand

- Demographics

- demonstrate

- deployed

- destination

- diverse

- dollars

- Dominance

- dominant

- done

- doubled

- driven

- due

- during

- Earlier

- economies

- ecosystem

- Ecosystems

- elevated

- emerging

- end

- engagement

- equity

- especially

- EVER

- evolving

- Expand

- expected

- Eyes

- fact

- factors

- families

- far

- Far Cry

- favorable

- few

- Finally

- financial

- fintech

- Fintech News

- firms

- fluctuated

- Focus

- For

- For Investors

- foreign

- form

- frenzy

- from

- fueling

- funds

- gaining

- Globally

- gojek

- grab

- Grow

- Growing

- Growth

- growth potential

- Have

- heavily

- heightened

- High

- high-quality

- highest

- highlights

- Home

- hottest

- HTTPS

- image

- important

- in

- Including

- Increase

- increased

- india

- individuals

- Indonesia

- interest

- into

- investment

- investment opportunities

- Investments

- investor

- Investors

- ITS

- Japan

- jpg

- Key

- known

- Lack

- landscape

- laos

- large

- larger

- Level

- light

- Limited

- local

- Low

- Macroeconomic

- mailchimp

- mainly

- maintain

- Making

- Malaysia

- many

- mar

- Market

- Market Trends

- Markets

- max-width

- Meanwhile

- million

- Mobile

- Momentum

- Month

- more

- much

- Myanmar

- nascent

- nearly

- Need

- Nevertheless

- New

- news

- next

- North

- Notes

- now

- number

- occurred

- of

- Offers

- on

- once

- only

- opportunities

- or

- Other

- Outlook

- over

- P&E

- pandemic

- participating

- participation

- particularly

- parts

- past

- People

- period

- pick

- pipeline

- Pitchbook

- plato

- Plato Data Intelligence

- PlatoData

- player

- Point

- population

- post-COVID-19

- Posts

- potential

- present

- private

- Private Equity

- Products

- proportion

- recent

- record

- recorded

- region

- regional

- regions

- remain

- remaining

- remains

- report

- representing

- response

- returns

- robust

- robust pipeline

- rounds

- same

- says

- Scalability

- scene

- sector

- Share

- show

- Shows

- significant

- Singapore

- Size

- smaller

- So

- so Far

- Software

- Source

- southeast

- Southeast Asia

- stages

- staggering

- stands

- start

- startup

- startup ecosystem

- Startups

- stood

- Stories

- Story

- strong

- substantial

- success

- Success Stories

- such

- support

- Surged

- surging

- tech

- Technology

- tensions

- testament

- than

- that

- The

- their

- These

- this

- those

- Through

- ticket

- time

- to

- top

- Total

- toward

- Trend

- Trends

- Turning

- Twice

- unlock

- us

- US-China tensions

- US$10

- value

- Vast

- VC

- VCs

- venture

- venture capital

- vibrant

- Vietnam

- volume

- was

- wealthy

- WELL

- were

- when

- while

- will

- with

- within

- year

- years

- young

- Your

- zephyrnet