- According to Sticth fintech, this new payment solution will enable consumers to directly buy goods and services using crypto.

- Corporate Titans like PayPal Holdings, Raba Partnership, and CRE Ventures have been keen on the progress of Stitch Fintech.

- On October 2023, the South African fintech firm landed a $25 million Series A Extension led by Ribbit Capital.

Amid the ups and downs of the 2023 crypto market, decentralized finance has continued to deepen its roots amid Africa’s ecosystem. Decentralized applications have continued to grow, with more developers unlocking new ways of applying blockchain technology.

In addition, the efforts of global payment, such as Visa, PayPal, and Mastercard, have greatly influenced the global outlook on crypto payment gateway. This new trend has rippled across the financial sector, causing many traditional banks and innovators to take the mantle and launch fintech-based corporations.

Over the years, Africa’s fintech industry has grown into a trillion-dollar franchise, with Flutterwave, Yellowcard, and Luno paving the way. The success stories of these African-based corporates have led to many to an increase in blockchain-based applications. In recent news, Sticth Fintech, a South African Fintech firm, has officially launched a unique payment solution based on cryptocurrency, “Pay with crypto.”

Stitch Fintech launches Pay With Crypto In South Africa.

South Africa has become a model nation in the web3 community. From the get-go, it was the only African nation to welcome the concept of digital currency positively. South Africa’s crypto ecosystem has consistently thrived through the collaborations of its government and web3 community.

For instance, South Africa has the highest number of crypto infrastructures, with 21 Bitcoin ATMs nationwide. In addition, it became the first African country to officially declare cryptocurrency as a financial product, further boosting its digital adoption.

In the past decade, the region has become a beacon of hope for cryptocurrency, only rivaled by Niergia and Kenya. In a recent development, the nation is gearing up to launch Africa’s first crypto legal frameworks that shed a positive light on the industry. Due to its friendly ecosystem, investors, entrepreneurs, and innovators have launched numerous blockchain-based and fintech startups.

Furthermore, South Africa has encouraged crypto services providers to register with the regulatory body in the past few months and attain the upcoming crypto licenses. During this period, the region has witnessed an unprecedented surge of crypto partnerships and innovation internationally.

Also, Read Paycorp Unveils CryptoExpress App for 3000 ATMs in South Africa.

Stitch Fintech also took the opportunity to unveil its latest innovation, Pay With Crypto.

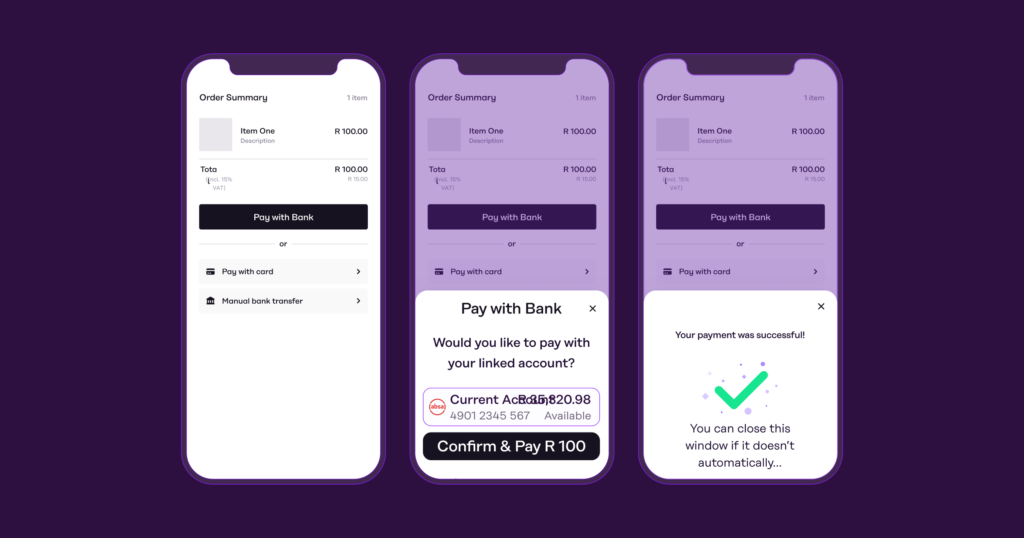

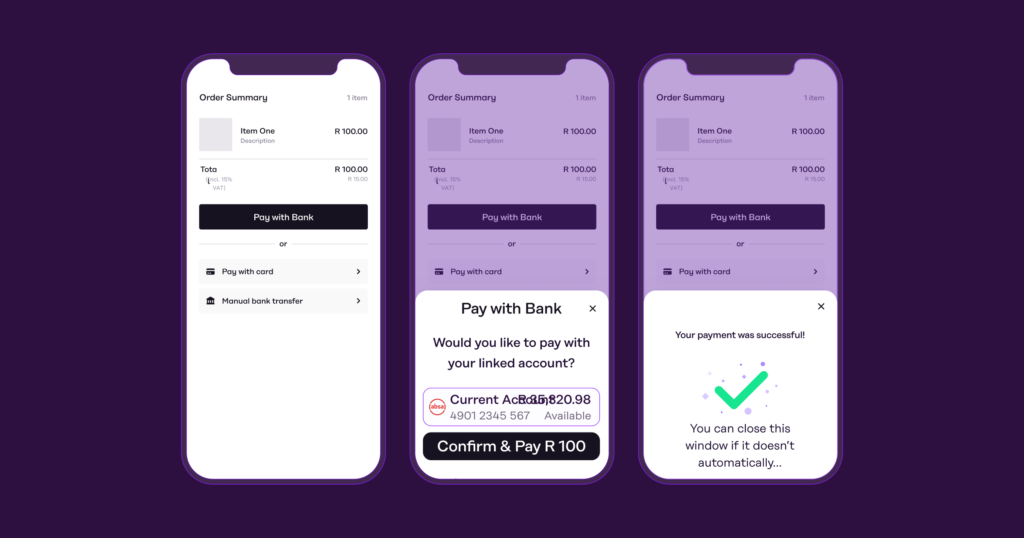

According to Sticth fintech, this new payment solution will enable consumers to directly buy goods and services using crypto. It will directly link the user’s crypto wallets with the South African FinTech firm platform to take advantage of the 7.7 million South African crypto owners.

Stitch President Junaid Dadan said, “Cryptocurrency adoption in South Africa has been one of the highest in the world. There’s a massive audience that would prefer to use their crypto to make payments. Thanks to our Pay with crypto method, we’re excited to offer Stitch clients an opportunity to reach and serve this audience without the need to take on direct volatility risk.“

Pay With Crypto will allow businesses in South Africa to offer customers the option to deposit or check out using crypto stored in the VALR or Binance Wallet. According to Sticth Fintech, the solution will only accept payment in stablecoins, Bitcoin and Ether.

Stitch Fintech has dedicated its efforts to launching APIs that give cryptocurrency a tangible feel.[Photo/Medium]

In addition, Stitch Fintech has accounted for the currency fluctuation by ensuring all business deals will be set in ZAR. Pay With Crypto will calculate and convert a user’s cryptocurrency into fiat before transferring it. With South Africa’s positive take on digital assets, many SMEs have shifted to introducing digital payment options.

Stitch fintech has utilized this trend to allow merchants to seamlessly integrate Pay With Crypto without hindering their business setups. The new payment solution can be integrated into online marketplaces, e-commerce companies, gaming and trading platforms, and local and international travel service providers.

The Dawn of a New Age in South Africa

Since February 2021, the South African fintech firm has dedicated its efforts to providing an API service that aligns with the region’s goals for digital payment. Their innovative ideas and unique approach also caught the eye of plenty of investors. On October 2023, the South African fintech firm landed a $25 million Series A Extension led by Ribbit Capital.

This feat allowed the organization to acquire the necessary funding to launch Pay WIth Capita. Furthermore, corporate Titans like PayPal Holdings, Raba Partnership, and CRE Ventures have been keen on the progress of Stitch Fintech.

Kiaan Pillay, CEO of Sitch Fintech, once said, “We moved away from being a single-method platform to a next-generation PSP for local and global enterprises. Initially, we just had a pay-in feature where we supported bank and card payments. While we’ve added more, we now have an orchestration layer, which many enterprises use to manage payment methods and reconcile across different banks. And we do payouts, whether a disbursement, a refund, or a withdrawal. Our solution is attractive for global companies trying to enter the market for the first time because of the end-to-end process.“

With VALR as their partner, the Pay WIth Crypto solution will change the dynamic of the South African fintech firm. Blake Player, VALR’s Head of Growth, commented, “We’re excited to see yet another partner building on top of the VALR Pay API. The Stitch integration expands the options VALR customers have to spend crypto balances in South Africa to the e-commerce market. The interest we’ve had in working with the VALR Pay product has been amazing, and we’re expecting high growth in the volume of crypto payments as it becomes more widely accepted.“

Currently, Stitch fintech has raised a total of $52 million in funding. With this amount, the organization continues to see greater heights in Africa’s fintech industry. Its innovative solution powers leading global and African businesses like MTN, Luno, Multichoice, The Foschini Group (TFG), Standard Bank’s SnapScan, and Yoco.

Also, Read Visa and VALR Forge Historic Partnership to Transform South Africa’s Crypto Landscape.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2023/11/29/news/stitch-fintech-pay-with-crypto/

- :has

- :is

- :where

- $UP

- 2021

- 2023

- 3000

- 33

- 7

- a

- Accept

- accepted

- According

- accounted

- acquire

- across

- added

- addition

- Adoption

- ADvantage

- africa

- African

- age

- Aligns

- All

- allow

- allowed

- also

- amazing

- Amid

- amount

- an

- and

- Another

- api

- APIs

- app

- applications

- Applying

- approach

- AS

- Assets

- ATMs

- attain

- attractive

- audience

- away

- balances

- Bank

- Banks

- based

- BE

- beacon

- became

- because

- become

- becomes

- been

- before

- being

- binance

- Bitcoin

- Bitcoin ATMs

- blockchain

- blockchain technology

- blockchain-based

- body

- boosting

- Building

- business

- business deals

- businesses

- buy

- by

- calculate

- CAN

- Capita

- capital

- card

- card payments

- caught

- causing

- ceo

- change

- check

- clients

- collaborations

- commented

- community

- Companies

- concept

- consistently

- Consumers

- continued

- continues

- convert

- Corporate

- corporates

- Corporations

- country

- CRE

- crypto

- Crypto ecosystem

- Crypto Market

- crypto payment

- Crypto Payments

- crypto services

- crypto wallets

- cryptocurrency

- Currency

- Customers

- Deals

- decade

- decentralized

- Decentralized Applications

- Decentralized Finance

- dedicated

- Deepen

- deposit

- developers

- Development

- different

- digital

- Digital Assets

- digital currency

- Digital Payment

- direct

- directly

- do

- downs

- due

- during

- dynamic

- e-commerce

- ecosystem

- efforts

- enable

- encouraged

- end-to-end

- ensuring

- Enter

- enterprises

- entrepreneurs

- Ether

- excited

- expands

- expecting

- extension

- eye

- feat

- Feature

- February

- feel

- few

- Fiat

- finance

- financial

- Financial sector

- fintech

- fintech startups

- Firm

- First

- first time

- fluctuation

- For

- forge

- frameworks

- franchise

- friendly

- from

- funding

- further

- Furthermore

- gaming

- gateway

- gearing

- Give

- Global

- Goals

- goods

- Government

- greater

- greatly

- Group

- Grow

- grown

- Growth

- had

- Have

- head

- heights

- High

- highest

- historic

- Holdings

- hope

- HTTPS

- ideas

- in

- Increase

- industry

- influenced

- infrastructures

- initially

- Innovation

- innovative

- innovators

- instance

- integrate

- integrated

- integration

- interest

- International

- internationally

- into

- introducing

- Investors

- IT

- ITS

- just

- Keen

- kenya

- latest

- launch

- launched

- launches

- launching

- layer

- leading

- Led

- Legal

- licenses

- light

- like

- LINK

- local

- Luno

- make

- manage

- many

- Market

- marketplaces

- massive

- mastercard

- max-width

- Merchants

- method

- methods

- million

- model

- months

- more

- moved

- MTN

- nation

- Nationwide

- necessary

- Need

- New

- news

- next-generation

- now

- number

- numerous

- october

- of

- offer

- Officially

- on

- once

- ONE

- online

- only

- Opportunity

- Option

- Options

- or

- orchestration

- organization

- our

- out

- Outlook

- owners

- partner

- Partnership

- partnerships

- past

- Paving

- Pay

- payment

- payment methods

- payment solution

- payments

- payouts

- PayPal

- period

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- player

- Plenty

- positive

- positively

- powers

- prefer

- president

- process

- Product

- Progress

- providers

- providing

- raised

- reach

- recent

- refund

- region

- register

- regulatory

- Risk

- roots

- Said

- seamlessly

- sector

- see

- Series

- Series A

- serve

- service

- service providers

- Services

- set

- shed

- shifted

- SMEs

- solution

- South

- South Africa

- South African

- spend

- Stablecoins

- standard

- Startups

- stored

- Stories

- success

- Success Stories

- such

- Supported

- surge

- Take

- tangible

- Technology

- Thanks

- that

- The

- the world

- their

- These

- this

- Through

- time

- titans

- to

- took

- top

- Total

- Trading

- Trading Platforms

- traditional

- Transferring

- Transform

- travel

- Trend

- true

- trying

- unique

- unlocking

- unprecedented

- unveil

- Unveils

- upcoming

- UPS

- use

- using

- utilized

- Ventures

- visa

- Volatility

- volume

- Wallet

- Wallets

- was

- Way..

- ways

- we

- Web3

- Web3 community

- welcome

- whether

- which

- while

- widely

- will

- with

- withdrawal

- without

- witnessed

- working

- world

- would

- years

- yet

- zephyrnet