Owning things is a not way to show status in society anymore. In a world where resources are limited modern society values access over ownership.

This shift in values has led to the emergence of the sharing economy, which fosters cooperation, ingenuity, and a sense of community. In this article, we explore what is the sharing economy in a nutshell and learn how card issuing is reshaping its sector.

Grow your revenue with a powerful payment processing solution

Provide a complete stack of payment acceptance services with SDK.finance Platform

Table of contents

The rise of the sharing economy

Access over ownership is the core principle of the sharing economy. It’s a shift away from the traditional model of ownership-based consumerism to renting, lending, subscribing, or reselling goods and services.

From sharing Uber trips to subscription-based platforms like Spotify and Netflix, the sharing economy encourages a more flexible and resource-efficient approach to consumption, where people can access products, without the burden of ownership.

The sharing economy is expected to grow more than $300 billion by 2025. One of the key drivers of the sharing economy’s growth is the popularity of digital platforms and mobile applications. These platforms facilitate peer-to-peer transactions, enabling individuals to share resources, collaborate, and monetize assets.

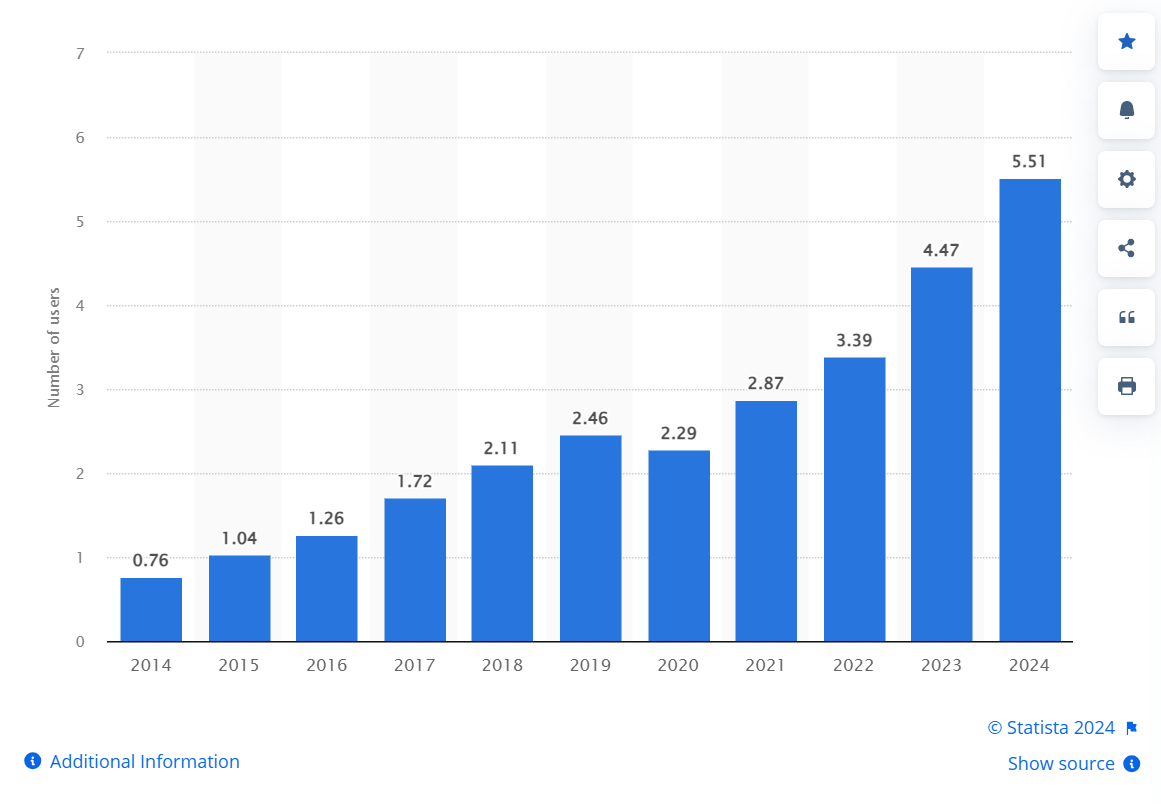

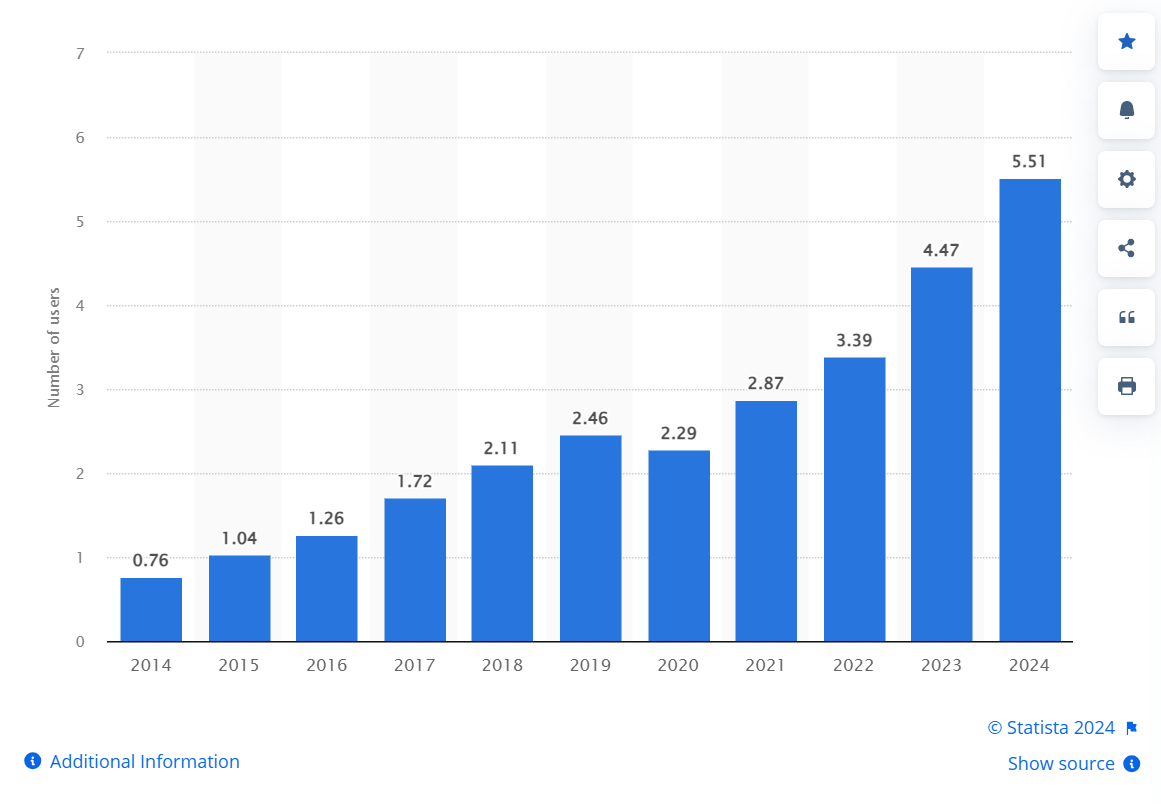

For instance, the number of car-sharing users in Germany has experienced remarkable growth over the past decade, reflecting the increasing popularity and adoption of sharing services among consumers.

Number of registered car-sharing users in Germany from 2014 to 2024

Source: Statista

Looking ahead, continued advancements in technology, and evolving consumer preferences are expected to further accelerate the growth of sharing services.

Grow your revenue with a powerful payment processing solution

Provide a complete stack of payment acceptance services with SDK.finance Platform

What are the benefits of the sharing economy?

The sharing economy is a modern economic model that benefits individuals, businesses, and society as a whole. It offers numerous advantages, including cost savings, increased efficiency, and flexibility and convenience for users.

- Cost savings

One of the key benefits of the sharing economy is cost savings. By sharing resources with others, individuals can reduce expenses associated with purchasing, maintaining, and storing items such as cars, accommodation, and household goods.

- Increased efficiency

Sharing economy platforms match supply with demand in real-time, enabling more efficient use of existing resources. This reduces underutilization and waste, leading to higher overall resource efficiency and productivity.

- Flexibility and convenience

It offers greater flexibility and convenience for users. Individuals can access goods and services on demand, often through mobile apps or online platforms, without the constraints of traditional ownership models.

- Environmental sustainability

Additionally, the sharing economy contributes to environmental sustainability by promoting resource sharing and reducing unnecessary consumption. Sharing resources such as cars, bikes, and accommodations can significantly reduce the carbon footprint and mitigate environmental impact.

- Social connection

Whether it’s sharing a ride, renting out a spare room, or lending household items, these interactions can lead to meaningful social connections and relationships.

By leveraging technology and fostering collaboration, the sharing economy has the potential to transform industries, reshape consumer behavior, and create positive social and economic impact.

Empower your financial product with a real-time accounting model

A ledger layer-based FinTech software for processing and accounting your financial transactions

The impact of card issuing in sharing economic

Card issuing has transformed the sharing economy by revolutionizing transactions and empowering users with convenience, security, and trust.

What is card-issuing?

Card issuing refers to the process of creating and distributing payment cards, ranging from traditional credit and debit cards to specialized prepaid cards and secure payment methods tailored to the unique needs of the sharing economy.

How does card issuing impact the sharing economy?

Through card issuing, sharing economy platforms can streamline payments between users, service providers, and platform operators. Whether it’s paying for a ride-share service, booking accommodation through a rental platform, or purchasing goods through a peer-to-peer marketplace, card issuing ensures that transactions are processed swiftly and securely.

The advantages of card-issuing services for the sharing economy

Streamlining transactions

Through the issuance of prepaid cards and secure payment methods, platforms can effectively manage payments, and expenses, enhancing operational efficiency and mitigating risks associated with financial transactions.

For ride-sharing companies, prepaid cards offer a streamlined solution for managing driver expenses, such as fuel, maintenance, and tolls. By issuing prepaid cards to drivers, ride-sharing platforms eliminate the need for drivers to use personal funds for business-related expenses, simplifying the reimbursement process and promoting financial transparency.

Similarly, rental platforms leverage card issuing for security deposits and damage control, enhancing financial management and risk mitigation strategies. By requiring users to provide card details for security deposits, rental platforms can ensure that funds are readily available to cover any potential damages or losses incurred during the rental period.

Financial flexibility and security

Through the issuance of prepaid cards and secure payment methods, users can effectively manage expenses, conduct transactions safely, and build trust within the ecosystem.

Prepaid cards serve as a versatile tool for users, offering the flexibility to access funds without the need for traditional banking services. Whether it’s a freelance gig worker receiving payments for services rendered or a traveler booking accommodations through a rental platform, prepaid cards provide a convenient and accessible means of conducting transactions.

Additionally, prepaid cards allow users to set spending limits, track expenses, and manage budgets more effectively, promoting financial discipline and control.

Launch your neobank faster and cost-effectively with SDK.finance Platform

Get a digital retail banking solution to build your PayTech product on top

Enhanced user experience

Card-issuing services contribute to a more seamless and enjoyable user experience within the sharing economy. Prepaid cards and secure payment methods offer users convenient and accessible payment solutions, eliminating the need for cash transactions and reducing friction in the booking and payment process. This enhances overall satisfaction and encourages repeat usage of sharing economy platforms.

Real-world examples of card-issuing in the sharing economy

Let’s explore some examples where card issuing enables the sharing economy to thrive:

Hospitality and dining

Platforms like Airbnb and CouchSurfing rely on card issuing to facilitate payments between hosts and guests. Prepaid cards can be issued to hosts to manage rental income or cover expenses, while guests can use cards for secure and convenient transactions during their stays.

Whether booking a cozy apartment or enjoying a homemade meal through Feastly, card issuing ensures a smooth and hassle-free experience for both hosts and guests.

Automotive and transportation

Car-sharing services such as Getaround, Uber, and Lyft leverage card issuing to enable seamless payments between drivers and passengers. Prepaid cards may be issued to drivers for fuel expenses or vehicle maintenance, while passengers use cards for fare payments.

Card issuing enhances the efficiency and reliability of transportation services, making it easier for users to access rides when needed and reducing reliance on traditional car ownership models.

Retail and consumer goods

Platforms like SnapGoods and Poshmark enable users to share or exchange goods, from clothing to household items. Card issuing facilitates transactions between buyers and sellers, ensuring secure and timely payments.

By issuing prepaid cards or implementing payment gateways, these platforms streamline the buying and selling process, fostering a vibrant community of users who can easily access and exchange goods without the need for traditional ownership.

Media and entertainment

Subscription-based services like Spotify and Wix rely on card issuing to manage recurring payments and subscriptions. Users can easily sign up for premium memberships or access exclusive content using prepaid cards or credit cards.

Card issuing ensures seamless access to media and entertainment services, allowing users to enjoy their favorite music, videos, or online content without interruptions.

Thereby, card issuing serves as a linchpin in the sharing economy, enabling platforms across various industries to facilitate transactions, manage payments, and enhance user experiences.

Whether booking accommodations, sharing rides, exchanging goods, or accessing entertainment, card issuing empowers users and platforms alike to participate in the collaborative and resource-efficient ecosystem of the sharing economy.

Future trends and considerations

As the sharing economy continues to evolve and expand, the role of card issuing in facilitating transactions and enhancing financial flexibility is expected to grow in importance.

Exploration of emerging technologies

The integration of blockchain technology and cryptocurrencies could revolutionize card issuing in the sharing economy, offering greater security, transparency, and efficiency in transactions.

Innovations in biometric authentication and mobile payments may enable users to access sharing economy services seamlessly and securely using their smartphones, reducing reliance on physical cards.

Analysis of regulatory developments

Regulatory frameworks governing card issuing and financial transactions in the sharing economy are likely to evolve in response to emerging challenges and opportunities.

Increased scrutiny on data privacy and security may lead to stricter regulations governing the handling of user financial information and transaction data by sharing economy platforms.

Looking for mobile wallet solution?

SDK.finance offers a robust FinTech Platform for faster launch and effective scaling of different mobile wallet apps

However, card-issuing services have potential challenges and opportunities for the growth of the sharing economy.

Challenges related to interoperability and compatibility between different card issuing platforms and payment systems may arise, requiring collaboration and standardization efforts within the sharing economy ecosystem.

Opportunities for collaboration between sharing economy platforms and traditional financial institutions may emerge, enabling platforms to leverage existing infrastructure and expertise to enhance their card-issuing capabilities.

The future of card issuing in the sharing economy holds immense potential for innovation and growth. By exploring emerging technologies, adapting to regulatory changes, and addressing market dynamics, sharing economy platforms and users can harness the advantages of card-issuing services to drive efficiency, security, and convenience in transactions within the sharing economy ecosystem.

Seamless virtual and physical card issuing by SDK.finance

Empower your fintech venture with SDK.finance’s comprehensive card issuing services, designed to seamlessly integrate into your digital banking or payment product. With our robust FinTech Platform serving as the foundation, you can effortlessly issue and manage both virtual and physical cards, offering your customers a frictionless payment experience.

How does your business benefit by issuing cards?

- Increase the revenue streams

Become a card issuer and earn interchange fees on transactions, creating additional revenue streams.

- Enhance user experience

Provide customers with convenient and flexible payment options, which will improve customer satisfaction and increase loyalty to your brand.

- Expand your market

Attract a wider audience by offering traditional payment methods such as debit cards. SDK.finance’s card issuing services enable you to reach consumers who prefer the familiarity and convenience of card-based transactions, expanding your market reach and potential customer base.

With our card-issuing services, businesses can unlock the full potential of their digital banking or payment products, delivering unparalleled value and convenience to their customers. Experience the power of SDK.finance today and revolutionize your fintech venture for the future.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://sdk.finance/beyond-b2c-and-b2b-the-power-of-card-issuing-in-the-sharing-economy/

- :has

- :is

- :not

- :where

- $UP

- 1

- 2014

- 2025

- 7

- a

- accelerate

- acceptance

- access

- accessible

- accessing

- accommodation

- Accounting

- across

- adapting

- Additional

- addressing

- Adoption

- advancements

- advantages

- ahead

- Airbnb

- alike

- allow

- Allowing

- among

- and

- any

- anymore

- Apartment

- applications

- approach

- apps

- ARE

- arise

- article

- AS

- Assets

- associated

- audience

- Authentication

- available

- away

- B2B

- B2C

- Banking

- base

- BE

- behavior

- benefit

- benefits

- between

- Beyond

- biometric

- biometric authentication

- blockchain

- blockchain technology

- booking

- both

- brand

- Budgets

- build

- build trust

- burden

- business

- businesses

- buyers

- Buying

- by

- CAN

- capabilities

- car

- carbon

- card

- Cards

- cars

- Cash

- challenges

- Changes

- Clothing

- collaborate

- collaboration

- collaborative

- community

- Companies

- compatibility

- complete

- comprehensive

- Conduct

- conducting

- Connections

- constraints

- consumer

- consumerism

- Consumers

- consumption

- content

- continued

- continues

- contribute

- contributes

- control

- convenience

- Convenient

- cooperation

- Core

- Cost

- cost savings

- could

- cover

- create

- Creating

- credit

- Credit Cards

- cryptocurrencies

- customer

- Customer satisfaction

- Customers

- damage

- data

- data privacy

- Data Privacy and Security

- Debit

- Debit Cards

- decade

- delivering

- Demand

- deposits

- designed

- details

- different

- digital

- digital banking

- discipline

- distributing

- does

- drive

- driver

- drivers

- during

- dynamics

- earn

- easier

- easily

- Economic

- Economic Impact

- economy

- economy’s

- ecosystem

- Effective

- effectively

- efficiency

- efficient

- effortlessly

- efforts

- eliminate

- eliminating

- emerge

- emergence

- emerging

- emerging technologies

- empowering

- empowers

- enable

- enables

- enabling

- encourages

- enhance

- Enhances

- enhancing

- enjoy

- enjoyable

- enjoying

- ensure

- ensures

- ensuring

- Entertainment

- environmental

- Environmental Sustainability

- evolve

- evolving

- examples

- exchange

- exchanging

- Exclusive

- existing

- Expand

- expanding

- expected

- expenses

- experience

- experienced

- Experiences

- expertise

- explore

- Exploring

- external

- facilitate

- facilitates

- facilitating

- Familiarity

- faster

- Favorite

- Fees

- finance

- financial

- financial discipline

- financial information

- Financial institutions

- financial transparency

- fintech

- Flexibility

- flexible

- Footprint

- For

- Forbes

- fostering

- fosters

- Foundation

- frameworks

- freelance

- friction

- frictionless

- from

- Fuel

- full

- funds

- further

- future

- gateways

- Germany

- goods

- governing

- greater

- greater security

- Grow

- Growth

- guests

- Handling

- harness

- Have

- higher

- holds

- hosts

- household

- How

- HTTPS

- immense

- Impact

- implementing

- importance

- improve

- in

- Including

- Income

- Increase

- increased

- increasing

- incurred

- individuals

- industries

- information

- Infrastructure

- ingenuity

- Innovation

- instance

- institutions

- integrate

- integration

- interactions

- interchange

- interchange fees

- internal

- Interoperability

- into

- issuance

- issue

- Issued

- Issuer

- issuing

- IT

- items

- ITS

- Key

- launch

- lead

- leading

- LEARN

- Led

- Ledger

- lending

- Leverage

- leveraging

- like

- likely

- Limited

- limits

- linchpin

- losses

- Loyalty

- Lyft

- Maintaining

- maintenance

- Making

- manage

- management

- managing

- Market

- marketplace

- Match

- max-width

- May..

- meaningful

- means

- Media

- memberships

- methods

- Mitigate

- mitigating

- mitigating risks

- mitigation

- Mobile

- Mobile Applications

- mobile payments

- Mobile Wallet

- mobile-apps

- model

- models

- Modern

- monetize

- more

- more efficient

- Music

- Need

- needed

- needs

- neobank

- Netflix

- number

- numerous

- Nutshell

- of

- offer

- offering

- Offers

- often

- on

- ONE

- online

- online platforms

- operational

- operators

- opportunities

- Options

- or

- Others

- our

- out

- over

- overall

- ownership

- participate

- past

- paying

- payment

- payment methods

- payment processing

- Payment Systems

- payments

- paytech

- peer to peer

- Peer-to-Peer Transactions

- People

- period

- personal

- physical

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- popularity

- positive

- potential

- power

- powerful

- prefer

- preferences

- Premium

- Prepaid

- principle

- privacy

- Privacy and Security

- process

- Processed

- processing

- Product

- productivity

- Products

- promoting

- provide

- providers

- purchasing

- ranging

- reach

- readily

- real-time

- receiving

- recurring

- reduce

- reduces

- reducing

- refers

- reflecting

- registered

- regulations

- regulatory

- related

- Relationships

- reliability

- reliance

- rely

- remarkable

- rendered

- repeat

- reselling

- reshape

- reshaping

- resource

- Resources

- response

- retail

- Retail Banking

- revenue

- revolutionize

- Revolutionizing

- Ride

- rides

- Rise

- Risk

- risks

- robust

- Role

- Room

- safely

- satisfaction

- Savings

- scaling

- scrutiny

- sdk

- seamless

- seamlessly

- sector

- secure

- securely

- security

- Sellers

- Selling

- sense

- serve

- serves

- service

- service providers

- Services

- serving

- set

- Share

- sharing

- shift

- show

- sign

- significantly

- simplifying

- smartphones

- smooth

- Social

- Society

- Software

- solution

- Solutions

- some

- specialized

- Spending

- Spotify

- stack

- standardization

- Status

- storing

- strategies

- streamline

- streamlined

- streams

- stricter

- subscriptions

- such

- supply

- Sustainability

- swiftly

- Systems

- tailored

- Technologies

- Technology

- than

- that

- The

- The Future

- their

- These

- things

- this

- Thrive

- Through

- timely

- to

- today

- tool

- track

- traditional

- traditional banking

- transaction

- Transactions

- Transform

- transformed

- Transparency

- transportation

- traveler

- Trends

- Trust

- Uber

- unique

- unlock

- unnecessary

- unparalleled

- Usage

- use

- User

- User Experience

- users

- using

- value

- Values

- various

- vehicle

- venture

- versatile

- vibrant

- Videos

- Virtual

- Wallet

- Waste

- Way..

- we

- What

- What is

- when

- whether

- which

- while

- WHO

- whole

- wider

- will

- with

- within

- without

- Wix

- worker

- world

- You

- Your

- zephyrnet