MRC, Cybersource and Verifi have released a new report that shares findings of a survey of global e-commerce merchants which. This study highlights the top trends in e-commerce in 2023.

The study, which polled 1,000+ merchants involved in e-commerce in December 2022, sought to understand the range of payment acceptance, management, and partnership practices these retailers are deploying, as well as the reasons why they are adopting these payment strategies and tactics. It also sought to unveil e-commerce fraud trends and the methods merchants are relying on to prevent fraud.

Findings of the survey revealed that merchants are actively embracing new payment methods, including buy now pay later (BNPL) arrangements and digital wallets as a way to improve customer experience. It also revealed that, in the face of increased fraud activity, retailers are increasingly turning to data analytics and advanced technologies to enhance fraud management and prevention.

Usage of BNPL arrangements on the rise

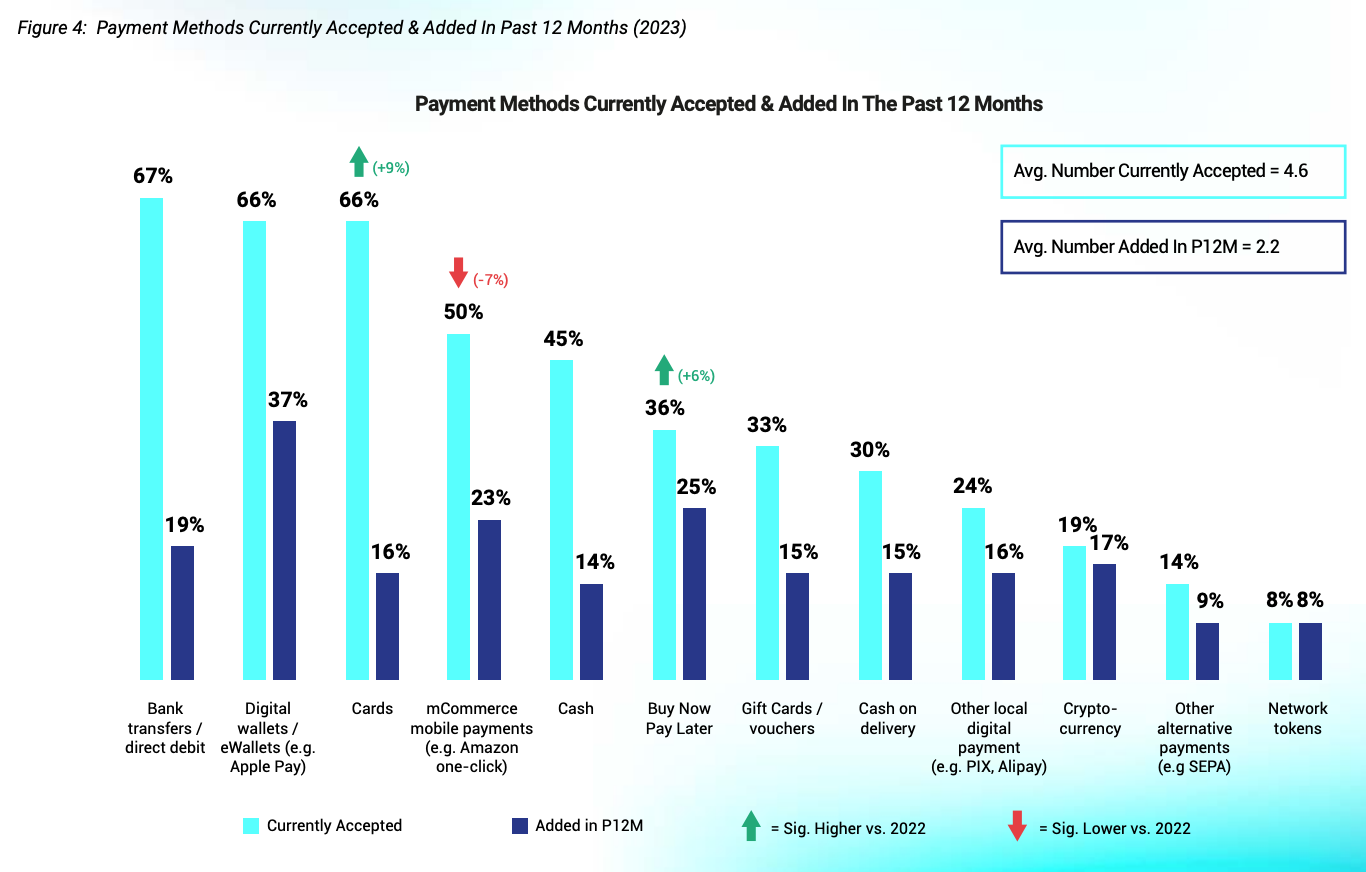

Globally, bank transfers/direct debit, digital wallets and cards remained the most widely accepted payment methods among e-commerce merchants, supported by more than 60% of respondents in 2022, the research found.

Digital wallets were the payment method that witnessed the strongest growth in adoption in 2022, with 37% of respondents stating that they added digital wallets last year. BNPL arrangements recorded the second strongest growth rate, with 25% of respondents adding support for these payment options in 2022.

Localized digital payment methods, including account-to-account (A2A) transactions and real-time payment schemes, as well as cryptocurrency payments, also witnessed a rise, as most e-commerce merchants began accepting these in 2022.

Payment Methods Currently Accepted & Added In Past 12 Months (2023), Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

Improving customer experience on top of mind

E-commerce merchants added new payment methods mainly to improve the customer experience, as well as reach new customer segments or markets, the study found.

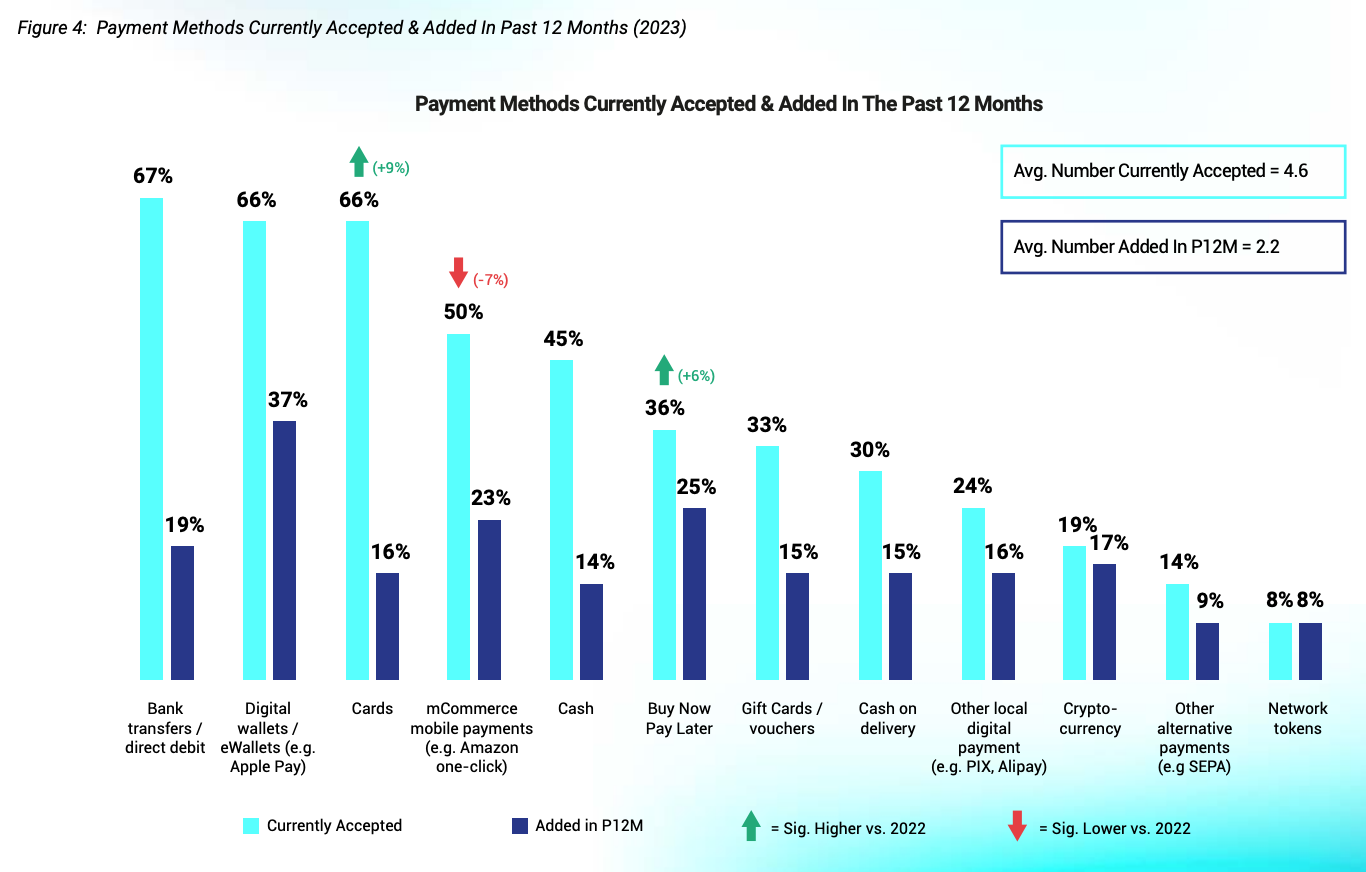

These motivations also drove their increased usage of third-party marketplaces, such as Amazon, eBay and Walmart, which were used by over three-quarters (77%) of the merchants polled.

Usage Of Top Third-Party Marketplaces And Reasons For Using Them, Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

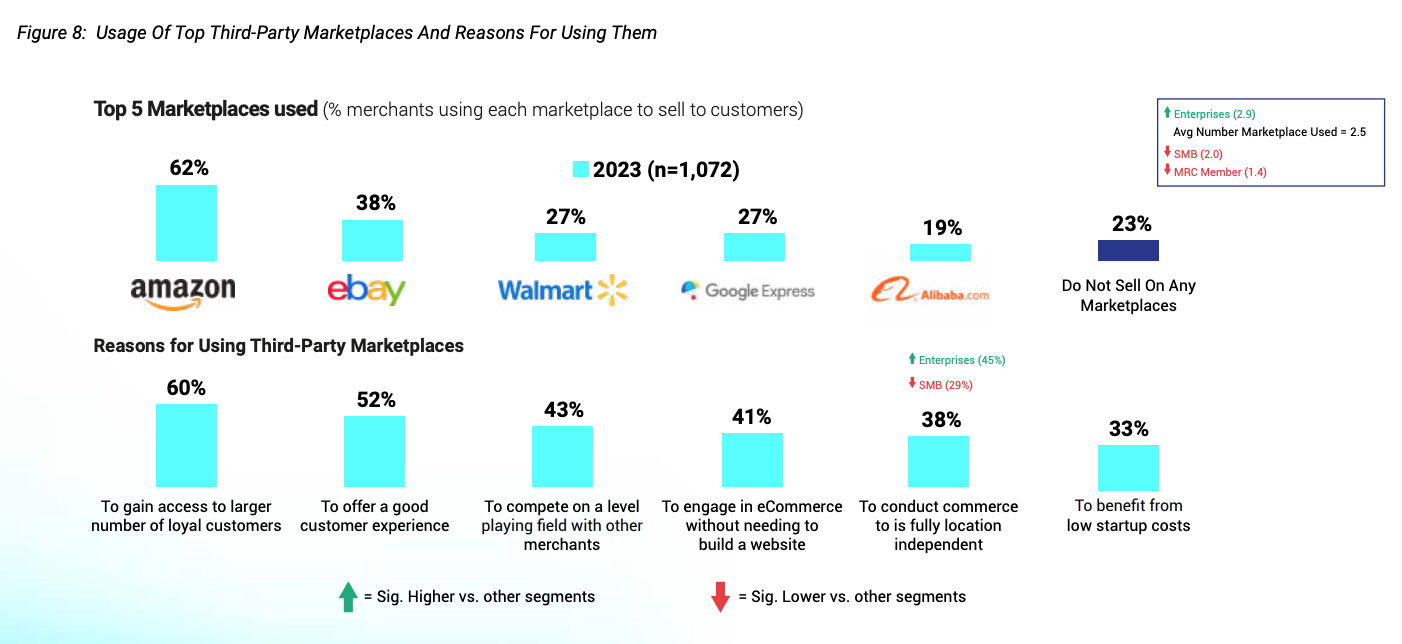

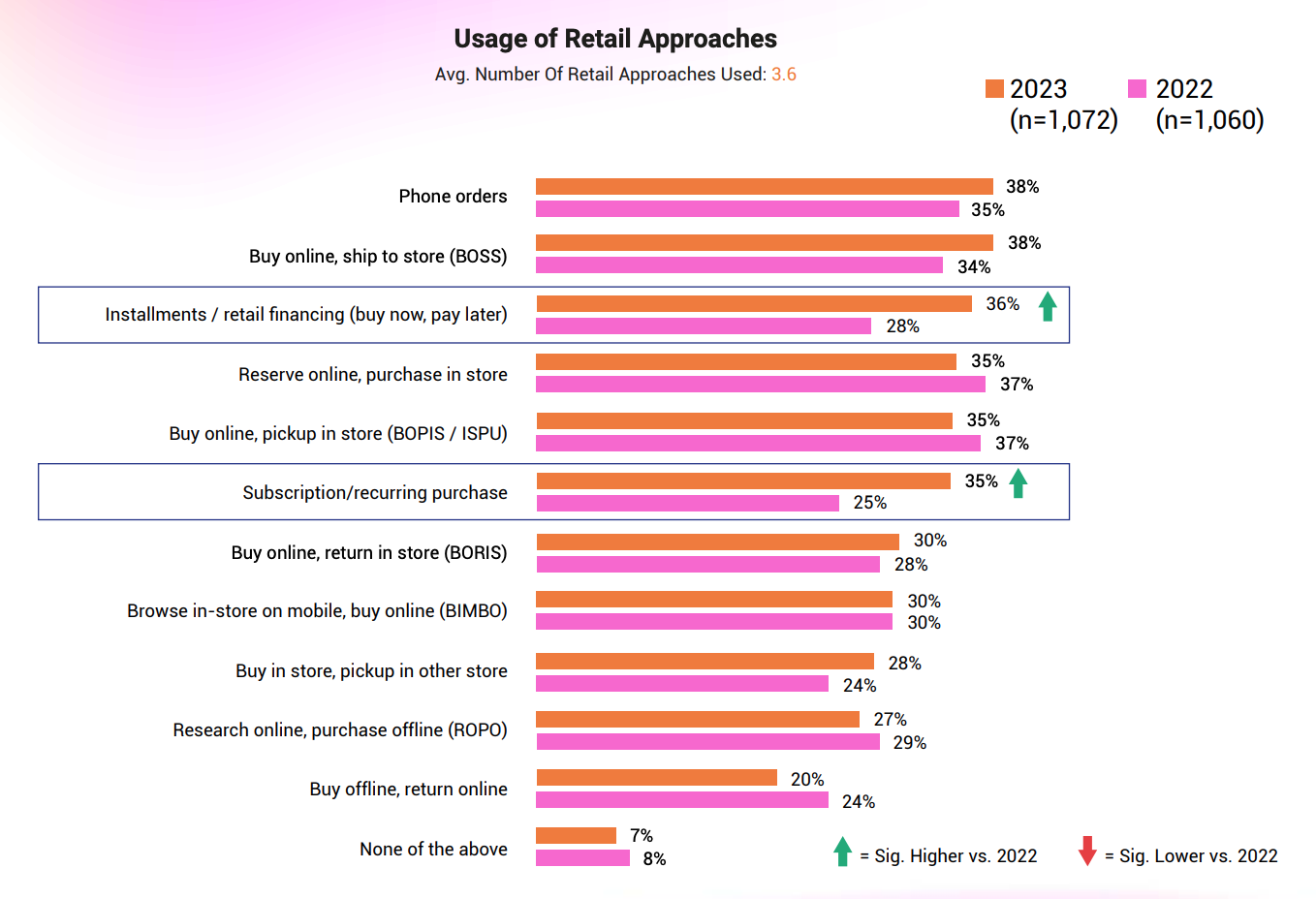

Improving customer experience was also the reason why merchants continued to adopt and experiment with new retail approaches and experiences. Recurring purchases and subscription, as well as BNPL arrangements, in particular, saw the largest increases in usage in 2022, with over one-third of global merchants now offering these options, compared to roughly one-quarter in 2021.

Usage of Retail Approaches, Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

Merchants turn to AI, new digital tools

Among the top trends in e-commerce in 2023 is also the usage of chatbots and customer service artificial intelligence (AI) programs, as well as connected devices, to improve customer experiences. 40% of respondents said they leveraged each of these tools last year.

Chatbots provides customers with an instant personalized experience, responding to their queries faster than human agents can. Connected devices, meanwhile, enable more seamless and streamlined omnichannel experiences, as well as touchless transactions.

Customer Experiences Offered, Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

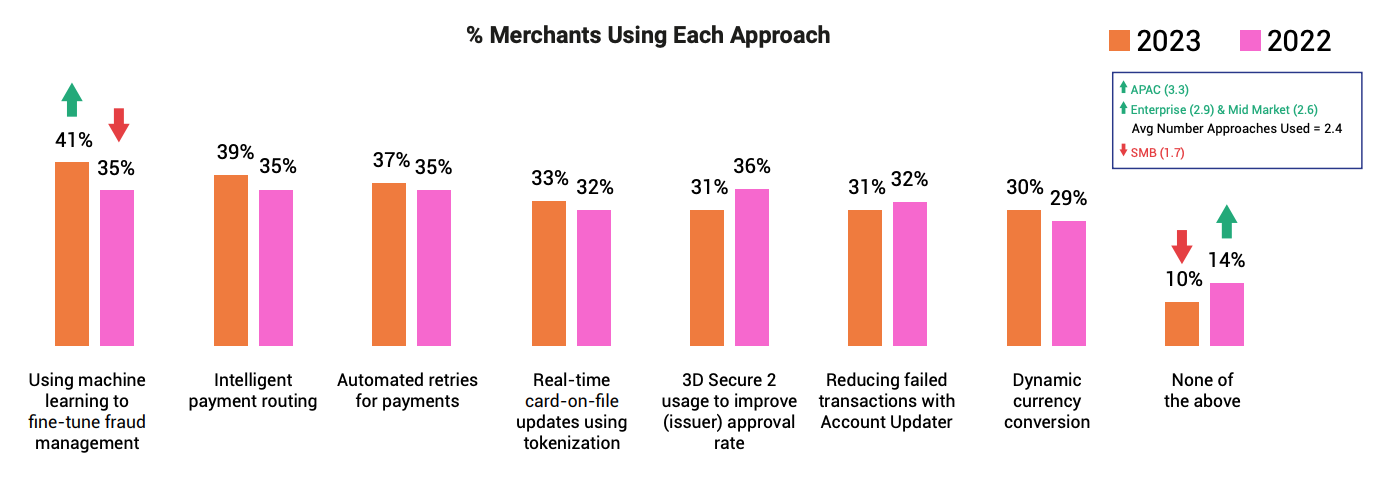

AI and machine learning (ML) techniques are also increasingly used for other applications, including payment authorization. 2022 saw growth in merchant usage of AI and ML to fine-tune fraud management and optimize payment processes, with four in ten retailers indicating using each of these approaches last year.

Usage Of Payment Authorization Approaches, Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

Fraud management improves

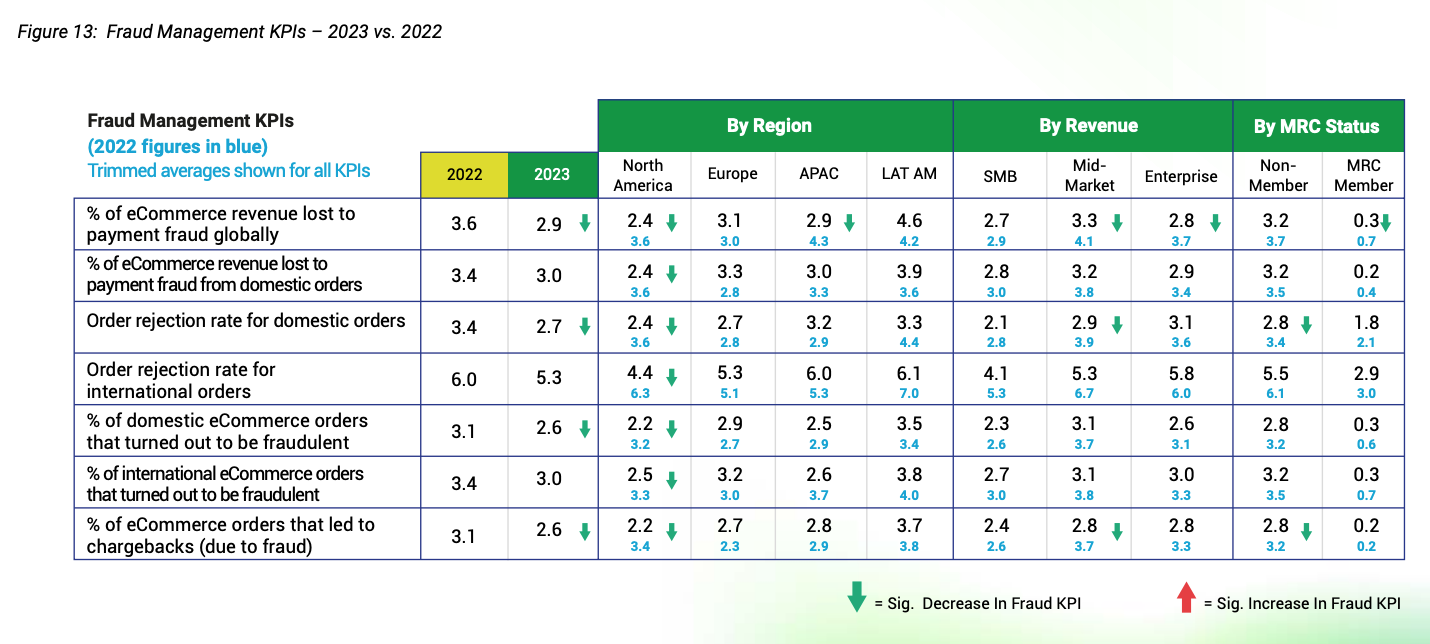

After a turbulent year 2021 characterized by increased fraud, merchants reported some improvement in several fraud-related key performance indicators (KPIs). In particular, the percentage of e-commerce revenue lost to fraud globally, order rejection and fraud rates on domestic orders, as well as the share of e-commerce orders that led to fraud-related chargebacks, all declined significantly in 2022 compared with the year prior.

Fraud Management KPIs – 2023 vs. 2022, Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

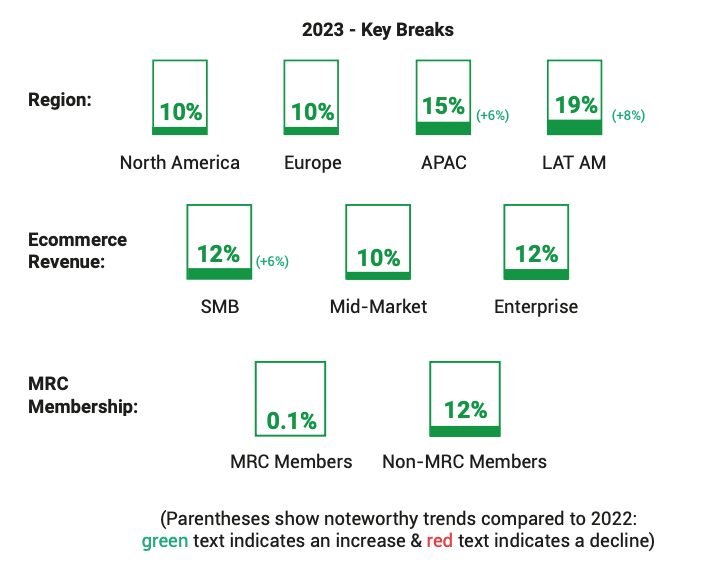

Improved fraud KPIs correlate with the increase in fraud management spend recorded last year. While merchants in North America and Europe spent about the same in 2022 to manage payment fraud as they did in 2021, those in Asia-Pacific (APAC) and Latin America (LatAm) increased their spending significantly in 2022 – by 6% for APAC and 8% for LatAm, the study found.

% Of Annual Ecommerce Revenue Spent To Manage Payment Fraud, Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

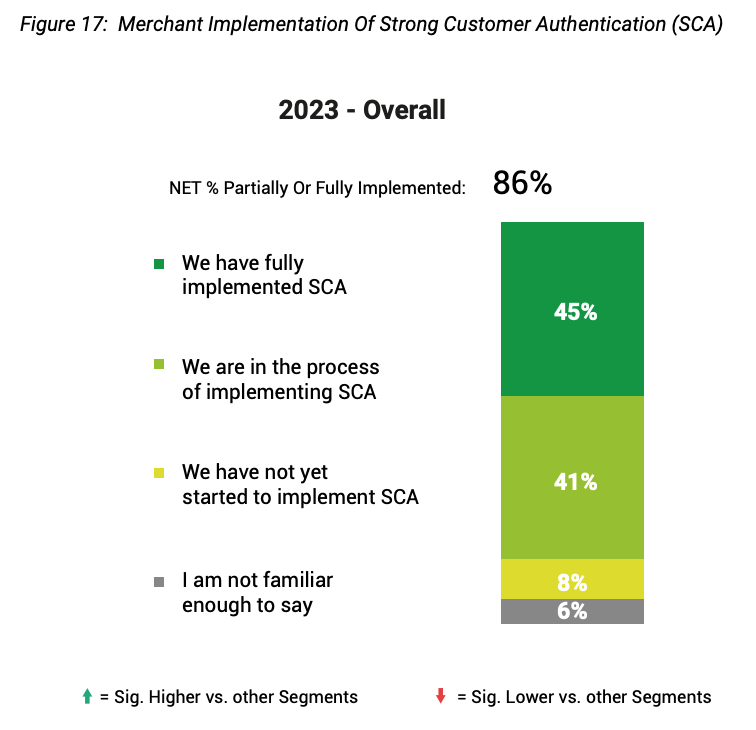

Most merchants were also found to be actively implementing strong customer authentication to comply with the European Union (EU)’s revised Payments Services Directive (PSD2). However, roughly half said they had yet to complete the process.

Merchant Implementation Of strong customer authentication (SCA), Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

Merchants tap new fraud detection tools

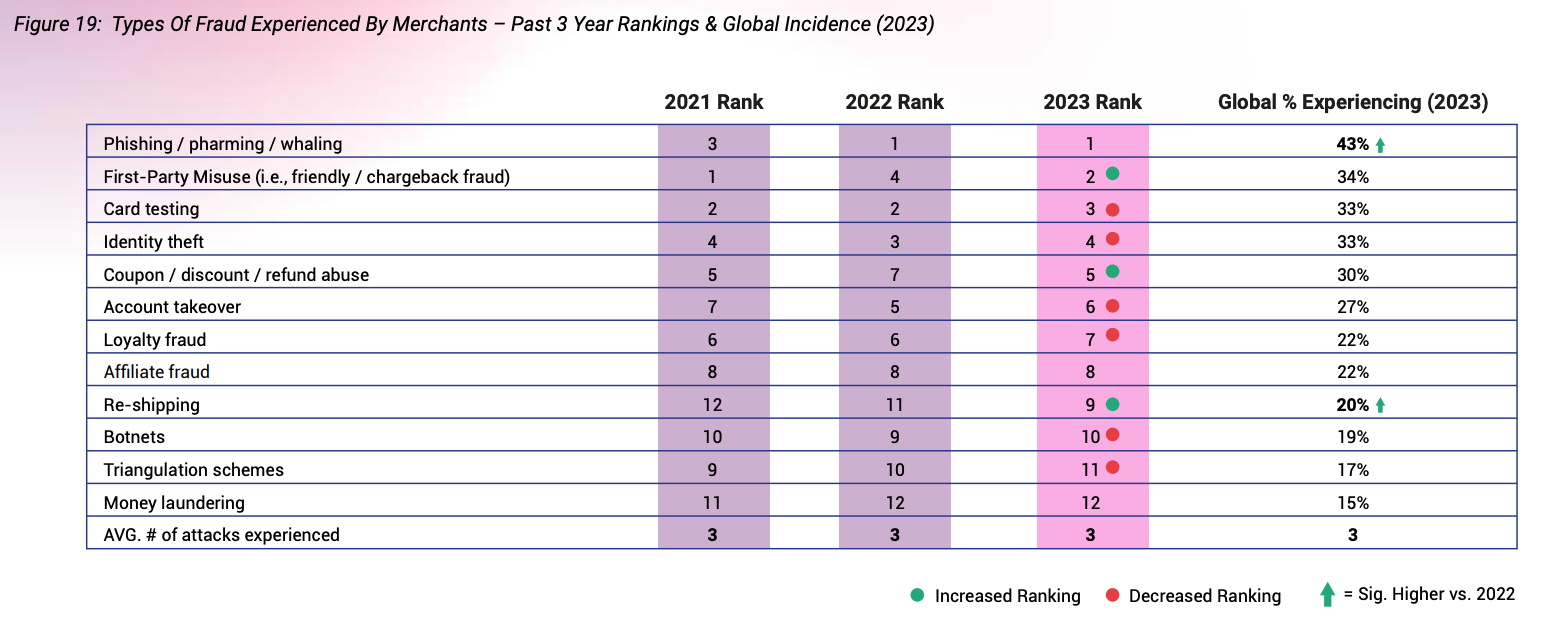

Looking at fraud trends in 2022, the study found that phishing, pharming and whaling attacks remained the most prevalent fraud type witnessed by e-commerce merchants.

This type of attacks showed a significant increase last year, the study found, with 43% of merchants experiencing this type of fraud in 2022, up from 35% the year prior. The rate of first-party misuse also increased, affecting 34% of the merchants polled globally.

Types Of Fraud Experienced By Merchants – Past 3 Year Rankings & Global Incidence (2023), Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

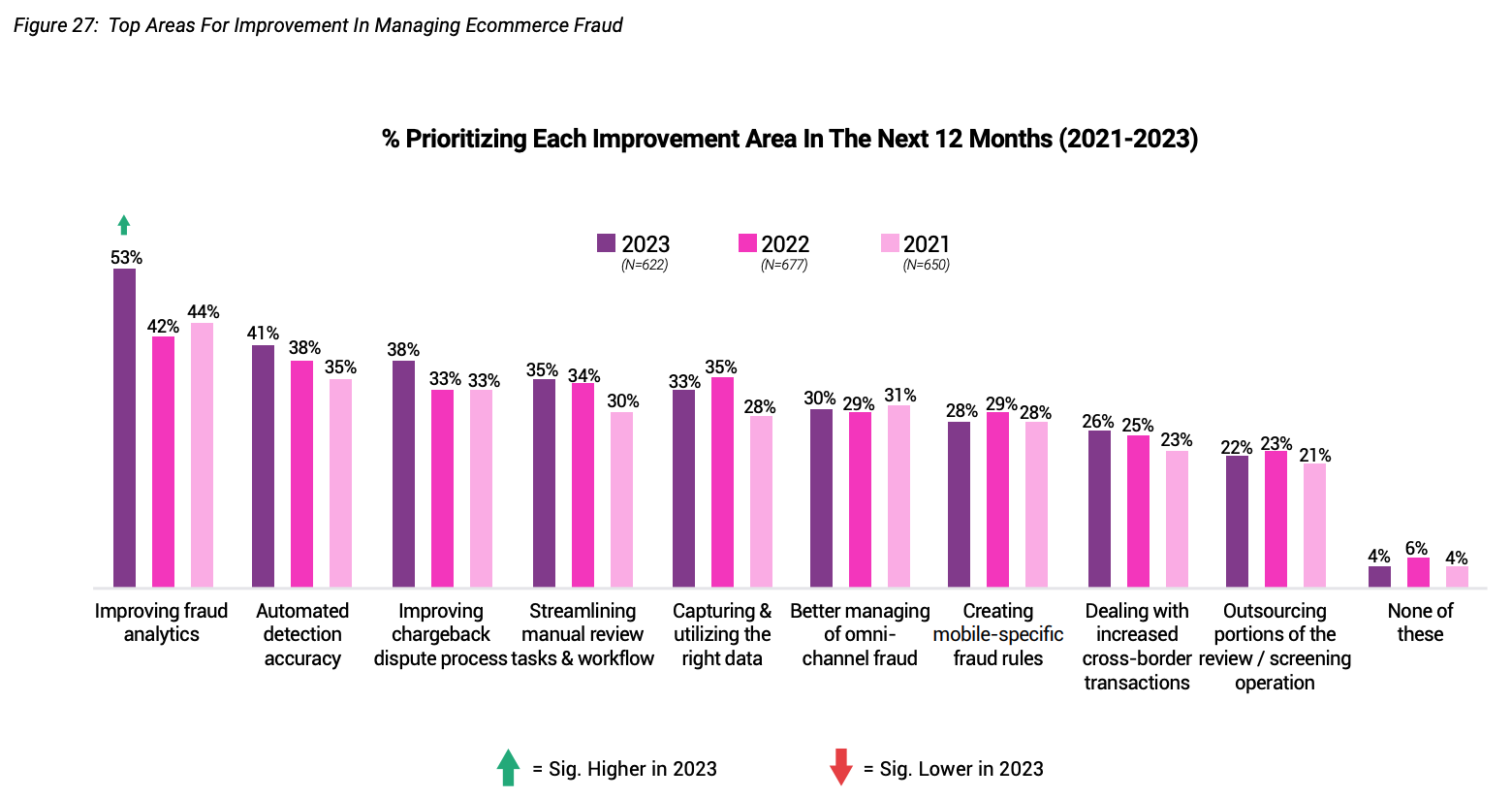

Overall, merchants reported increasing challenges in managing e-commerce fraud and showed interest in using data and analytics to better manage fraud. 53% of respondents cited improving fraud analytics as their top improvement area in the next 12 months, followed by automated detection accuracy (41%), improving chargeback dispute process (38%) and streamlining manual review tasks and workflow (35%).

Top Areas For Improvement In Managing Ecommerce Fraud, Source: 2023 Global Ecommerce Payments and Fraud Report; MRC, Cybersource, and Verifi; 2023

The study also found that merchants utilized an increasing array of fraud detection solutions in 2022. On average, merchants used five different tools last year with credit card verification services (55%), identity verification/verification services (50%) and two-factor phone authentication (44%) being the widely used fraud detection solutions, the research found.

The survey also asked respondents the tools they were planning on using in the future, to which 3D secure authentication (15%), geographic indicators and comparisons (13%) and biometric indicators (12%) recorded among the highest rates.

Featured image credit: edited from Freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://fintechnews.sg/71990/e-commerce/top-trends-in-e-commerce-in-2023/

- :is

- $UP

- 1

- 12

- 12 months

- 15%

- 2021

- 2022

- 2023

- 35%

- 3d

- 7

- a

- About

- acceptance

- accepted

- accuracy

- actively

- activity

- added

- adding

- adopt

- Adopting

- Adoption

- advanced

- affecting

- agents

- AI

- All

- also

- Amazon

- america

- among

- an

- analytics

- and

- annual

- APAC

- applications

- approaches

- ARE

- AREA

- areas

- Array

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- At

- Attacks

- Authentication

- authorization

- Automated

- average

- Bank

- BE

- began

- being

- Better

- biometric

- BNPL

- buy

- buy now pay later

- buy now pay later (BNPL)

- by

- CAN

- caps

- card

- Cards

- challenges

- characterized

- chatbots

- cited

- compared

- complete

- connected

- continued

- credit

- credit card

- cryptocurrency

- Cryptocurrency Payments

- Currently

- customer

- customer experience

- Customer Service

- Customers

- data

- Data Analytics

- Debit

- December

- deploying

- Detection

- Devices

- DID

- different

- digital

- Digital Payment

- digital wallets

- Dispute

- Domestic

- e-commerce

- each

- eBay

- ecommerce

- embracing

- enable

- enhance

- EU

- Europe

- European

- european union

- experience

- experienced

- Experiences

- experiencing

- experiment

- Face

- false

- faster

- followed

- For

- found

- four

- fraud

- fraud detection

- friendly

- from

- future

- geographic

- Global

- Globally

- Growth

- had

- Half

- Have

- highest

- highlights

- However

- HTTPS

- human

- Identity

- image

- implementation

- implementing

- improve

- improvement

- improving

- in

- incidence

- Including

- Increase

- increased

- Increases

- increasing

- increasingly

- Indicators

- instant

- Intelligence

- interest

- involved

- IT

- Key

- largest

- Last

- Last Year

- LATAM

- later

- Latin

- latin america

- learning

- Led

- lost

- machine

- machine learning

- mainly

- manage

- management

- managing

- manual

- marketplaces

- Markets

- max-width

- Meanwhile

- Merchant

- Merchants

- method

- methods

- ML

- months

- more

- most

- motivations

- New

- next

- North

- north america

- now

- of

- offered

- offering

- omnichannel

- on

- One-third

- Optimize

- Options

- or

- order

- orders

- Other

- over

- particular

- Partnership

- past

- Pay

- payment

- payment method

- payment methods

- payments

- percentage

- performance

- Personalized

- phishing

- phone

- planning

- plato

- Plato Data Intelligence

- PlatoData

- practices

- prevalent

- prevent

- Prevention

- Prior

- process

- processes

- Programs

- provides

- purchases

- queries

- range

- Rate

- Rates

- reach

- real-time

- reason

- reasons

- recorded

- recurring

- released

- remained

- report

- Reported

- research

- respondents

- responding

- retail

- retailers

- return

- Revealed

- revenue

- review

- Rise

- roughly

- Said

- same

- schemes

- seamless

- Second

- secure

- segments

- service

- Services

- several

- shaping

- Share

- Shares

- significant

- significantly

- Solutions

- some

- Source

- spend

- Spending

- spent

- strategies

- streamlined

- streamlining

- strong

- Study

- subscription

- such

- support

- Supported

- Survey

- tactics

- Tap

- tasks

- techniques

- Technologies

- ten

- than

- that

- The

- The Future

- their

- Them

- These

- they

- third-party

- this

- those

- to

- tools

- top

- top 5

- touchless

- Transactions

- Trends

- turbulent

- TURN

- Turning

- type

- types

- understand

- union

- Usage

- used

- using

- utilized

- Verification

- vs

- Wallets

- Walmart

- was

- Way..

- WELL

- were

- which

- while

- why

- widely

- with

- witnessed

- year

- yet

- zephyrnet