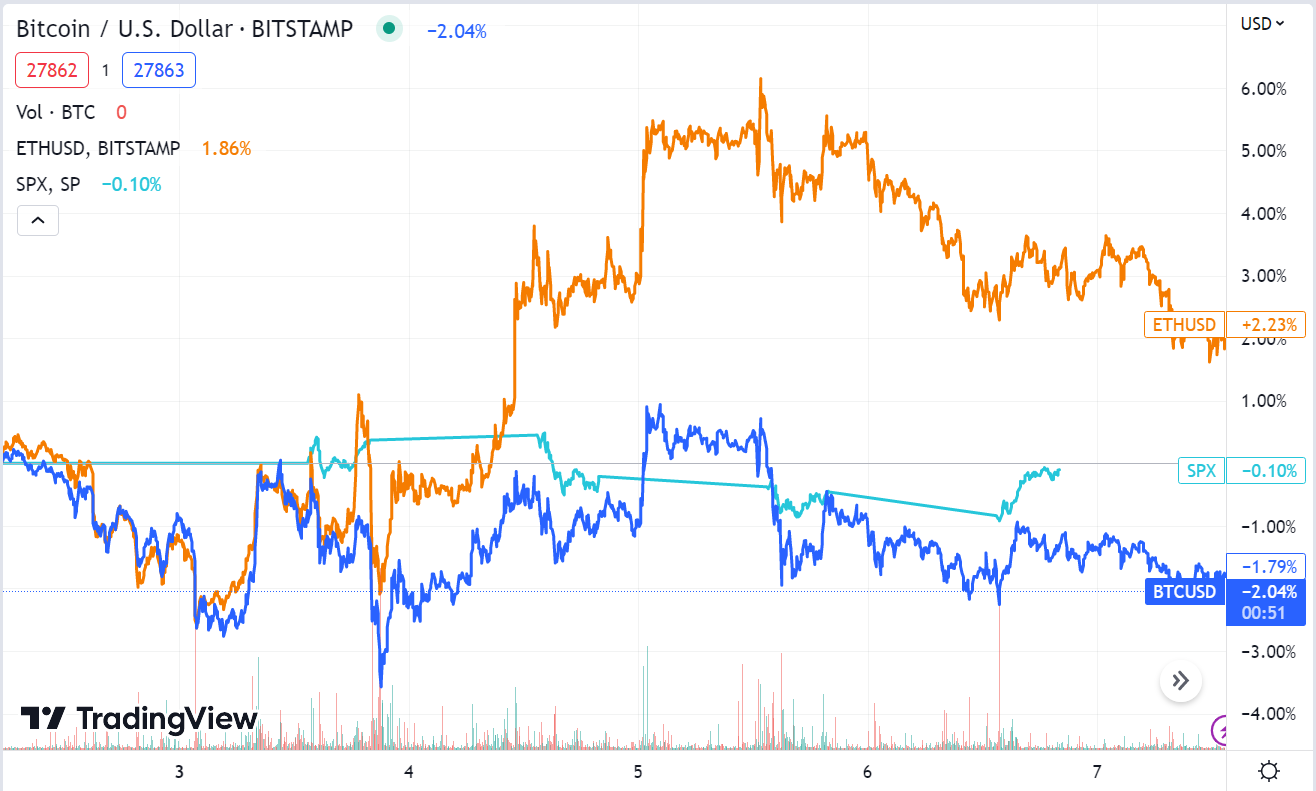

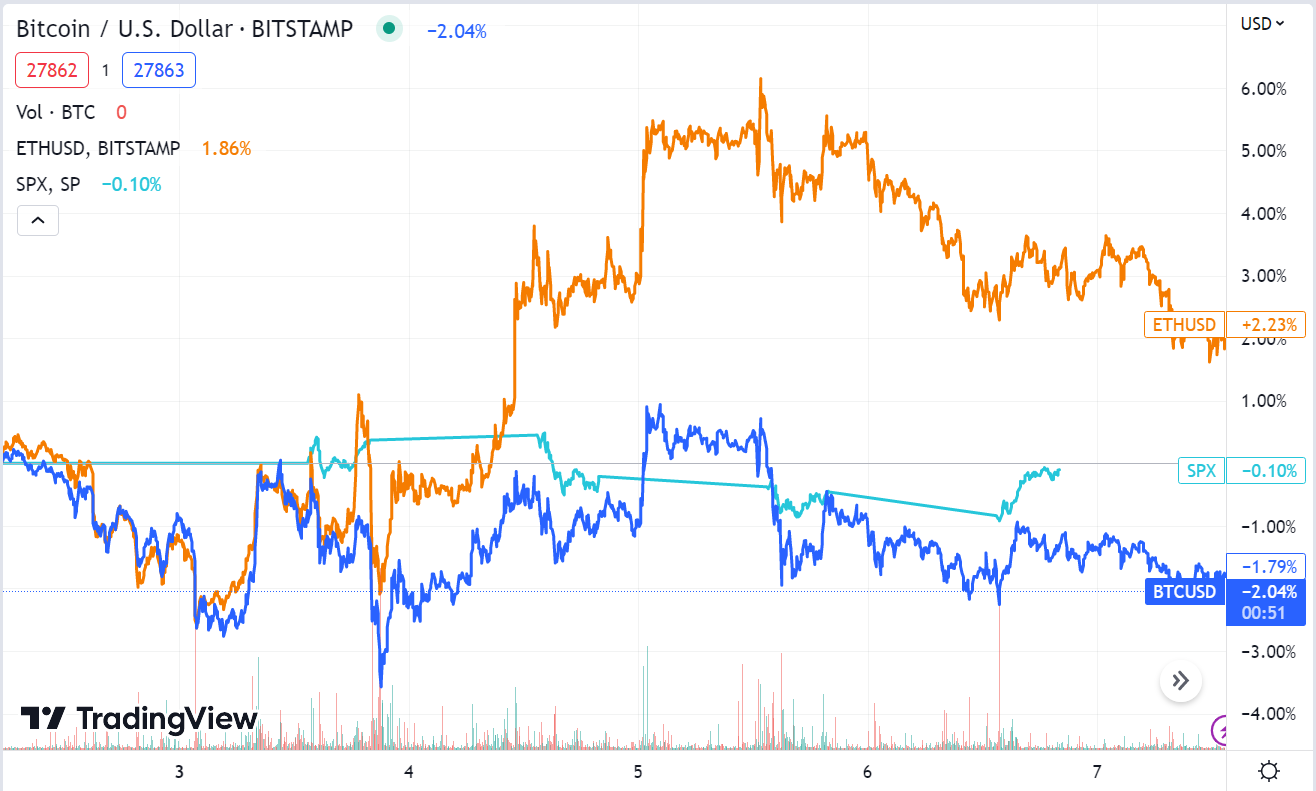

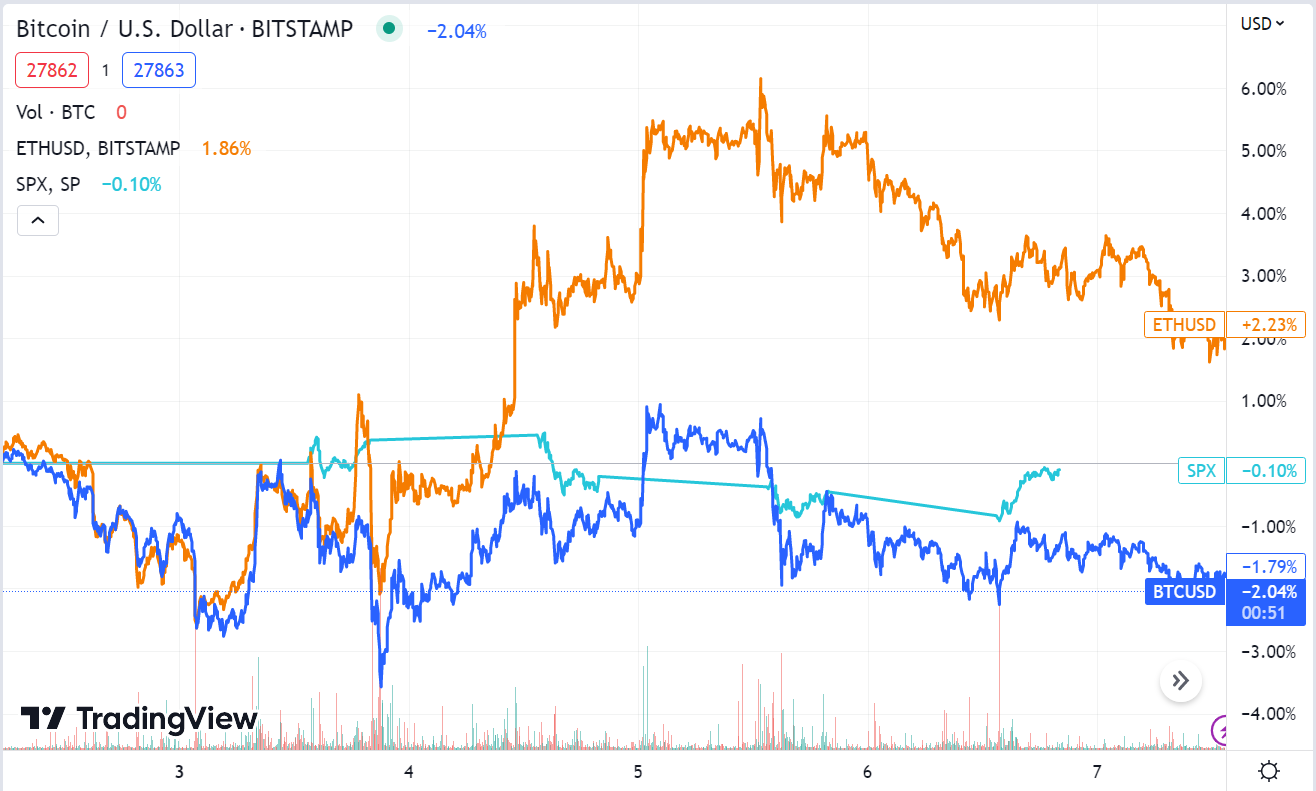

Bitcoin, the world’s largest cryptocurrency by market capitalization, fell 0.96% from March 31 to April 7 to trade at US$27,916 at 9:15 p.m. on Friday in Hong Kong. Ether rose 2.54% in the same period to US$1,854.

This week, worries about bank failures were replaced by concerns about a recession in the U.S. Nonfarm payrolls rose by 236,000 in March, close to 239,000 expected by economists polled by Reuters. This was the lowest monthly gain since December 2020, which may indicate a slowing economy.

According to the International Monetary Fund, global GDP is expected to grow by around 3% over the next five years, below the 20-year average of 3.8%.

Kadan Stadelmann, chief technical officer of blockchain infrastructure development firm Komodo, said Bitcoin is still suffering from bear market blues and price trends are mixed.

“Normally, we see risk on conditions as something that drives up the Bitcoin price. But, over the last month with the banking crisis, we’ve actually seen risk off be positive for Bitcoin. Right now, the price action is telling us the market is undecided,” Stadelmann said in a statement shared with Forkast.

Stablecoin reserves on exchanges continued to drop this week, hitting a two-year low of US$18.06 billion, according to data from analytics platform CryptoQuant, hinting that crypto market liquidity is drying up after the shutdown of three major crypto-focused banks in the U.S.

Tether’s USDT added more than US$1 billion to its stablecoins-leading market capitalization this week, raising it toUS$80.27 billion. Its market cap is up 11.92% over the past month, while rival USDC’s dropped 25.03% to US$32.41 billion, as BUSD lost 15.91% to US$7.09 billion, according to DefiLlama.

The global crypto market capitalization stood at US$1.18 trillion on Friday at 9:15 p.m. in Hong Kong, the same value it had a week ago, according to CoinMarketCap data. Bitcoin’s US$539 billion market cap accounted for 45.9% of the market, while Ether’s US$223 billion accounted for 19%.

See related article: Ethereum’s Shapella upgrade is imminent – and investors are excited

Biggest gainers: INJ & ENJ

INJ, the native governance token of Injective, a layer-1 smart contract blockchain for financial apps, was this week’s biggest gainer among the top 100 coins by market capitalization listed on CoinMarketCap. INJ rose 23.17% during the past week to trade at US$5.77. The token started gaining momentum in early March since launching the ongoing Injective Global Hackathon.

Enjin Coin, the utility token of Enjin, a blockchain platform building non-fungible token solutions, was the week’s second-biggest gainer in the top 100. ENJ rose 19.68% to change hands at US$0.47. The token started its rally on Tuesday, ahead of the release of the upcoming Enjin Platform, which the company teased on social media.

Next week: Will Bitcoin claim US$30,000?

Stadelmann said that Bitcoin could break through US$30,000 briefly in the coming week but cautioned that a recession might be looming.

When this sinks in, some panic selling will start in Bitcoin, but like during the Covid-19 panic, Bitcoin will rebound rather quickly, he said. “The bank runs we have seen in recent months build the case for Bitcoin. They are why Bitcoin was built.”

Marat Minkin, the co-founder of decentralized finance payment app TONBanking, said that regulatory developments and economic data will continue to dictate the crypto market trend next week.

The U.S. is scheduled to release key inflation numbers next week. According to Minkin, Bitcoin is a safe haven asset to hedge against inflation and recession.

See related article: Bitcoin trades under US$28,000, Dogecoin biggest loser

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://forkast.news/bitcoin-stuck-us28000-amid-signs-slowing-economies/

- :is

- ][p

- $UP

- 000

- 1

- 100

- 11

- 7

- 77

- 9

- a

- About

- According

- Action

- actually

- added

- After

- against

- ahead

- Amid

- among

- analytics

- and

- app

- apps

- April

- ARE

- around

- article

- AS

- asset

- At

- average

- Bank

- bank failures

- bank runs

- Banking

- banking crisis

- Banks

- BE

- Bear

- Bear Market

- below

- Biggest

- Billion

- Bitcoin

- Bitcoin Price

- blockchain

- blockchain platform

- Break

- briefly

- build

- Building

- built

- BUSD

- by

- cap

- capitalization

- case

- change

- chief

- claim

- Close

- Co-founder

- Coin

- CoinMarketCap

- Coins

- coming

- company

- Concerns

- conditions

- continue

- continued

- contract

- could

- COVID-19

- crisis

- crypto

- Crypto Market

- cryptocurrency

- data

- decentralized

- Decentralized Finance

- Development

- developments

- Dogecoin

- Drop

- dropped

- during

- Early

- Economic

- economies

- economists

- economy

- ENJ

- Enjin

- Exchanges

- expected

- finance

- financial

- Firm

- For

- Friday

- from

- Gain

- Gainers

- gaining

- GDP

- Global

- Global Crypto

- governance

- Grow

- Hands

- Have

- hedge

- hitting

- Hong

- Hong Kong

- HTTPS

- IMF

- in

- indicate

- inflation

- Infrastructure

- INJ

- Investors

- IT

- ITS

- Key

- Kong

- largest

- Last

- launching

- like

- Liquidity

- Listed

- looming

- Low

- major

- March

- Market

- Market Cap

- Market Capitalization

- market wrap

- might

- mixed

- Momentum

- Monetary

- Month

- monthly

- months

- more

- native

- next

- next week

- non-fungible

- non-fungible token

- Nonfarm

- Nonfarm Payrolls

- numbers

- of

- Officer

- on

- ongoing

- Panic

- past

- payment

- Payrolls

- period

- platform

- plato

- Plato Data Intelligence

- PlatoData

- positive

- price

- PRICE ACTION

- quickly

- raising

- rally

- rather

- rebound

- recent

- recession

- regulatory

- related

- release

- replaced

- reserves

- Reuters

- Risk

- Rival

- ROSE

- s

- safe

- Safe Haven

- Said

- same

- scheduled

- Selling

- shared

- shutdown

- Signs

- since

- Since launching

- Slowing

- smart

- smart contract

- Solutions

- some

- something

- start

- started

- Statement

- Still

- suffering

- Technical

- that

- The

- this week

- three

- Through

- to

- token

- top

- trade

- trades

- Trend

- Trends

- Trillion

- Tuesday

- u.s.

- under

- upcoming

- upgrade

- us

- USDT

- utility

- Utility Token

- value

- week

- weekly

- which

- while

- will

- with

- world’s

- wrap

- years

- zephyrnet