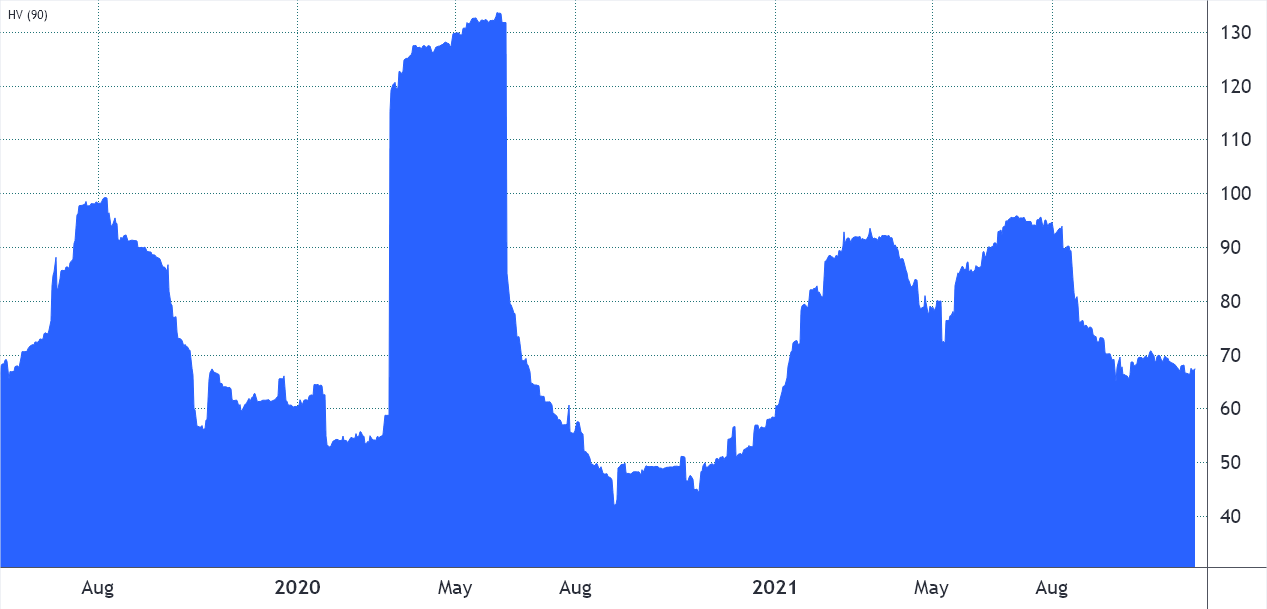

The first rule of Bitcoin (BTC) trading should be “expect the unexpected.” In just the past year alone, there have been five instances of 20% or higher daily gains, as well as five intraday 18% drawdowns. Truth to be told, the volatility of the past 3-months has been relatively modest compared to recent peaks.

Whether it be multi-million dollar institutional fund managers or retail investors, traders new to Bitcoin are often mesmerized by a 19% correction after a local top. Even more shocking to many is the fact that the current $13,360 correction from the Nov. 10 $69,000 all-time high took place over nine days.

The downside move did not trigger alarming-raising liquidations

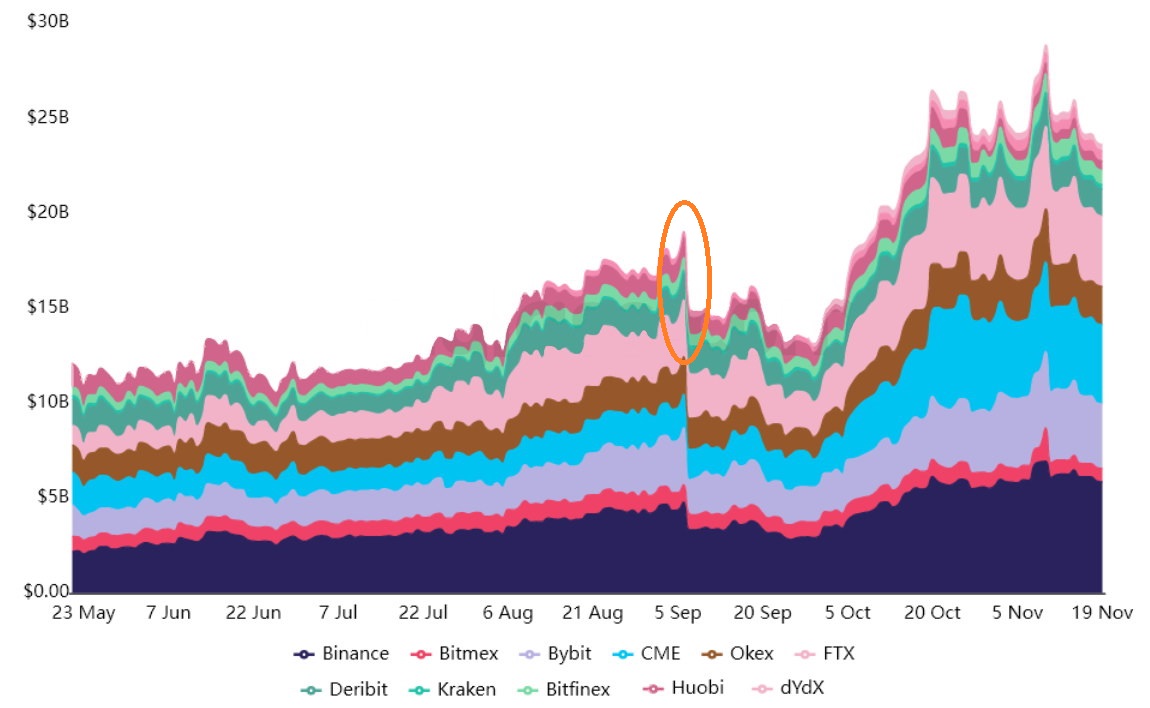

Cryptocurrency traders are notoriously known for high-leverage trading and in just the past 4 days nearly $600 million worth of long (buy) Bitcoin futures contracts were liquidated. That might sound like a decent enough number, but it represents less than 2% of the total BTC futures markets.

The first evidence that the 19% drop down to $56,000 marked a local bottom is the lack of a significant liquidation event despite the sharp price move. Had there been excessive buyers’ leverage at play, a sign of an unhealthy market, the open interest would have shown an abrupt change, similar to the one seen on Sept. 7.

The options markets’ risk gauge remained calm

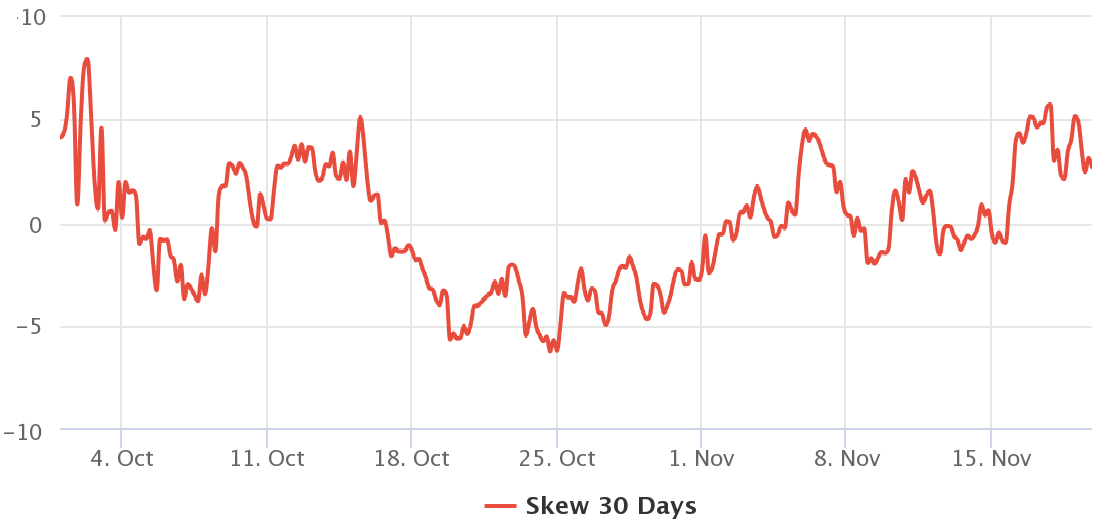

To determine how worried professional traders are, investors should analyze the 25% delta skew. This indicator provides a reliable view into “fear and greed” sentiment by comparing similar call (buy) and put (sell) options side by side.

This metric will turn positive when the neutral-to-bearish put options premium is higher than similar-risk call options. This situation is usually considered a “fear” scenario. The opposite trend signals bullishness or “greed.”

Values between negative 7% and positive 7% are deemed neutral, so nothing out of the ordinary happened during the recent $56,000 support test. This indicator would have spiked above 10% had pro traders and arbitrage traders detected higher risks of a market collapse.

Comercianții în marjă încă merg mult timp

Tranzacționarea în marjă permite investitorilor să împrumute criptomonede pentru a-și valorifica poziția de tranzacționare, crescând astfel randamentele. De exemplu, se pot cumpăra criptomonede împrumutând Tether (USDT) and increasing their exposure. On the other hand, Bitcoin borrowers can only short it as they bet on the price decrease.

Spre deosebire de contractele futures, echilibrul dintre marje lungi și scurte nu este întotdeauna egal.

The above chart shows that traders have been borrowing more USDT recently, as the ratio increased from 7 on Nov. 10 to the current 13. The data leans bullish because the indicator favors stablecoin borrowing by 13 times, so this could be reflecting their positive exposure to Bitcoin price.

All of the above indicators show resilience in the face of the recent BTC price drop. As previously mentioned, anything can happen in crypto, but derivatives data hints that $56,000 was the local bottom.

Opiniile și opiniile exprimate aici sunt doar cele ale autor și nu reflectă neapărat părerile lui Cointelegraph. Fiecare mișcare de investiții și tranzacționare implică risc. Ar trebui să efectuați propria cercetare atunci când luați o decizie.

- 000

- 7

- arbitrajul

- Bitcoin

- Bitcoin Futures

- Prețul Bitcoin

- Imprumut

- BTC

- pret btc

- Bullish

- cumpăra

- apel

- Schimbare

- Cointelegraph

- contracte

- cripto

- cryptocurrencies

- cryptocurrency

- Curent

- de date

- Deltă

- Instrumentele financiare derivate

- FĂCUT

- Dolar

- Picătură

- eveniment

- Față

- First

- fond

- Futures

- aici

- Înalt

- Cum

- HTTPS

- Instituţional

- interes

- investiţie

- Investitori

- IT

- împrumut

- Pârghie

- Lichidare

- local

- Lung

- Efectuarea

- Piață

- pieţe

- milion

- muta

- deschide

- Avize

- Opţiuni

- Altele

- Joaca

- Premium

- preţ

- Pro

- motive

- cercetare

- cu amănuntul

- Investitori de vânzare cu amănuntul

- Returnează

- Risc

- vinde

- sentiment

- Pantaloni scurți

- pantaloni scurti

- So

- stablecoin

- a sustine

- test

- Tether

- top

- Comercianti

- Trading

- USDT

- Vizualizare

- Volatilitate

- valoare

- an