Crypto regulations among different states within the US have picked up. In California, the Department of Financial Protection and Innovation (DFPI) warned its consumers to be cautious before investing in crypto interest accounts.

California cracks down on crypto interest accounts

DFPI a cerut users to refrain from crypto-asset accounts that attracted interest. The regulatory body said it was investigating the crypto accounts that provided multiple interests to assess whether they violated the laws set by the DFPUI in the jurisdictions where it had authority.

On Tuesday, the DFPI said that the providers of such accounts did not comply with the rules and regulations followed by banks and other financial institutions such as credit unions. Moreover, some of these platforms prevented customers from withdrawing money from their accounts or transferring funds between accounts.

Capitalul dvs. este în pericol.

In the warning, the DFPI added that consumers and investors based in California should be vigilant because most of the providers of these accounts failed to disclose the associated level of risk faced by customers after they make their deposits. It also urged investors to look out for any solicitation from such platforms asking them to invest and access financial services.

According to the regulator, certain providers of crypto-interest accounts provided unregistered securities to their clients. Moreover, the regulator has issued cease and desist order to Voyager Digital and BlockFi, urging them to halt operations in California.

Voyager’s bankruptcy filing

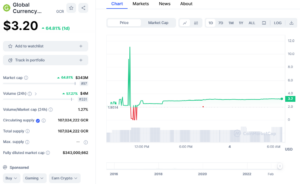

It is important to note that BlockFi and Voyager are facing a liquidity crisis, and the latter has already filed for bankruptcy. However, the company has also provided a recovery plan where depositors will receive a combination of cryptocurrencies, VGX tokens, and the common shares of a newly reorganized company. Proceeds recovered from 3AC will also be shared with the exchange’s users.

Voyager added that the amount distributed to the users will depend on the restructuring and the recovery of assets from 3AC. However, this plan did not sit well with all of the exchange’s depositors.

One Twitter user expressed his disapproval of the recovery plan and even quoted the DFPI’s concerns about the risk disclosure of some crypto platforms. The Twitter user complained that the exchange had not issued any notice that it would freeze assets. The user complained that Voyager had used its assets to raise its value. Voyager filed for bankruptcy after 3AC failed to repay a $680M loan.

Citeşte mai mult:

Battle Infinity – Noua prevânzare Crypto

- Prevânzare Până în octombrie 2022 – 16500 BNB Hard Cap

- Primul joc Fantasy Sports Metaverse

- Jucați pentru a câștiga utilitar – Jeton IBAT

- Alimentat de Unreal Engine

- Verificat CoinSniper, auditat cu dovezi solide

- Roadmap și White Paper la battleinfinity.io

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- descentralizată

- DEFI

- Active digitale

- ethereum

- InsideBitcoins

- masina de învățare

- jeton non-fungibil

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- W3

- zephyrnet