Bitcoin (BTC) bounced considerably on Sept 22, potentially marking the end of a nearly two week long downward movement.

Afterwards, the ongoing increase has invalidated a significant portion of potential bearish counts. Therefore, it is likely that BTC has bottomed.

Two possibilities

Comerciant Cryptocurrency @TheTradinghubb outlined two potential counts for BTC, one bullish and the other bearish. In this article, we will take a look at both and determine which is the most likely to transpire.

Bullish BTC count

The only thing that seems certain for the BTC movement is that the decrease from the April 14 all-time high (highlighted) is a five wave bearish impulse. However, it is not certain if that is part of a C wave (white) or if it is the beginning of a new bearish impulse.

The bullish count indicates that it is a C wave. Therefore, a new impulse (white) began on June 22. The ongoing decrease since Sept 7 was part of wave 2. Afterwards, the bounce on Sept 22 likely marked the end of the correction. The fact that the bounce occurred right at the 0.5 Fib retracement level further solidifies this possibility.

The sub-wave count is given in orange. The aforementioned decrease resembles a textbook A-B-C corrective structure, in which waves A:C had a 1:1 ratio.

Furthermore, the movement is contained inside a descending parallel channel.

The increase above the wave one low at $42,900 (red line) invalidates the majority of potential bear counts, unless this is a massive 1-2/1-2 formation, which seems extremely unlikely.

Număr de BTC în baj

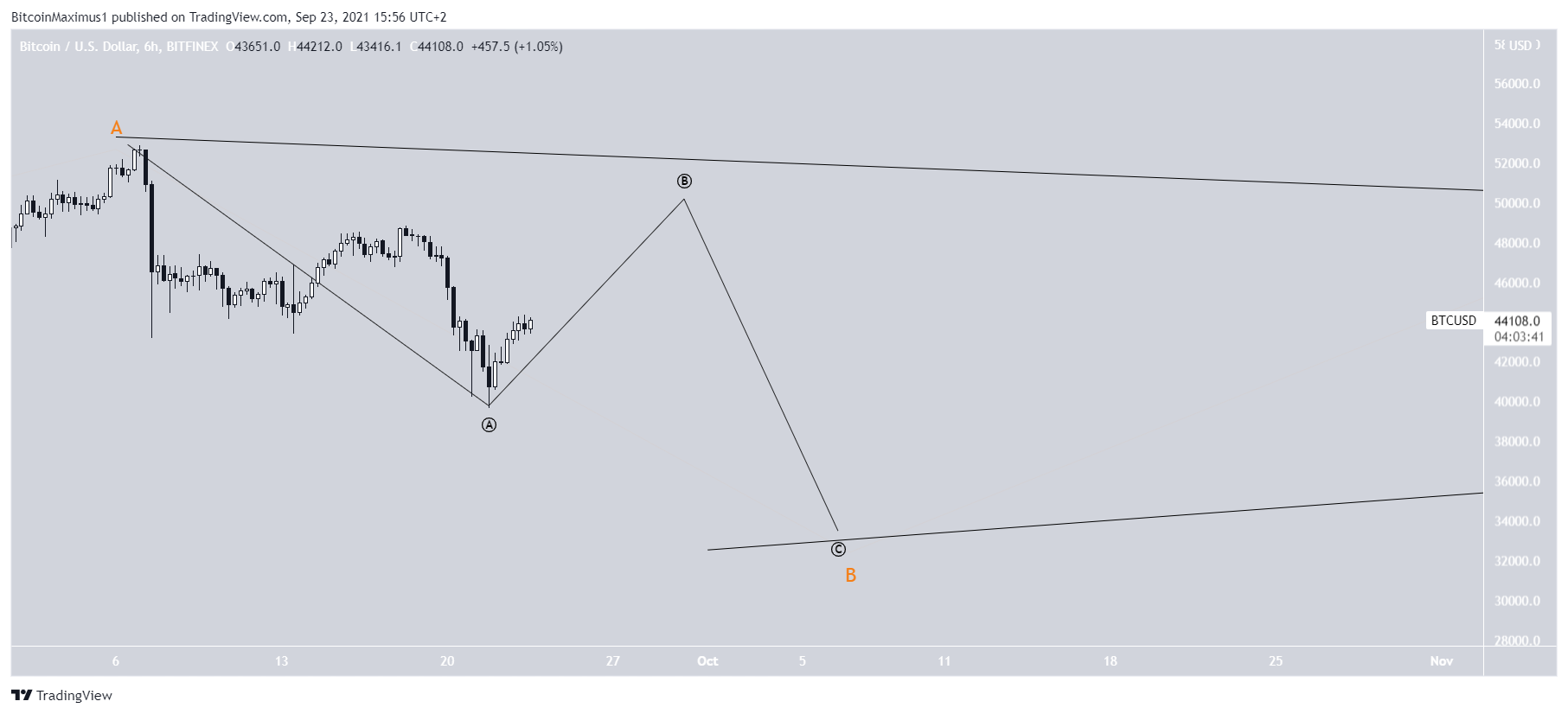

The bearish count suggests that the entire upward movement since June 22 was part of a corrective structure (orange). In this case, another downward movement that takes the price below the June 22 lows would be expected (white).

The issue with this count is the length of the C wave (orange), which is nearly 3.61 times as long as wave A.

However, even if the count proves to be true, an upward movement towards $50,000 would be initially expected before the ensuing drop.

Pentru cele mai recente BeInCrypto Bitcoin (BTC) analiza, click aici.

Ce părere aveți despre acest subiect? Scrie-ne și spune-ne!

Declinare a responsabilităţii

Toate informațiile conținute pe site-ul nostru web sunt publicate cu bună-credință și numai în scopuri generale. Orice acțiune pe care cititorul o ia asupra informațiilor găsite pe site-ul nostru este strict pe propria răspundere.

Source: https://beincrypto.com/outlining-bitcoins-btc-most-likely-wave-count/

- 000

- 7

- Acțiune

- TOATE

- analiză

- analist

- Aprilie

- articol

- Barcelona

- de urs

- BTC

- Bullish

- cryptocurrencies

- cryptocurrency

- de date

- a descoperit

- Picătură

- Economie

- financiar

- General

- bine

- absolvent

- Înalt

- Evidențiat

- HTTPS

- Crește

- informații

- IT

- Nivel

- Linie

- Lung

- Majoritate

- pieţe

- Altele

- preţ

- dovedește

- Cititor

- Risc

- Şcoală

- comerciant

- us

- Val

- valuri

- website

- site-uri web

- săptămână

- scris

- youtube