Bitcoin rose in afternoon trading in Asia, leading the gainers in the top 10 cryptocurrencies, fueling a wider market recovery as it returned to the US$26,000 support level. Despite the uptick, market experts warn of another potential drop to US$25,000.

Vezi articolul aferent: Încheierea săptămânală a pieței: verdictul favorabil al tribunalului Grayscale, hypeul ETF nu reușește să ridice Bitcoin peste 28,000 USD

Bitcoin, Solana leads winners in top 10

Bitcoin was the day’s biggest gainer in the top 10 cryptocurrencies, rising 1.86% in the 24 hours leading up to 4:30 p.m. in Hong Kong, to US$26,208, regaining the US$26,000 support level for the first time since Monday. Despite the bullish momentum, market analysts are warning of another potential drop to US$25,000.

“Bitcoin has been wandering on a steady sideways move since the beginning of September. The lack of liquidity in the market leaves it with no volatility,” Aziz Kenjaev, financial analyst and director of business development at cross-chain liquidity protocol Încurcați, a declarat pentru Forkast.

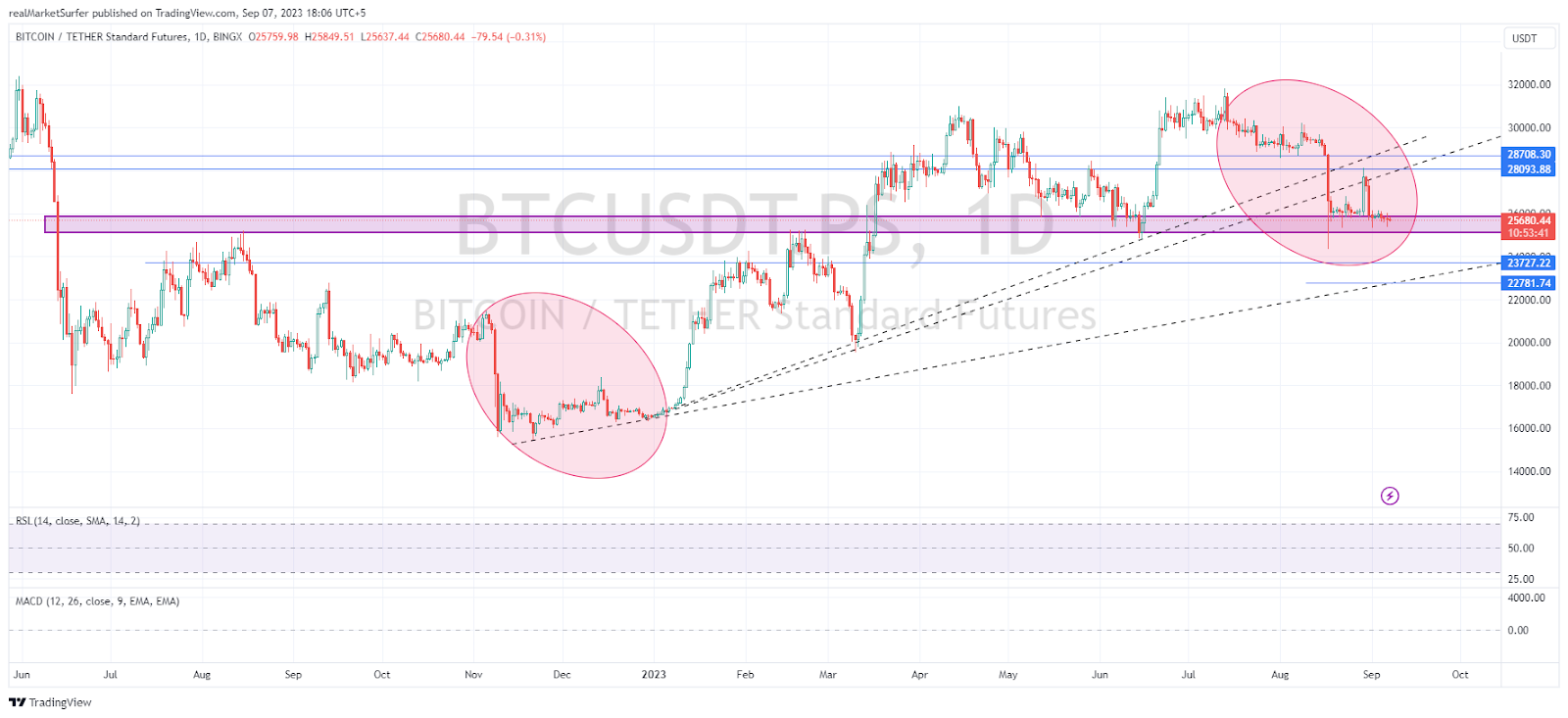

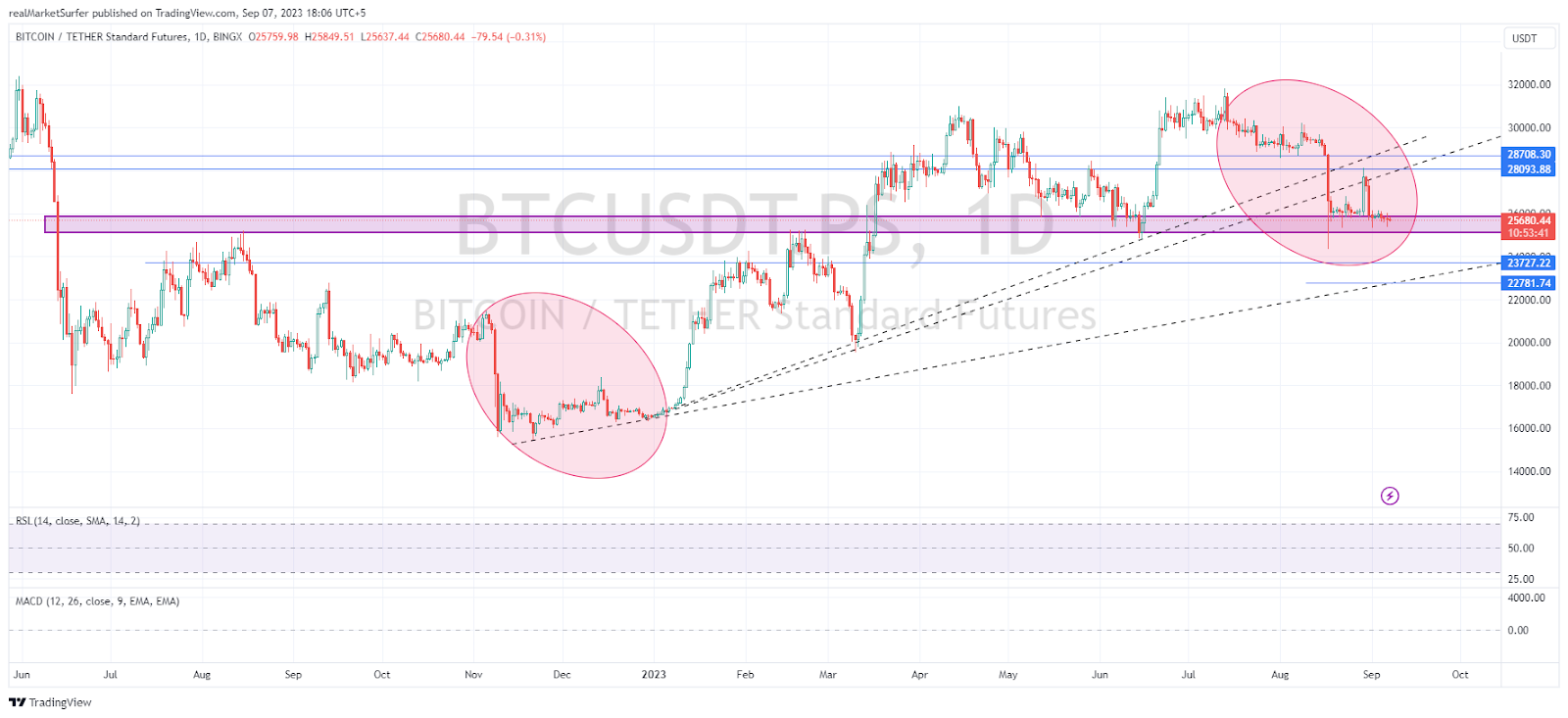

“In the current scenario, Bitcoin must close [the week] above US$26,000 to continue bullish, and closing below US$25,100 might signal another drop, towards US$23,750,” added Kenjaev, referencing the below chart.

Ether remained flat during afternoon trading in Asia at US$1,644, despite Cathie Wood’s Ark Invest filing for a spot Ether ETF in Statele Unite ale Americii

Jetonul SOL al Solanei was the day’s second-biggest gainer, rising 1.46% in the past 24 hours to US$19.78, but still remaining near its two-month low.

Capitalizarea totală a pieței cripto în ultimele 24 de ore a crescut cu 1.08%, până la 1.05 trilioane USD, în timp ce volumul pieței a scăzut cu 0.94%, la 26.07 miliarde USD, potrivit datelor. CoinMarketCap de date.

Solana becomes second-largest network by 24-hour NFT sales volume

Indexul Forkast 500 NFT a scăzut cu 0.28% la 2,138.62 puncte în cele 24 de ore până la 4:30 în Hong Kong și a scăzut cu 2.50% în timpul săptămânii.

Solana became the second-largest blockchain network by 24-hour NFT sales volume, rising 9.37% to US$1.17 million, boosted by a 90% surge in the Taiyo Pilots collection that generated US$74,533 in sales for the network.

Mirroring the sales surge, The Forkast SOL NFT compozit a crescut cu 0.7% la 643.56 puncte.

Ethereumvânzările NFT pe 24 de ore au crescut cu 9.14%, până la 6.5 milioane USD, ca vânzări pentru Clubul de iahturi Bored Ape increased 40.83% to US$1.25 million, making it the largest NFT collection across all blockchains by 24-hour sales volume.

Over on Polygon, 24-hour sales for the DraftKings collection slumped 61.92% to US$529,173, as Polygon fell to become the fifth-largest blockchain by daily NFT sales volume.

Asian, U.S. equities fall; STOXX 600 sees biggest losing streak since 2016

Major Asian equities fell for a second consecutive day as of 4:30 p.m. in Hong Kong, including the Shanghai compozit, A Japoniei Nikkei 225 si Componenta Shenzhen.

Hong Kong exchanges canceled all trading on Friday after an extreme weather alert from the city’s meteorological authority.

Investors remained concerned about China’s lagging economic recovery, after yesterday’s customs data showed that Chinese exports and imports marked the fourth consecutive month of declines.

Au scăzut, de asemenea, contractele futures majore din SUA, inclusiv indicele futures S&P 500, futures-ul Nasdaq-100, puternic tehnologic, și futures Dow Jones Industrial Average.

The declines came despite investors betting on a pause in interest rate hikes at the next Federal Open Market Committee meeting scheduled for Sept. 19-20. The Instrument CME FedWatch prezice o șansă de 95% ca banca centrală să mențină rata actuală neschimbată în septembrie, în creștere față de 93% de joi. Oferă o șansă de 57.4% pentru o altă pauză în noiembrie.

Over in Europe, the benchmark STOXX 600 fell 0.5%, marking its biggest losing streak since October 2016. Frankfurt’s DAX 40 declined 0.64%, in its sixth consecutive session of losses.

Investors remained uncertain about the European Central Bank’s next interest rate decision scheduled for next Thursday.

Vezi articolul aferent: Grayscale câștigă împotriva SEC pe măsură ce India trece pe blockchain; Friend.tech își pierde prietenii

Actualizări cu acțiuni

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- PlatoData.Network Vertical Generative Ai. Împuterniciți-vă. Accesați Aici.

- PlatoAiStream. Web3 Intelligence. Cunoștințe amplificate. Accesați Aici.

- PlatoESG. Automobile/VE-uri, carbon, CleanTech, Energie, Mediu inconjurator, Solar, Managementul deșeurilor. Accesați Aici.

- PlatoHealth. Biotehnologie și Inteligență pentru studii clinice. Accesați Aici.

- ChartPrime. Crește-ți jocul de tranzacționare cu ChartPrime. Accesați Aici.

- BlockOffsets. Modernizarea proprietății de compensare a mediului. Accesați Aici.

- Sursa: https://forkast.news/ether-most-top-10-cryptos-rise-bitcoin-leads-gains-market-recovery/

- :are

- ][p

- $UP

- 000

- 07

- 1

- 10

- 100

- 17

- 17 milioane de euro

- 2016

- 24

- 25

- 30

- 40

- 500

- 9

- 95%

- a

- Despre Noi

- mai sus

- Conform

- peste

- adăugat

- După

- împotriva

- Alerta

- TOATE

- de asemenea

- an

- analist

- analiști

- și

- O alta

- APE

- SUNT

- Arcă

- arca invest

- articol

- AS

- Asia

- asiatic

- At

- autoritate

- in medie

- Bancă

- a devenit

- deveni

- devine

- fost

- Început

- de mai jos

- Benchmark

- Pariu

- Cea mai mare

- Miliard

- Bitcoin

- blockchain

- Rețea de blocări

- blockchains

- amplificat

- Bullish

- afaceri

- dezvoltarea afacerii

- dar

- by

- a venit

- capitalizare

- central

- Banca centrala

- șansă

- Diagramă

- Din China

- chinez

- Oraș

- Închide

- închidere

- CO

- colectare

- COM

- comitet

- îngrijorat

- consecutiv

- continua

- Tribunal

- Cross-Chain

- cripto

- Piața Crypto

- cryptocurrencies

- cryptos

- Curent

- vamă

- zilnic

- de date

- zi

- decizie

- Scăderile

- scăzut

- În ciuda

- Dezvoltare

- Director

- dow

- Dow Jones

- Dow Jones Industrial Average

- DraftKings

- Picătură

- în timpul

- Economic

- element

- aciunile

- ETF

- Eter

- Europa

- european

- Platforme de tranzacţionare

- experți

- exporturile

- extremă

- FAIL

- Cădea

- favorabil

- federal

- Comitetul Federal pentru Piața Deschisă

- Depunerea

- financiar

- First

- prima dată

- plat

- Pentru

- Al patrulea

- Vineri

- prieten

- din

- Futures

- Câștig

- câștig

- generată

- oferă

- Drumeții

- Hong

- Hong Kong

- ORE

- HTML

- http

- HTTPS

- hype

- importurile

- in

- Inclusiv

- a crescut

- index

- India

- industrial

- interes

- RATA DOBÂNZII

- CREȘTERILE DOBÂNZILOR

- Investi

- Investitori

- IT

- ESTE

- Japonia

- jones

- jpg

- Kong

- lipsă

- rămâne în urmă

- cea mai mare

- conducere

- Conduce

- Nivel

- Lichiditate

- Pierde

- care pierde

- pierderi

- Jos

- menține

- Efectuarea

- marcat

- Piață

- Capitalizare de piață

- înveliș de piață

- marcare

- max-width

- Reuniunea

- ar putea

- milion

- Impuls

- luni

- Lună

- cele mai multe

- muta

- mişcă

- trebuie sa

- În apropiere

- reţea

- Nou

- New York

- New York City

- următor

- NFT

- Colecția NFT

- vânzări nft

- Volumul vânzărilor NFT

- Nu.

- noiembrie

- octombrie

- of

- on

- deschide

- peste

- trecut

- pauză

- Plato

- Informații despre date Platon

- PlatoData

- puncte

- Poligon

- potenţial

- prezice

- protocol

- rată

- creșterea ratei

- recuperare

- corelarea

- legate de

- a ramas

- rămas

- Ridica

- în creștere

- ROSE

- s

- S&P

- S&P 500

- de vânzări

- Volum de vânzări

- scenariu

- programată

- SEC

- Al doilea

- al doilea cel mai mare

- vede

- Șapte

- Septembrie

- sesiune

- a arătat

- lateral

- Semnal

- Semne

- întrucât

- al șaselea

- SOL

- SOL NFT

- suntrap

- constant

- Încă

- stoc

- dungă

- stradă

- a sustine

- nivel de suport

- apare

- tech

- acea

- joi

- timp

- la

- top

- Top 10

- Total

- față de

- Trading

- Trilion

- ne

- Nesigur

- Verdict

- Volatilitate

- volum

- Perete

- Wall Street

- de avertizare

- a fost

- Vreme

- săptămână

- în timp ce

- mai larg

- voi

- Câştigătorii

- Victorii

- cu

- încadra

- iaht

- York

- zephyrnet