Fintech platform COTI is launching volatilitate jetoane pe descentralizate (DEX) to enable the trading of crypto market volatility.

Users can now buy a volatility token long on a DEX, if they think volatility will increase. Conversely, users can sell a volatility token if they think volatility will decrease. Some tokens even have leverage already built into them.

Besides speculating on volatility, the token can also serve as an impermanent-loss protection mechanism. Because most decentralized finance (DEFI) protocols are linked to Ethereum, volatility tokens’ value could rise due to any imbalance between the related tokens during a volatile period.

First, COTI will lansa the ETHVOL token, which can be traded on any Ethereum-based DEXs. It will follow this with the CVIVOL token, which can be traded on any Polygon-supported DEXs.

Crypto volatility index

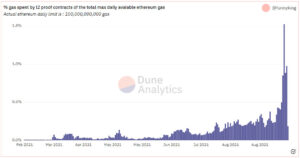

COTI is launching these tokens to complement its recently a lansat Crypto Volatility Index (CVI). CVI is the first decentralized version of the VIX, the Chicago Board Options Exchange’s CBOE Volatility Index. Commonly referred to as the “Market Fear Index,” the VIX allows traders to hedge against or profit off of market volatility.

With CVI, COTI is now enabling this ability for traders in the crypto markets. COTI derived the CVI from cryptocurrency option prices coupled with the market’s expectation of future volatility. It works in a decentralized fashion by using a network of decentralized Chainlink oracles.

Volatilitatea tranzacționării

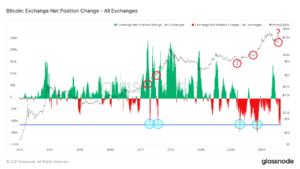

While volatility trading instruments have existed in traditional finance for some time, they are only now being introduced into the crypto markets. Aside from hedging against or profiting from volatility traders, institutional investors and hedge fund managers use such them for portfolio diversification.

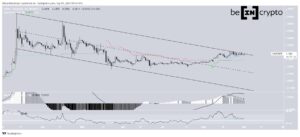

Meanwhile, as cryptocurrencies evolve into a new class of financial assets, volatility seems to be one of their complementary features. This has particularly been the case over the last month. While bitcoin reached a peak of nearly $65,000 in April, tweets from Elon Musk saw it fall below $50,000. Successive ştiri out of China has also sent the price of bitcoin reeling, and it’s been bouncing between $30,000 and $40,000 over the past few weeks.

A reliable decentralized volatility index, and the means to trade this volatility seems pertinent to traders in such an environment. According to Stansberry Research’s “Crypto Capital” report of April 2021, the crypto volatility market is ripe for investment, with potential gains of more than 400% in the next 12–24 months.

Declinare a responsabilităţii

Toate informațiile conținute pe site-ul nostru web sunt publicate cu bună-credință și numai în scopuri generale. Orice acțiune pe care cititorul o ia asupra informațiilor găsite pe site-ul nostru este strict pe propria răspundere.

Source: https://beincrypto.com/crypto-volatility-tokens-traders-profit-turbulent-markets/

- 000

- Acțiune

- TOATE

- Google Analytics

- Aprilie

- Bunuri

- CEL MAI BUN

- Bitcoin

- blockchain

- Tehnologia blocurilor

- bord

- afaceri

- cumpăra

- Za

- Chicago

- China

- Comunicare

- cripto

- Piața Crypto

- Piețele Crypto

- cryptocurrencies

- cryptocurrency

- de date

- om de știință de date

- descentralizată

- Finanțe descentralizate

- Dex

- diversificarea

- Economic

- Economie

- Elon Musk

- Mediu inconjurator

- Modă

- DESCRIERE

- finanţa

- financiar

- First

- urma

- fond

- viitor

- General

- bine

- HTTPS

- Crește

- index

- informații

- Instituţional

- investitori instituționali

- investiţie

- Investitori

- IT

- Pârghie

- Lung

- Piață

- pieţe

- mediu

- luni

- reţea

- Opțiune

- Opţiuni

- platformă

- portofoliu

- preţ

- Profit

- protecţie

- Cititor

- raportează

- Risc

- Ştiinţă

- vinde

- Tehnologia

- timp

- semn

- indicativele

- comerţului

- Comercianti

- Trading

- finanțe tradiționale

- utilizatorii

- valoare

- Volatilitate

- website

- OMS

- fabrică

- scris