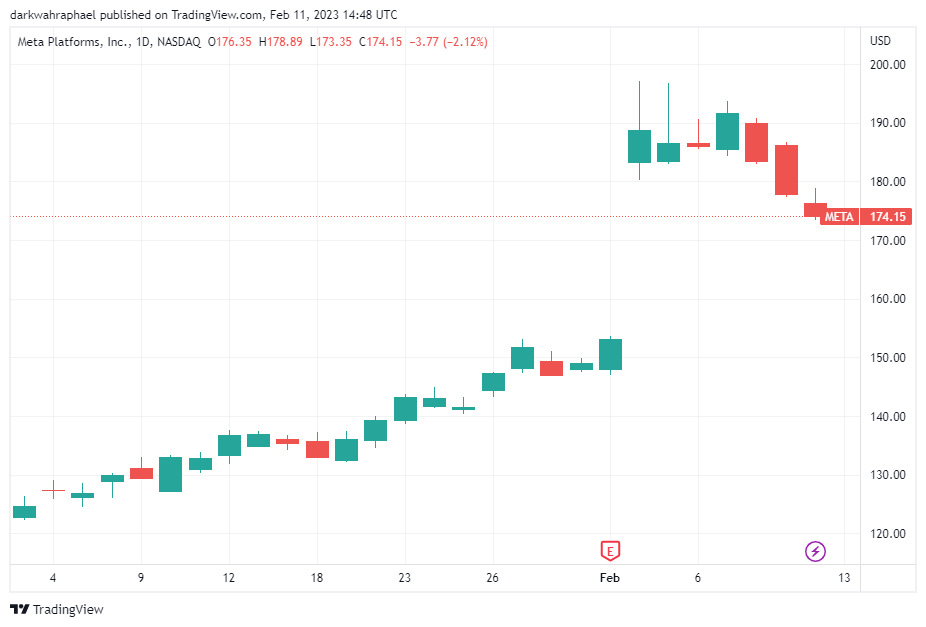

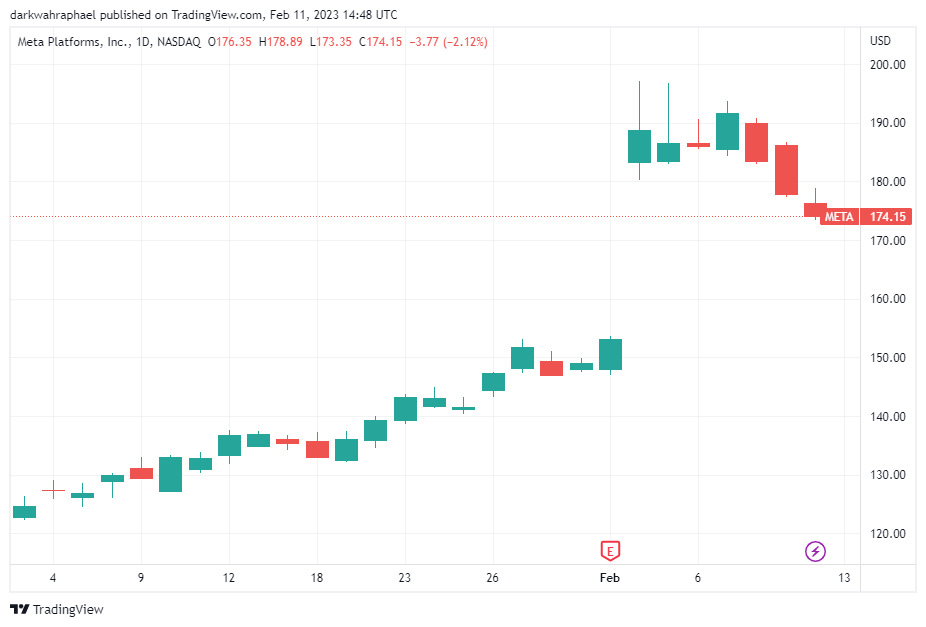

META, the stock of Meta Platforms Inc., a company that owns products such as Facebook, Instagram, Messenger, WhatsApp, Meta Quest, Horizon Worlds, Mapillary, Workplace, and Diem which operates in the social media, social network, advertising, consumer electronics, and virtual reality (VR) space has risen by 60% in the first five weeks of 2023 on the back of a positive earnings report released on Feb. 1.

TradingView

Meta Platforms Inc. exceeds revenue expectations

The company exceeded its fourth-quarter revenue expectations of $ 31.53 de miliarde de by bringing in $ 32.17 de miliarde de and this led METAs price to reach a yearly high of $197.16 on Feb. 2 after opening the year with a trading price of $122.82.

Excerpts of the report disclosed that the daily active user base of Facebook increased to 2 miliarde din 1.98 miliarde in the final quarter of 2022. This led to a $163.34 miliarde increment in market capitalization to $ 489 de miliarde de after opening the year with a valuation of $ 326 de miliarde de.

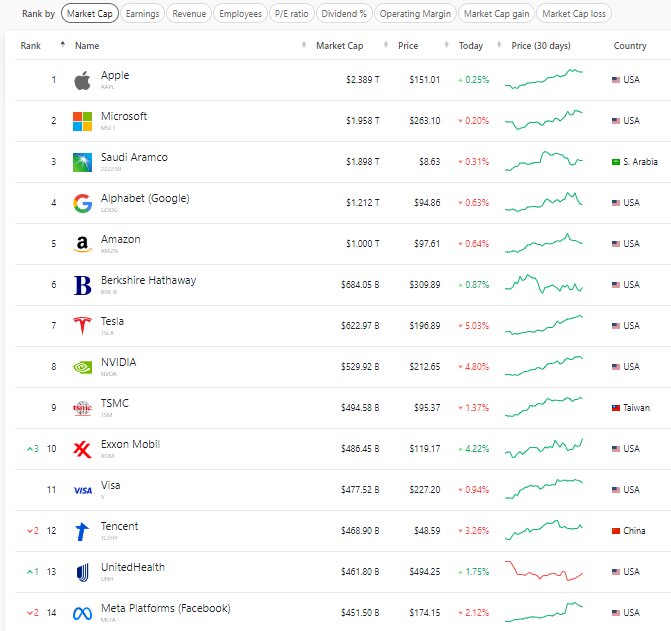

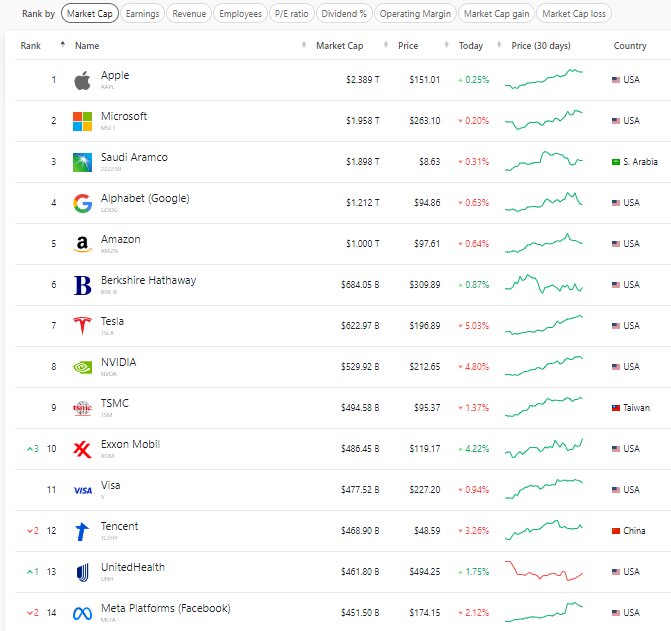

Diagrame financiare

META gets its mojo back

After losing its grip in the stock market by closing with a capitalization of $ 271.41 de miliarde de, companies such as beverage corporations Coca-Cola (KO) și PepsiCo (PEP), computer technology company Oracle (ORCL), a retail store chain Costco (COST), multinational oil and gas company Shell (Shel), automotive manufacturer Toyota (TM), world’s largest restaurant chain McDonald (MCD), consumer wear brand Nike (NKE), computer software company Adobe (ADBE), media company Netflix (NFLX), telecommunications holding company AT&T (T), and Boeing (BA) surpassed META on the ranks of the most valuable companies across the globe.

With the significant rise in share price, the company currently trails only United Health (Unh), Tencent (TCEHY), Viza (V), Exxon Mobil (XOM), TSMC (TSM), NVIDIA (NDVA), Tesla (TSLA), Berkshire Hathaway (B-BRK), Amazon (AMZN), Alfabet (GOOG), Saudi Aramco (2222SR), Microsoft (MSFT), și Apple (AAPL).

Companii Market Cap

Zuckerberg calls 2023 a year of efficiency

After betting big on the Metaverse, a growing sector that has been forecasted to be worth $ 824.53 de miliarde de by 2030 at a compound annual growth rate (CAGR) de 39.1% and losing, META shed more than 60% din valoarea sa în 2022.

On the back of the losses led to a substantial reduction in its staff by a total of 11,000 in November last year. This is why Mark Zuckerberg said in a statement covered by CNBC that this year is a Year of Efficiency and the company is focused on becoming stronger and appreciates the strong engagement across the use of his firm’s applications.

Facebook expanding with Within Unlimited acquisition

Meta has been given the green light to buy Within Unlimited, a maker of virtual reality (VR) fitness application called Supernatural. This comes seven months after the Comisia Federală de Comerț (FTC) sued to block the acquisition in July by accusing Meta of trying to buy its way to the top of the competition in the technology industry.

Such deals which solidify Meta’s position in the development of the Metaverse de aceea 47 analiștii chestionați de CNN de afaceri forecasts the company’s stock to reach a median price of $210 and a high price of $275 în următoarele 12 luni.

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- Platoblockchain. Web3 Metaverse Intelligence. Cunoștințe amplificate. Accesați Aici.

- Sursa: https://metanews.com/meta-plans-fresh-job-cuts-to-kick-off-year-of-efficiency/?utm_source=rss&utm_medium=rss&utm_campaign=meta-plans-fresh-job-cuts-to-kick-off-year-of-efficiency

- 1

- 12 luni

- 2022

- 2023

- 98

- a

- achiziție

- peste

- activ

- adăugat

- chirpici

- Promovare

- După

- Alfabet

- Amazon

- analiști

- și

- anual

- Apple

- aplicație

- aplicatii

- AT & T

- auto

- înapoi

- de bază

- devenire

- Berkshire

- Berkshire Hathaway

- Pariu

- BĂUTURĂ

- Mare

- Miliard

- Bloca

- Boeing

- marca

- Aducere

- cumpăra

- denumit

- apeluri

- capitalizare

- lanţ

- închidere

- CNBC

- CNN

- Coca-Cola

- Companii

- companie

- Compania

- concurs

- Compus

- calculator

- consumator

- Corporații

- acoperit

- În prezent

- reduceri

- zilnic

- Oferte

- Dezvoltare

- Diem

- Câștig

- Raportul privind câștigurile

- eficiență

- Componente electronice

- angajament

- depășește

- extinderea

- aşteptări

- explodeaza

- Exxon Mobil

- final

- First

- fitness

- concentrat

- proaspăt

- FTC

- GAS

- dat

- glob

- Verde

- lumina verde

- În creştere

- Creștere

- Sănătate

- Înalt

- deținere

- orizont

- Lumile Orizont

- HTML

- HTTPS

- in

- Inc

- a crescut

- industrie

- Loc de munca

- reduceri de locuri de muncă

- iulie

- lovi cu piciorul

- cea mai mare

- Nume

- Anul trecut

- Led

- ușoară

- care pierde

- pierderi

- producător

- Producător

- marca

- marca zuckerberg

- Piață

- Capitalizare de piață

- max-width

- MCDONALD

- Mass-media

- Mesager

- meta

- META PLATFORME

- Meta căutare

- Goluri

- luni

- mai mult

- cele mai multe

- multinațională

- Netflix

- reţea

- următor

- NIKE

- noiembrie

- Nvidia

- Ulei

- Petrol și gaze

- de deschidere

- opereaza

- oracol

- deține

- Planurile

- Platforme

- Plato

- Informații despre date Platon

- PlatoData

- poziţie

- pozitiv

- preţ

- Produse

- Trimestru

- căutare

- rândurile

- rată

- ajunge

- Realitate

- eliberat

- raportează

- restaurant

- cu amănuntul

- venituri

- Ridica

- răsărit

- Said

- Arabia

- Saudi Aramco

- sector

- Șapte

- Distribuie

- Coajă

- semnificativ

- Social

- social media

- reţea socială

- Software

- Spaţiu

- Personal

- Declarație

- stoc

- bursa de valori

- stoca

- puternic

- puternic

- substanțial

- astfel de

- dat în judecată

- supranatural

- depășit

- au realizat studii

- Tehnologia

- de telecomunicaţii

- Tencent

- Tesla

- în acest an

- la

- top

- Total

- toyota

- comerţului

- Trading

- adevărat

- tsmc

- Unit

- nelimitat

- utilizare

- Utilizator

- Valoros

- Evaluare

- valoare

- Virtual

- Realitate virtuala

- are drept scop

- vr

- săptămâni

- care

- în

- La locul de muncă

- lume

- an

- zephyrnet

- Zuckerberg