Acțiuni ale

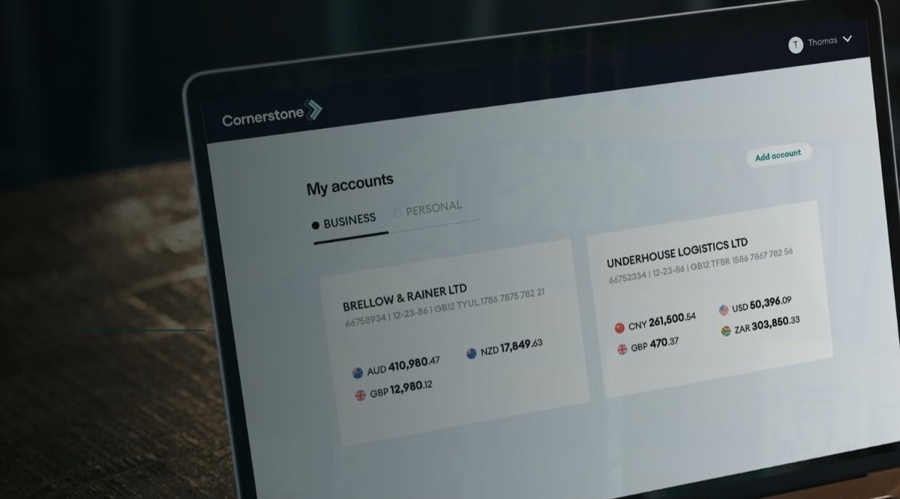

Cornerstone, a foreign exchange and payments solution provider, surged nearly

35% today (Monday) on the London Stock Exchange following a trading update that

suggested their revenue and EBITDA for the fiscal year 2023 (FY23) will be “materially above current market expectations.” Although the company

did not provide specific figures, this information was sufficient to spark

optimism among investors.

Cornerstone’s Revenue

Expected to Exceed £8 Million

Mai târziu

trading update came after an announcement at the end of October, when the

company reported that its full revenue for FY23 is expected to be cel puțin 8 de lire sterline

milion, marking a 66% increase year-over-year.

Acum,

company hints that the final results will be higher than previously

anticipated as it continues to experience “strong trading momentum,”

reflecting changes made in its operations over the past year.

"Foarte

strong trading has continued to date and, as a result, the Group now

anticipates reporting revenue and adjusted EBITDA for the year to 31 December

2023 materially ahead of current market expectations,” the company

a comentat.

Acestea

developments led Cornerstone’s shares to rise by 34.8% to 16.3 pence on Monday,

testing over-monthly highs.

Sursa: Tradingview.com

Continued Strong

Performance for Cornerstone

În prima jumătate din 2023, Cornerstone announced a 90% increase in

venituri, reaching £3.6 million. The company was optimistic about maintaining

this positive trend in the latter half of the fiscal year 2023, anticipating

results that surpass expectations.

Should Cornerstone achieve or exceed its projected outcomes for 2023, it

would mark a continuation of the impressive growth vazut in 2022. Anul trecut,

company saw its revenue soar by 110% to £4.8 million, up from £2.3 million the

year before.

A significant portion of Cornerstone’s revenue is attributed to its core

services in foreign schimb și plăți , especially from spot and forward

transactions. These services accounted for 92% and 8% of the total revenue,

respectiv.

Acțiuni ale

Cornerstone, a foreign exchange and payments solution provider, surged nearly

35% today (Monday) on the London Stock Exchange following a trading update that

suggested their revenue and EBITDA for the fiscal year 2023 (FY23) will be “materially above current market expectations.” Although the company

did not provide specific figures, this information was sufficient to spark

optimism among investors.

Cornerstone’s Revenue

Expected to Exceed £8 Million

Mai târziu

trading update came after an announcement at the end of October, when the

company reported that its full revenue for FY23 is expected to be cel puțin 8 de lire sterline

milion, marking a 66% increase year-over-year.

Acum,

company hints that the final results will be higher than previously

anticipated as it continues to experience “strong trading momentum,”

reflecting changes made in its operations over the past year.

"Foarte

strong trading has continued to date and, as a result, the Group now

anticipates reporting revenue and adjusted EBITDA for the year to 31 December

2023 materially ahead of current market expectations,” the company

a comentat.

Acestea

developments led Cornerstone’s shares to rise by 34.8% to 16.3 pence on Monday,

testing over-monthly highs.

Sursa: Tradingview.com

Continued Strong

Performance for Cornerstone

În prima jumătate din 2023, Cornerstone announced a 90% increase in

venituri, reaching £3.6 million. The company was optimistic about maintaining

this positive trend in the latter half of the fiscal year 2023, anticipating

results that surpass expectations.

Should Cornerstone achieve or exceed its projected outcomes for 2023, it

would mark a continuation of the impressive growth vazut in 2022. Anul trecut,

company saw its revenue soar by 110% to £4.8 million, up from £2.3 million the

year before.

A significant portion of Cornerstone’s revenue is attributed to its core

services in foreign schimb și plăți , especially from spot and forward

transactions. These services accounted for 92% and 8% of the total revenue,

respectiv.

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- PlatoData.Network Vertical Generative Ai. Împuterniciți-vă. Accesați Aici.

- PlatoAiStream. Web3 Intelligence. Cunoștințe amplificate. Accesați Aici.

- PlatoESG. carbon, CleanTech, Energie, Mediu inconjurator, Solar, Managementul deșeurilor. Accesați Aici.

- PlatoHealth. Biotehnologie și Inteligență pentru studii clinice. Accesați Aici.

- Sursa: https://www.financemagnates.com//fintech/cornerstone-predicts-fy23-revenue-above-market-views-shares-surge/

- :are

- :este

- :nu

- $UP

- 16

- 2023

- 31

- 35%

- 7

- 8

- a

- Despre Noi

- mai sus

- reprezentat

- Obține

- Ajustat

- După

- înainte

- Cu toate ca

- printre

- an

- și

- a anunțat

- Anunț

- Anticipat

- anticipează

- anticipând

- AS

- At

- BE

- înainte

- by

- a venit

- Modificări

- a comentat

- companie

- continuare

- a continuat

- continuă

- Nucleu

- piatră de temelie

- Curent

- Data

- decembrie

- evoluții

- FĂCUT

- EBITDA

- capăt

- mai ales

- depăși

- schimb

- aşteptări

- de aşteptat

- experienţă

- cifre

- final

- Fiscal

- următor

- Pentru

- străin

- devize

- Înainte

- din

- Complet

- grup

- Creștere

- Jumătate

- superior

- maximele

- sugestii

- HTTPS

- impresionant

- creștere impresionantă

- in

- Crește

- informații

- Investitori

- IT

- ESTE

- jpg

- Nume

- Anul trecut

- Ultimele

- cel mai puțin

- Led

- Londra

- Bursa din Londra

- făcut

- Mentine

- marca

- Piață

- marcare

- material

- milion

- Impuls

- luni

- aproape

- acum

- octombrie

- of

- on

- Operațiuni

- Optimism

- Optimist

- or

- rezultate

- peste

- trecut

- plăți

- performanță

- Plato

- Informații despre date Platon

- PlatoData

- porţiune

- pozitiv

- prezice

- în prealabil

- proiectat

- furniza

- furnizorul

- reflectând

- Raportat

- Raportarea

- respectiv

- rezultat

- REZULTATE

- venituri

- Ridica

- s

- văzut

- Servicii

- Acțiuni

- semnificativ

- avânta

- soluţie

- Scânteie

- specific

- Loc

- stoc

- Bursa de Valori

- puternic

- suficient

- a crescut

- depăși

- Testarea

- decât

- acea

- lor

- Acestea

- acest

- la

- astăzi

- Total

- Trading

- TradingView

- Tranzacții

- tendință

- Actualizează

- foarte

- vizualizari

- a fost

- cand

- voi

- ar

- an

- zephyrnet