Întotdeauna există o piață de tauri undeva.

Today, that somewhere may be Uniswap, one of DeFi’s most recognizable decentralized exchanges.

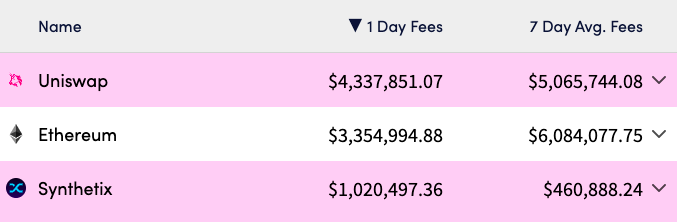

With $4.3M in fees generated in the past 24 hours, Uniswap has surpassed even its home network, Ethereum, as of June 20. In fact, the decentralized exchange (DEX) has jumped to the top of CryptoFees’ leaderboard.

Notably, 100% of Uniswap fees go to liquidity providers (LPs), who are users who deposit assets and are exposed to impermanent loss. So, while the DEX’s UNI token has jumped 7.2% in the last 24 hours, its holders don’t get a piece of the cash flows, which come from users paying a fee when swapping between digital assets.

Still, as the leading base layer for DeFi and other smart contract-enabled activity, it’s noteworthy whenever a protocol leads Ethereum in terms of fee generation.

Multiple Deployments

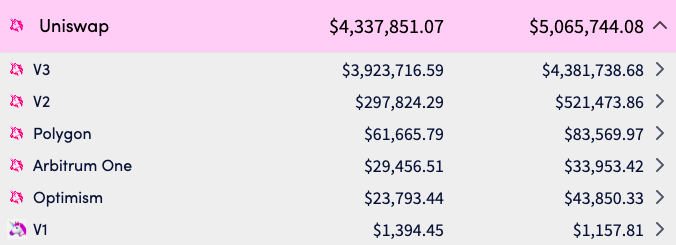

The fees are spread across multiple deployments of Uniswap, with just over 90% going to LPs in the DEX’s V3 iteration on mainnet, which allows LPs to provide concentrated liquidity in specific price ranges.

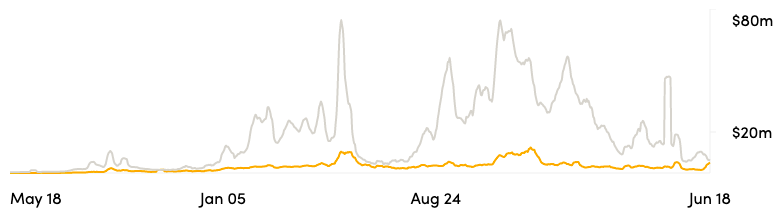

Uniswap has rarely accelerated past Ethereum since the protocol’s V2 deployment in May 2020. Uniswap V2 is largely accepted as its 0-to-1 moment because it allowed any ERC20 tokens to be paired with each other, rather than just ERC20-ETH pairings.

Of course, the lucrative fees have come during an extremely volatile period for crypto and world markets at large which are being rocked by creșterea ratelor dobânzii și strângere cantitativă (QT) amid rapidly soaring inflation — some people are undoubtedly trading out of crashing speculative assets and into stablecoins.

Still, as has been apparent through what has been a dismal year for digital asset prices, DeFi continues to work.

Citiți postarea originală pe Sfidătorul

- 2020

- 7

- a

- accelerat

- Conform

- peste

- activitate

- permite

- mereu

- În mijlocul

- activ

- Bunuri

- deoarece

- fiind

- între

- taur

- Bani gheata

- cum

- continuă

- crashing

- cripto

- zilnic

- descentralizată

- Schimbul descentralizat

- DEFI

- desfășurarea

- implementări

- Dex

- digital

- Active digitale

- Active digitale

- în timpul

- fiecare

- ERC20

- ethereum

- schimb

- Platforme de tranzacţionare

- expus

- Taxe

- din

- generată

- generator

- generaţie

- merge

- Titularii

- Acasă

- HTTPS

- interes

- IT

- mare

- strat

- conducere

- Conduce

- Lichiditate

- furnizori de lichiditate

- LP-uri

- lucrativ

- Piață

- pieţe

- cele mai multe

- multiplu

- reţea

- original

- Altele

- împerecherilor

- oameni

- perioadă

- bucată

- preţ

- Proiecte

- protocol

- furniza

- furnizori

- întrucât

- inteligent

- So

- unele

- undeva

- specific

- răspândire

- Stablecoins

- depășit

- termeni

- trei

- Prin

- semn

- indicativele

- top

- Trading

- uniswap

- utilizatorii

- Impotriva

- Ce

- în timp ce

- OMS

- Apartamente

- lume

- an