- Last week’s broad-based US dollar strength has dissipated ex-post US non-farm payroll data with the continuation of its underperformance against the GBP.

- The US labour market has started to show growing slack where the labour force participation rate has dipped to 62.5%, its largest monthly decline in almost three years and full-time employment recorded its steepest drop since April 2020.

- Bearish reversal conditions seen on the USD/JPY after the prior 5-day rebound suggest the potential continuation of medium-term JPY strength.

- Watch the 146.70 key resistance of USD/JPY.

Aceasta este o analiză ulterioară a raportului nostru anterior, “USD/JPY Technical: Countertrend USD rebound remains intact ahead of US NFP” published on 5 January 2023. Click aici pentru o recapitulare.

Acțiunile de preț ale USD / JPY have pierced upwards as expected to print an intraday high of 145.98 in last Friday, 5 January (72 pips shy of the 146.70 key resistance as highlighted in our earlier analysis) upon the release of the US non-farm payrolls (NFP) data for December; the headline number of jobs added rose more than expected (+216K versus +170K consensus), and above the downward revised +173K in November.

Overall, the total jobs gain in the US for 2023 hit 2.7 million, the smallest annual gain since 2019 excluding the Covid pandemic year of 2020, and December’s +216K added jobs was still slightly below the 12-month average of +225K.

Growing slack in the US labour market

Also, the other key components of the jobs report have been lacklustre as highlighted by a steep drop in the labour force participation rate where it declined by 0.3 percentage points to 62.5% in December, the largest monthly decline in almost three years. In addition, full-time employment decreased to 133,196K in December from 134,727K in November, the steepest drop since April 2020.

Overall, the mixed US jobs report for December has indicated the prior US Federal Reserve’s interest rate hike cycle has started to inflict some adverse impact on the labour market which in turn keeps the expectation of a Fed dovish pivot “alive” in 2024.

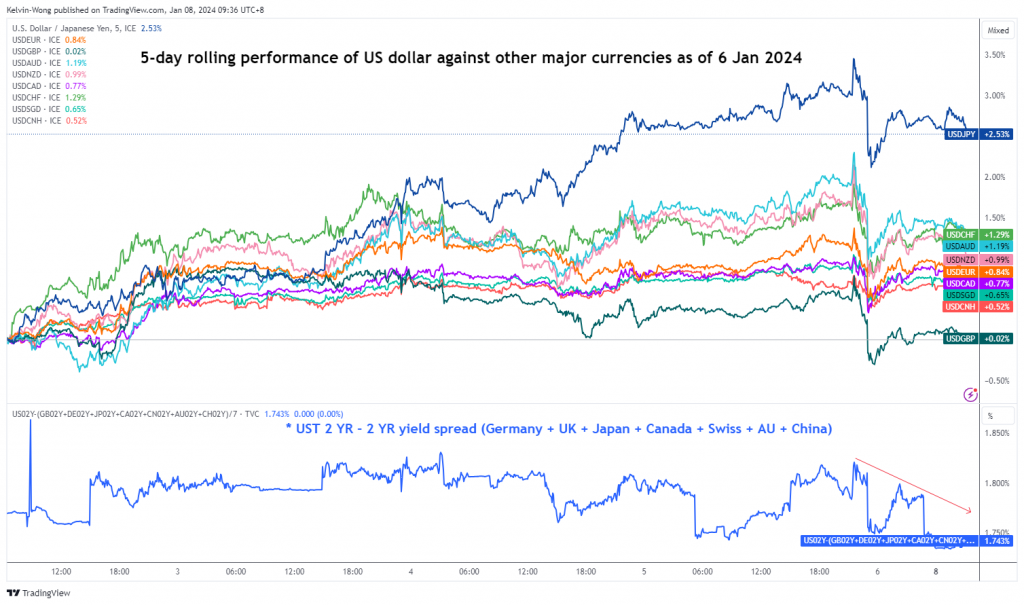

US 2-year Treasury yield premium shrinkage is supporting a fresh leg of potential USD weakness

The US dollar strength has dissipated ex-post NFP release where the USD/JPY (the strongest USD outperformer) declined from a peak of +3.5% printed last week to +2.6% based on a 5-day rolling performance basis at this time of the writing.

Also, the USD has continued its underperformance against the GBP (unchanged for now).

The yield premium shrinkage of the US 2-year treasury yield over the rest of the world’s 2-year sovereign bond yields (an equal average of Germany, UK, Japan, Canada, Switzerland, Australia & China) has reinforced the current bullish exhaustion seen in the US dollar strength where it has declined by 9 basis points to 1.74% from a peak of 1.83% printed last week.

Bearish reversal conditions emerged in USD/JPY

Fig 2: USD/JPY tendință pe termen mediu din 8 ianuarie 2024 (Sursa: TradingView, faceți clic pentru a mări grafic)

Fig 3: USD/JPY tendință minoră pe termen scurt din 8 ianuarie 2023 (Sursa: TradingView, faceți clic pentru a mări graficul

The 5-day rebound of +573 pips/+4.9% that was seen in the USD/JPY from its 28 December 2023 minor swing low of 140.25 to last Friday, 5 January intraday high of 145.98 has almost reached a key inflection level of 146.70 (former swing low areas of 29 November/4 December 2023, downward sloping 50-day moving average & 50% Fibonacci retracement of the medium-term downtrend from 13 November 2023 high to 28 December 2023 low).

Last Friday, 5 January price actions of the USD/JPY formed a daily “long-legged Doji” candlestick by the end of the US session which suggests some form of exhaustion in the prior upmove sequence.

In addition, the upside momentum has also been eradicated in a shorter time frame as seen by the hourly RSI momentum indicator of the USD/JPY where it has broken down below a key parallel support at the 64 level after it flashed a bearish divergence at its overbought region.

Therefore, it is likely that the 5-day rebound from its 28 December 2023 low of 140.25 is more skewed towards a minor corrective rebound within a medium-term downtrend phase that is still intact for USD/JPY.

If the 146.70 key short-term pivotal resistance is not surpassed to the upside, a break below 143.75 may ignite a potential fresh impulsive downmove sequence to expose the next intermediate supports at 142.20 and 140.70/25 in the first step followed by 139.20 next.

On the flip side, a clearance above 146.70 invalidates the bearish scenario to see the next intermediate resistances coming in at 147.45 and 148.30.

Conținutul are doar scop informativ general. Nu este un sfat de investiții sau o soluție de cumpărare sau vânzare de valori mobiliare. Opiniile sunt autorii; nu neapărat cel al OANDA Business Information & Services, Inc. sau al oricăruia dintre afiliații, filialele, funcționarii sau directorii săi. Dacă doriți să reproduceți sau să redistribuiți orice conținut găsit pe MarketPulse, un serviciu premiat de analiză valutară, mărfuri și indici globali și site de știri, produs de OANDA Business Information & Services, Inc., vă rugăm să accesați fluxul RSS sau să ne contactați la info@marketpulse.com. Vizita https://www.marketpulse.com/ pentru a afla mai multe despre ritmul piețelor globale. © 2023 OANDA Business Information & Services Inc.

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- PlatoData.Network Vertical Generative Ai. Împuterniciți-vă. Accesați Aici.

- PlatoAiStream. Web3 Intelligence. Cunoștințe amplificate. Accesați Aici.

- PlatoESG. carbon, CleanTech, Energie, Mediu inconjurator, Solar, Managementul deșeurilor. Accesați Aici.

- PlatoHealth. Biotehnologie și Inteligență pentru studii clinice. Accesați Aici.

- Sursa: https://www.marketpulse.com/fundamental/usd-jpy-technical-us-dollar-strength-fizzled-out-ex-post-us-nfp/kwong

- :are

- :este

- :nu

- :Unde

- 1

- 13

- 140

- 143

- ani 15

- 15%

- 20

- 2019

- 2020

- 2023

- 2024

- 25

- 28

- 29

- 30

- 7

- 70

- 700

- 72

- 75

- 8

- 9

- 98

- a

- Despre Noi

- mai sus

- acces

- acțiuni

- adăugat

- plus

- advers

- sfat

- afiliate

- După

- împotriva

- înainte

- aproape

- de asemenea

- an

- analize

- analiză

- și

- anual

- Orice

- Aprilie

- SUNT

- domenii

- în jurul

- AS

- At

- Australia

- autor

- Autorii

- Avatar

- in medie

- acordare

- bazat

- bază

- de urs

- divergență bearish

- bate

- fost

- de mai jos

- legătură

- Randamentele obligațiunilor

- Cutie

- Pauză

- cu bază largă

- Spart

- Bullish

- afaceri

- cumpăra

- by

- Canada

- Diagramă

- China

- degajare

- clic

- COM

- combinaţie

- venire

- Mărfuri

- componente

- Condiții

- efectuat

- Conectarea

- Consens

- contactați-ne

- conţinut

- continuare

- a continuat

- cursuri

- Covidien

- Curent

- ciclu

- zilnic

- de date

- decembrie

- Refuzați

- scăzut

- Directorii

- Divergență

- Dolar

- dovish

- jos

- trend descendent

- în jos

- Picătură

- Mai devreme

- Elliott

- a apărut

- ocuparea forţei de muncă

- capăt

- mări

- egal

- schimb

- F? r?

- aşteptare

- de aşteptat

- experienţă

- expert

- fed-

- federal

- Rezervele Federale

- Fibonacci

- financiar

- Găsi

- First

- Flip

- debit

- a urmat

- Pentru

- Forţarea

- străin

- devize

- Forex

- formă

- format

- Fost

- găsit

- FRAME

- proaspăt

- Vineri

- din

- fond

- fundamental

- Câştig

- lira sterlină

- General

- Germania

- Caritate

- piețele globale

- În creştere

- Avea

- titlu

- Înalt

- Evidențiat

- Excursie pe jos

- Lovit

- HTTPS

- if

- Aprinde

- Impactul

- impulsiv

- in

- Inc

- indicată

- Indicator

- Indici

- de inflexiune

- cauza

- informații

- interes

- RATA DOBÂNZII

- majorarea ratei dobânzii

- investiţie

- IT

- ESTE

- Jan

- ianuarie

- Japonia

- Locuri de munca

- raport de locuri de muncă

- JPY

- păstrează

- Kelvin

- Cheie

- cheie rezistență

- Muncii

- cea mai mare

- Nume

- Nivel

- nivelurile de

- ca

- Probabil

- Jos

- Macro

- Piață

- perspective de piață

- de cercetare de piață

- MarketPulse

- pieţe

- max-width

- Mai..

- milion

- minor

- mixt

- Impuls

- lunar

- mai mult

- în mişcare

- media mobilă

- în mod necesar

- ştiri

- următor

- NFP

- Salarii non-agricole

- noiembrie

- acum

- număr

- numeroși

- of

- ofițerii

- on

- afară

- Avize

- or

- Altele

- al nostru

- afară

- Perspectivă

- peste

- pandemie

- Paralel

- participare

- pasionat

- stat de plată

- payrolls

- Vârf

- procent

- performanță

- perspective

- fază

- Pivot

- pivot

- Plato

- Informații despre date Platon

- PlatoData

- "vă rog"

- puncte

- poziţionare

- postări

- potenţial

- Premium

- preţ

- anterior

- Produs

- furnizarea

- publicat

- scopuri

- rată

- Evaluați creșterea

- atins

- recul

- recapitula

- inregistrata

- regiune

- eliberaţi

- rămășițe

- raportează

- cercetare

- Rezistență

- REST

- cu amănuntul

- retragerea

- Inversare

- Rulare

- ROSE

- RSI

- RSS

- scenariu

- Titluri de valoare

- vedea

- văzut

- vinde

- senior

- Secvenţă

- serviciu

- Servicii

- sesiune

- partajarea

- Pe termen scurt

- Arăta

- timid

- parte

- întrucât

- Singapore

- teren

- moale

- înclinat

- soluţie

- unele

- Sursă

- suveran

- specializata

- început

- Pas

- Încă

- stoc

- Piețele de acțiuni

- Strateg

- rezistenţă

- mai puternic

- sugera

- sugerează

- a sustine

- De sprijin

- Sprijină

- depășit

- Leagăn

- Elveția

- Tehnic

- Analiza Tehnica

- zece

- decât

- acea

- acest

- mii

- trei

- timp

- la

- Total

- față de

- Comercianti

- Trading

- TradingView

- Pregătire

- trezorerie

- tendință

- ÎNTORCĂ

- Uk

- unic

- pe

- întoarsă pe dos

- în sus

- us

- Dolar american

- Federal SUA

- Raport privind locurile de muncă din SUA

- noi NFP

- USD

- USD / JPY

- folosind

- v1

- Impotriva

- Vizita

- a fost

- Val

- săptămână

- BINE

- care

- câștigător

- cu

- în

- wong

- lume

- ar

- scris

- an

- ani

- Randament

- randamentele

- Tu

- zephyrnet