The notion of a digital dollar for the United States has been increasingly in the news in recent months. Research by the Federal Reserve into a Central Bank Digital Currency (CBDC) has been ongoing, and it’s easy to see why: between efforts from China to use digital currency in apps, to the increasing adoption rate of cryptocurrencies, and other faster payments technologies, it’s clear that technology supporting the digital vision is here. A U.S. CBDC could offer significant advantages.

But that implementation is no simple task. This week, the Fed released a new paper exploring what impact pursuit of a CBDC might have on monetary policy going forward, considering a scenario in which a digital dollar were widely adopted for both payments and as a store of value. It raises some clear concerns; while swapping cash for digital dollars doesn’t change much on a macro scale for how the economy runs, replacing bank deposits with digital currency definitely would – the balance sheets at commercial banks would almost certainly shrink, driving a need for greater reserves and potentially impacting credit availability.

It’s just one reason not everyone thinks that a Federal Reserve-backed digital currency is a wise idea – and indeed, that linking the U.S. dollar to the blockchain ar fi doar o modalitate de a anula avantajele care fac ca cripto-ul să fie atrăgător pentru mulți din spațiu. Un document de lucru din Web 3.0 – Collateral Insights de Christian Kameir, Managing Partner la Sustany Capital, a subliniat multe dintre preocupările inovatorilor din sector.

Multe dintre preocupările actuale provin din a Lansare ianuarie 2022 de la Fed, despre care Kameir notează că ratează un punct important: în opinia colaboratorilor piesei, moneda și banii sunt două lucruri foarte diferite.

“The paper’s conflation of legal concepts (money) and technology (currency) clouds all further analysis and makes it difficult for the authors to correctly identify technological innovation in general, and network technologies in particular. A shortcoming exemplified by the manuscript’s brief excursion into ‘digital assets’ — a rather problematic term itself – on page eleven, which starts out by proclaiming that cryptocurrencies may have ‘money-like characteristics’, while further repeating a number of long-debunked myths surrounding the space of cryptographic primitives and decentralized software solutions — aka ‘blockchains’.”‘

Monedele au riscul de țară, riscul de lichiditate și costurile de manipulare schimbate legate de acestea. O marfă are propriile sale probleme, dar valoarea unui adevărat valută is a whole different topic. So, when the Fed says they’re looking to introduce a digital dollar as a cryptocurrency, what are the components of risk for that which people have to monitor? As Kameir put it:

“The main risk is mitigated property rights. If I have money in an account, I don’t really have money; I have a claim against a bank. That’s different from money in my pocket. Possession is 90% of ownership. That’s what we should be looking for in a digital asset. Every transaction needs to be addressed on its own merit.”

Privacy also remains a concern. Unlike most physical cash transactions, it would be entirely possible for the Fed to gather a lot of information about how a digital dollar is being spent. Ostensibly, this could help combat criminal activity. But it’s a real tightrope to be walked between offering protections against bad actors and protecting consumer privacy rights. It is, at least, an issue that is a strong point of focus for the Fed, as noted in their January paper:

„O CBDC cu scop general ar genera date despre tranzacțiile financiare ale utilizatorilor în același mod în care banii băncilor comerciale și nebancare generează astfel de date astăzi. În modelul CBDC intermediat pe care l-ar lua în considerare Rezerva Federală, intermediarii ar aborda preocupările legate de confidențialitate prin valorificarea instrumentelor existente.”

This model can’t — and indeed, doesn’t seem to aim to — replicate the total anonymity of a cash transaction. Aiming for a level of privacy on par with payments made through traditional banking systems is a start, and for some, likely to be sufficient as an end state, particularly as it will include several safeguards and the level of reversability that customers making online purchases are accustomed to today.

All that said, there still a lot about the idea that holds an obvious appeal. The U.S. dollar is a bedrock of trust for currencies, and there’s a reason that it stands as the surety for most existing stablecoins. A CBDC could, if anything, make it even easier for the dollar to be used abroad, with an easier road to tracking where money’s being used.

Și dincolo de orice îngrijorare, rămâne o nevoie reală ca SUA să facă acești pași pentru a intra în spațiu, așa cum a menționat chiar și documentul Collateral Insights:

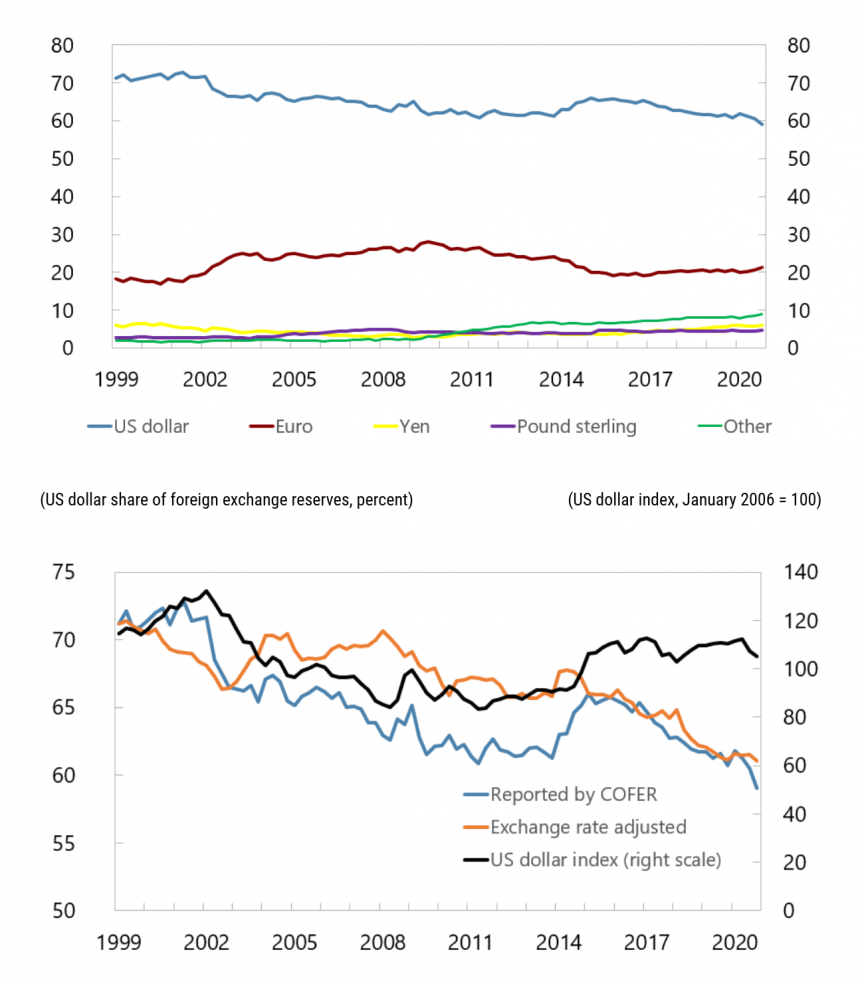

„În măsura în care instrumentele digitale la purtător ale oricărei unități de cont se pot deconta cu finalitate aproape în timp real și oferă opționalitate „bani programabili”, acestea sunt deja o realitate tehnică care nu poate fi ignorată fără a suferi consecințele datoriei tehnologice. Acesta din urmă poate fi observat deja cu ușurință în declinul tranzacțiilor în USD ale activității economice globale. Potrivit Fondului Monetar Internațional, cota dolarului american în rezervele valutare globale a scăzut la cel mai scăzut nivel din ultimii douăzeci de ani.”

So we continue to watch as the Fed takes it first steps on this vital journey — and hope that they don’t make missteps along the way.

- furnică financiară

- blockchain

- conferința blockchain fintech

- CBDCA

- chime fintech

- coinbase

- coingenius

- criptoconferință fintech

- cryptocurrency

- Criptofinanțare

- Federal Reserve

- FinTech

- aplicația fintech

- inovație fintech

- Ascensiunea Fintech

- Asociația globală a activelor digitale și a criptomonedei

- Opensea

- PayPal

- Paytech

- payway

- Plato

- platoul ai

- Informații despre date Platon

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- fintech pătrat

- dungă

- Tehnologia

- tencent fintech

- Xero

- zephyrnet