The Australian dollar is trading quietly on Wednesday. AUD/USD is at 0.6904, up 0.14%.

Australian CPI climbs to 7.3%

Australian inflation pushed higher in November, rising to 7.3% following a 6.9% gain in October. This matched the forecast. The trimmed mean rate, a key gauge of core inflation, rose to 5.6% in November, up from 5.4% a month earlier and its highest level since 2018. The drivers behind the increase were higher jet fuel prices as well as accommodation prices. The drop in inflation in October (6.9%, down from 7.3% prior) had raised hopes that inflation might have peaked, but the rise in the November release has dampened such hopes. Retail sales for November jumped 1.4%, buoyed by Black Friday sales. This was much higher than the forecast of 0.6% and the October read of 0.4%. Consumer spending remains strong despite the double-whammy of rising interest rates and high inflation.

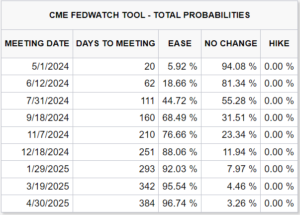

What will be the RBA’s take on this data? The trimmed mean rate indicates that the rise in inflation is broad-based, a reminder that the RBA has more work to do as it tackles high inflation. The strong retail sales data shows that the economy can still bear further hikes, and the markets have priced in a 25-basis point increase at the February 7th întâlnire.

The RBA rate policy is data-dependent, which means that the quarterly CPI release on January 25th could determine what decision the central bank takes at the meeting. The minutes of the December meeting indicated that the RBA considered three options at that meeting – a 25 bp hike, a 50-bp hike and a pause. In the end, RBA members opted for the 25-bp increase. I would expect the RBA to show similar flexibility at the February meeting.

Fed Chair Powell finds himself under constant scrutiny, not just for his comments but also for what he doesn’t say. Powell participated on a panel at a symposium of the Swedish central bank on Tuesday. The topic was central bank independence, and Powell did not touch upon the economy or monetary policy. The markets took this as a dovish sign and the US dollar pared gains as a result.

.

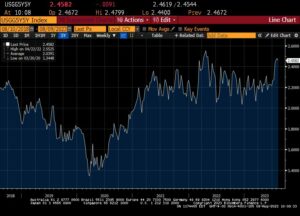

AUD / USD Tehnic

- 0.6931 remains a weak resistance line, followed by 0.7044

- 0.6817 și 0.6747 oferă suport

Acest articol are doar scop informativ. Nu este sfat de investiții sau o soluție pentru a cumpăra sau vinde titluri de valoare. Opiniile sunt autorii; nu neapărat cea a OANDA Corporation sau a oricăreia dintre filialele, filialele, ofițerii sau directorii săi. Tranzacționarea cu levier este cu risc ridicat și nu este potrivită pentru toți. Ați putea pierde toate fondurile depuse.

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- Platoblockchain. Web3 Metaverse Intelligence. Cunoștințe amplificate. Accesați Aici.

- Sursa: https://www.marketpulse.com/20230111/australian-dollar-shrugs-as-cpi-jumps/

- 1

- 2012

- 2018

- 7

- a

- mai sus

- sfat

- afiliate

- TOATE

- Alfa

- analiză

- analist

- și

- articol

- AUD / USD

- australian

- Dolarul australian

- autor

- Autorii

- Bancă

- bazat

- Urs

- în spatele

- de mai jos

- Negru

- Black Friday

- vânzări de vineri negre

- Cutie

- BP

- larg

- cu bază largă

- cumpăra

- central

- Banca centrala

- Scaun

- COM

- comentarii

- Mărfuri

- luate în considerare

- constant

- consumator

- contribuabil

- Nucleu

- inflația de bază

- CORPORAȚIE

- ar putea

- Covers

- IPC

- zilnic

- de date

- decembrie

- decizie

- depus

- În ciuda

- Determina

- FĂCUT

- Directorii

- Nu

- Dolar

- dovish

- jos

- drivere

- Picătură

- Mai devreme

- economie

- aciunile

- aștepta

- cu experienţă

- financiar

- Piata financiara

- descoperiri

- Flexibilitate

- Concentra

- a urmat

- următor

- Prognoză

- Forex

- Vineri

- din

- Combustibil

- fundamental

- Fondurile

- mai mult

- Câştig

- câștig

- General

- Înalt

- Inflație ridicată

- superior

- cea mai mare

- extrem de

- Excursie pe jos

- Drumeții

- speranțe

- HTTPS

- in

- Inclusiv

- Crește

- independenţă

- indică

- inflaţiei

- informații

- interes

- Ratele dobânzilor

- investind

- investiţie

- Israel

- IT

- ianuarie

- sărit

- salturi

- Cheie

- Nivel

- Linie

- pierde

- major

- Piață

- MarketPulse

- pieţe

- max-width

- mijloace

- Reuniunea

- Membri actuali

- ar putea

- minute

- Monetar

- Politică monetară

- Lună

- mai mult

- în mod necesar

- noiembrie

- octombrie

- ofițerii

- on-line

- Avize

- Opţiuni

- panou

- a participat

- Plato

- Informații despre date Platon

- PlatoData

- Punct

- Politica

- postări

- Powell

- Prețuri

- anterior

- furnizarea

- Publicații

- publicat

- scopuri

- împins

- cuminte

- ridicat

- gamă

- rată

- tarife

- RBA

- Rata RBA

- Citeste

- eliberaţi

- rămășițe

- Rezistență

- rezultat

- cu amănuntul

- Vânzările cu amănuntul

- Ridica

- în creștere

- Risc

- ROSE

- de vânzări

- Titluri de valoare

- caută

- Căutând alfa

- vinde

- câteva

- partajarea

- Arăta

- Emisiuni

- semna

- asemănător

- întrucât

- soluţie

- Cheltuire

- Încă

- puternic

- astfel de

- potrivit

- Suedeză

- Simpozion

- Parime

- Lua

- ia

- trei

- la

- subiect

- atingeţi

- Trading

- marţi

- în

- us

- Dolar american

- miercuri

- Ce

- care

- voi

- Apartamente

- ar

- Tu

- Ta

- zephyrnet