Acesta este un editorial de opinie al lui Scott Worden, un inginer, un avocat și fondatorul Trusturi BTC.

„Am lucrat la un nou sistem electronic de numerar care este complet peer-to-peer, fără terți de încredere.”- Satoshi Nakamoto

It’s one of those perfect fall days in Colorado, and I’m sitting outside of a pub in the late afternoon. I’m meeting with a fellow bitcoiner, a man I met in Austin at the end of this summer. As the sun fell behind the mountains, the sky turned orange, setting the perfect backdrop for lively bitcoin conversation.

As we ticked down the typical list of everything we agreed on — censorship is bad, red meat is good, etc., — I made an offhand comment about wishing more businesses would accept bitcoin as payment. “Well I don’t, why would you want to part with your sats?” was the reply he tossed back. The implication, of course, is that a true Bitcoiner values satoshis more than anything else in the world. Why would you trade them for groceries, t-shirts or beer? “Haven’t you heard of Laslo Hanyecz? That fool traded 10,000 bitcoin for a couple of pizzas. I’m not repeating that mistake. Talk to me when bitcoin hits $200k, then maybe it would make sense.”

Noul meu prieten nu este singur cu această linie de gândire. Este un sentiment care este oferit de oameni precum Michael Saylor și alții din comunitatea HODL. Se vor căsători, "The scarcest asset in the world is Bitcoin. It’s digital gold, ""Buying bitcoin is like purchasing property in Manhattan 100 years ago”, and “Don’t sell your bitcoin!” Yet at the same time, there is an intuitive recognition that if bitcoin can’t ever be traded for a good or service, it in effect has no value, no matter what price is flashing on the BLOCKCLOCK in the office. I call this the HODLer’s dilemma.

Dar este aceasta cu adevărat o dilemă? Aceste mantre, pe cât de prolifice sunt, sunt în concordanță cu spiritul? Satoshi’s innovation? Does the proliferation of the Lightning Network and non-custodial mobile wallets that our parents (or children) can intuitively operate require us to evolve our understanding of Bitcoin’s value proposition? Personally, I believe the time is now to stop thinking of bitcoin as simply a store of value and begin to conceptualize it în primul rând ca mijloc de schimb …, de asemenea, se întâmplă să stocheze valoarea mai bine decât orice bun de pe pământ. În cazul în care nu ai fost deja atent, iată câteva motive pentru care.

Privacy

“Bitcoin would be convenient for people who don’t have a credit card or don’t want to use the cards they have.”- Satoshi Nakamoto

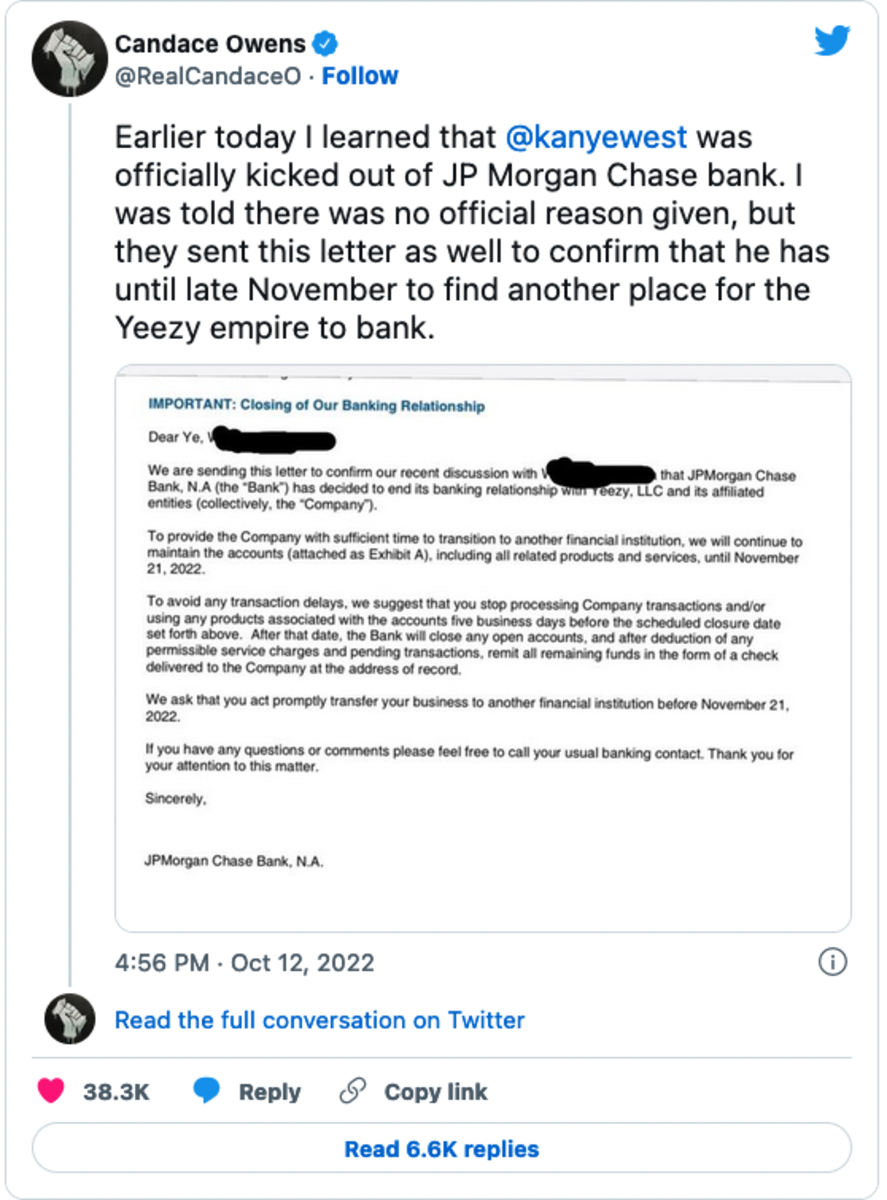

Momentul pentru a începe să ieșiți din sistem este chiar acum. Semnalul nu a fost niciodată mai puternic. Astăzi trăim într-o lume în care sistemul fiat poate:

Toate acestea se întâmplă astăzi, și probabil este doar vârful aisbergului. Într-un sistem de vânzare cu amănuntul în care tranzacțiile cu numerar devin din ce în ce mai rare și incomode, majoritatea băncilor mari, agențiilor de credit și sistemelor de plată au acceptat cerințele unui guvern care pare să aibă o miză existențială în controlul comportamentului nostru..

Of course, bitcoin isn’t a panacea to censorship — at least how it’s most commonly purchased and exchanged today. The Protestul camioneștilor canadieni showed us that a government committed to suppressing the voice of their citizens will go to almost any length to do so, and in the process taught us that licensed exchanges and chain analysis techniques can be highly effective in blacklisting addresses and even identifying donors. These vulnerabilities will need to be overcome in order to provide a more censorship-free currency-of-exchange. But by transacting in bitcoin with peers and merchants for everyday goods and services as often as possible, we incentivize others to both accept and transact in bitcoin. Through numbers alone we can render the bitcoin economy more robust, decentralized and difficult to censor. A community that values privacy will naturally choose to adopt non-custodial wallets, engage in collaborative transactions and avoid KYC exchanges. Growing and educating this community has never been more important.

Comoditate și autonomie

Cu moneda electronică bazată pe dovezi criptografice, fără a fi nevoie să aveți încredere într-un intermediar terță parte, banii pot fi siguri și tranzacțiile pot fi fără efort. "- Satoshi Nakamoto

A common counter-argument to transacting in bitcoin is that it’s either too complicated or too slow compared with swiping a credit card. This is simply no longer true. Today, any beginner-level Bitcoiner can download Muun Wallet and within minutes send Lightning invoices to clients for payment via QR Code. Coinkite has an NFC device that allows users to sign for transactions with a tap of their card. There are more examples, and many more to come. The beauty of these solutions is that they are fully non-custodial, i.e., there is no central third party that controls your coins. The software is merely enabling transactions to be broadcast to the network. Lightning transactions clear instantaneously, with fees an order of magnitude lower than Visa or Mastercard’s traditional 2–3%. (For example, it recently cost me about $.60 in fees to send the equivalent of $700 USD to Fermele Wrich saptamana trecuta pentru carnea de vita. Aceeași tranzacție l-ar fi costat pe comerciant în jur de 20 USD dacă aș fi folosit Visa.)

In addition, these transactions promote autonomy on both sides. Lightning transactions, like everything else backed by Bitcoin’s proof-of-work, occur without counterparty risk. Removed from the equation is the risk that a consumer won’t pay his bill, dispute a charge, not have enough money in his account or file for bankruptcy down the road. All of this risk manifests as transactional inefficiency, and its costs are directly or indirectly absorbed by merchants and consumers. A trustless system like bitcoin is thus more efficient, reducing risk for merchants, and ultimately rendering goods and services less expensive for responsible consumers.

„Sunt sigur că în 20 de ani fie va exista un volum foarte mare de tranzacții, fie nu va exista niciun volum.”- Satoshi Nakamoto

We would do well to think of all of our transactions in terms of bitcoin. When money is truly a store of value, we take a measured approach to spending and account for the potential increase in value that money may have in the future. This is logical, and applies whether you’re spending sats or dollars. The website bitcoinorshit.com drives this point home quite bluntly.

Există și povestea lui laszlo hanyecz, who in 2010, famously purchased two pizzas for 10,000 BTC. In effect, Laszlo paid a couple of billion U.S. dollars for pizza, if we take into consideration BTC’s market value over a decade later. It surprises me though, when Bitcoiners jump on Laszlo for being economically naive, and use this example to support their position that bitcoin should never be spent. The simple truth is that everyone who bought pizza in 2010 effectively spent thousands of bitcoin on it. The only way to avoid this would be to eat something less expensive or go hungry. The fact is, every fiat transaction we make is a direct trade off for potentially increasing our stack. Once we understand this, the public controversy over spending bitcoin on products or services is fundamentally dead.

Majoritatea covârșitoare dintre noi trebuie să schimbăm energie monetară pentru bunuri și servicii pentru a supraviețui în societatea actuală. Singura controversă care rămâne este care produsele sau serviciile au prioritate asupra oportunității de a achiziționa mai multe sat. Este o decizie personală și unică pentru fiecare dintre noi. Răspunsul ar trebui gândit independent și indiferent dacă acea energie monetară este cheltuită în sats, dolari sau yeni - este doar energia monetară salvat - ceea ce a rămas — care este relevant când vine vorba de dilema HODLerului.

We are all likely to save more BTC if we begin transacting more in BTC. For one thing, when we deal in a sound money that is a proven store-of-value, we’re more apt to be discerning in our purchases. Sure, we really want the new iPhone, but is it worth 5 million sats if you expect a sat to be worth a penny someday? We might decide to wait another year before we upgrade and retain those sats for the future. On the other hand we all need food, shelter and clothing. If I have a choice between buying my meat from Costco with my Visa card, or buying direct from a rancher who accepts bitcoin, why wouldn’t I choose the latter?

Today, the number of merchants that accept bitcoin is relatively small, though growing steadily. As bitcoiners begin to understand that their “spend dollars, save sats,” theory may be counterproductive, greater numbers will begin to seek goods from merchants that accept bitcoin for payment. This spike in demand will drive merchant adoption, potentially shifting the timeline for a bitcoin economy significantly to the left.

Mai mult schimb este egal cu mai multă valoare

„Pe măsură ce numărul de utilizatori crește, valoarea pe monedă crește. Are potențialul pentru o buclă de feedback pozitiv; pe măsură ce utilizatorii cresc, valoarea crește, ceea ce ar putea atrage mai mulți utilizatori pentru a profita de creșterea valorii.” - Satoshi Nakamoto

This is where we sit today. There’s a growing number of speculators and bitcoin enthusiasts who have bought into the idea that Bitcoin is a bona fide store of value. This community further believes that the asset’s scarcity will inevitably lend to a supply squeeze that will cause the price to rocket upwards. Sure, it’s possible that this could happen through the mere act of HODLing, but as Satoshi Nakamoto points out, the value goes up when the numbers of utilizatorii go up. Does buying and holding an asset qualify as use? If the brilliance behind bitcoin is enabling peer-to-peer transactions without a third-party middleman, are we really leveraging that capability by exclusively stacking and not spending?

I believe that bitcoin needs to become a true medium of exchange in order for it to fully realize its potential as a store of value. Since value is not derived from scarcity alone — demand is fundamental to bitcoin’s price. If bitcoin’s utilitate becomes the driving force for its demand, it is at this moment that its true potential as a store of value will be realized. Today’s economic and political backdrop might just be the motivation we all need. But until bitcoin becomes an essential part of our daily economic activity, it is apt to be valued alongside other speculative assets, and subject to the whims of the same fiat system it was meant to supplant.

Aceasta este o postare invitată de Scott Worden. Opiniile exprimate sunt în întregime proprii și nu reflectă neapărat cele ale BTC Inc sau Bitcoin Magazine.

- Bitcoin

- Revista Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- Bani gheata

- Cenzură

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- Cultură

- descentralizată

- DEFI

- Active digitale

- ethereum

- masina de învățare

- Marty's Bent

- jeton non-fungibil

- Opinie

- Plato

- platoul ai

- Informații despre date Platon

- PlatoData

- platogaming

- Poligon

- intimitate

- dovada mizei

- W3

- zephyrnet