Casele de compensare au publicat cel mai recent CPMI-IOSCO Dezvăluiri cantitative:

- Inițială margine for ETD at $528 billion is down 7% QoQ and up 19% YoY

- Inițială margine pentru IRS at $280 billion is up 4% QoQ and 8% YoY, to hit a record high

- Inițială margine pentru CDS at $76 billion is up 15% QoQ and 31% YoY

- LME Disclosures that increase in the latest quarter are highlighted

- O serie de dezvăluiri ale CCP arată niveluri record de la începutul raportării în septembrie 2015

- Including at B3, CDCC, ECC, Eurex, ICE Clear Credit, LCH SwapClear …

- Continuați să citiți pentru diagrame și detalii

Context

În conformitate cu CPMI-IOSCO Divulgări publice cantitative, CPC publică peste două sute de câmpuri de date cantitative care acoperă margine, resurse implicite, risc de credit, colateral, risc de lichiditate, back-testing și multe altele.

CCPView has over 6 years of these quarterly disclosures for 44 Clearing Houses, each with multiple Clearing Services, covering the period from 30 Sep 2015 to 30 Jun 2022. This disclosure data provides insights into trends over time at one PCC și comparații între CPC.

Să aruncăm o privire la cele mai recente dezvăluiri.

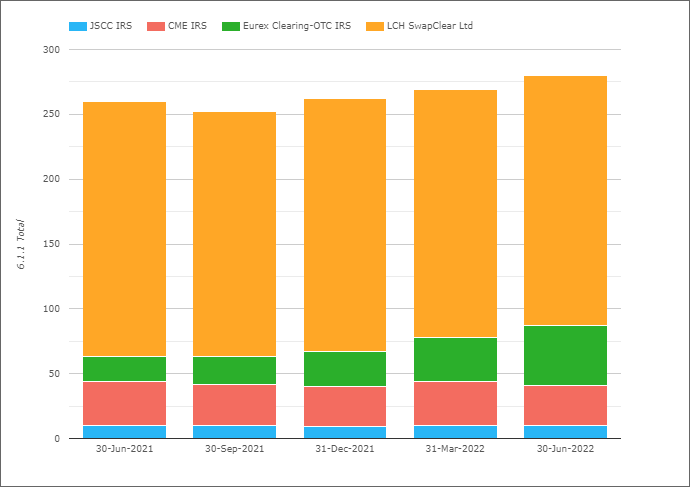

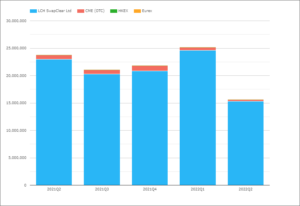

Marja inițială pentru IRS

- IM total pentru aceste patru CCP a fost de 280 de miliarde de dolari la 30 iunie 2022

- $11 billion or 4% higher QoQ and $20 billion or 8% higher YoY

- LCH SwapClear cu 193 de miliarde de dolari sau 159 de miliarde de lire sterline la 30 iunie 2022

- Up 9% QoQ and 12% YoY in GBP terms ( and up 1% and down 2% in USD terms)

- EUREX OTC IRS with $46 billion or €44 billion, is again higher than CME

- Creștere cu 13 miliarde EUR sau cu 42% ToT și 28 miliarde EUR sau 177% pe an (în termeni EUR)

- extensia CM IRS cu 31.5 de miliarde de dolari, în scădere cu 6% ToT și cu 7% YoY

- JSCC IRS cu 10 miliarde USD sau 1,366 miliarde Y, în creștere cu 14% ToT și în creștere cu 24% YoY (în termeni JPY).

Total IM for IRS at $280 billion, is above the record high of $271 billion on 31-Mar-20.

Eurex OTC IRS increasing significantly QoQ and even more so YoY.

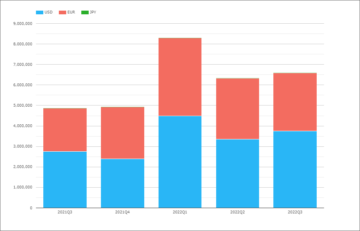

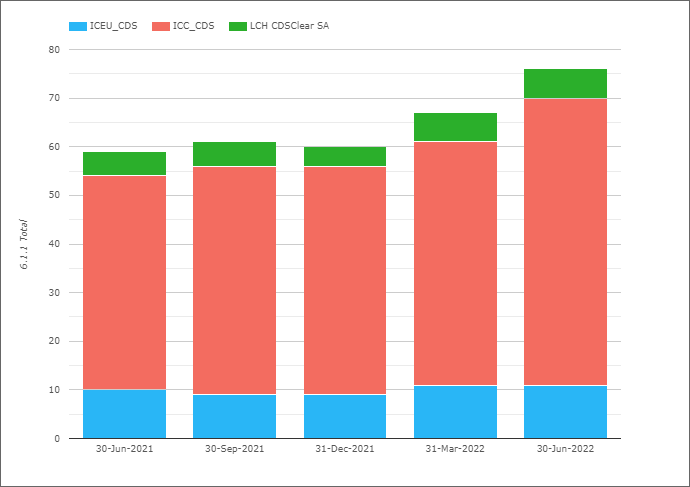

Marja inițială pentru CDS

- Total IM pentru aceste trei CCP a fost de 76 de miliarde de dolari la 30 iunie 2022

- Up $10 billion or 15% QoQ and up $18 billion or 31% YoY

- ICE Credit Clear cu 58.8 miliarde USD, în creștere cu 18% ToT și 35% YoY

- ICE Europe Credit with €10.65 billion, up 11% QoQ and 32% YoY

- LCH CDSClear cu 5.9 miliarde EUR, în creștere cu 15% ToT și cu 47% Anual

IM increasing at each CCP by double digit QoQ percentages and >30% YoY.

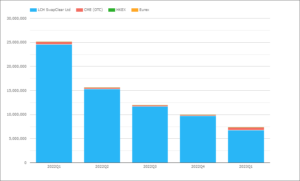

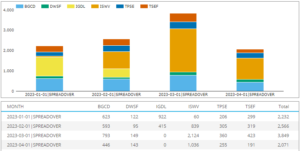

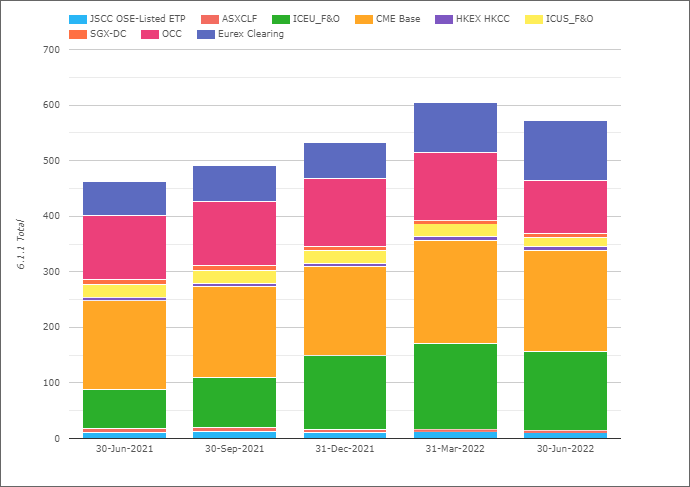

Marja inițială pentru ETD

- Total IM pentru aceste CCP a fost de 528 miliarde USD la 30 iunie 2022

- Down $43b or 7.5% QoQ and up $84b or 19% YoY

- (Note the chart shows higher totals as the EUREX figura include OTC IRS IM, pe care îl exclud)

- extensia CM Baza cu 182 miliarde USD, în scădere cu 2% ToT și în creștere cu 14% YoY.

- ICE Europe F&O with $141 billion, down 8% QoQ and up 100% YoY!

- OCC cu 95 de miliarde USD, în scădere cu 22% ToT și 18% YoY.

- EUREX with $63 billion, up 12% QoQ and 50% YoY.

- ICE SUA F&O 17 miliarde USD, în scădere cu 20% ToT și 27% YoY.

- JSCC OSE Listed ETP with $10.5 billion, down 14% QoQ and 4% YoY

- HKEX HKCC cu 7.2 miliarde de dolari, în scădere cu 12% QoQ și cu 34% pe an

- SGX-DC 7 miliarde USD, în creștere cu 1% ToT și în scădere cu 18% YoY

- asx CLF 5.1 miliarde USD, în scădere cu 2% ToT și 22% YoY

ETD IM showing the first decrease since the 30-Sep-2020 quarter end.

- OCC with the largest decrease in amount terms, dropping to $95 billion from $121 billion in the prior quarter, persumbly as equity prices and positions decreased.

- ICE Europe and ICE US down 8% and 20% respectively, persumably as commodity prices decreased a touch and volatility down.

- Eurex the only CCP to buck the QoQ trend, up 12% in USD terms.

LME Disclosures

Last quarter we covered the London Metal Exchange (LME) disclosures in some detail, given the suspension of Nickel trading. Consquently it is worth looking for disccloures that have changed materially between 31-Mar-2022 and 30-Jun-2022:

- 4.1.4 Prefunded – Aggregate participant contributions doubled from $1.1 billion to $2.08 billion

- 4.1.8 Committed – Aggregate participant contributions to address a default also up from $1.1 billion to $2.08 billion

- Neither is surprising given the price volatility in commodity markets and events of early March 2022.

- 5.3.4 Number of days during the look-back period on which the fall in value during the assumed liquidation period exceeded the haircut on an asset increased to 64 from 44, a record high

- 6.1.1. Client Net IM dropped from $8.6 billion to $5.9 billion

- 6.1.1 House Net IM dropped from $6.2 billion to $4.5 billion

- 6.1.1. Total IM at $10.35 billion is down from $14.75 billion and the same as it was on 31-Dec-21

- 16.2.17 Estimate of the risk on the invetsment portfolio (99% 1-day VaR) increased to $275k from $88k, a record high

Reports and lawsuits are still pending on the suspension of nickel trading on 8 March 2022, so we will have to wait a while longer to learn more detail on the outcomes.

Alte dezvăluiri de interese

Next let’s do a quick scan of 30-Jun-22 disclosures, highlighting a few historically significant ones, with a number of new record highs:

- B3 – 6.7.1 Maximum total variation margin paid to the CCP on any given day, was $4.2 billion, up from $3 billion and the highest on record

- B3 – 16.2.1 Percentage of total particpant cash held as cash deposit (including reverse repo) was 41.6%, up from 35% and a record high ( with commensurate drops in domestic government bond holdings)

- CDCC – 6.1.1 Client Gross IM required was $2.1 billion, up from $1.7 billion and a new record high

- ECC (European Commodity Clearing), which we recently added, has 4.1.4 Prefunded – Aggregate participant contribution of €3.1 billion

- ECC 6.1.1 Client Gross IM required of €44.7 billion, up from €39.8 billion in the prior quarter

- EUREX – 6.1.1 Total IM required of €105 billion is a record high up from €82 billion in the prior quarter and €39 billion on 30-Jun-2016

- EUREX – 6.7.1 Maximum total variation margin paid to the CCP on any given day was €12.1 billion, a new record high and up from €7.5 billion, €4.4 billion and €3.3 billion in prior quarters

- EUREX – 7.3.1 Estimated largest multiday payment obligation in total that would be caused by the default of a single particpant in extreme but plausible market conditions was €18.7 billion, a record high and up from €7.8 billion, €5.8 billion and €6.3 billion in prior quarters

- ICE Clear Credit – 4.4.3 Estimated largest stress loss (in excess of IM) from the default of any single participant PeakDayAv, was $1.8 billion, a record high and up from $1.2 billion

- ICE Clear Credit 6.1.1 Client Gross IM required was $41.5 billion, a record high and up from $34.8 billion

- LCH SwapClear 6.5.1.1 Number of times over the past 12 months that margin cover held against any acocunt fell below the actual mtm exposure of that member account was 8,117, a record high and up from 4,365, 1,664 and 172 in prior quarters

- LCH SwapClear 6.6.1 Average total VM paid to the CCP by participabts was $10.2 billion, a record high and up from $8.7 billion, $7 billion and $4.9 billion in prior quarters

- .....

Există mult mai multe Servicii de Compensare și Dezvăluiri, dar mă voi opri aici și mă voi lăsa pe seama celor dintre voi cu ale dumneavoastră CCPView acces pentru a analiza modificările ulterioare.

Pe lângă o interfață de utilizare web, oferim și un API pentru a accesa aceste date în mod programatic.

Dezvăluiri cantitative IOSCO

CCPView are dezvăluiri de la 44 de case de compensare, fiecare cu multe servicii de compensare, care acoperă acțiuni, obligațiuni, futures, opțiuni și OTC Derivatives with over 200 quantitative data fields each quarter and quarterly figures from September 2015 to June 2022.

Te rugăm să ne contactezi Contacteaza-ne dacă sunteți interesat să vă abonați la CCPView.

- furnică financiară

- blockchain

- conferința blockchain fintech

- chime fintech

- Clarus

- Cliring

- coinbase

- coingenius

- criptoconferință fintech

- FinTech

- aplicația fintech

- inovație fintech

- Opensea

- PayPal

- Paytech

- payway

- Plato

- platoul ai

- Informații despre date Platon

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- fintech pătrat

- dungă

- tencent fintech

- Xero

- zephyrnet