29 iunie 2021 / Unchained Daily / Laura Shin

Bucăți zilnice ✍️✍️✍️

Ce îți amintești?

Ce este Poppin '?

Part 1: The US Has CBDC FOMO

In a speech, yesterday titled “Parachute Pants and Central Bank Money,” Randal K. Quarles, the Federal Reserve’s vice chair for supervision, said that the fever pitch for a US-issued CBDC has become outright FOMO.

Quarles points to America’s “susceptibility to boosterism and fear of missing out” as a character trait that has “sometimes led to a mass suspension of our critical thinking and to occasionally impetuous, deluded crazes or fads,” like parachute pants.

Beyond the parachute pants illustration, Quarles emphasized three points:

- The US dollar payment system is working just fine. Mr. Quarles is skeptical that a CBDC is necessary for a country where the “general public already transacts mostly in digital dollars.” (He’s talking about the kind that sometimes take five days to move between banks.) Furthermore, he does not believe the Fed has the legal authority to issue “CBDC models without legislation” being further fleshed out.

- The benefits of creating a CBDC are unclear when foreign CBDCs or other crypto assets are yet to prove competitive to the dollar. Quarles is not worried about a foreign CBDC or stablecoin overtaking the dollar as the world’s dominant currency. He said, “It seems unlikely, however, that the dollar’s status as a global reserve currency, or the dollar’s role as the dominant currency in international financial transactions, will be threatened by a foreign CBDC.”

He also noted that the US should not fear stablecoins, positing that a “US dollar stablecoin might support the role of the dollar in the global economy.” On “Bitcoin and its ilk,” Quarles argued that such assets would “remain a risky and speculative investment rather than a revolutionary means of payment, and they are therefore highly unlikely to affect the role of the U.S. dollar or require a response with a CBDC.”

- A potential CBDC may pose considerable risk to the Fed and US alike. Quarles says it could “be expensive and difficult to manage,” as the Fed would, in essence, have to act as a retail bank to the general public. He also touched on the challenging balance between creating a CBDC that would respect an individual’s privacy while also minimizing the risk of money laundering.

Citiți discursul complet aici.

Part 2: Coinbase Wants to List Every Token (That Meets Its Standards)

Coinbase CEO Brian Armstrong took to Twitter to explain how Coinbase handles new asset listings on its platform.

His tweet came shortly after the exchange added Polkadot, Shiba Inu, and Dogecoin within one month.

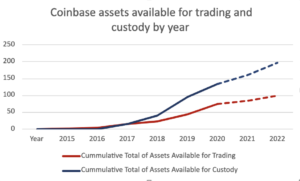

În conformitate cu decriptaţi, Coinbase has aggressively picked up the pace of its asset offerings. For context, the exchange added 21 new assets in 2020. Halfway through 2021, the company has already added 29 new tokens. Coinbase’s custody division has also expanded, announcing support for 74 additional tokens — more than doubling the number of assets available to custody on the platform in just six months.

Source Decrypt

Armstrong’s Tweet thread made it clear that Coinbase is “asset agnostic” and believes in a free market with consumer choice. He also noted that a Coinbase listing is not an endorsement of a token. Instead, it’s just the acknowledgment that a token hit the exchange’s minimum listing standards.

“Do your own research and exercise good judgment,” Armstrong warned.

Citiri recomandate

- Congressman Tom Emmer on why Congress must fight overregulation of blockchain and crypto innovation:

- Ben Lilly’s investment thesis for crypto is based on one chart… U.S. 30 year bond yields:

- Alex Gladstein on how Bitcoin could be used to fight monetary colonialism:

Pe pod ...

EIP-1559 al Ethereum va rezolva unele probleme, dar cei mari vor rămâne

Taylor Monahan, CEO al MyCrypto, și Tim Beiko, facilitatorul core-dev al Fundației Ethereum, discută despre viitoarea actualizare a rețelei Ethereum, EIP 1559. Arătați cele mai importante:

-

de ce Tim crede că EIP 1559 este necesar

-

ce narațiune conduce EIP 1559

-

ce probleme va rezolva actualizarea rețelei

-

modul în care funcționează tranzacțiile / taxele Ethereum

-

dacă prețurile la gaz sunt corelate cu ETH / USD

-

cele 3 modificări de protocol principale pe care le propune EIP 1559

-

de ce Taylor, în calitate de CEO al unui furnizor de portofele, este precaut cu privire la EIP 1559

-

modul în care EIP 1559 va afecta dimensiunea blocului Ethereum

-

ce schimbări iau în considerare furnizorii de portofele datorită EIP 1559

-

dacă evenimentele „Black Swan” vor fi mai mult sau mai puțin probabile după actualizarea rețelei

-

modul în care EIP 1559 va afecta minerii

-

indiferent dacă Tim sau Taylor consideră că minerii ar putea forța Ethereum să oprească EIP 1559

-

modul în care EIP 1559 va schimba starea valorii extractibile a minerilor (MEV)

-

cum se simt Taylor și Tim despre Ethereum ca o narațiune a banilor sănătoși în lumina EIP 1559

-

când EIP 1559 va intra în direct

Actualizare carte

Cartea mea, Criptopienii: idealism, lăcomie, minciuni și crearea primei nebunii mari de criptomonede, este acum disponibil pentru precomandă acum.

Cartea, care este despre Ethereum și mania ICO 2017, apare pe 2 noiembrie. Precomandați-l astăzi!

O puteți achiziționa de aici: http://bit.ly/cryptopians

- 2020

- Suplimentar

- TOATE

- activ

- Bunuri

- Bancă

- Băncile

- Bitcoin

- blockchain

- Brian Armstrong

- CBDCA

- CBDC

- Banca centrala

- CEO

- Schimbare

- coinbase

- companie

- Congres

- consumator

- Crearea

- cripto

- cryptocurrency

- Monedă

- Custodie

- digital

- Active digitale

- dogecoin

- Dolar

- de dolari

- conducere

- economie

- emmer

- ethereum

- fundație ethereum

- rețea ethereum

- evenimente

- schimb

- Exercita

- fed-

- federal

- financiar

- capăt

- First

- FOMO

- furculiţă

- Gratuit

- Complet

- GAS

- General

- Caritate

- Economia globala

- bine

- aici

- Cum

- HTTPS

- ICO

- Inovaţie

- Internațional

- investiţie

- IT

- Led

- Legal

- ușoară

- Listă

- listare

- înregistrări

- Efectuarea

- Piață

- meme

- minerii

- bani

- Spălare de bani

- luni

- muta

- reţea

- ofertele

- Altele

- plată

- sistem de plata

- platformă

- intimitate

- Produse

- public

- cumpărare

- cercetare

- răspuns

- cu amănuntul

- Risc

- SIX

- REZOLVAREA

- stablecoin

- Stablecoins

- standarde

- Stat

- Stare

- a sustine

- sistem

- vorbesc

- Gândire

- semn

- indicativele

- Tranzacții

- tweet

- stare de nervozitate

- ne

- us

- Dolar american

- valoare

- Portofel

- în

- an