This is a transcribed excerpt of the “Bitcoin Magazine Podcast,” hosted by P and Q. In this episode, they are joined by Knut Svanholm to talk about how Bitcoin can improve all facets of your life and the ways Bitcoin works as a weapon of peace.

Oglejte si to epizodo na YouTubu Or Rumble

Poslušajte epizodo tukaj:

Knut Svanholm: Včeraj sem med brskanjem po YouTubu ugotovil, da je imel film Pink Floyd “The Wall” velik vpliv na moj pogled na svet. To sem videl, ko sem bil star 16 let, in bilo je precej globoko. Takrat se mi je zdelo precej globoko. Če se spomnite tega filma, so mi všeč, ker je bil kot noben drug film. Pripovedovanje zgodbe se zelo razlikuje od linearnega filma, vendar se začne s fantom, čigar oče je umrl v vojni. In tukaj je močan stavek o tem: »Takrat mi je kraljevo poveljstvo njenega veličanstva vzelo očeta. To je tako težko; neka institucija ima pravico nekomu drugemu vzeti življenje in mu naročiti smrt za višjo ceno in kaj to naredi generacijam, ki sledijo. Seveda po tem sledi celoten šolski sistem, kjer imate to tovarno za mletje mesa, ki ljudi skupaj zmečka v volilno živino. Zato mislim, da je za nazaj ta film verjetno močno vplival na to, kako gledam na svet in kako sovražim kolektivizem.

Še več, odraščal sem na podeželju ob svobodoljubnem očetu. Objadral sem sedem morij. Osem let sem delal na cestninski ladji in videl sem veliko različnih držav. Že ko sem bil otrok, sem nekajkrat živel v tujini: pol leta v Mozambiku, ko sem bil star 10 ali 11 let, pa v Tanzaniji in še kje. Mislim, da sem bil takrat manj nagnjen k temu, da bi verjel kakršnim koli nacionalnim lažem.

Spomnite se osemdesetih na Švedskem; nismo imeli komercialnih televizijskih kanalov in komercialnih radijskih kanalov. Vse je v državni lasti in je v veliki meri še danes. Obstaja sistem subvencioniranja, da veliki mediji dobijo denar od države in seveda ne grizejo roke, ki jih hrani. Torej je to. Toda v 1980. letih je bil res odrezan od preostalega sveta. Risanke moramo gledati enkrat letno na božični večer. Takrat smo enkrat letno videli Donalda Ducka. Tako je torej potekalo odraščanje na Švedskem v 80. letih. Za nazaj je bilo lepo, precej temno. Mislim, da so vse te stvari vplivale na moje razmišljanje.

V: Želim govoriti o časovni preferenci. Bi lahko našim članom občinstva, ki tega morda ne razumejo, pomagali razumeti, kakšna je razlika med visoko in nizko časovno preferenco?

Svanholm: Velika časovna preferenca je, ko dajete prednost hitremu zadovoljstvu, ko ne odlašate z zadovoljstvom. Torej, če ste oropani vsega, kar imate, se odločite za visoko časovno preferenco, ker to potrebujete, ker potrebujete hrano za preživetje in potrebujete zavetje, da ne – na večini krajev – potrebujete zavetja, da ponoči ne zmrznete do smrti. Tako postanete posameznik, ki ima veliko časa in daje prednost kratkoročnim dobičkom, zaradi česar ste tudi nagnjeni h kriminalu in slabemu odločanju, kratkoročnemu odločanju.

In nizka časovna prednost je nasprotje tega. Takrat razmišljaš o prihodnosti in razmišljaš o prihajajočih generacijah. Načrtujete vnaprej in gradite nekaj za prihodnost. Verjamem, da sta visoka časovna preferenca in nizka časovna preferenca na enaki lestvici kot strah in ljubezen, ker je visoka časovna preferenca zame strah vzbujajoče stanje. In kaj je nasprotje strahu? Nasprotje strahu je ljubezen. Torej sprejeti nižjo časovno preferenco ali biti sposoben sprejeti nižjo časovno preferenco, ker imate več kapitala in bolj gotovo prihodnost, ki vam omogoča, da ste bolj ljubeči ne samo do sočloveka, ampak do sebe.

I think this is the killer app of Bitcoin, is that it makes us better human beings. It makes us friendlier to one another and also friendlier and more loving to ourselves. We can afford to take care of ourselves and take care of others to a larger extent. My talk was about this to a large extent.

It ties into something my grandfather said, which is, “That which you can do without, you own,” which is something that has been stuck in my mind ever since the first time I heard it. It’s the flip side of “Your possessions end up owning you.” Because if you can control your mind to the extent that you don’t crave things anymore, then you own those things that you don’t crave, in a sense. For instance, I would never buy a Lambo regardless of how much bitcoin I have or how wealthy I become. I don’t crave Lambos. In a sense, I own all the Lambos because I control my urges. I think Bitcoin is like a gateway drug to that insight.

Sooner or later Bitcoiners come to the realization that they don’t need that much shit in their life. Material things matter less and less the longer you are in Bitcoin. And it’s going to be very interesting to see how this plays out because in fiat land, as we know, in order to become rich or when you do become rich, you buy a load of shit lingling and crap that you don’t need, and I think this reverses on a post hyperbitcoinization. We’ll have an abundant future without over consumption because we won’t crave as much shit as we do now. I think that’s the real killer thing here.

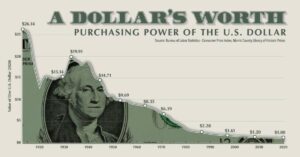

Q: I wanna try to unpack that a little bit. There’s a question behind all of this, and I’ll start with a question, which is: Do you think people recognize that when they use fiat money, it inflates so regularly, so they need to be spending it constantly? Versus with bitcoin, I think all of us recognize the value proposition of spending our bitcoin today is far greater than if we were to hold it and then spend it in the future.

Svanholm: Mislim, da se tega ne zavedajo na zavestni ravni, toda to je tisto, kar počne ljudem. Ljudje, ki pridobijo sredstva in najamejo velika posojila, zmagajo v fiat igri. Tako zmagaš. Kupiš kup sranja, vključno s hišami, na primer. Nepremičnine so shitcoin. Videl sem nekaj meritev iz ZDA, da več kot polovica nepremičnin, kupljenih v ZDA lani, ni bila za bivanje ljudi, ampak za uporabo Airbnb.

So it’s becoming this, “You’ll own nothing and you’ll be happy” playing out in front of our eyes. But I prefer that “You’ll owe nothing and be happy” future of Bitcoin because just replace one letter and and you get the Bitcoin future, which is you accumulate capital first and then you consume — if you’re willing to part with your bitcoin. The longer you hold your bitcoin, the more you realize how valuable they really are.

That’s where I come to the second prediction about the future. I’ve experienced it even now because I’ve collaborated with a whole bunch of Bitcoiners and they’ve given me stuff. They’ve given me their services and physical stuff like FractalEncrypt’s art pieces, for instance. They’ve helped me with translations and proofreading and editing and animations and narration, you name it — all for free. We very rarely exchange satoshis with one another. That sort of leads me to the conclusion that us being nice to one another is just Gresham’s Law on a bitcoin standard because we find our stacks to be so valuable so we’re willing to stake our reputational capital instead. That is the less valuable coin if you compare the two. So I think there’s a connection there and that’s why I think that the necessity for money to exist at all goes down in a hyperbitcoinized world.

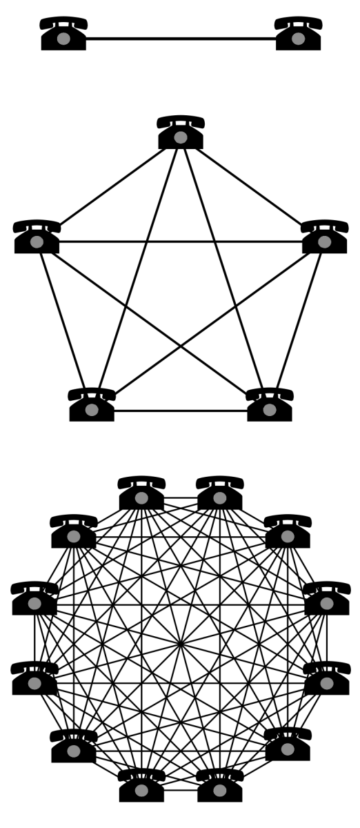

That’s the real scaling solution. Fewer transactions are necessary. Ironically, this “don’t trust, verify” attitude of Bitcoiners leads to a world in which we can trust one another more. If you compare it to how you interact with your friends and your family, you very rarely exchange money there, too. You help one another without even asking for it.

This is where I think Bitcoin is going or people in Bitcoin are going toward the state where we’re always incentivized to help one another. It’s not only the time-preference thing, but it’s also pumping our bags. We want Bitcoin to succeed, therefore, we want other Bitcoiners to succeed.

This is the main reason that we’re having this conversation right now. We all love Bitcoin and we want others to come on board and enjoy it too. And in the process, we enrich ourselves if we hold some bitcoin, so we’re incentivized to help one another and exchange favors for free.

The funny thing is that doesn’t go away just because we hyperbitcoinize; we still have that. The Bitcoin private key is a key to your heart, literally. We run this mathematical experiment in the back of our heads and we just become better people.

To se mi zdi neskončno fascinantno. Ne morem nehati razmišljati o tem. To mi daje upanje.

- Bitcoin

- Bitcoin Magazine

- Podcast revije Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Kultura

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- nezamenljiv žeton

- filozofija

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- Podcast

- poligon

- dokazilo o vložku

- Ugled

- Škrlatnost

- W3

- zefirnet