Business finance teams perform a 3 way match of vendor invoices as an essential accounts payable process. By 3 way matching supporting documents, companies can detect duplicate, erroneous, or fraudulent payments.

The goal of this article is to understand the 3 way match process, the pain points of manual matching processes, how to automate the three way matching process, and the benefits of automation.

3 way matching is best performed as an automated workflow powered by accounts payable automation solutions such as Nanonets.

Kaj je 3-way match?

All payments involve some sort of verification to avoid fraud and ensure that financial details in supporting documents match each other.

A 3 way match is an internal control process comparing the purchase order (PO) against the good received note (GRN) and the concerned supplier’s invoice.

A 2 way match, in comparison, only compares the PO with the invoice. The quantity billed (in the invoice) should match the quantity ordered (in the purchase order). And the invoice price should match the price quoted in the purchase order.

The 2 way matching process is the default approach to verify invoices across organisations. But companies are increasingly adopting three way matching to add an additional layer of verification and prevent overspending.

3 way matching helps approve invoice payments faster and also flag any inconsistencies, errors or potential fraud.

Three way matching compares line item details and totals across purchase orders (PO), receipts for good (verified receiving document and packing slip), and vendor invoices sent to the customer.

A successfully verified invoice must match the PO and receipt within acceptable tolerance levels. An invoice that fails matching tolerances is placed on hold and is sent for appropriate review.

Želite avtomatizirati svoje ročne postopke 3-smernega ujemanja? Rezervirajte 30-minutno predstavitev v živo in si oglejte, kako lahko Nanonets vaši ekipi pomaga pri implementaciji od konca do konca AP avtomatizacija.

Kazalo

How to 3 way match?

O postopek obračunavanja obveznosti is largely dependent on tracking details across three documents: purchase orders, order receipts and invoices.

Before processing vendor payments, AP teams go over these 3 documents to verify that the product/service received by the company matches the details of what was initially ordered/requested.

3 način matching of invoices helps highlight errors or inconsistencies in any of the 3 important documents mentioned above. Errors/issues could include wrong payment details, inflated/incorrect prices, wrong or damaged products etc.

If errors are flagged in the 3 way matching process, the invoice is put on hold and payment is withheld. Once the issue is reconciled and a successful three way match, the invoice can be processed and paid.

3 way match example

To illustrate, suppose that a buyer, Buyer Inc., receives an invoice for $1500 from a vendor/supplier, Supplier Inc., for a hundred pen drives:

- The AP team first compares/matches the invoice with its PO to check if the description (pen drives), quantity (100), cost ($15 per piece), total price ($1500) and terms (payment terms) match those in the initially approved PO.

- Next, the invoice and PO details are compared/matched against those in the order receipt (receiving report). This receipt is prepared by the receiving department based on the packing slip that comes along with the delivery. The type and quantity of pen drives (100), the price ($15 per piece) and the total price ($1500) should match those detailed in the original PO and invoice.

- The receiving department also checks damage and quality at this stage.

If the invoice, PO and order receipt match exactly (or within an acceptable tolerance level), then you a have a successful 3 way match. The invoice can now be paid by the AP team.

If the 3 documents don’t match – above the three way matching tolerance level – then the invoice is put on hold until the errors/issues are sorted.

Let’s briefly look at each of these documents and see how they relate to the accounts payable 3 way matching process:

Naročilnica

A purchase order or PO is a company’s standard, sequentially numbered form that lists the products or services it requires. The purchase order is used to authorise a purchase.

The PO becomes a contract when it is sent to and accepted by the vendor that intends to deliver the goods or services. O nabavni oddelek generira naročilnico na podlagi podpisane in potrjene naročilnica po izbiri prodajalca.

O postopek naročila captures company name and logo, vendor name and contact information, legal and payment terms, discounts offered, purchase order number, company billing and shipping address, line items with descriptions, pricing, quantities ordered, extended amount, subtotal, sales tax if any, and total amount.

Prejem

A receipt is a physical or electronic document that reflects the actual receipt of goods/services. Receipts are verified by the company’s receiving department against the itemized vendor packing slip included with the delivered products.

The receipt references the payment method as well as the purchase order number – facilitating document matching.

Prejem blaga je lahko dostava celotnega naročila ali delna pošiljka, če je kateri koli izdelek znova naročen za kasnejšo dostavo ali odposlan z druge lokacije.

Račun prodajalca

A vendor invoice is a document that bills the customer for goods delivered or services rendered. The invoice is a request for payment.

Invoice fields are primarily the same as those of a purchase order.

Invoices also mention an invoice number, order dates, shipment dates, remittance address, payment terms, early payment discounts, subtotal, sales tax, and total amount due.

Avtomatizirajte zajem podatkov, zgradite delovne tokove in streamline the 3 way match process v nekaj sekundah. Koda ni potrebna. Rezervirajte 30-minutno predstavitev v živo zdaj.

Pain points in manual matching

Manual 2 way or 3 way matching can be a painfully slow, expensive and error-prone. Automating 3 way matching and the accounts payable approval workflow would definitely help AP teams focus on higher value tasks and save them from a mountain of manual paper work.

Manual matching of thousands of supporting documents can be time-consuming, expensive and labour-intensive. AP teams end up spending lots of man-hours manually hunting for every invoice, PO and receipt!

Delays and errors force the accounts payable team to work overtime and could also bring on penalties for late payments to vendors.

Here are some of the major pain points in the manual three way matching process that end up causing delays and cost overruns:

Lost or missing documents

A manual matching process requires all documents to be collected, stored and maintained for future reference. Over time, documents could get damaged, lost, stolen or go missing. This can severely affect visibility into payables and cause delays.

Ravnanje s spremembami

A variation arises when the line items, quantities, extended amounts, or total due on a vendor invoice don’t match the purchase order or receipt of goods or services. Handling variations or exceptions manually can be extremely tricky and hard to document.

Enkratni scenariji

If an accounts payable employee encounters a one-off matching error, they will need to investigate the problem to solve it. The resolution takes extra time compared to a known repetitive issue.

For example, if the vendor invoices the wrong product, accounts payable will need to request a corrected invoice to complete the match. Waiting to receive a corrected invoice from the vendor will delay invoice approval, payment and reduce overall productivity.

Duplicate or fraudulent invoices

Duplicate invoices will not have necessary supporting documents, which have already been matched with the original invoice. But imagine trying to manually identify a duplicate or fraudulent invoice from among thousand others!

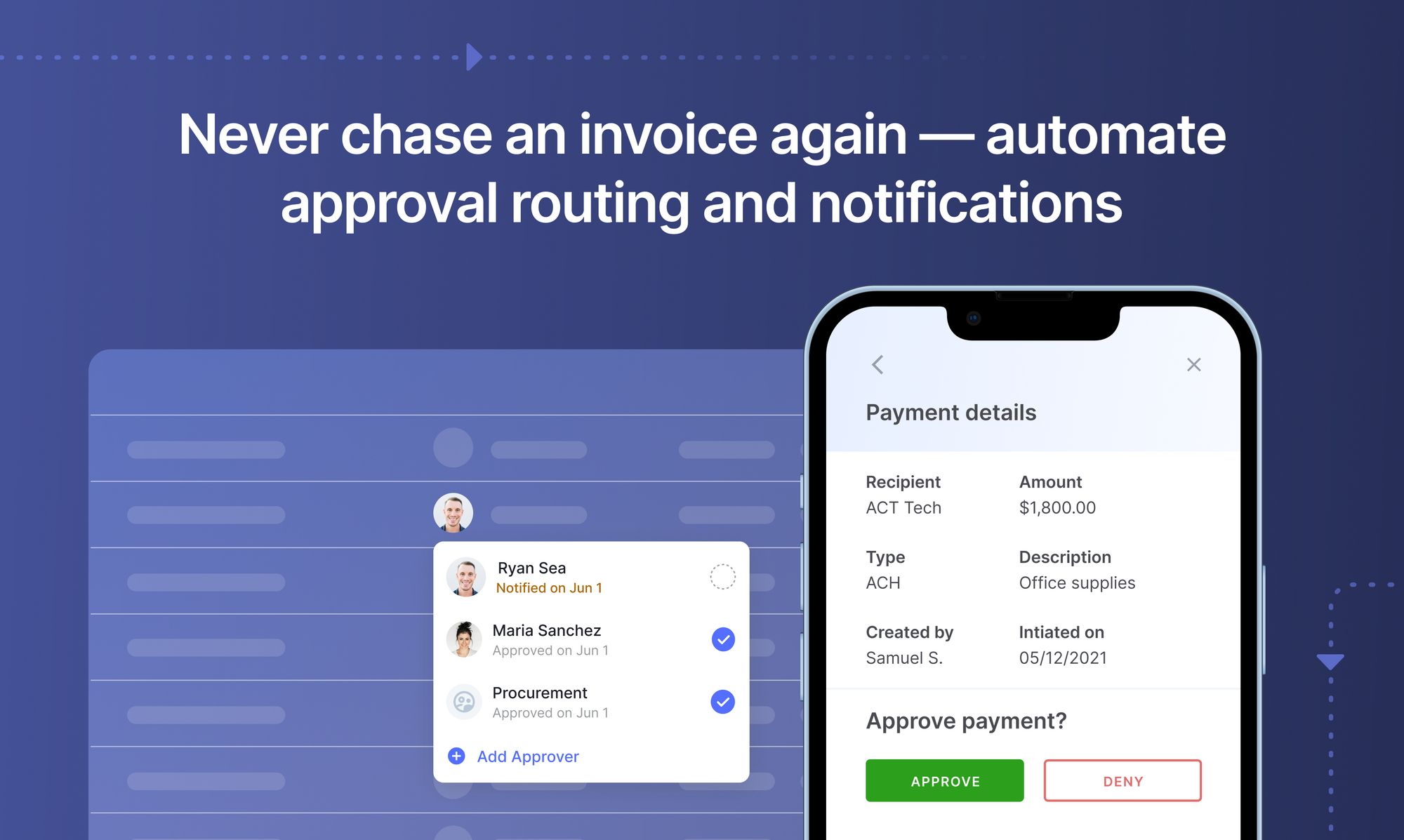

Zamude pri odobritvi računa

In a manual invoice approval workflow, the invoice literally gets pushed from one desk to another until final approval. It is hard to keep track of which level of approval a document is currently stuck at, and who the approver is.

In paper-based three way matching and invoice approvals approver delays can result from procrastination, heavy workloads, resolving questions with the requester, and holidays/leaves.

Rezervirajte to 30-minutno predstavitev v živo, da bo to zadnjič, ko boste morali ročno vnašati podatke iz računov ali potrdil v programsko opremo ERP.

Prednosti avtomatizacije postopka

Automating the 3 way matching process addresses most if not all the of pain points of manual matching covered above. Here are some of the top reasons why business are increasingly automating the three way match and the larger AP process:

Provide audit trails

An automated digital-first approach ensures that all records are consistent and provide a single source of truth. When data is readily accessible at all times, businesses can access clear audit trails and pinpoint financial inconsistencies quickly.

Reduce error rates & fraud

Automated 3 way matching software operate on preset rules/workflows based on tolerance levels and approvals. Such automated workflows are rapid and highly accurate. They quickly flag errors and potential cases of fraud so that AP teams can take immediate action.

Improve supplier relationships

A supercharged 3 way matching AP workflow ensures timely vendor payments. Vendors value early payments and could offer discounts in return. Thus automation can help save costs while establishing a stable supply chain.

Increase the bottom line

Automating three way matching and other AP processes saves time, reduces labour costs, prevents fraud/errors, and provides vendor discounts in the long run. This plays a significant role on the company’s bottom line.

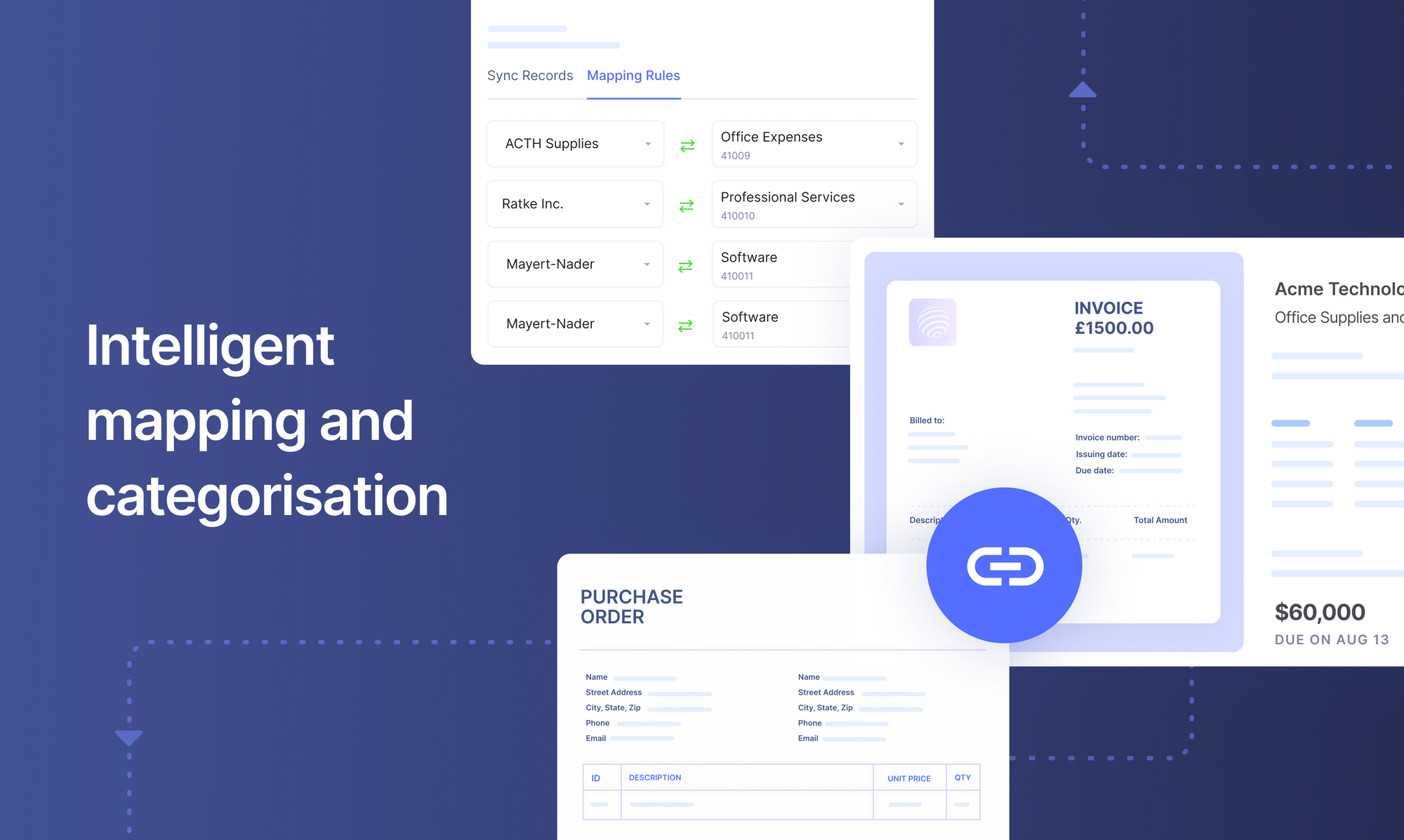

Brezhibna sinhronizacija

Close your books faster by syncing your 3-way match directly on to your ERP or accounting software.

Nastavite delovne poteke AP brez dotika in poenostavite postopek obračunavanja obveznosti v nekaj sekundah. Rezervirajte 30-minutno predstavitev v živo zdaj.

How to automate 3 way matching and AP workflows

most Programska oprema za avtomatizacijo AP, like Nanonets, can help organisations switch from manual 3 way matching to a completely touchless automated workflow. AP teams across enterprises use Nanonets to build end-to-end automated accounts payable workflows.

AP automation & 3 way matching workflows set up on Nanonets can reduce 80% of the AP department’s workload without employing additional staff.

With Nanonets you can set up an automated AP 3 way matching workflow that automatically:

- Pulls documents and files from multiple sources – email, scanned documents, digital files/images, cloud storage, ERP etc.

- Classifies and sorts the documents correctly as invoices, POs and receipts

- Reads & captures data from all invoices, POs and receipts accurately

- Reconciles fields, expenses, balances and SKU level information across related invoices, POs and receipts by a 3 way match

- Flags 3 way match errors that breach tolerance levels or sends invoices for further approval on a successful 3 way match.

- Upravljajte vse poteke dela glede stroškov, od ustvarjanja poročila o stroških do pridobivanja odobritev upravitelja

- And sync/integrate all the above with any ERP, accounting software or business tool of your choice

- Z lahkoto se integriramo s Sage, Xero, Netsuite, Quickbooks in drugimi

Save your AP team from tasks involving mountains of paper work. Book a demo to see how Nanonets can automate all your AP processes.

- obveznosti do dobaviteljev

- avtomatizacija plačljivih računov

- AI

- AI in strojno učenje

- ai art

- ai art generator

- imajo robota

- Umetna inteligenca

- certificiranje umetne inteligence

- umetna inteligenca v bančništvu

- robot z umetno inteligenco

- roboti z umetno inteligenco

- programska oprema za umetno inteligenco

- blockchain

- blockchain konferenca ai

- coingenius

- pogovorna umetna inteligenca

- kripto konferenca ai

- dall's

- globoko učenje

- obdelava računov

- strojno učenje

- platon

- platon ai

- Platonova podatkovna inteligenca

- Igra Platon

- PlatoData

- platogaming

- lestvica ai

- sintaksa

- zefirnet