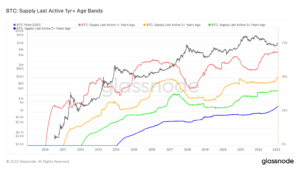

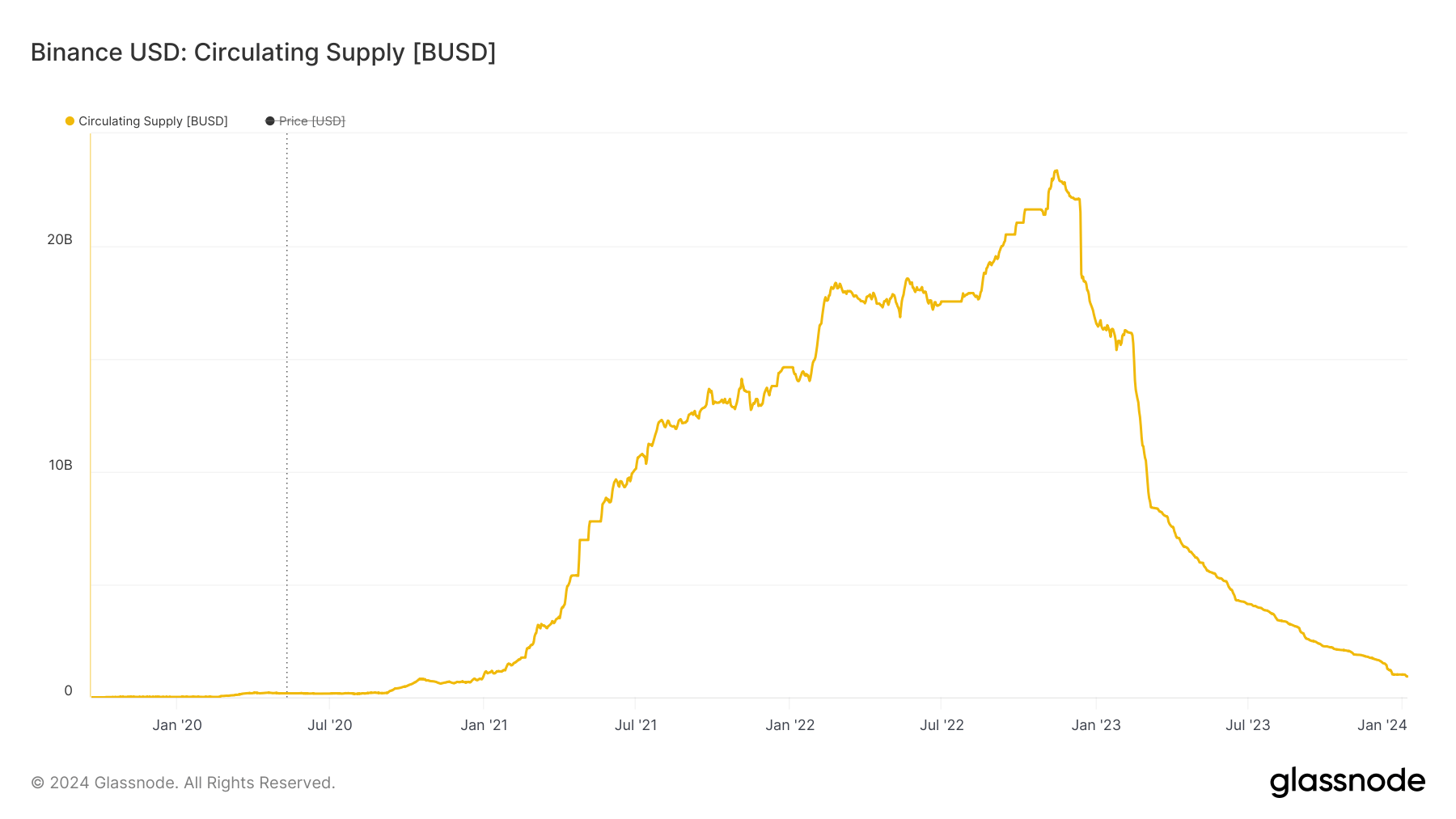

Binance AMERIŠKI DOLAR (BUSD) slipped out of the top five stablecoins by market capitalization over the weekend after its circulating supply dipped under 1 billion, its lowest point since Dec. 2020.

datum iz CryptoSlate kaže, da krožna ponudba BUSD znaša 927 milijonov žetonov, kar pomeni osupljivo 96-odstotno zmanjšanje glede na največjo ponudbo 23.45 milijarde. Ta padec je tudi močno vplival na njegov obseg trgovanja, ki je v zadnjih 50 urah znašal manj kot 24 milijonov dolarjev.

The Binance-backed stablecoin troubles began last year after the U.S. Securities and Exchange Commission (SEC) labeled it a varnost in its legal actions against the cryptocurrency exchange. Besides that, BUSD issuer paxos was forced to stop other mints of the asset by the New York Department of Financial Services. Binance and Paxos vehemently zavrnjena this SEC classification.

These developments prompted a swift exodus from the troubled stablecoin within the crypto community as Binance immediately began to push several stablecoin alternatives, including TrueUSD (TUSD) and First Digital USD (FDUSD), to its users.

5. januarja, Binance je pokazala, that it completed the automatic conversion of eligible users’ balances in the BUSD token to FDUSD. It further razložiti that it no longer supports the withdrawals of BUSD and urged its users to ročno zamenjajte te žetone BUSD za žetone FDUSD po pretvorbenem razmerju 1:1 na Binance Convert.

Kljub temu sta se Binance in Paxos zavezala, da bosta podpirala BUSD do njegove popolne opustitve letos.

USDT, USDC ohranjata prevlado stabilnega kovanca

With BUSD’s decline, the top five stablecoins market by market capitalization now includes new entrants like TUSD and FDUSD—two stablecoins that were močno promoviran avtor Binance.

Vendar pa Tetherjev USDT ostaja prevladujoč igralec v prostoru, saj nadzoruje okoli 70 % trga s tržno kapitalizacijo več kot 90 milijard dolarjev. Tesno mu sledi Circleov USDC, katerega tržna kapitalizacija znaša 24.56 milijarde dolarjev.

Raziskovalec 21Share Tom Wan je poudaril, da bi se stablecoin lahko učinkovito spopadel s temi velikani, bi bila potrebna integracija v centralizirane borze, vključitev v platforme DeFi in uporaba v funkcijah plačil in nakazil.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- vir: https://cryptoslate.com/binances-busd-loses-top-five-stablecoin-spot-as-supply-dips-under-1b/

- :ima

- : je

- 1

- 1800

- 1b

- 2020

- 23

- 24

- a

- dejavnosti

- po

- proti

- Prav tako

- alternative

- in

- uporaba

- okoli

- AS

- sredstvo

- At

- Samodejno

- tehtnice

- začel

- Behemoti

- poleg tega

- Billion

- binance

- BUSD

- by

- cap

- Kapitalizacija

- centralizirano

- Centralizirane borze

- krožijo

- Razvrstitev

- tesno

- Komisija

- storjeno

- skupnost

- dokončanje

- Končana

- nadzor

- Pretvorba

- pretvorbo

- kripto

- kripto skupnost

- cryptocurrency

- Zamenjava kripto valute

- december

- Zavrni

- zmanjša

- Defi

- platforme defi

- Oddelek

- razvoju

- digitalni

- prevladujoč

- med

- učinkovito

- upravičeni

- dohodni

- Izmenjava

- Izmenjave

- finančna

- finančne storitve

- prva

- pet

- sledili

- za

- prisiljena

- iz

- funkcije

- nadalje

- stekleno vozlišče

- Imajo

- visoka

- URE

- HTTPS

- takoj

- prizadeti

- in

- vključuje

- Vključno

- integracija

- v

- Izdajatelj

- IT

- ITS

- John

- Zadnja

- Lansko leto

- Pravne informacije

- manj

- kot

- več

- Izgubi

- najnižja

- vzdrževati

- Tržna

- Market Cap

- Tržna kapitalizacija

- označevanje

- max širine

- milijonov

- več

- Novo

- NY

- Newyorško ministrstvo za finančne storitve

- št

- zdaj

- of

- on

- Ostalo

- ven

- več

- preteklosti

- paxos

- Plačilo

- Peak

- Platforme

- platon

- Platonova podatkovna inteligenca

- PlatoData

- predvajalnik

- Točka

- Push

- Oceniti

- ostanki

- Nakazilo

- zahteva

- raziskovalec

- s

- SEC

- Vrednostni papirji

- Securities and Exchange Commission

- Storitve

- več

- Razstave

- bistveno

- saj

- sedi

- vir

- Vesolje

- Komercialni

- stabilno

- Stablecoins

- osupli

- stop

- dobavi

- Podpora

- Podpira

- swap

- besedilo

- kot

- da

- O

- te

- ta

- letos

- do

- žeton

- Boni

- tom

- vrh

- Trgovanje

- obseg trgovanja

- resnično

- tusd

- nas

- Ameriški vrednostni papirji

- Ameriška komisija za vrednostne papirje in borzo

- pod

- dokler

- ameriški dolar

- USDC

- USDT

- Uporabniki

- Obseg

- je

- vikend

- so bili

- katerih

- z

- Umiki

- v

- bi

- leto

- york

- zefirnet